After a volatile year in global markets, equity investors are on high alert. With so much uncertainty about the macroeconomic growth outlook, we think it’s important to make sure that an equity allocation is positioned to do well no matter what happens to the economy.

Mixed signals are hanging over markets as 2019 begins. Will global economic growth slow? What will happen when central banks withdraw asset-purchase programs and if interest rates rise? How do you navigate political risks, from Brexit to the US-China trade war? We don’t expect a global economic recession, but the breadth of possible outcomes is much wider than usual, which probably means more volatility this year.

It’s tough to design an equity portfolio for these conditions. Traditional defensive portfolios typically deliver better results if economic growth crashes. Higher-risk equity portfolios may rely on faster economic growth to fuel returns. Today, we think the best solution is to build a macro-resistant equity portfolio that is equipped both to withstand macroeconomic shocks and to deliver if things turn out better than expected.

Growth Fears Stoke Volatility

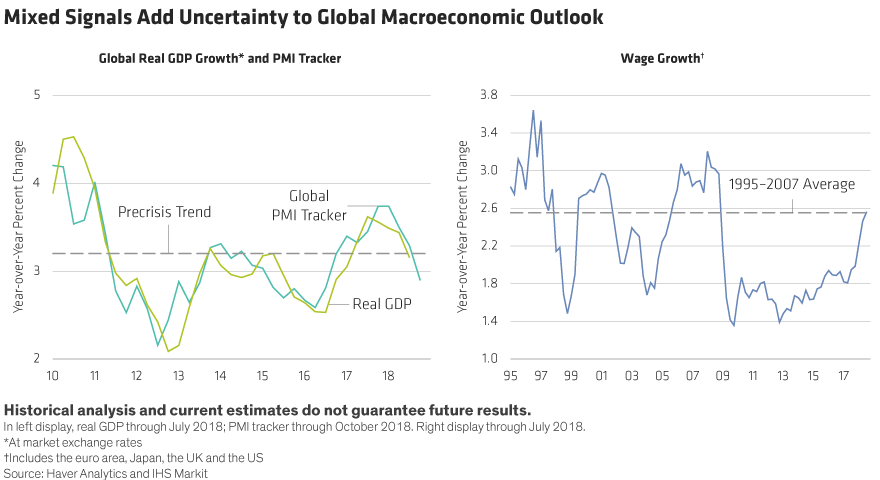

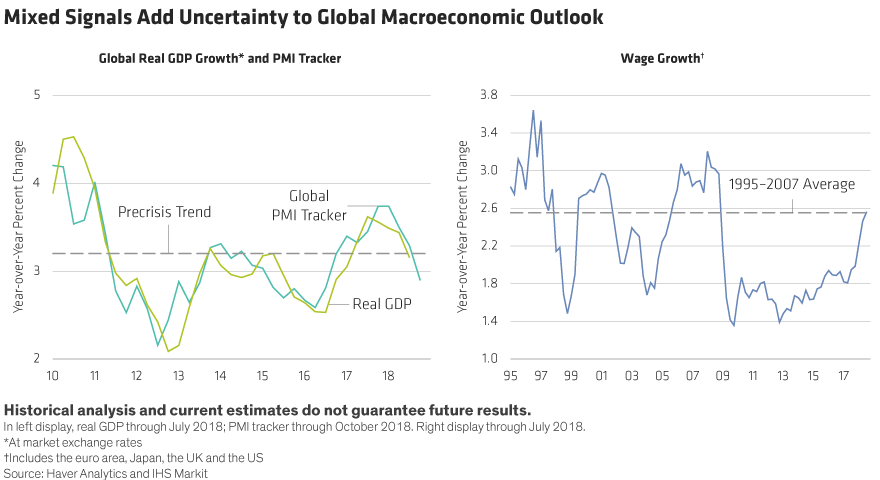

The macroeconomic growth outlook is very uncertain today. The global Purchasing Managers’ Index tracker fell during 2018, signaling a potential economic slowdown is brewing (Display, left). Global GDP growth has started to slow. At the same time, wage growth is rising in developed countries (Display, right), adding to inflationary concerns that seem to conflict with the growth slowdown. No wonder that market volatility increased dramatically last year. The MSCI World Index rose or fell by more than 1% on 45 days during 2018, compared with only three days in an unusually calm 2017.

In this environment, we think there are three key components to creating a macro-proof portfolio. First, take a closer look at traditional defensive stocks. Second, focus on industry themes that don’t depend on economic growth. Third, pay close attention to balance sheets.

Return to Traditional Defensives

In recent years, we’ve been concerned that some traditional defensive sectors might not provide investors with optimal protection from downturns. About two or three years ago, as interest rates were falling to near zero levels, investors were piling into bond proxies to tap into sources of income. Utilities, real estate investment trusts (REITs) and consumer staples became very expensive, because many investors flocked to these traditional safe havens to protect against potential volatility.

These stocks performed relatively well in the recent downturn. What’s changed? At the turning point from the trough in interest rates, these stocks were very risky as their performance is generally correlated with interest rates. Some of these concerns have diminished now that US interest rates are off extreme lows and valuations are much more reasonable.

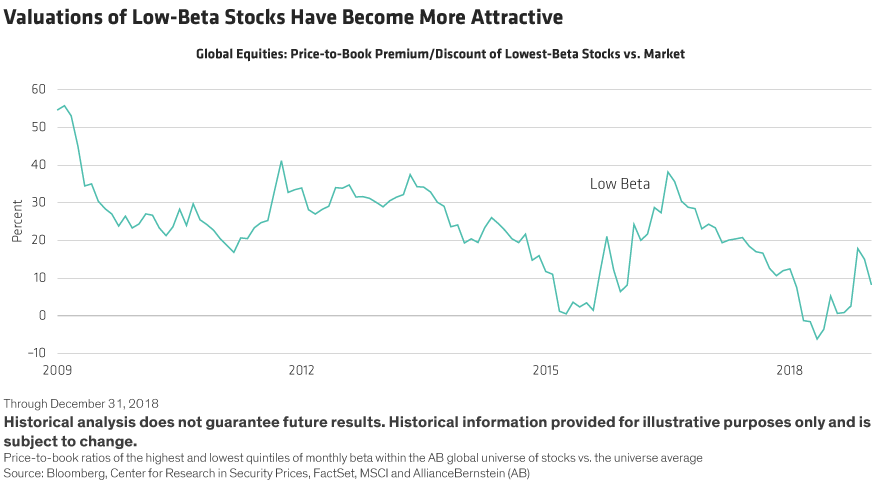

Since US interest rates began to rise in late 2016, valuations of low-beta stocks, which are less risky than the market, have improved (Display). When building a defensive equity portfolio, it’s always important to pay attention to valuations. Yet valuations are dynamic, so attractively valued opportunities may be found today in stocks and sectors that were expensive yesterday.

Find Investing Themes That Are Resistant to a Slowdown

Some industries and companies just aren’t as vulnerable to a macroeconomic slowdown as others are. For example, human resources firms such as ADP and Paychex are benefiting from a growing tendency of companies to outsource HR functions. This growth has nothing to do with the state of an economy; as companies become more complex, it simply makes more sense to outsource HR.

Similarly, in the financial sector, payments processing is enjoying steady growth as more consumers around the world shift away from cash payments to cards and other payment systems. In the US, electronic and card payments accounted for about two-thirds of consumer spending in 2018, up from less than half a decade earlier, according to BMO Capital Markets. And globally, international electronic payment volumes are projected to grow at 12% a year over the next three years, double the rate of domestic markets, according to the Nilson Report.

Retailers are often seen as cyclical companies that are vulnerable to an economic slowdown. Yet there are defensive pockets of the retail industry that actually tend to do well through downturns. Examples include T.J. Maxx, the off-brand retailer, which benefits when more consumers seek to buy lower-cost clothes.

Professional publishing is another niche market that should hold up in a downturn, in our view. Examples include RELX Group and Wolters Kluwer, providers of critical professional information that lawyers, doctors and professors need on hand for time-sensitive decisions—even if the economy is slowing down.

Watch the Balance Sheet

Quality stocks are still the backbone of a defensive equity strategy. That means scrutinizing companies for their earnings potential in tougher times, including whether they have the balance-sheet strength to endure a rising-rate environment.

Corporate debt is rampant today. After a decade of easy-money policies globally, many companies that borrowed could be vulnerable as conditions change. The potential for rising rates and tighter credit markets could put a lot of pressure on companies that levered up over the past decade. So scrutinizing balance sheets is more essential than ever to ensure that quality stocks will hold up regardless of the direction of the economy and rates.

Not every low-beta portfolio is truly indifferent to the economic environment. By searching for high-quality stocks that offer a degree of stability and trade at attractive valuations, we believe a portfolio can be created that is resilient to macroeconomic whims, which can help investors stay invested through turbulent market episodes—and benefit from an eventual recovery.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein