How the fourth industrial revolution will transform economics, politics, and more

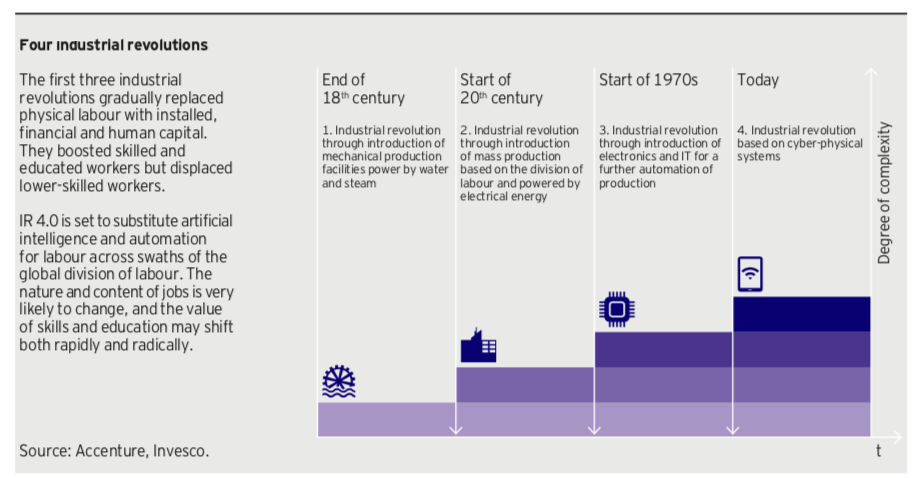

After two centuries of industrial transformation and change, we’ve reached what many now call the Fourth Industrial Revolution. It’s marked not by the introduction of steam power or the advent of mass production but by the rise of artificial intelligence and automation that will fundamentally transform the global division of labour.

Our new paper, Industrial revolution 4.0: ghosts of disruption past, present and future, explores the similarities and differences between the first, second, and third industrial revolutions and what is happening today (Figure 1). And while steam, mass production, and the introduction of computers in the 1970s had a substantial impact on economies and societies, the fourth industrial revolution – IR 4.0 – is set to change the nature and content of jobs and to rapidly and radically shift the value of skills and education.

IR 4.0 is also influencing the political environment and raising questions around how workers, voters and policymakers will ultimately respond to the march of the machines. Will it be reactive, regressive, or rational? And are there investment implications we can take away from this as we seek to position our portfolios for the long-term?

Here are four of our key takeaways:

The rise of robots won’t displace all jobs

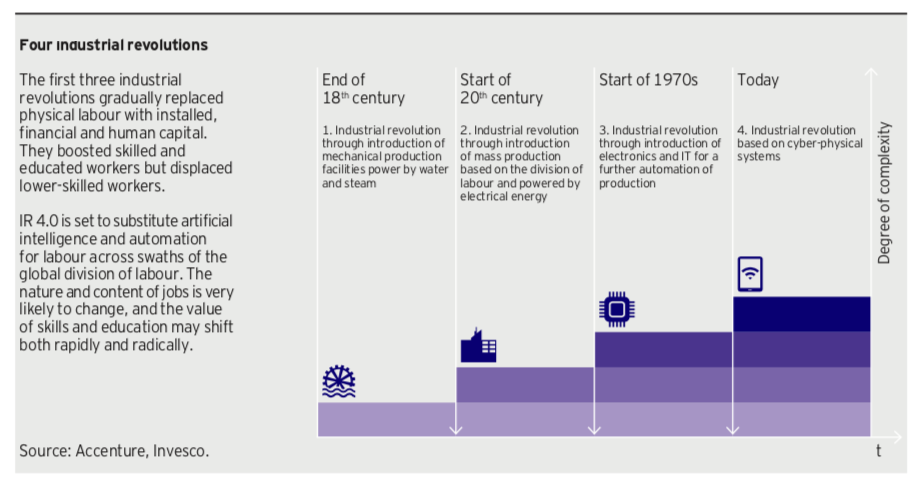

Lower-skilled workers undoubtedly bore the brunt of the first, second and third industrial revolutions, but the would-be victims of automation are less easily pigeon-holed. An OECD study (Figure 2) shows the professions with a high probability of being replaced by automation (rated above 98%): telemarketers, insurance underwriters, mathematical technicians, watch repairers and accounts clerks.1

Those less likely to be replaced by automation (rated below 1%) include recreational therapists, social workers, audiologists, dieticians and choreographers.

From this, we can see jobs oriented around routine or repeated tasks are likely to be automated while jobs that require manual dexterity, human interaction and judgment are unlikely to be automated.

Taking a broader view, it seems reasonable to speculate that workers earning low to middle wages could be hit hardest. However, automating the lowest-paying jobs makes little or no economic sense, while automating the highest-paying jobs is liable to prove challenging.

The rage of the relegated

A recent research paper, Political Machinery: Did – Robots Swing the 2016 US Presidential Election?, puts forth the theory that “the intuition that voters who have lost out to technology are more likely to opt for radical political change”.2 It examined the region-by-region Republican share of the vote in the 2012 and 2016 presidential elections and compared them with levels of automation, again on a region-by-region basis, during the same timeframe. It was found that greater intensity of exposure to robots could be roughly associated with a shift in the popular vote and that this shift was less marked in relatively high-skill, high-education, high-income states.

This raises important questions for policymakers: could the rise of robots affect voter behaviour? And what does such a politically charged environment mean for countries and societies?

Long-term thinking is needed

In 2016, in a report entitled The Future of Jobs, the World Economic Forum (WEF) predicted that IR 4.0 would cause a net loss of more than five million jobs by 2020. In response to this, policymakers must seek a long-term and rational response to the immensely complex set of interrelated challenges now confronting the global economy. Policies are needed to foster innovation while striving either to maintain or to restore people’s productive, wage-earning capacity.

Emerging markets will come under pressure

We’ve already seen competition between the US/Western model of decentralised and devolved innovation and the Chinese model of state-coordinated progress towards the technological frontier. China’s apparently relentless pursuit of the latter course arguably makes it uniquely well placed among emerging markets (EMs) in tackling the unprecedented challenges that IR 4.0 poses. Its idea of the way ahead could scarcely be firmer. By contrast, many EMs could instead be left facing premature de-industrialisation.

Read the full paper and our analysis of investment implications.

Figure 1

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog