by Carl Ross, GMO

Executive Summary

Emerging market sovereign debt in U.S. dollars can offer strong returns for investors who can ride out periodic bouts of volatility caused by concurrent crises in one or more countries. Crises, though real and frequent, are not typically as destructive to a country’s fundamentals as observers imagine.

When crises drive valuations to over-discount changes to long-term country fundamentals, it can be an attractive time to buy emerging sovereign debt. We believe today, following the recent 100-bps widening in sovereign spreads, is one of those times. Further, we believe that our low-turnover, value-oriented strategy can generate alpha above the base case.

Introduction

Crises happen, especially in the emerging world. Commodity swings, political upheaval, less developed institutions, economies levered to global growth – it seems something is always “going wrong” in one or more of the 85+ countries in the investable emerging debt universe. When we assess the severity and impact of the crises, we often see opportunity.

Definitions of what constitutes a ‘crisis’ vary. Emerging debt practitioners count the “biggies” as the Tequila crisis of 1994, the Asia/Russia/Long Term Capital crisis of 1997-1998, and the Lehman crisis of 2008.

In each of these crises, spreads widened by hundreds of basis points, resulting in substantial, temporary declines. As the asset class has matured and the investor base broadened, such massive spread widenings have become more rare.

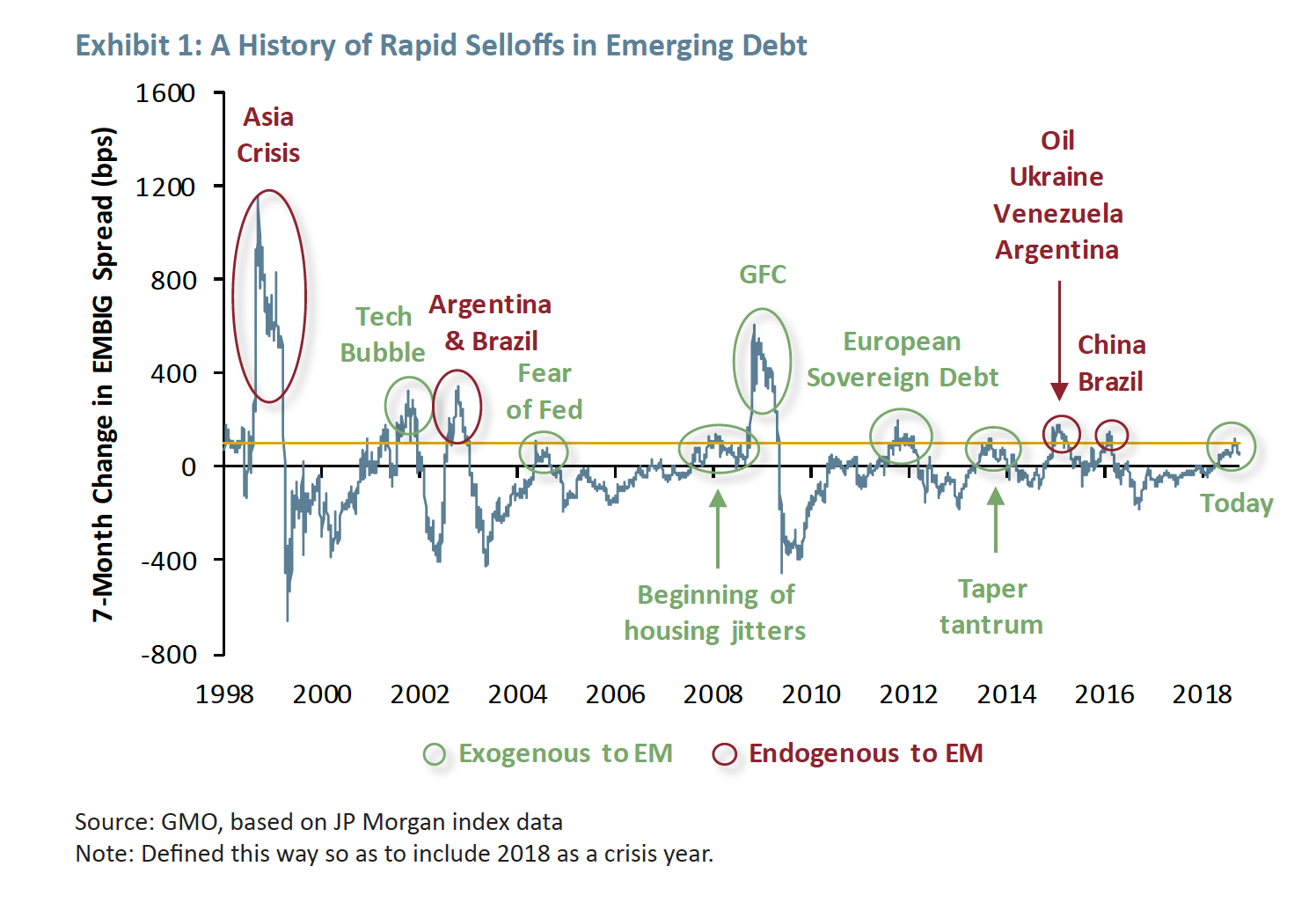

For this piece, we define a ‘crisis’ broadly: a widening of the benchmark credit spread by at least 100 basis points over a seven-month period. As seen the chart below, crises defined in this way are frequent (11 in the past 20 years), and their causes are somewhat random and difficult to predict.

They can be caused by events that are exogenous to EM, such as the bursting of the technology bubble in 2000 or the European Sovereign Debt issues of 2011-2012, or by endogenous events like the Asian crisis of 1997-1998 or the 2014 oil price collapse and Russian military intervention in Ukraine.

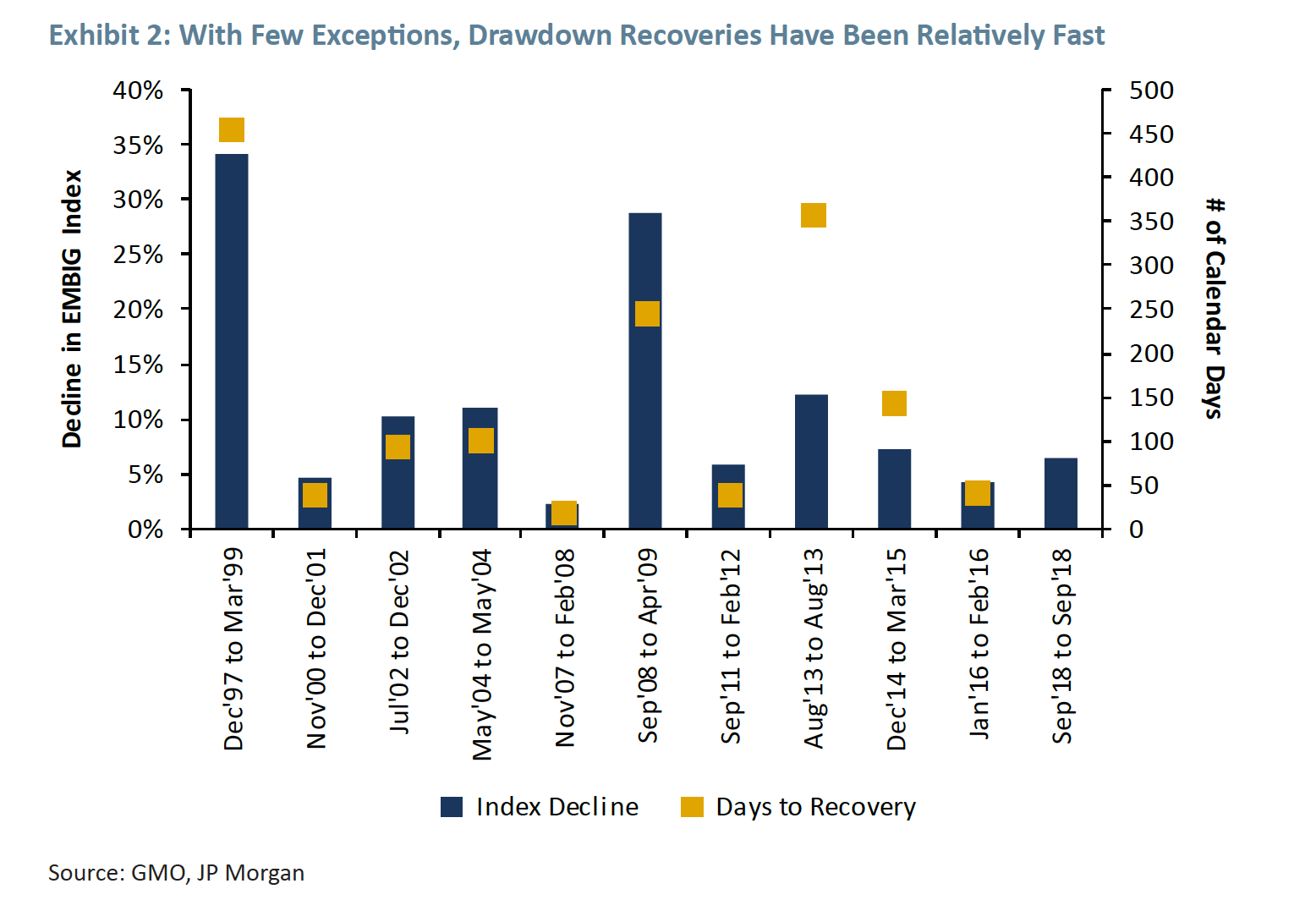

The good news, though, is that these crises, though frequent and hard to predict, tend to produce fast recoveries. Total return drawdowns are typically shallow (less than 10%), partially due to the dampening effect of U.S. interest-rate exposure, with full recoveries often taking no longer than six months, according to our calculations.

Permanent impairments of capital are also rare, and in EM debt are limited to losses from default. Borrower countries seek to avoid causing such losses, as they want to protect their access to the global credit markets. While these losses can be large in certain very unique circumstances (one being Argentina’s default of 2001), they are generally quite small and surprisingly infrequent.

2018 Example: Turkey

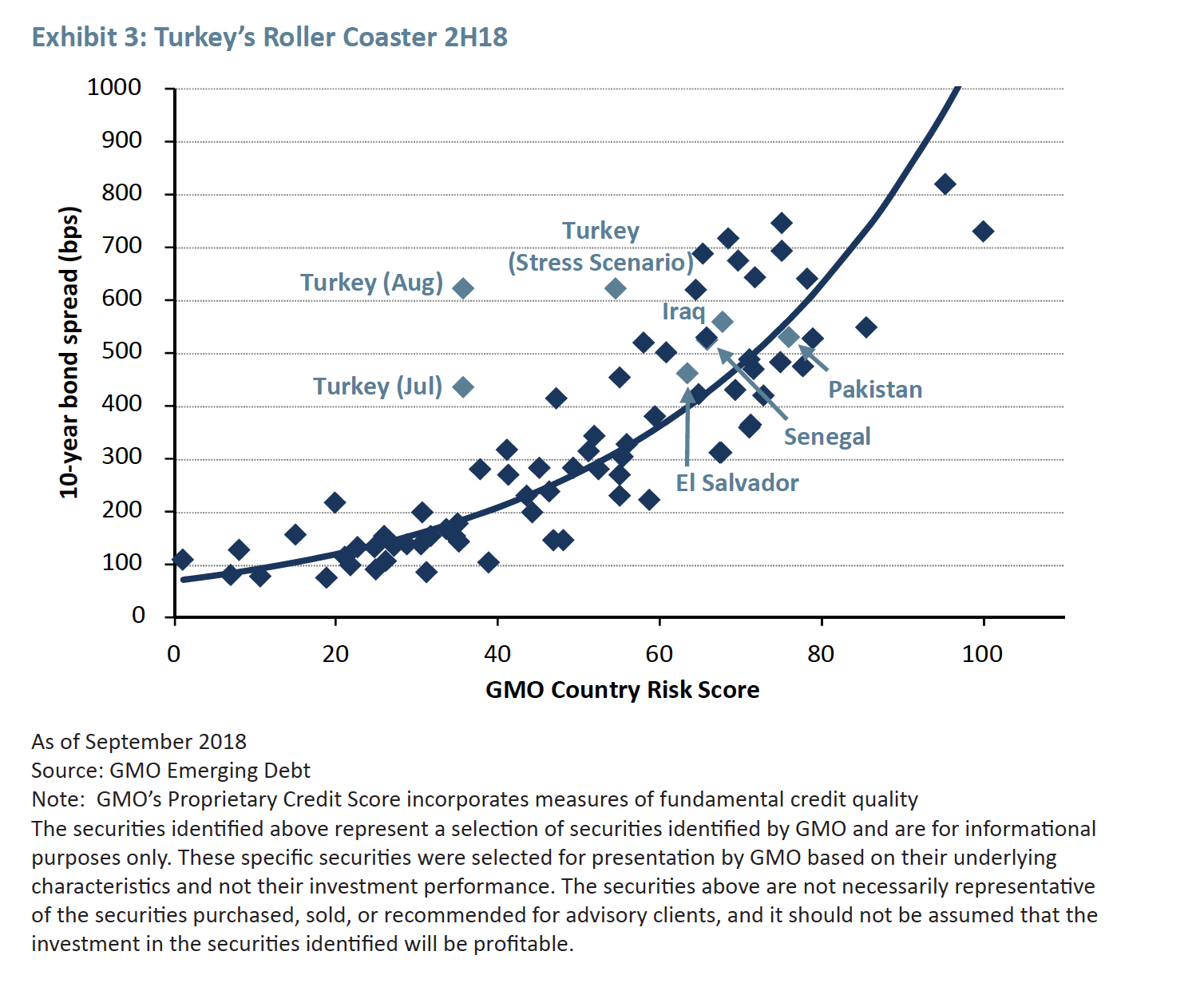

Turkey emerged as a buying opportunity in the second half of 2018 as spreads widened significantly, and the lira declined sharply. The lira’s decline sparked high inflation and rising loan defaults among Turkey’s domestic corporate borrowers. Despite these short-term impacts, the country continued to score highly on our quantitative screen, as shown in Exhibit 3.

We believed that because Turkey had a comparably sound economic structure and fiscal sustainability to its peers, bolstered by external liquidity that would likely improve as a result of lira devaluation and economic policy responses, that spreads of Turkey’s debt had widened beyond what could be justified by fundamentals and therefore represented a buying opportunity. We wrote about the opportunity afforded in Turkey and Argentina in August.1

