The US Federal Reserve raised interest rates for the fourth time this year, but with critics starting to question the central bank’s actions, will it take a tightening pause in 2019? Franklin Templeton Fixed Income Group’s Michael Materasso weighs in.

The US Federal Reserve (Fed) continued on its path of monetary policy tightening, raising its benchmark short-term interest rate, the fed funds rate, 25 basis points at its December US monetary policy meeting. It was the fourth rate hike this year and the ninth in its current tightening cycle, which dates back to 2015. This hike brings the fed funds rate to a range of 2.25% to 2.50%, which is still quite low historically.

The Fed also updated its monetary policy and economic forecasts, which saw a few changes from the projections made in September.

Here are some highlights of the latest projections:

- The Fed lowered its 2018 US growth forecast to 3.0% from its prior forecast of 3.1%, and lowered its 2019 forecast to 2.3% from 2.5%.

- The 2019 inflation projection (based on Core Personal Consumption Expenditures) was lowered to 1.9% from 2.0% previously.

- The projection for the unemployment rate remained at 3.7% for 2018 and 3.5% for 2019.

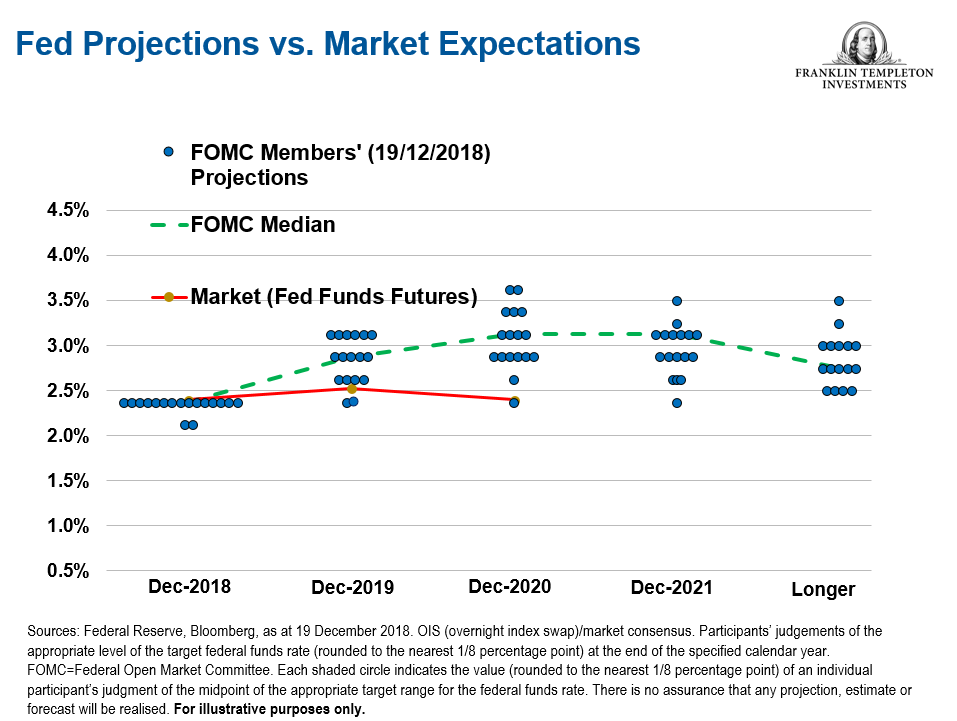

- The Fed lowered its interest-rate hike projections for 2019, putting the federal funds rate at 2.9%. It projects a rate of 3.1% in 2020.

In discussing the outlook for the US economy, Fed Chairman Jerome Powell said it was a “reasonably positive forecast” and did not seem terribly concerned about a global growth slowdown, despite market fears. We would agree.

US Economy Looks Fundamentally Sound

While there have been a few areas of concern, overall the US economic landscape still looks very positive. The job market has been strong, with labour participation rates holding steady. Average hourly earnings have been moving up but are still relatively low when compared with similar cyclical periods of a full-employment economy.

Consumer spending accounts for roughly two-thirds of US gross domestic product (GDP), and the consumer remains on solid footing with reasonable debt levels and savings. We believe the consumer should have the wherewithal to keep spending.

Fiscal policy—primarily tax reforms and tax cuts for both consumers and businesses—has been a growth driver in 2018. There has been talk that fiscal policy has run its course, but we disagree. The tax package was significant, and in the first half of 2019, many individuals will benefit from larger tax refunds. In addition, the enacted tax reforms will stay with the economy for quarters to come.

Given this backdrop, it seems likely to us that the US economy can continue to grow at an above-trend pace in the first quarter of 2019 and beyond. Our view is that while inflation is not a problem, it will likely edge upwards, so it is also likely the Fed will continue to raise rates in 2019. Whether it winds up being one or two rate hikes isn’t all that important in our view.

Taking everything into consideration, the Fed made what we’d call a dovish rate hike.

Plotting the Dots

The Fed updated its “dot plot” chart, which presents a picture of where the central bank sees rates headed.

What seems rather interesting to us in looking at the dot plot versus the prior meeting in September is that the Fed doves became less dovish, and the Fed hawks became less hawkish. The hawks softened their stance to the extent that the new high end of the range is now part of the central tendency—which excludes the three highest and three lowest projections.

That said, Powell reiterated that policy decisions “are not on a pre-set course” and there was still a fairly high degree of uncertainty in terms of the path and destination of further rate hikes.

At the press conference following the Federal Open Market Committee’s announcement, Powell fielded some questions about inflation and whether the Fed really needed to continue tightening next year. We have seen a repricing of risk in the markets, and therefore many people think the Fed has to pause, but Fed policymakers focus on fundamentals of the economy, not market fears.

In a full-employment economy, it’s natural for wage pressures to rise, even though increases so far have been rather muted. However, the output gap—the difference between the actual and potential output of an economy—closed a while ago, so now there are capacity constraints, and some raw materials costs are increasing.

With above-trend GDP growth projected, we think it’s more likely manufacturers will be able to pass those increased costs to consumers. Bottom line, we don’t think this hike is the last hike in the cycle, unless things change dramatically in the economy in the near term.

It’s worth noting that one of the goals of tax reform is to increase capital spending, which typically leads to higher productivity. When productivity increases, the economy’s trend rate of growth will typically increase as well. That being the case, one could argue the Fed’s “neutral rate” should probably move up, too. Higher productivity accompanied by low inflation could allow for a higher fed funds rate, because the neutral rate should rise with rising productivity.

There’s been some talk recently about what the neutral rate should be—in October, Powell said the Fed was still “a long way from neutral” but then in November, said rates were “just below” neutral. At this latest policy meeting, Powell said he thinks rates have reached the bottom end of the range of what the Committee estimates as neutral.

A No-Win Situation for Powell?

As noted, we have seen a more risk-off type of environment, and the immediate market reaction in the wake of the Fed’s announcement seemed to reflect a continuation of that risk-aversion, both on the equity and fixed income side. It seems to me that from a market standpoint, it was almost a no-win situation for Powell.

If he communicated the Fed was finished tightening, it could be interpreted as a signal the economic picture is deteriorating. If he were to be more hawkish in tone, the markets probably wouldn’t like that, either. We believe the US economy has broad-based strength to weather another rate hike or two in the coming year.

There is a concern about slowing global growth—particularly in China—that will cause the United States to slow down as well. However, the United States is a largely insulated economy and our monetary and fiscal policy is significantly different than China or Europe. The US economy has and can continue to grow, even if China and Europe are slowing.

In sum, we think the United States can continue to grow above trend as fiscal policy and employment trends are large positives that bode well for strong growth. In that type of environment, we see potential opportunities to increase exposures to certain credit sectors.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.