Yesterday, saw a record surge in the markets.

Such was not surprising given the extreme oversold condition in the market. More importantly, throughout market history, the biggest bull rallies have occurred during bear markets.

Yesterday’s relief rally was simply that.

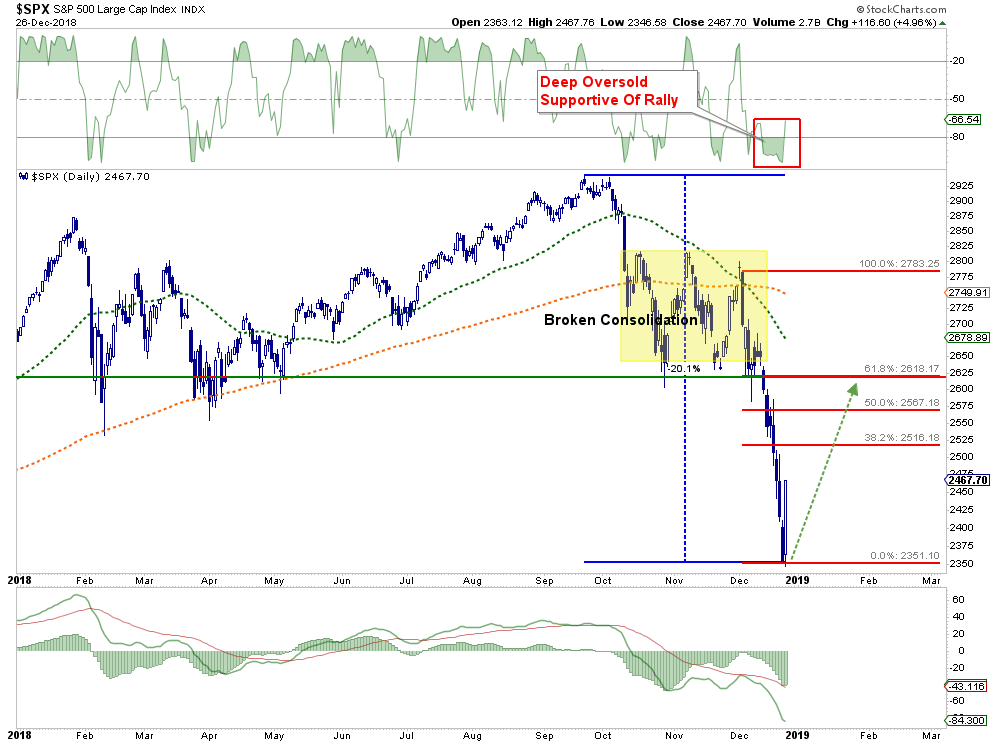

As shown in the chart below, following the breakdown of the market from its consolidation pattern in October and November, the market plunged 20% from its previous all-time highs. Despite the massive surge in stocks yesterday, all the market managed to do was recoup 2-days of losses.

From the previous peak in early December, the market has yet to even achieve a 38.2% retracement of that decline. It would not be surprising to see this rally try and recoup a full 61.8% of the decline over the next several weeks.

However, that may not even be enough to solve the biggest risk to the market currently.

In 2010, as Ben Bernanke was preparing to unleash the second round of “Quantitative Easing” upon the economy, he noted specifically the goal was to increase the “wealth effect” in order to assist the nascent economic recovery that was underway.

What exactly does that mean?

“The wealth effect is a theory suggesting that when the value of equity portfolios are on the rise because of accelerating stock prices, individuals feel more comfortable and confident about their wealth, which will cause them to spend more.” – Investopedia

This targeting of the “wealth effect” became known as the Fed’s “Third Mandate” which remains alive and well today as recently noted by Bill Dudley during a speech at the BIS Annual General Meeting:

“As I see it, financial conditions are a key transmission channel of monetary policy because they affect households’ and firms’ saving and investment plans and thus influence economic activity and the economic outlook.”

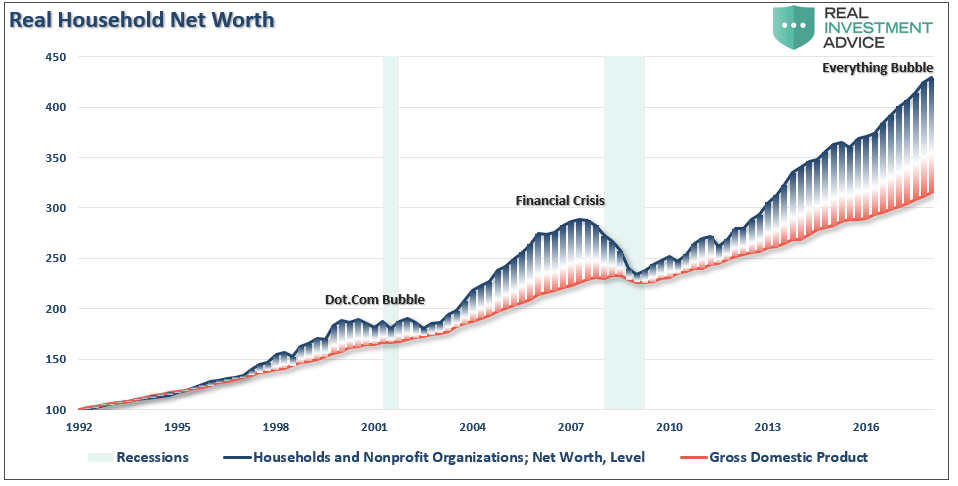

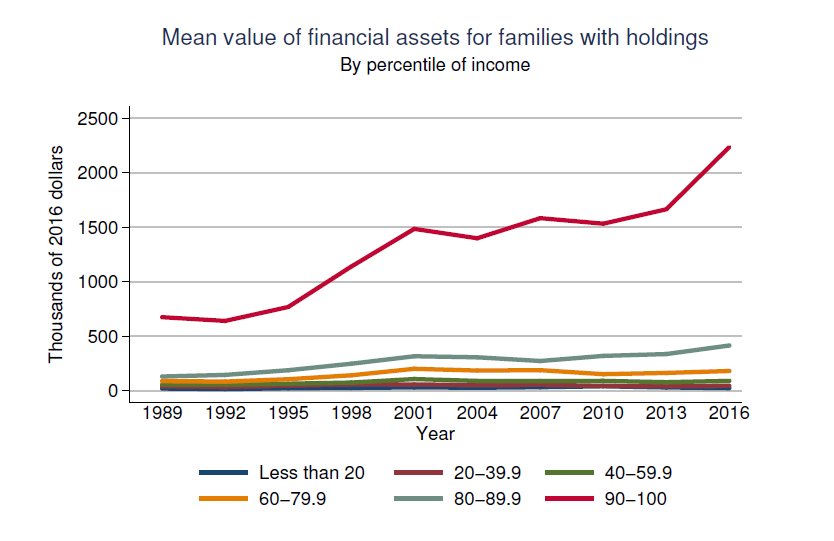

Over the last decade, successive rounds of both monetary and fiscal policy in the U.S. has created an inflation of asset prices to historic levels.

The problem, as I have shown previously, is that it failed to translate across the broader economic spectrum as intended. Instead, it simply boosted the wealth of the wealthiest 10% of Americans.

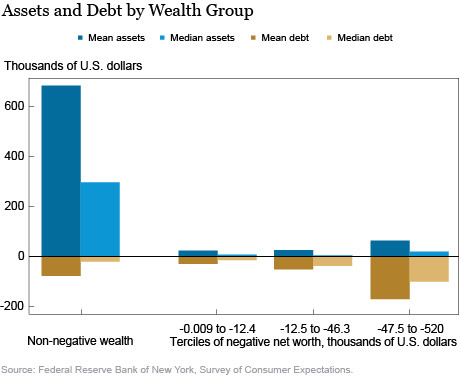

This was also shown in a recent study by the World Economic Forum on negative wealth. To wit:

“With respect to assets, we ask respondents how much money is in their defined contribution plan(s)—including 401(k), 403(b), 457 or thrift savings plans—and Individual Retirement Arrangement accounts, which cover the most common channels through which Americans save for retirement. We also ask the respondents about their total savings and investments, such as money in their checking accounts, stocks, and other financial instruments they may possess. Homeowners are asked to self-appraise the current value of their home. Finally, we ask for self-appraised valuations of any additional land, businesses, vehicles, or other assets the respondent’s household may own. The measure of total assets is then the sum of financial wealth, retirement wealth, home value, and other assets.”

So, what did the results show after a decade of booming asset prices?

“The chart below displays, in the leftmost column, the average and median asset and debt levels for households with non-negative wealth. The next three columns display the same statistics separately for each tercile of negative-wealth households, for example, the second column illustrates the data for those with the least negative wealth and the final column reflects households with the most negative wealth. The very low median levels of assets for all negative-wealth households are readily apparent, as are the large average and median debt amounts among households with larger negative wealth.”

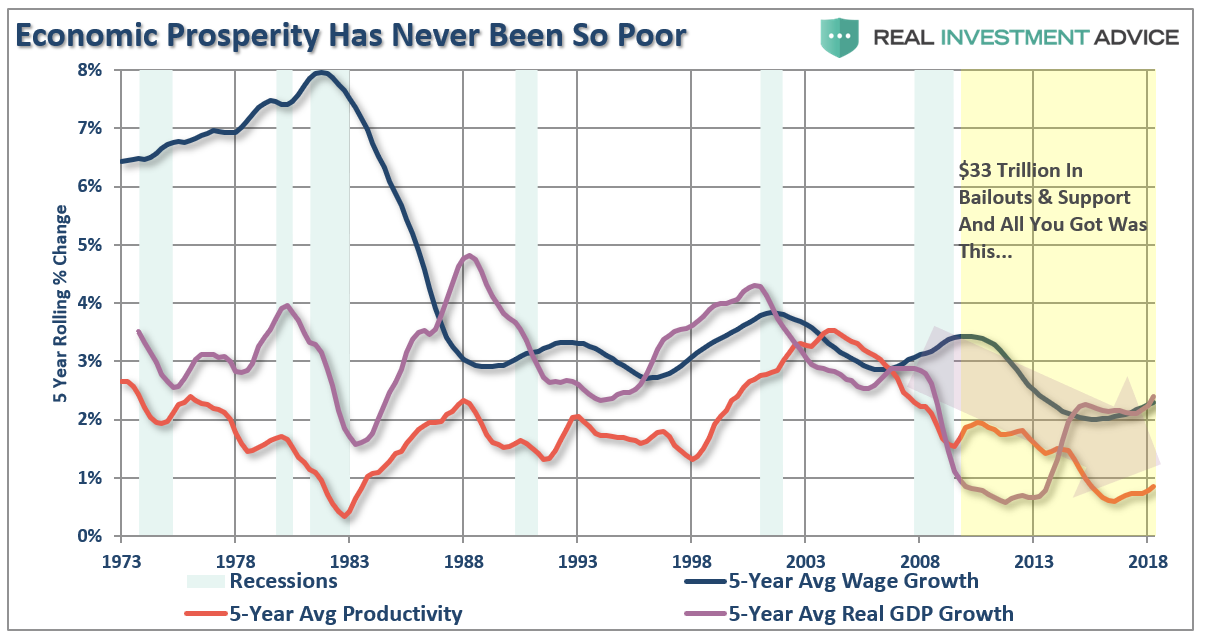

The lack of distribution of wealth across the economy explains why growth, outside the short-term impact of natural disasters and deficit spending, has remained so weak.

“More importantly, if we assume that inflation remains stagnant at 2%, as the Fed hopes, this would mean a real rate of return of just 0.5%.

Economic growth matters, and it matters a lot.

As an investor, it is important to remember that in the end corporate earnings and profits are a function of the economy and not the other way around. Historically, GDP growth and revenues have grown at roughly equivalent rates.”

Wealth Effect Runs In Reverse

Of course, the problem for the Fed, who are now in the process of reversing a decade of monetary stimulus, is when the “wealth effect” reverses. As noted by my friend Doug Kass:

“The prospects for economic and profit growth are waning in the face of the rapid drop in stock prices.

According to Wilshire Associates, the U.S. stock market fell by $2.1 trillion last week.

That loss in value is more than 10% of the 2017 U.S. Gross Domestic Production (GDP) of $19.3 trillion. (Our domestic GDP represents approximately 31% of world GDP). The loss in value from the September 2018 market top is well in excess of $5 trillion, representing about 25% of projected 2018 U.S. GDP.

The fixed income’s message of slowing economic and profit growth has been resounding — and until recently has been dismissed by most who were intoxicated by rising equity prices and favorable (but lagging) economic data.

Given the steady drumbeat of disappointing high-frequency economic data that suggest consensus growth expectations are too optimistic and underscores the fragile state of the domestic economy, this is a particularly untimely period for stocks to crater.

The economy — from a rate of change standpoint — is now at a critical point. No doubt a lot of damage to forward 2019 economic growth has already occurred and will result in a reduction in consensus profit forecasts.”

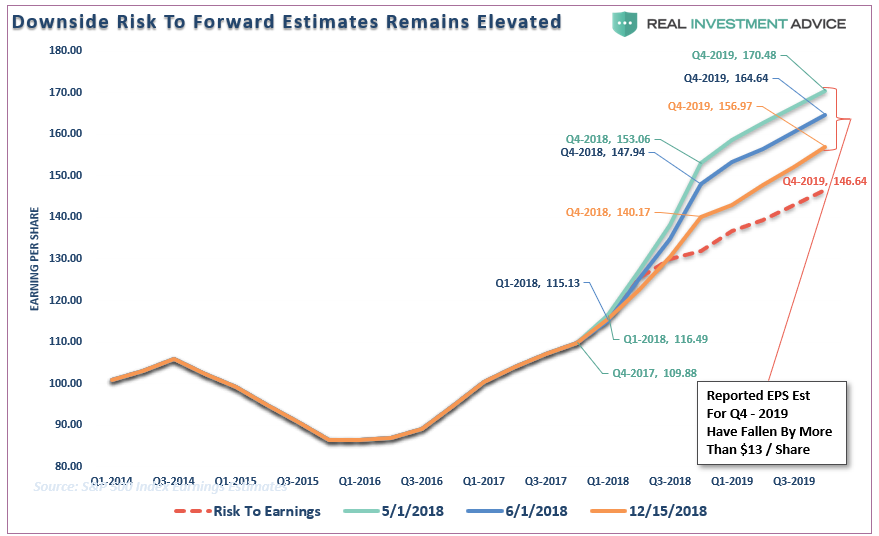

Of course, Doug is absolutely correct and we have already been consistently warning about the downdraft in forward earnings expectations which still remain way too elevated. As shown below, the forward estimates for 2019 have already fallen by more than $13/share and will likely hit our target of $146 by early next year.

By the way, that decline will wipe out the entire benefit of the “tax cuts.”

But that decline in profitability should not be surprising given the decline in confidence among consumers. Our friends at Upfina recently penned an interesting piece on this point:

