by Ryan Detrick, Investment Strategist, LPL Research

Today might be Halloween, but the market this month sure has added a new layer to fear—hasn’t it? Unless the S&P 500 Index ends the month with two consecutive green days, this will be the first time in history the S&P 500 has gone the entire month of October without back-to-back gains. That right there sums up how strong the selling has been.

In honor of Halloween, the big question is: What scares us? As we discussed in our latest Weekly Market Commentary, here are three concerns that are keeping us up at night:

Recent U.S.-China trade headlines. We continue to expect a trade agreement of some sort by early 2019, given how much both sides have to lose. But markets are susceptible to headline risk between now and then, and there is always a chance the relationship deteriorates to such an extent that more tariffs will be put in place and potentially become permanent—causing further supply chain disruptions that would likely put added pressure on companies’ profitability.

The Fed could make a mistake. The Federal Reserve (Fed) seems fully committed to further rate hikes. Should long-term interest rates fall due to growth concerns while (short-term) rate hikes continue, the central bank could potentially invert the yield curve, which historically has been a reliable recession signal. With wage pressures building, an uptick in inflation that spooks the Fed in 2019 could be possible.

Stocks have lost technical momentum. The S&P 500 broke below its 200-day moving average on October 11, and that gap is starting to widen, indicating that technical momentum is deteriorating. In addition, we have not seen the type of panic selling that has marked recent major lows, like those in August 2015, February 2016, and February 2018, based on the percentages of stocks that are oversold and put-call ratios, which are measures of bearish sentiment.

Be sure to listen to our latest LPL Market Signals podcast, as Chief Investment Strategist John Lynch discusses each of these concerns in detail.

It isn’t all bad news though.

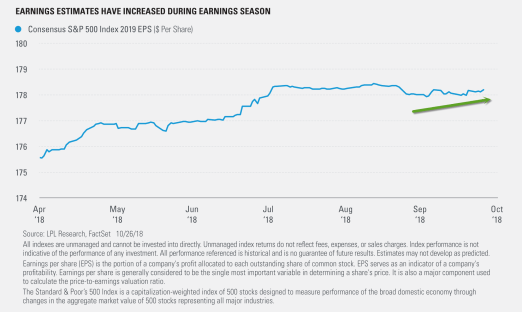

“Even though the list of worries has grown in October, it is quite reassuring to know that consensus estimates for 2019 S&P 500 earnings per share (EPS) actually increased this month! Call us old school, but we still think earnings drive long-term stock gains, and this is a great sign amid all the market volatility,” explained Senior Market Strategist Ryan Detrick.

As our LPL Chart of the day shows, earnings have been quite resilient during this tough month:

*****

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not bank/credit union obligations and are not endorsed, recommended or guaranteed by any bank/credit union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Member FINRA/SIPC

Tracking #1-787923 (Exp. 10/19)

Copyright © LPL Research