What is the “neutral” rate of interest? And why should you care? Richard explains.

The “neutral” rate of interest is an elusive yet important metric in monetary policy decision-making. It represents the level of interest rate at which monetary policy neither stimulates nor restricts economic growth. Naturally, where the Federal Reserve sees the neutral has profound implication on its policy making–and on financial markets. Here’s the catch: the neutral is unobservable and can only be estimated statistically. Our estimates show that the Fed’s policy rate is still below neutral, or slightly stimulative. Yet as the Fed’s policy rate closes in on the neutral, we see new uncertainties emerging on the Fed’s rate outlook.

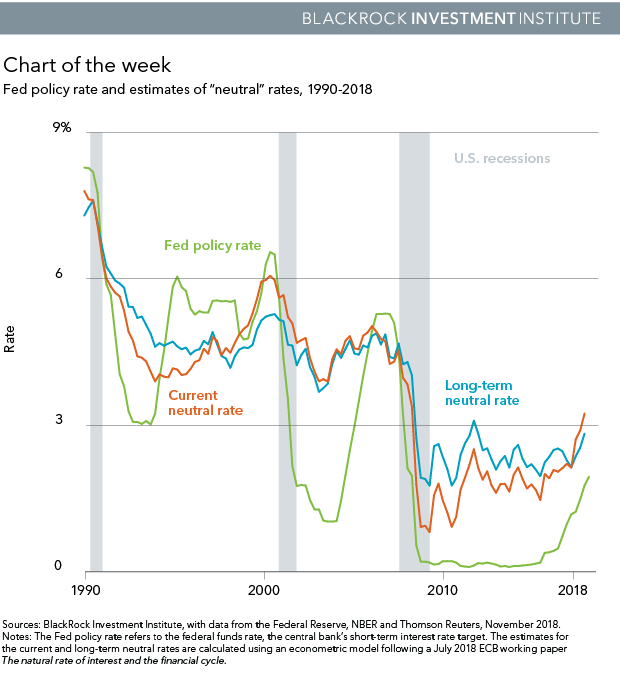

The Fed’s policy rate sits below our estimate of the neutral, but is closing in, according to analysis by our Economic & Market Research Team. The below-neutral policy rate suggests U.S. monetary policy should still be providing some stimulus to the economy, though this boost is much smaller than several years ago when the gap to neutral was much wider. We present two estimates of the neutral rate: long-term and current, as the chart shows. The long-term neutral rate is considered the equilibrium level that would prevail if financial leverage followed its long-run trend. It is guided by factors including the trend pace of economic growth and long-term demand for savings. The current neutral level factors in the additional impact of the financial cycle. A sustained period of credit growth serves to push the current level of neutral up because higher interest rates are needed to stabilize the economy. Conversely, the current neutral rate falls in a period of persistent deleveraging.

Neutral and the financial cycle

The extent to which the current neutral rate deviates from its long-term equilibrium level over a financial cycle has important implications for monetary policy. In the depths of the financial crisis, depressed animal spirits and rapid private sector deleveraging pushed the current neutral rate below its long-term equilibrium level. In such an environment, the Fed had to cut its policy rate even further below the long-term neutral level. Over time, the wounds of the crisis have healed and the situation has reversed. The current period of sustained re-levering has pushed the neutral rate back up above its long-term level. This implies the Fed would have to “lean against the wind” and push rates higher in order to prevent overheating pressures from building up.

The closer the Fed gets to neutral, a milestone it has been pursuing gradually for nearly three years, the greater the uncertainty over the interest rate outlook. For one, there is inherent uncertainty around the Fed’s assessment of “neutral” given that it is an unobservable metric that can only be estimated statistically. Fed Chairman Jerome Powell has signaled he prefers to place less emphasis on the neutral rate in Fed communication given the difficulty in pinning it down. The Federal Open Market Committee, the central bank’s policy-setting group, may become increasingly cautious as it “feels” its way toward neutral.

The narrowing gap between the Fed policy rate and the neutral level, and the rising uncertainty likely to accompany it, has implications for financial markets. The policy rate is ultimately likely to settle at levels far below pre-crisis averages. Yet for the first time in a decade, markets would no longer be under the auspices of stimulative monetary policies. This shift toward tightening financial conditions presents a hurdle for risk assets, underscoring our call for building greater resilience into investment portfolios. This implies a focus on quality and liquidity. We favor stocks of companies with strong balance sheets, ample cash flow and a healthy earnings outlook, and we find these companies predominantly in the U.S. In fixed income, we prefer an up-in-quality bent in credit.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog