by Blaine Rollins, CFA, 361 Capital

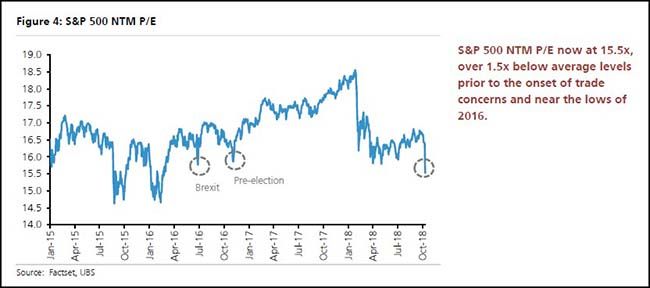

Halloween isn’t for another two weeks, but the tricks came early this year as investors were reminded that stocks can fall in price. So what caused last week’s sharp correction? You could blame rising interest rates, but they have been rising steadily for two years now. You could blame the trade wars but they began to bubble in the spring and then boil in the summer. Maybe Italy, but that was also a summer event. Brexit was a 2016 event, but we are getting closer to that deadline. Saudi Arabia was a surprise given their importance in the global oil trade, yes, they will definitely get some of the blame. But, if I had to point fingers, I would look to a decreasing corporate earnings outlook.

Earnings estimates going into the third quarter reporting season are very high. Over the last few weeks, we have had some warnings and guidance disappointments come out of the auto sector (F, BMW, DLPH), the materials sector (PPG), the luxury goods sector (LVMH), the industrial sector (FDX, FAST, FLR, CTAS), the semi sector (IPGP) and the consumer sector (CAG, CCL, GIS). On Friday we were given the early read from the big banks (JPM, C, WFC and PNC) and the results seemed to hit on 83% of their cylinders, but it just wasn’t good enough given where we are in the economic cycle. The next big move in the U.S. economy is not higher, it is lower. So companies need to be crushing it right now for investors to reward their share prices. As one looks through the early earnings releases or pre-announcements, you will find increasing difficulty in hitting the top line and rising margin pressures due to rising wages, raw material costs, and transportation costs. PPG, the world’s largest coatings company, gave up fighting the cost pressures last week and just decided to raise prices 10% across the board. So, guess what their auto and housing customers are going to do with their prices?

The stock market is a pretty efficient discounting machine. Right now, it sees growing evidence that corporate earnings will slow due to slowing global GDP, combined with rising cost pressures. As market interest rates rise due to rising inflation, Fed tightening and significant incoming supply ($1.5 trillion in Treasury debt in 2019), the hurdle rate for owning assets is also rising. Last night, Sears Holdings filed for bankruptcy. This is probably something that should have occurred five years ago but with interest rates near zero percent, some investors thought it was worth giving this retailer a 2nd, 3rd and 4th chance. But now, in an era of 2.85% two-year, risk-free rates, Sears could no longer find anyone to give it cheap money for a 5th chance. While it will be a good thing to clean out the market and get rid of these zombie companies and put capital to more productive uses, it will be painful in the near term to watch companies go out of business while the ripples impact other companies and individuals.

So, in February the market sent us the first big warning to reduce risk as initial rising labor and input costs sent interest rates soaring higher. Then in June, the trade wars ramped up and impacted the auto and industrial stocks sending investors another warning. Now, corporate margin fears are taking center stage due to rising costs and the trade wars which is hitting stock prices and interest rates hard. For investors with a risk appetite, the foreseeable future doesn’t look like a treat anymore. I would not be looking to take much risk right now. If you want some long exposure, match it up with some short exposure. Keep an eye on the U.S. dollar to see if future weakness will provide you with an opportunity to make returns in overseas stocks and bonds. Enjoy your commodity positions which should also win if the dollar falls. And consider your treats the piles of cash that a well hedged portfolio will provide. When was the last time you made near 3% owning a risk-free asset? Now off to the Sears bankruptcy sale as I just heard that they are closing my store. Of course, I haven’t been there in 10+ years, but I am certain they would still have white sheets for sale for my Halloween costume.

To receive this weekly briefing directly to your inbox, subscribe now.

When the head of the largest hedge fund speaks, you listen…

Bob Prince, co-chief investment officer at Bridgewater, believes the recent market turmoil was triggered by investors realising that this year’s strong economic growth and robust corporate earnings were likely peaking, as interest rates rise and the boost from tax cuts fades. “A lot of optimism about future earnings growth has been baked into equity valuations. But we are at a potential inflection point where the economy is moving from hot to mediocre,” Mr Prince said in an interview. Mr Prince, who manages Bridgewater’s $160bn of assets alongside founder Ray Dalio and co-CIO Greg Jensen, said: “We are now approaching the stage where monetary tightening could produce, perhaps not a big downturn, but more pressure.”…

Most bourses regained their footing on Friday, and US Treasury yields have fallen from the seven-year highs they touched at the peak of the bond rout. But Mr Prince cautioned that more turbulence was likely, given how major central banks, led by the Fed, were turning the screws on monetary policy. “This week could fade into history and we won’t remember it, but we are clearly shifting from an era of monetary easing to monetary tightening,” he said. “If that [a growth inflection point] is what is happening, then this won’t be a one-week event.”

Remember when Bernanke and Yellen use to bail out the market on big pullbacks?

After years of seemingly unquestioned central bank support — including the so-called “Fed Put” — stock and bond markets are transitioning away from a world where liquidity injections underpin asset prices and moving toward a greater role for fundamentals. Almost by definition, this is a volatile process: Think of a plane changing engines while flying at a high altitude. Turbulence is to be expected.

Gundlach is also pointing to interest rates…

While the POTUS is not happy with the Fed…

I watched the craziest episode of Black Mirror this week…

Good food for thought from the WSJ Editorial Board…

The question that no one can answer with certainty is whether the correction in asset prices will be longer and deeper because the Fed’s financial repression was so extended. Some of our friends think it is irrelevant and that higher corporate earnings and faster growth will carry stocks to new heights, give or take the occasional adjustment. We hope they’re right.But an honest assessment has to be that no one knows. We have never seen the kind of central bank experiment that Mr. Bernanke began and that Europe and Japan followed. It’s certainly possible that as long bond rates rise, capital will flow out of certain risk assets and back to a more normal pattern of investment allocation and risk.

No one knows, too, how much such a reversal will affect the real economy. Growth and overall economic confidence are strong enough now that even a major stock correction may not get in the way. Then again, if the “wealth effect” of rising 401(k)s and stock prices contributed to consumer confidence on the way up, perhaps it will subtract on the way down.

(WSJ)

Strongly agree with Doug Ramsey here…

If the leadership themes that got us here are over, then it will take a while for new themes to develop. I’d stay away from those assets sharply breaking their 200-day moving averages.

Doug Ramsey, chief investment officer of the Leuthold Group, thinks the Sept. 20 high for the S&P 500 of 2930.75 may well mark the peak for the year, and perhaps even for the historic run that began in March 2009.

For confirmation of that, he’s looking for a breakdown in the leadership themes that have defined this bull market: growth stocks over value; U.S. assets over foreign assets; financial assets over real assets; and the relative strength in momentum stocks, which, as Ben Levisohn writes in the Trader column, has already begun to break down. If those other three “paw prints” of the bear are sighted, the beast’s return will be confirmed, Ramsey concludes.

(Barron’s)

Always listen to Walter…

Now the question is, does it lead by 9, 12 or 18 months?

Back to corporate margins, Goldman is concerned…

Mounting inflationary pressures on record-high net profit margins have also led to investor concerns. Rising US labor costs represents a key margin risk. Our economists’ Wage Survey Leading Indicator currently stands at 3.3%, the highest level this cycle. Additionally, our political economist believes there is a 60% chance that the US will impose tariffs on most or all of the $267 billion of Chinese imports that have not been previously targeted with tariffs (see US Daily, Sep. 20). In such a scenario, our estimate of 2019 S&P 500 EPS, currently $170, could fall as low as $159, eliminating all expected earnings growth next year. This estimate conservatively assumes no substitution to other suppliers, no pass-through of costs to consumers, no boost to domestic revenues, and no change in economic activity.

(Goldman Sachs)

The PPG earnings pre-release scared the market silly on Tuesday…

Cuts Q3 $1.41-1.45 v $1.59e; Rev ~$3.8B v $3.87Be, attributed to softening demand in China, weaker automotive sales, and rising costs

Guides Q4 $1.03-1.13 v $1.35e

Comments:

“In the third quarter, we continued to experience significant raw material and elevating logistics cost inflation, including the effects from higher epoxy resin and increasing oil prices,” said Michael McGarry, PPG chairman and chief executive officer.

“These inflationary impacts increased during the quarter and, as a result, we experienced the highest level of cost inflation since the cycle began two years ago.”

“Also, during the quarter, we saw overall demand in China soften, and we experienced weaker automotive refinish sales as several of our U.S. and European customers are carrying high inventory levels due to lower end-use market demand,” McGarry added.

“Finally, the impact from weakening foreign currencies, primarily in emerging regions, has resulted in a year-over-year decrease in income of about $15 million. This lower demand, coupled with the currency effects, was impactful to our year-over-year earnings and is expected to continue for the balance of the year.”

“We expect sales volume growth of about 2 percent, excluding the unfavorable impact from the previously announced customer assortment changes in the U.S. architectural coatings business. In addition, we expect higher selling prices sequentially versus the second quarter.”

“We are anticipating continued raw material cost inflation in the fourth quarter, but at a more modest year-over-year rate given the inflation spike that occurred in the fourth quarter 2017. Improving our segment operating margins remains a priority, and we expect margins to be comparable versus the fourth quarter 2017 in aggregate. We currently expect fourth quarter earnings per diluted share to be in the range of $1.03 to $1.13, with the wide range primarily due to finalizing our full year tax rate. We remain committed to earnings-accretive cash deployment and expect to deploy approximately $1 billion on either acquisitions or share repurchases during the fourth quarter.”

(TradeTheNews.com)

Double-digit inflation at the household level…

The U.S. Postal Service proposed raising the price of a first-class stamp by 10% to 55 cents and increasing rates on a popular option used by Amazon.com Inc. and other shippers by more than 12% as the agency seeks to shore up its finances.

The increase on first-class stamps would be the largest on a percentage basis in more than three decades.

(WSJ)

Ford is doing all it can to manage the global supply chain disruptions from the trade wars…

Unfortunately, that now means job cuts to try and stay profitable.

Jim Hackett, Ford’s CEO, is working to engineer a $25.5 billion restructuring of the automaker, hoping to cut costs and remain competitive, the Wall Street Journal reports. But auto sales are down, and one reason is the trade tariffs that Trump has imposed on metals and other goods. According to Bloomberg, Hackett has said they have already cost the company $1 billion in profit and could do “more damage” if the disputes aren’t resolved quickly.

Ford, the No. 2 U.S. automaker by sales, is making aggressive job cuts as part of that reorganization, NBC News reported. While the company hasn’t said how many jobs will be lost, a report from Morgan Stanley estimates “a global headcount reduction of approximately 12 percent,” or 24,000 of Ford’s 202,000 workers worldwide.”

While reports have indicated that the job cuts are likely to come early next year, The Kansas City Star reported Tuesday that Ford has temporarily halted production of transit vans in Claycomo, Mo. The move is intended to prevent a build-up in Ford’s inventories of the vans, but it will leave 2,000 workers idle between Oct. 22 and Nov. 4.

(Fortune)

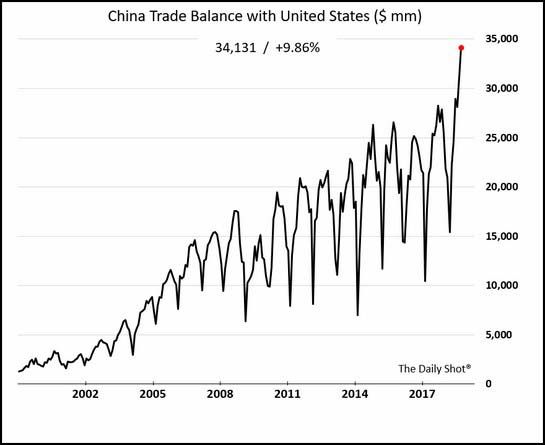

Last week’s trade balance data shows you how supply chains are being disrupted…

This spike in U.S. trade with China is being caused by U.S. customers buying aggressively in the advance of the trade tariffs. This is an inefficient use of capital and will cause margins and cash flows to be negatively impacted.

And now the trade wars are messing with Texas…

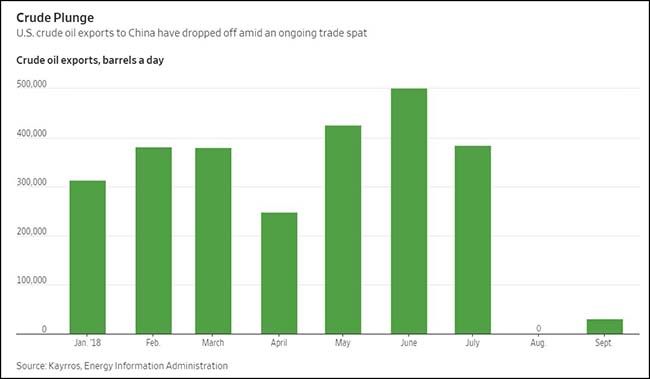

U.S. oil exports to China have slowed to a trickle amid the trade spatbetween Washington and Beijing, in an abrupt reversal that is upending global crude trade flows and forcing American producers to find new buyers.

China was the biggest buyer of U.S. crude oil in the first half of this year. But in August, U.S. crude exports to China, the world’s largest oil importer, fell to zero, according to tanker tracking data surveyed by The Wall Street Journal. In September, only 30,000 barrels a day of U.S. oil went to China, down from an average of over 350,000 barrels in the year up till July.

(WSJ)

Gary Cohn was one of the few in the White House who understood global trade…

Now the rest of America is learning how it works. For many, it will be a painful lesson.

Kent International Inc., a bicycle company, opened a factory in Manning, S.C., in 2014 to start assembling some of the bicycles it sells to Walmart Inc. and other retailers. It currently employs about 167 people.

Kent planned to expand the facility next year by importing steel tubes cut in China for painting and welding. It planned to hire another 30 to 40 workers at the plant, which assembles about 300,000 of the roughly 3 million bicycles the company sells world-wide each year.

“When we started getting wind of tariffs and were confident cut tubes would be subject to the tariffs, we stopped,” said Arnold Kamler, majority owner of the company and its chief executive for more than 30 years. Instead, he is traveling to Thailand, Vietnam, Cambodia, the Philippines and Taiwan to find new suppliers for Chinese products hit by tariffs.

“We are not bringing jobs back to America with this thing,” Mr. Kamler said. “We are bringing jobs to different countries in Southeast Asia.”

Companies hit by the tariffs aren’t simply raising prices to offset the added costs. Some business owners say they are delaying plans to expand their U.S. footprint, looking at dropping product lines or shifting production offshore.

“Overall, manufacturing in the short-term in the U.S. is worse off because of the tariffs,” said Harry Moser, founder of the Reshoring Initiative, a nonprofit that helps manufacturers make decisions about relocating production.

(WSJ)

The St. Louis Fed just dug into the root cause of the U.S. trade deficit and they are not a fan of a trade war with China…

There are three likely outcomes from an extended trade conflict with China: (1) Chinese imports will become more expensive; (2) U.S. trade deficits will shift to other countries with similar comparative advantages in producing labor-intensive goods; and (3) U.S. exports to China will become more expensive as a result of China’s retaliation. None of the above is likely to increase U.S. exports and reduce its trade deficits.

Most important, a trade war with China cannot stop declining American manufacturing employment if it is driven mainly by rapid technology progress, such as automation, robots and artificial intelligence. Instead, it may significantly reduce American consumers’ welfare and cause the U.S. to lose its leadership in free trade and globalization.

The U.S. has a long, successful history of promoting public education that has allowed workers to remain skilled and adaptable to a changing world. Therefore, the U.S. may need to more effectively promote education and job training programs that will allow Americans to better compete in a rapidly changing global environment. This policy will not necessarily increase manufacturing employment per se but would train workers for highly skilled manufacturing and services, which are the future of the economy.

IMF worries about an inflation surprise…

In its semiannual outlook released this week, the International Monetary Fund said the U.S. economy is already operating above its normal capacity, and the fiscal boost coming from lower taxes and increased spending “could lead to an inflation surprise,” triggering rapid rate increases, global financial turmoil, and a stronger dollar, all bad for global growth. It says Mr. Trump’s higher tariffs, in particular on Chinese imports, and resulting retaliation, could further hurt growth. J.P. Morgan estimates tariffs could temporarily boost inflation 0.2 to 0.3 percentage points next year.

One pessimistic scenario is that the threat of inflation from tight labor markets, higher oil prices and tariffs will spur the Fed to raise interest rates above neutral into restrictive territory, just as the stimulus from tax cuts fades around 2020.

Much depends on how much room the Fed thinks the economy has to run. Optimistic analysts think it has a lot. The expansion since 2009 has been long in part because the postcrisis environment has discouraged the sorts of risk-taking and imbalances that bring on a recession, such as heavy private sector borrowing.

(WSJ)

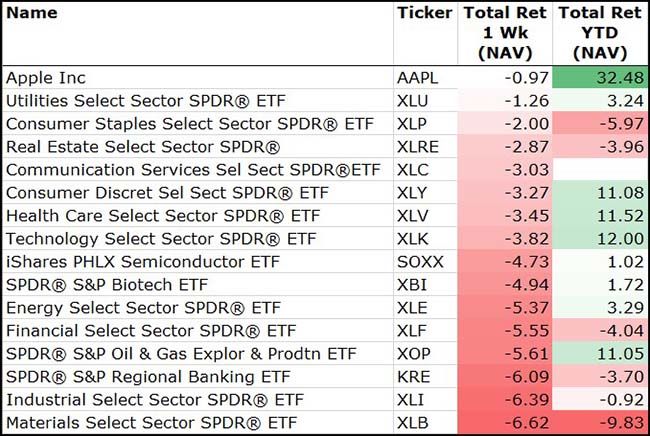

Equities were hit hard on the week…

Risk-free bonds and Gold was all that survived. Notice that Russell Value stocks go negative for 2018.

And all equity sectors were lower on the week…

The Banking and Financial ETFs both turned negative on the year.

Complacency?

I’m surprised the mutual fund outflows were not greater this week…

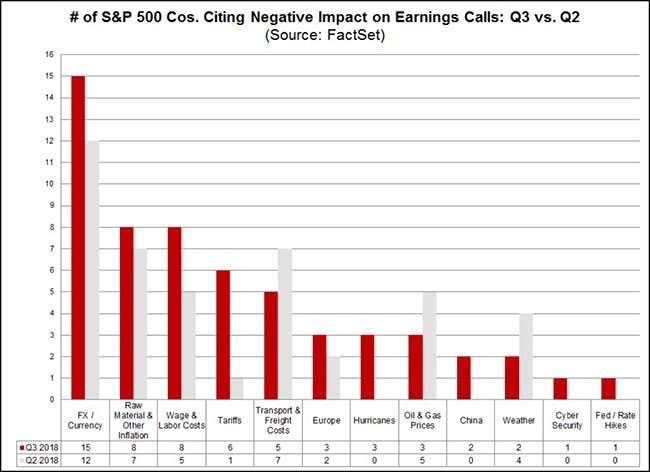

As you would expect, companies are complaining about the U.S. Dollar, rising costs and trade tariffs on their Q3 conference calls…

(Factset)

Plenty more earnings releases this week to evaluate…

(@eWhispers)

There is little good news in the housing sector…

No reason to buy housing stocks until the second derivative of inventory turns negative. It could take months or years.

Here is a chart of the Homebuilder ETF along with it’s new cliff diving partner, the Regional Bank ETF…

@361Capital: If you think the market is out of the woods, then here are 2 charts to make you sleep with one eye open this weekend… $ITB $KRE

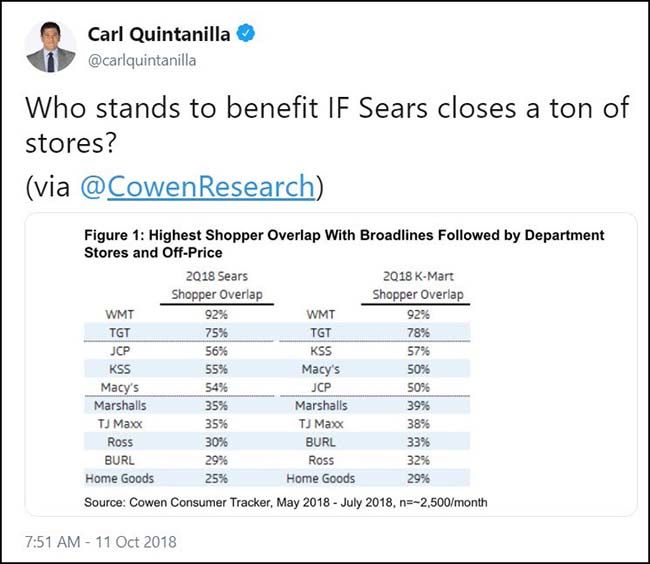

If not for QE and ZIRP, Sears would have disappeared years ago. So the good thing about higher rates is the zombie companies will be finally laid to rest and future capital can be put to more productive uses.

My Sears won’t make it to Christmas. These retailers will benefit…

I know that I am not the only Global Macro player to find this chart attractive…

Now, if the White House would stop with the Trade Wars, we might really see what upside there is in commodity prices.

If you are long tobacco stocks or bonds, you might want to study up on vaping…

The FDA should chill out and take a lesson from the more relaxed attitudes to vaping in countries such as Germany and the UK. Tobacco causes cancer, lung problems and heart disease, killing 480,000 Americans a year, and nicotine is the addictive alkaloid in tobacco. But these two facts do not prove that nicotine is a dangerous drug that needs to be treated as an equal menace.

Worse than a category error, this would be stupid. Getting a nicotine habit is a waste of money, and puffing from what looks like a USB drive may lead others to question your sanity. But it is nothing like as dangerous as smoking — the best estimates are that ecigarettes convey about 0.5 per cent of the cancer risk and 5 per cent of the overall health risk of cigarettes.

Health campaigners ought to welcome vaping, rather than confusing smokers with grim warnings that make it sound as if ecigarettes are not much better than the real thing. The reason why shares of tobacco companies such as Philip Morris International, the world’s largest, have fallen sharply is that smokers in developed economies are increasingly giving up, partly thanks to the arrival of satisfying substitutes.

Teenagers really should not vape, since there is some medical evidence that nicotine affects their brain development (although the same can be said of caffeine, and Nespresso pods do not carry health warnings). But the risk is not so high that it justifies encouraging adults to keep smoking in order to cut off the supply of Juuls and other vaping devices to school students.

And finally, a great story to start your week…

I have only worn Nike for 40+ years. It’s not just about the shoes.