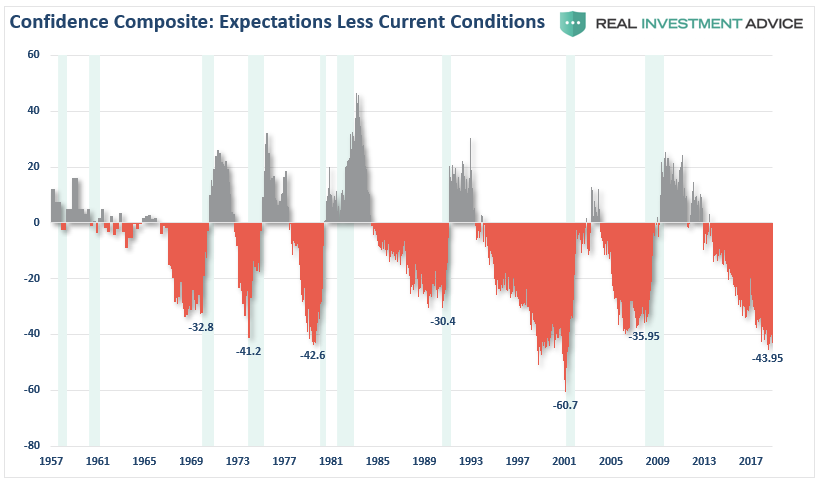

“The consumer expectations index minus the current situation index in the consumer confidence report is signaling a recession is coming.

We are reviewing where consumer spending is headed by showing the differential between expectations and the current situation. As you can see from the chart below, the current differential is worse than the last cycle, but still higher than the 1990s cycle. Recessions come after this indicator bottoms, and there isn’t much room for it to fall further.”

The chart below is a slightly different variation of Upfina’s which shows the composite index of both University of Michigan and the Conference Board measures of confidence. However, the results are virtually the same with the difference between forward expectations and current conditions ringing in at levels that have normally preceded recessions.

Given that GDP is roughly 70% consumption, deterioration in economic confidence is a hugely important factor. Rising interest rates which bite into discretionary cash flows, falling house and stock prices, and job losses weigh heavily on spending decisions by consumers. Reductions in spending reduce corporate profitability which leads to lower asset prices, so forth, and so on, until the cycle is complete.

None of this should be surprising, of course, as we head into 2019. We saw record low levels of unemployment and jobless claims. Record high levels of sentiment on many different measures. However, as I wrote in August of this year:

“’Record levels” of anything are “records for a reason.’

Remember:

- Bull markets END when everything is as “good as it can get.”

- Bear markets END when things simply can’t “get any worse.”

Currently, we are in the early stages of the transition from “bull” to “bear.”

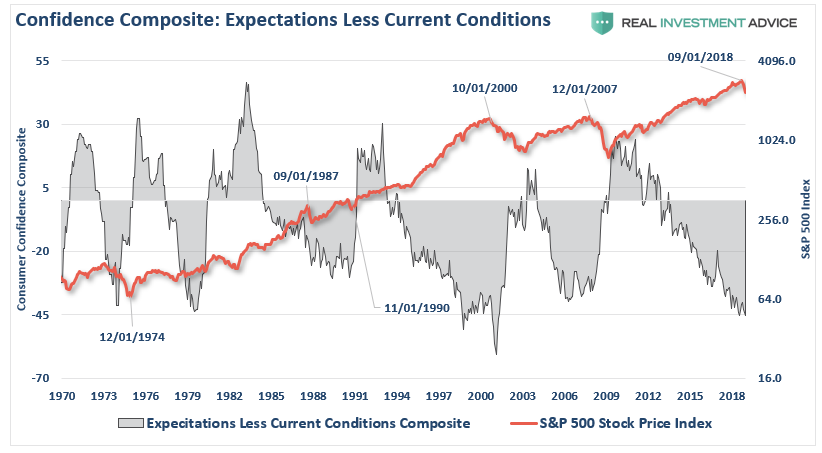

As investors begin to understand the magnitude of their losses in “dollar” terms, the impact to confidence will become an important headwind for the market. With higher rates already curtailing home and auto purchases, falling asset values will likely start to weigh more significantly on other purchasing decisions.

This was a point made by Bloomberg yesterday:

“The outlook [for additional rate hikes], however, is likely to be tempered by market volatility as falling stocks hurt consumption by reducing household wealth. Business confidence is damaged as volatility rises, the cost of capital increases, and uncertainty over government policies — be it a trade war or an assault on the Fed — forestalls investment.”

Confidence drives everything.

Which also continues to suggest the risk of a recessionary onset in 2019 has risen markedly in recent months.

In other words, it is quite likely the recent roar of the “bear” is not the last we are going to hear.