The Opening Value Opportunity

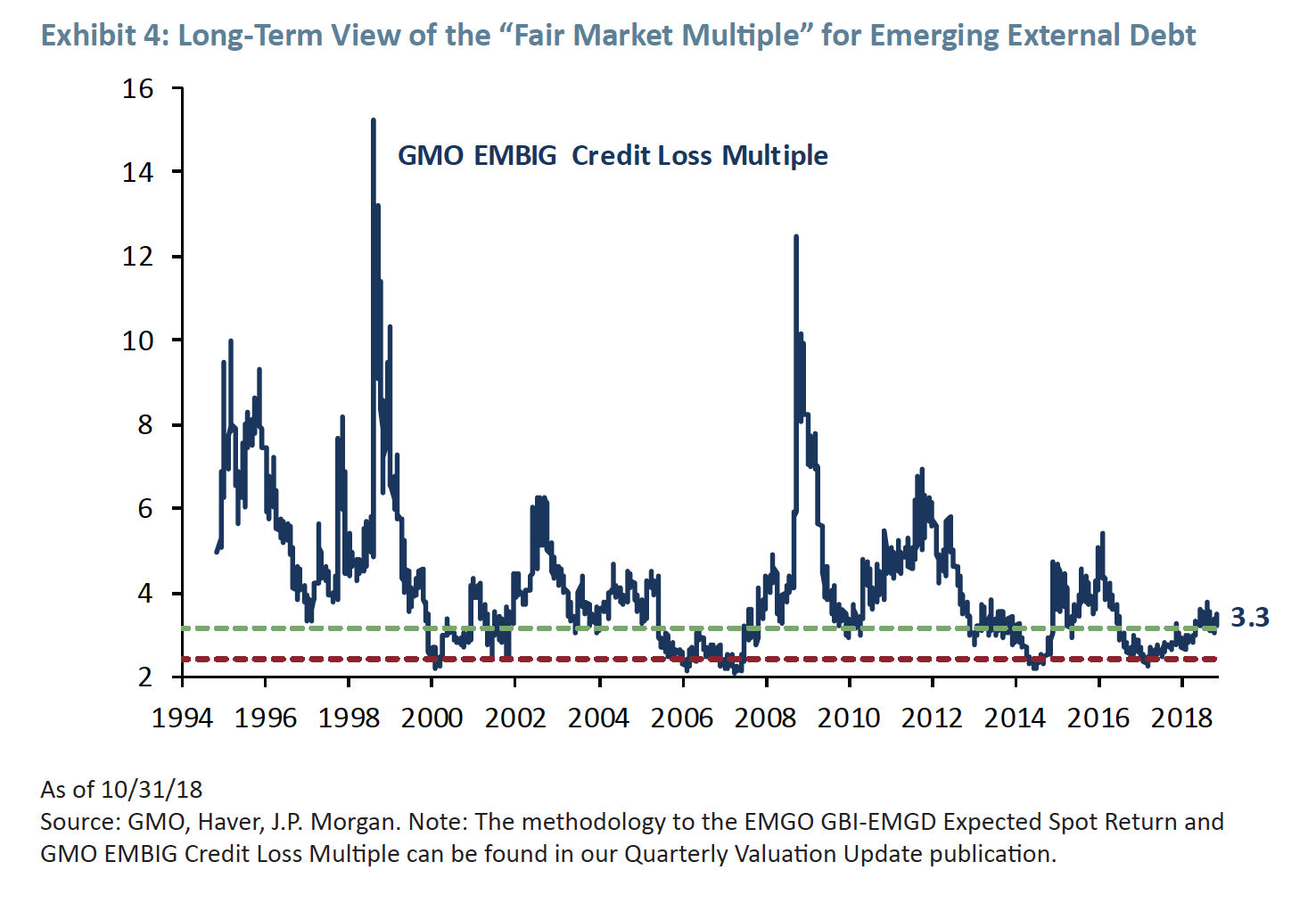

As a value-based investor, we take great care to compare market prices to fundamentals when advising potential investors about their allocation decisions. Below you will see our preferred metric for evaluating emerging external debt, the “credit loss multiple,” as of 10/31/18.2 The 3.3 current level is just above the level where credit returns to external debt investors have been skewed to the positive over time.

After a few years of seeing this multiple languish either in the “neutral” (between green and red) or, worse, “overvalued” (red or below) zone, we’re happy that the recent ‘crisis’ has opened this valuation opportunity for prospective investors (green and above).

Alpha Prospects

In addition to the improvement in the asset class valuation, we are fairly sanguine about alpha opportunities prospectively for our portfolios, both in security selection and country selection.

Turkey and Argentina, for example, both represent country overweights, and, within the two countries, each has attractive sovereign and quasi-sovereign security selection opportunities.

Conclusion

After a turbulent second half of the year and a widening of spreads, we believe emerging debt offers attractive valuations and opportunities for alpha. As GMO enters its 25th year managing emerging debt, we have become used to periodic crises, both big and small, and we believe we are well positioned to take advantage of them.

1 Thoughts on Turkey And Argentina Across EMD Portfolios (August 2018), available at www.gmo.com

2 Available for subscription at www.gmo.com.

*****

Carl Ross. Dr. Ross is engaged in research for GMO’s Emerging Country Debt team. Prior to joining GMO in 2014, he was a managing director at Oppenheimer & Co. Inc. where he covered emerging debt markets. Previously, he was the Senior Managing Director and Head of Emerging Markets Fixed Income Research at Bear Stearns & Co. Dr. Ross earned his BA in Economics from Mount Allison University as well as his M.A. and PhD in Economics from Georgetown University.

Disclaimer: The views expressed are the views of Carl Ross through the period ending January 2019, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forward‐looking statements based upon the reasonable beliefs of the Emerging Debt team and are not a guarantee of future performance. Forward‐looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward‐looking statements. Forward‐looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from those anticipated.

Copyright © 2019 by GMO LLC. All rights reserved.