by Matthew Sheridan, Fixed Income AllianceBernstein

Bond strategies that balance interest-rate and credit risk struggled in 2018. Is this time-tested approach past its prime? Hardly. We think investors will need to blend exposure to both to generate income and limit risk in 2019.

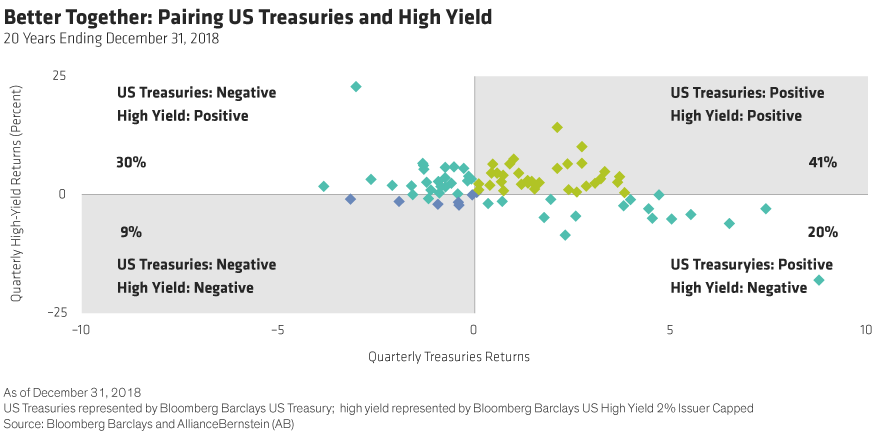

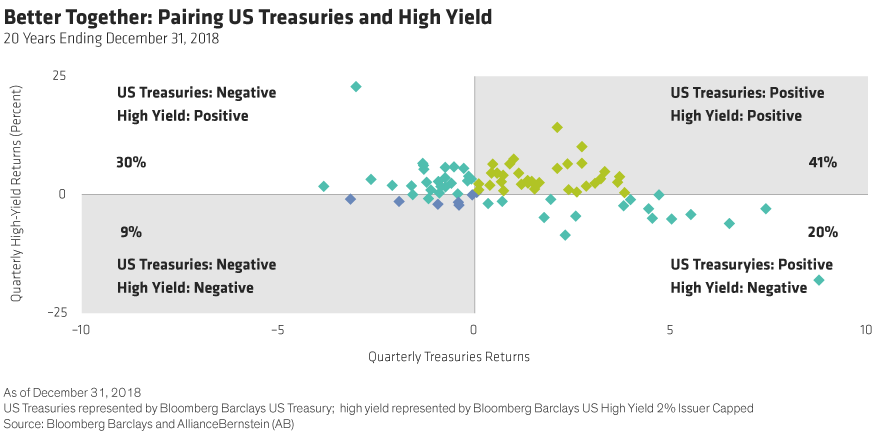

Pairing high-yield corporate bonds and other credit assets with high-quality government debt in a single strategy has historically been a good way to manage volatility and limit downside risk. That’s because these bonds usually take turns outperforming each other.

For example, faster growth tends to feed inflation and push up interest rates, which erodes the purchasing power—and market value—of government bonds. But growth boosts consumer spending and corporate profits—provided inflation doesn’t get out of hand. That’s good for high-yield bonds because it lowers the odds of default.

When growth slows, it’s the risk-reducing government bonds that outperform and help compensate for losses in more growth-sensitive credit assets. A portfolio that combines both in an integrated way can thrive in most market and economic environments.

2018: An Unusually Challenging Year

Sometimes, though, returns for both groups of assets move in the same direction. That’s what happened at times during 2018, as anyone who reviewed her investment statements will have noticed.

A quick recap: In the first half of the year, the Federal Reserve pushed up interest rates amid signs of strong US growth while simultaneously shrinking its balance sheet. And by year-end, the European Central Bank stopped expanding its own balance sheet and the Bank of Japan’s net asset purchases slowed to a crawl. This hit the prices of many interest-rate-sensitive bonds, driving the US 10-year Treasury yield in October to a seven-year high near 3.25%.

Then, as tighter financial conditions started to bite—especially outside the US—and trade tensions worsened, high-yield bonds and other credit assets sold off, reducing returns on the return-seeking side of balanced bond strategies.

The result: both sides of balanced income strategies underperformed. But 2018 was unusual because it was a transition year: markets were moving away from a prolonged period of easy money and low volatility to one of slower growth, tighter financial conditions and higher political risks.

The good news is that periods of correlated performance among credit and government bonds are rare and usually don’t last long. While both types of assets struggled at times last year, it was only during the first quarter that both posted negative returns. And over the last 20 years, the two staged correlated sell-offs only 9% of the time. In fact, returns have risen together far more often than they’ve fallen—thanks, largely, to the income bonds produce (Display).

We don’t think this time is different. Markets are likely to remain shaky in 2019, but we think there’s a strong case for sticking with a balanced approach.

Here are a few reasons why:

Higher yields for government bonds and credit mean fixed income’s return potential is bigger than it’s been in quite a while. As long as a bond doesn’t default, investors can reinvest its proceeds when it matures in a newer and higher-yielding security. Over time, the added income outweighs short-term losses and boosts total return. While we think investors should be deliberate about where they take their credit risk today, we think avoiding credit altogether at current valuations would be a mistake.

It’s always dangerous to ditch duration. That’s because duration—or interest-rate exposure—can dampen volatility and provide an important source of income and return. For example, markets are likely to remain volatile in 2019, as higher interest rates will eventually cause growth to slow and the credit cycle to get closer to its end. In these periods, Treasuries tend to beat credit assets such as high-yield bonds, providing both income and downside protection in an appropriately blended portfolio.

We saw this in late 2018 as Treasury prices rallied, with the yield on five- and 10-year notes falling sharply in December. This illustrates why duration should always have a seat at the asset-allocation table.

High-quality government bond exposure can also keep your bond portfolio liquid. Investors with enough duration can then rebalance by selling their outperforming interest-rate-sensitive assets and buying underperforming credit assets at discount prices.

That’s important, because it’s rare for credit sectors to suffer negative returns for two straight years, and history has shown that overall credit returns tend to be strong following periods when both credit and government bonds underperform.

We think there are attractive opportunities in parts of global high-yield markets at current prices, and we expect those opportunities to multiply should yield spreads—the extra yield corporate bonds offer over comparable government debt—widen further in 2019.

Keep Calm and Carry On

The year 2018 was difficult for investors around the world. After years of unusually placid financial markets, many of us struggled to adapt to today’s new and more volatile market reality.

But this isn’t the time to panic or ditch time-tested investment strategies. The way we see it, a balanced fixed-income strategy—and a skilled manager who can adjust the balance as conditions change—still has the potential to produce relatively high returns and a smoother ride in today’s turbulent conditions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein