As expected, the Fed hiked interest rates yesterday, but we now think there will be fewer hikes in 2019 than we previously called for. Not because the US economy is in trouble, but because the Fed is changing its approach to setting policy.

The Federal Open Market Committee (FOMC) raised its target interest rate by 25 basis points yesterday, to 2.25%–2.50%, a move that was widely expected by both us and most market participants. Nonetheless, we’re cutting our 2019 interest-rate forecast to two hikes—down from the four hikes we saw in 2018 and the four we called for in our original 2019 forecast.

The US Economy Remains on Solid Ground

There are two parts to forecasting the Fed: an economic outlook and an understanding of how Fed policy reacts to incoming information.

Our revised rate forecast actually has very little to do with a change in our economic outlook. Sure, downside risks have risen in the past few weeks, primarily as a result of turbulent financial markets. But with the labor market and consumer both in good shape, we continue to expect solid growth and gradually increasing inflation, which will likely prompt the Fed to raise rates a couple of times in 2019.

If the economy is in fairly good shape, then why did we cut our 2019 rate forecast?

The Fed Is Changing the Lens for Setting Policy

The primary driver relates to the second element of Fed forecasting: the Fed’s “reaction function,” which has changed. In other words, the Fed is reacting differently to incoming information in setting monetary policy. In yesterday’s press conference following the FOMC’s last meeting of 2019, Fed Chair Jerome Powell emphasized that future rate moves will be more “data dependent” than past moves have been.

That statement represents a softening of the Fed’s tone, and it’s an indication that the FOMC wants to be more cautious about raising short-term rates further going forward. Why the change? In our view, it has to do with the idea of a “neutral” interest rate—the short-term interest rate that neither boosts nor slows economic growth.

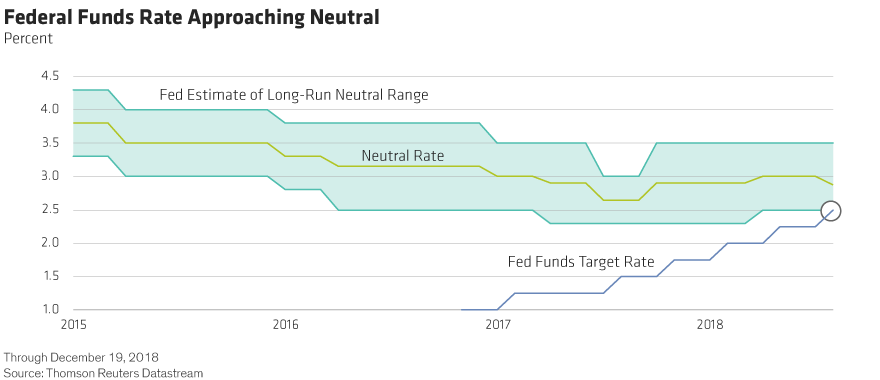

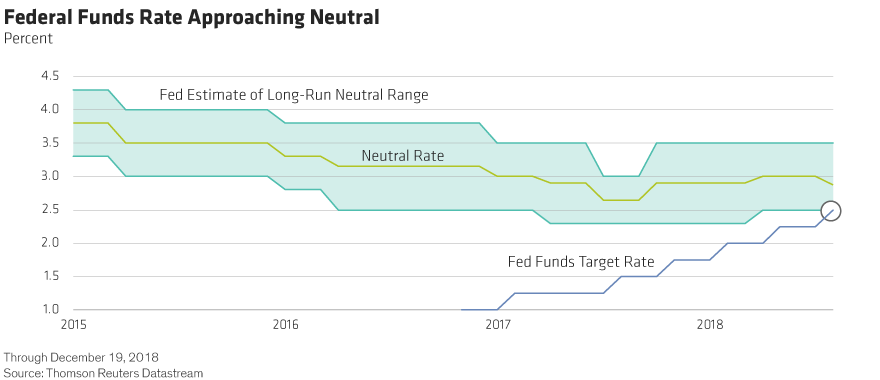

As recently as a few weeks ago, the FOMC discussed policy in the context of a forecast of a specific neutral rate. The committee has been estimating this rate at around 3%, which suggested that rate hikes would continue into next year before reaching the neutral point. The committee has changed its tune in recent weeks, making more explicit reference to a neutral ”range” of interest rates: between 2.5% and 3.5%, according to the latest estimate (Display).

Monetary Policy Likely to Become More Data Dependent

Based on that shift in context, yesterday’s rate hike pushed the fed funds target rate up to the bottom end of the forecast range for the neutral rate. In this territory, it makes good sense for the Fed to become more data dependent. The actual neutral rate is an estimate, not an easily observable point, so it makes sense to rely more on incoming data to demonstrate to both the Fed and markets whether monetary policy is still accommodative.

That’s consistent with a slower pace of rate hikes—the committee will want to see more data play out between rate moves to make sure it isn’t accidentally overtightening. With inflation stable and oil prices low, the FOMC certainly has the room to move slowly on interest rates—and we expect that it will.

Bear in mind, though, that being more data dependent isn’t the same thing as being dovish. If the economy turns out to be stronger than expected (this happened in 2018), there will be additional rate hikes. If the economy ends up weaker (think 2016), we’ll see fewer rate hikes. While our revised forecast is for two 2019 hikes, it remains possible that there could be more or less, depending on how the economic outlook evolves.

One factor we don’t think will influence the Fed is political pressure. Chair Powell emphasized repeatedly in his press conference that the committee is not—and will not—be influenced by President Trump’s preferences. That’s good news for the economy and financial markets in the long term. Monetary policy works best when it works independently, and we see no evidence that the Fed will be swayed by the charged political climate.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein