by Blaine Rollins, CFA, 361 Capital

Plenty of noise to filter through to get to the items that will affect the financial markets. It is Federal Reserve week, so expect a fourth rate hike for 2018, along with a talking setup for another to follow. The current economy is strong and inflationary pressures are building because of its strength, or because of the global trade tariffs.

Speaking of trade, China is not happy with our plan to place tariffs on all of their imports into 2019, so they have bailed on the trade talks. Not good news for anyone needing to replace their Christmas lights this year (since they all come from China). And whatever you do, don’t promise a bicycle under the Christmas tree because Walmart doesn’t even know where they will find them now.

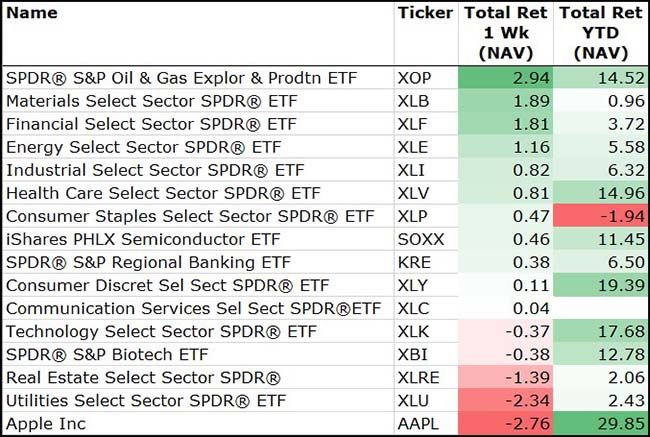

It was a mixed week for the markets with interest rates moving sharply higher helping Financials, while hurting rate-sensitive names (REITs and Utilities) and Growth stocks (higher rates tough on DCFs). The U.S. Dollar was impacted by trade war upticks which helped stock and bond holdings overseas. The markets could use an end to the trade wars. This new salvo with China is going to clip U.S. GDP and send prices much higher. Just ask anyone trying to rebuild in the Carolinas right now. The equity markets just made new highs last week. But, with stock buybacks ending going into the Q3 reporting season, and negative pre-announcements rising, how long can the market keep its gains? This remains a market to keep one foot in and one foot out of the tent. If the elephants and zebras stampede, you want to make for a quick exit.

To receive this weekly briefing directly to your inbox, subscribe now.

Big news of the week was the acceleration in trade wars with China…

Just advance right to the bottom line given the week’s deterioration in U.S.-China relations…

Walmart is now getting involved in the fight against Chinese tariffs…

They have also started a website to help register U.S. voters and educate them about current issues affecting them, including the trade wars: https://walmartcommunityvotes.com/

CNN Money reported that two weeks before the most recent tariffs were placed on Chinese goods, Walmart made a plea in a letter to Lighthizer to refrain from placing tariffs on products like Christmas lights, shampoo, dog food, backpacks, vacuum cleaners and bicycles, among other items.

“The immediate impact will be to raise prices on consumers and tax American business and manufacturers,” Walmart said in the letter.

Despite the request from the retail giant, the Trump administration on Monday went on to slap 10 percent tariffs on those products in addition to $200 billion worth of other imports from China amid the escalating trade war between the world’s top two economies.

“Either consumers will pay more, suppliers will receive less, retail margins will be lower, or consumers will buy fewer products or forego purchases altogether,” Walmart warned in the letter.

(The Hill)

Trade wars are causing the bosses who sign the checks to cut back…

Companies are reining in their plans for capital investment amid growing anxiety over President Donald Trump’s trade war, according to an industry survey released Monday.

The Business Roundtable found that nearly two-thirds of chief executives said recent tariffs and future trade tension would have a negative impact on their capital investment decisions over the next six months. Roughly one-third expected no impact on their business, while only 2 percent forecast a positive effect.

The group’s quarterly survey also showed plans for hiring dropped as well, falling almost 3 points from the previous quarter to 92.6. But expectations for sales rose 2 points to 132.3.

(CNBC)

What is ‘Yes’ for $200 Alex?

How Bend, Oregon is feeling the trade wars…

Tariffs benefit U.S. raw materials producers because they can raise prices without driving customers to foreign competitors, said Scott Mills, president of Smith Brothers Pushrods in Redmond, which makes after-¬market parts for drag racing and other vehicles.

“In the end, I think it’ll just be inflationary,” Mills said. “We’re not the only ones passing along price increases.”

Smith Brothers, which is one of the machine shops that supplies The Robert Axle Project, spends several hundred thousand dollars a year on aluminum, steel, brass and bronze. The company buys its steel from Europe and the United States, Mills said, and it’s paying much more since tariffs on European steel took effect in the spring.

“You try to pass on what you can,” Mills said. “From there, it erodes our profit margins.”

Smith Brothers’ cost of raw materials was up 35 percent in the second quarter from the same period in 2017, he said.

I wonder if the Carolina insurers accounted for a 20-30% cost increase to rebuild a home right now?

Homebuilders and contractors say the administration’s trade policy will add to the price increases that usually follow natural disasters. In addition to materials like lumber, steel and aluminum, the United States will impose tariffs on $200 billion in Chinese imports next week, including countertops, furniture and gypsum, a key ingredient in drywall. All told, some builders estimate that construction costs could be 20 to 30 percent higher than they would have been without these tariffs.

“We’re all going to pay the price for it in terms of higher construction costs,” said Alan Banks, president of the North Carolina Home Builders Association…

Contractors are also bracing for the 10 percent tariff that the federal government will impose on $200 billion in Chinese imports starting on Monday; the duty will jump to 25 percent in January. The list of affected products runs to nearly 200 pages and includes products like flooring, furniture, ceramic tiles and textiles that go into drapes and curtains.

“In a lot of these cases, American companies don’t make these products anymore, so no domestic industry will benefit,” said Chad P. Bown, a senior fellow at the Peterson Institute for International Economics. “The tariffs compound the situation these struggling homeowners face after the hurricane.”

(NY Times)

If you are wondering why all new homes will have wall to wall carpeting…

Goldman has thoughts on the outlook for Federal Reserve rate hikes…

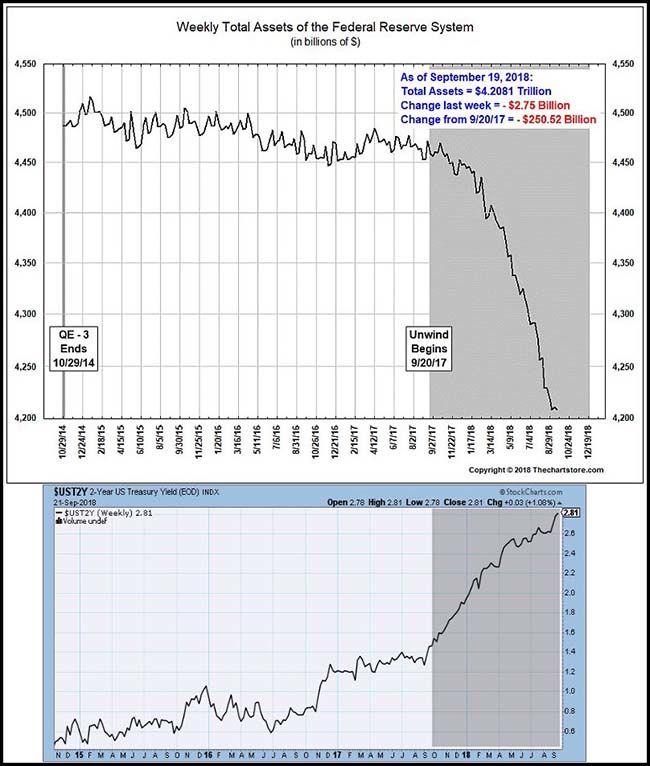

As the Fed drains liquidity, look at how short interest rates have doubled…

Important to note the the Fed has a LONG way to go.

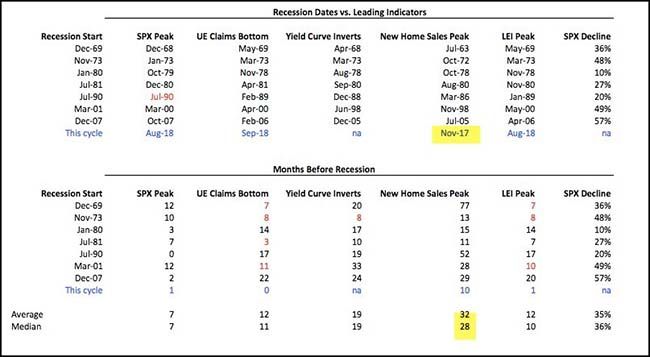

So, if peak home sales are the indicator, we could be less than two years away from the next recession…

@ukarlewitz: Housing typically peaks first, with a long lead time to the next recession. Setting up to be the case this time as well

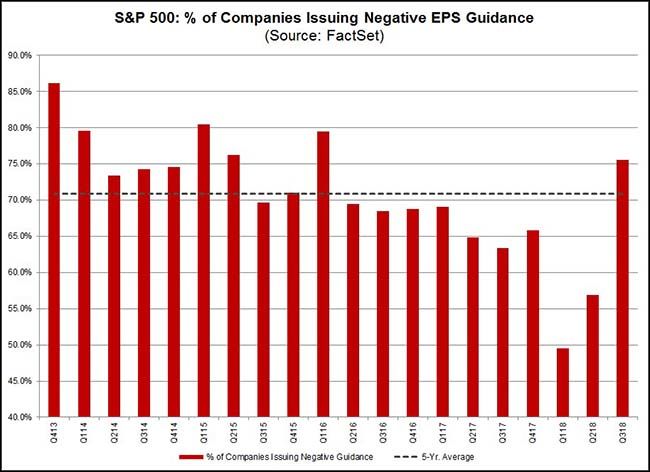

Homebuilder earnings outlooks have been cut. They aren’t the only ones in the last two months…

Heading into the end of the third quarter, 98 S&P 500 companies have issued EPS guidance for the quarter. Of these 98 companies, 74 have issued negative EPS guidance and 24 companies have issued positive EPS guidance. The percentage of companies issuing negative EPS guidance is 76% (74 out of 98), which is above the five-year average of 71%. If 76% is the final percentage for the quarter, it will mark the highest percentage of S&P 500 companies issuing negative EPS guidance for a quarter since Q1 2016 (79%).

(Factset)

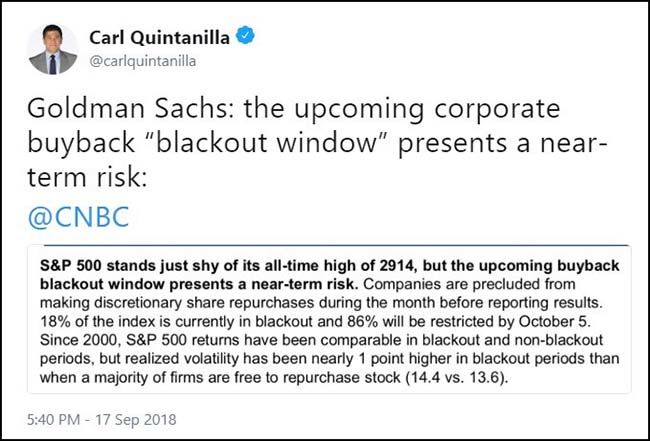

Stock buybacks will be on the sidelines for the next few weeks…

For the week, it was better to have your assets overseas with the U.S. Dollar falling sharply again…

Among the sectors, a bounce in the large multinationals with overseas exposures…

(9/21/18)

Chill some sake because Tokyo is looking to breakout…

Not many good looking International charts so this one is getting plenty of attention.

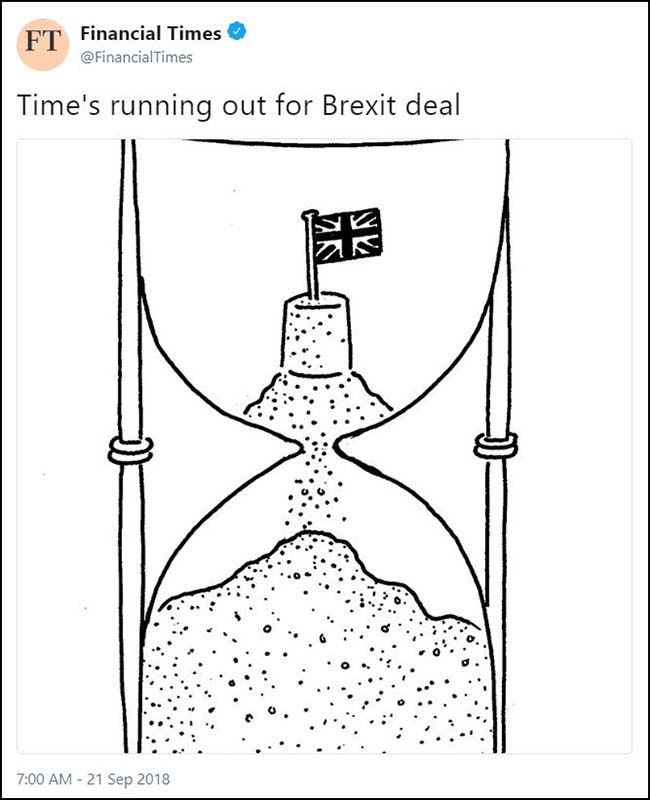

Meanwhile in the U.K., the Financial Times had the best visual update for Brexit negotiations….

‘Colo-exit’ gets the attention of this weekend’s Wall Street Journal…

While most would prefer not to live next to an oil well, if a majority of Coloradan’s vote ‘Yes’ on election day, it is easy to calculate how 10% of our state’s revenues could disappear causing a financial crisis. So if you cannot predict the outcome of this vote, it would serve you well to delay any real estate purchase decisions or business relocations into Colorado until after the election in six weeks.

Proposition 112 would restrict new energy development within a 2,500-foot radius of any building, playground, amphitheater, park, body of water or “any other additional vulnerable areas designated by the state or local government.” The restrictions rule out 85% of all non-federal land in the state, according to the Colorado Oil & Gas Conservation Commission. In the five counties that produce 90% to 95% of Colorado’s oil and gas, 94% of non-federal land would be off-limits. The implications of such a ban would be national. Colorado ranks fifth among the states in production of natural gas and seventh for oil.

In the first year the restrictions would take $201 million to $258 million out of state and local tax revenue. As energy production dwindled, that loss could rise to $1.1 billion annually by 2030, according to a Common Sense Policy Roundtable analysis reviewed by faculty from the Colorado School of Mines. The ban could kill up to 147,800 jobs and reduce state GDP by perhaps $218 billion between 2018 and 2030.

(WSJ)

Gentrification quantified: Each Starbucks is worth a 0.5% increase in housing prices…

Combining Yelp and Census data, we find that gentrification, as measured by changes in the educational, age, and racial composition within a ZIP code, is strongly associated with increases in the numbers of grocery stores, cafes, restaurants, and bars, with little evidence of crowd-out of other categories of businesses. We also find that changes in the local business landscape is a leading indicator of housing price changes, and that the entry of Starbucks (and coffee shops more generally) into a neighborhood predicts gentrification. Each additional Starbucks that enters a zip code is associated with a 0.5% increase in housing prices.

(NBER)

Why Wendy’s is still the best account on Twitter…

If you are close to cutting the cable/satellite cord, Amazon just mailed you a pair of scissors…

This is basically a TIVO box that is optimized for the Amazon ecosystem, with a HD over air antennae that will record any of your major network programming. Pair it with Amazon Prime, Netflix, Hulu and your favorite sports network sub and slice a chunk off your monthly cable bill (plus 500 channels that you’ll never watch).

FIRE TV RECAST BRINGS OVER-THE-AIR CHANNELS (ABC, CBS, FOX, NBC) TO FIRE TV

If streaming apps aren’t enough to satisfy your video streaming needs, Amazon’s new Fire TV Recast will add OTA channels to the mix — and a DVR for recording them. It’s essentially a super-powered Slingbox designed for Amazon’s ecosystem, letting you “watch, record, and replay free over-the-air programming to any Fire TV, Echo Show, and on compatible Fire tablet and mobile devices.” You plug an antenna into it to get TV channels up and running; Amazon says it will help customers find the best place to put the Fire TV Recast for optimal channel reception during setup.

A two-tuner model will let you record two shows at once and includes 500GB of DVR space for $229.99. A four-tuner version with 1TB of storage is also coming.

Fire TV Recast’s channels are integrated right into the Fire TV channel guide. You can schedule and delete recordings using Alexa, as well. It’s scheduled to ship before the holidays.

Of course, new technology is never perfect…

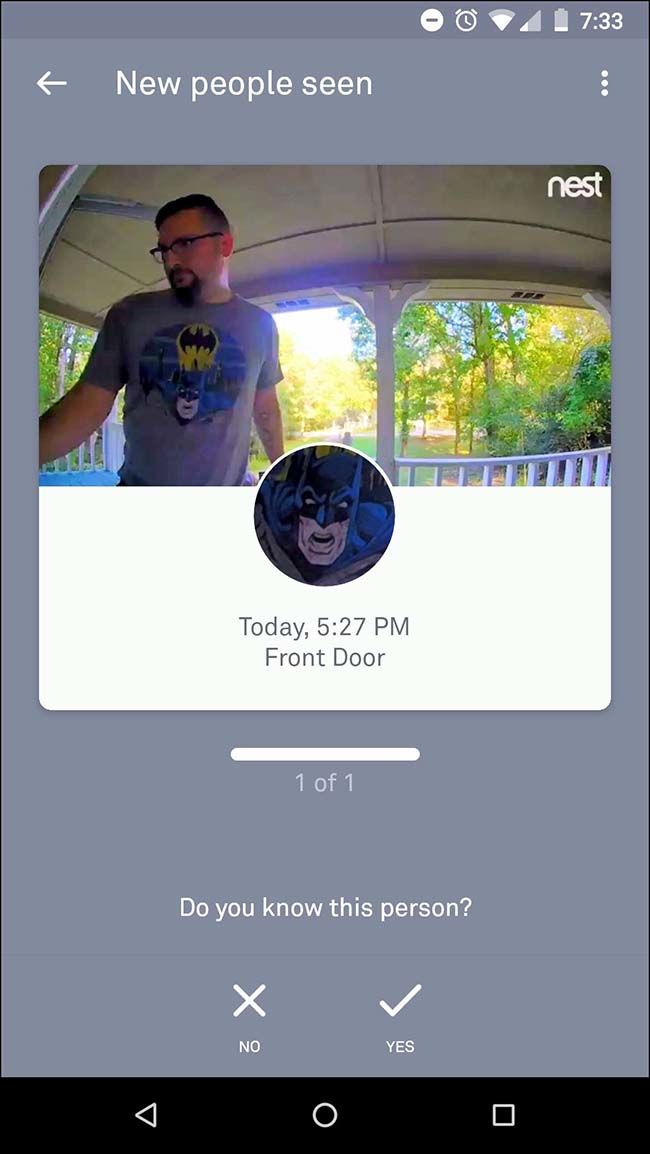

@bjmay: My @nest doorbell automatically locks the front door when it sees a face it doesn’t recognize. Today it didn’t recognize me, so I went into the app to investigate and…

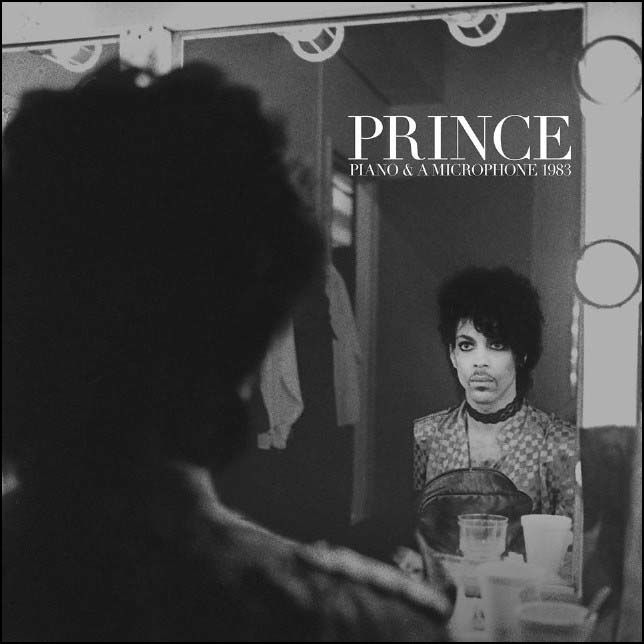

If you are a fan of Prince, the new album will give you shivers…

“Piano & a Microphone 1983” contains nine songs that were recorded on a cassette at his home studio the year before “Purple Rain” would multiply the size of his audience. It’s just Prince on his own (with an engineer) for about 35 minutes, brainstorming while tape ran, segueing from song to song until it was time to turn over the cassette. While the session is informal — he sniffles now and then, and at times something rattles in the piano — the performance is not sloppy for a moment. The one-take, real-time vocals are exquisite.

Prince probably never expected these recordings to be made public. The album feels like eavesdropping, as Prince the songwriter delves into nuances and Prince the pianist cuts loose. He’s exploring and playing around, not constructing taut commercial tracks. Yet the album also turns out to be a compendium, or at least a thumbnail, of Prince’s boundless musicality and of his lifelong themes: romance, solitude, sensuality, salvation, sin, yearning and ecstasy. He shifts musical styles and vocal personae at whim — melancholy, playful, devout, flirtatious — yet it’s all Prince.

(NY Times)

Finally, shame on us as parents. We have failed our kids…

Addiction sucks. Cancer sucks. Let’s fix this.

The number of high-school students who used e-cigarettes in the past 30 days has risen roughly 75% since last year, according to a person who has seen new preliminary federal data.

That would equate to about three million, or about 20% of high-school students, up from 1.73 million, or 11.7% of high-school students in the most recently published federal numbers from 2017.

Nearly a third of 13-to-18-year-olds who responded to a separate survey conducted by The Wall Street Journal with research firm Mercury Analytics said they currently vape.

(WSJ)

Copyright © 361 Capital