by Charles Roth, Thornburg Investment Management

High-yield returns have been great lately, as technical flows, fundamental factors and good economic growth align. But tight spreads, lofty net leverage and event risk don’t make for smooth sailing ahead.

Speculative-grade credit issues have been market darlings in 2018, even prompting a U.S. multinational investment bank to issue a report earlier this month suggesting that junk bonds, of all things, might be a new safe haven.

High yield certainly delivered the goods over the first eight months of the year. The Bloomberg Barclays U.S. High Yield Index produced a solid 2% total return, with the junkiest CCC-rated segment contributing heavily to returns. Leveraged loans, which companies issue when it costs too much to tap the junk bond market, have also been on a tear, with the S&P/LSTA Leveraged Loan Index returning 3.3%. The near 2% decline in investment-grade corporate bonds and 0.8% loss in U.S. Treasuries in the period pale in comparison. While there’s plenty to recommend dedicating a portfolio sleeve to riskier assets, it’s hazardous to a portfolio’s financial health to downplay the highly asymmetric risk/reward profile of lower-quality credit.

It’s understandable why investors might think high-yield is less risky nowadays. Technical flows and high-yield fundamentals are supportive: issuance of high-yield bonds was down $46.3 billion, or 26%, in January through August from the year-earlier period (and sales of investment grade corporate credit were off 16%), according to the Securities Industry and Financial Markets Association, or SIFMA. Although demand has also shrunk—Bank of America Merrill Lynch notes in a report earlier this month that $24 billion flowed from institutional and retail high-yield funds—it has ebbed about half as much as supply.

While the U.S. high-yield bond market has grown 15% over the last five years, the investment-grade corporate market has jumped 70%, the leveraged loan market 44%, and emerging market corporate bonds 43%, BofAML points out. “Being at the epicenter of the last default wave in energy in 2015-2016 has helped the HY market come out with a relatively better balance sheet on the other end, which is a natural outcome of a cycle,” it adds. Moreover, strong corporate earnings burnish HY’s leverage metrics.

Bond Market Grows as Net Leverage Rises

Still, this year’s deleveraging and a lower rate of growth in recent times relative to other credit market segments doesn’t mean the high-yield debt market hasn’t gained a lot of weight over a longer time span. The U.S. junk bond market now tops out at $1.2 trillion, doubling from $590 billion a decade ago. Meanwhile, the broad leveraged-loan market, in which most issues are covenant light, has grown to nearly $1.3 trillion, doubling in size just since 2012, according to Fitch Ratings.

And non-financial corporate bonds rated BBB, just a couple rungs above speculative grade, have jumped nearly to $2 trillion, representing almost 40% of the U.S. non-financial corporate bond market, up from 31% in 2000. Aggregate BBB net leverage, or net debt-to-earnings before interest, taxes, depreciation and amortization (EBITDA) is running close to 2.9 times, up from 1.7 times in 2000. “It’s at a level that you would expect to see in a recession, when cash flows have fallen,” says Thornburg Portfolio Manager Lon Erickson.

That decline in creditworthiness is also reflected in the U.S., and global high yield, for that matter. “The non-financial corporate debt burden today is higher than its peak before the 2008-09 financial crisis,” Moody’s Investors Service said in a May press release. “For investment-grade firms, median debt/EBITDA today is around 30% higher than it was in 2007, while for speculative-grade companies it is up about 10%. For many speculative-grade issuers debt capacity may have reached its limit, although investor protections continue to weaken.”

U.S. and global economic growth have been solid of late, helping to keep default rates in check. Indeed, Moody’s expects the U.S. high-yield default rate to decline to 2.7% by the end of 2018 from 3.6% the year before, while globally, it sees the rate falling to 2.1% from 3.3% at the end of 2017. In June, the leveraged loan trailing 12-month default rate was running at 2.5%, Fitch recently reported.

Risks? What Risks?

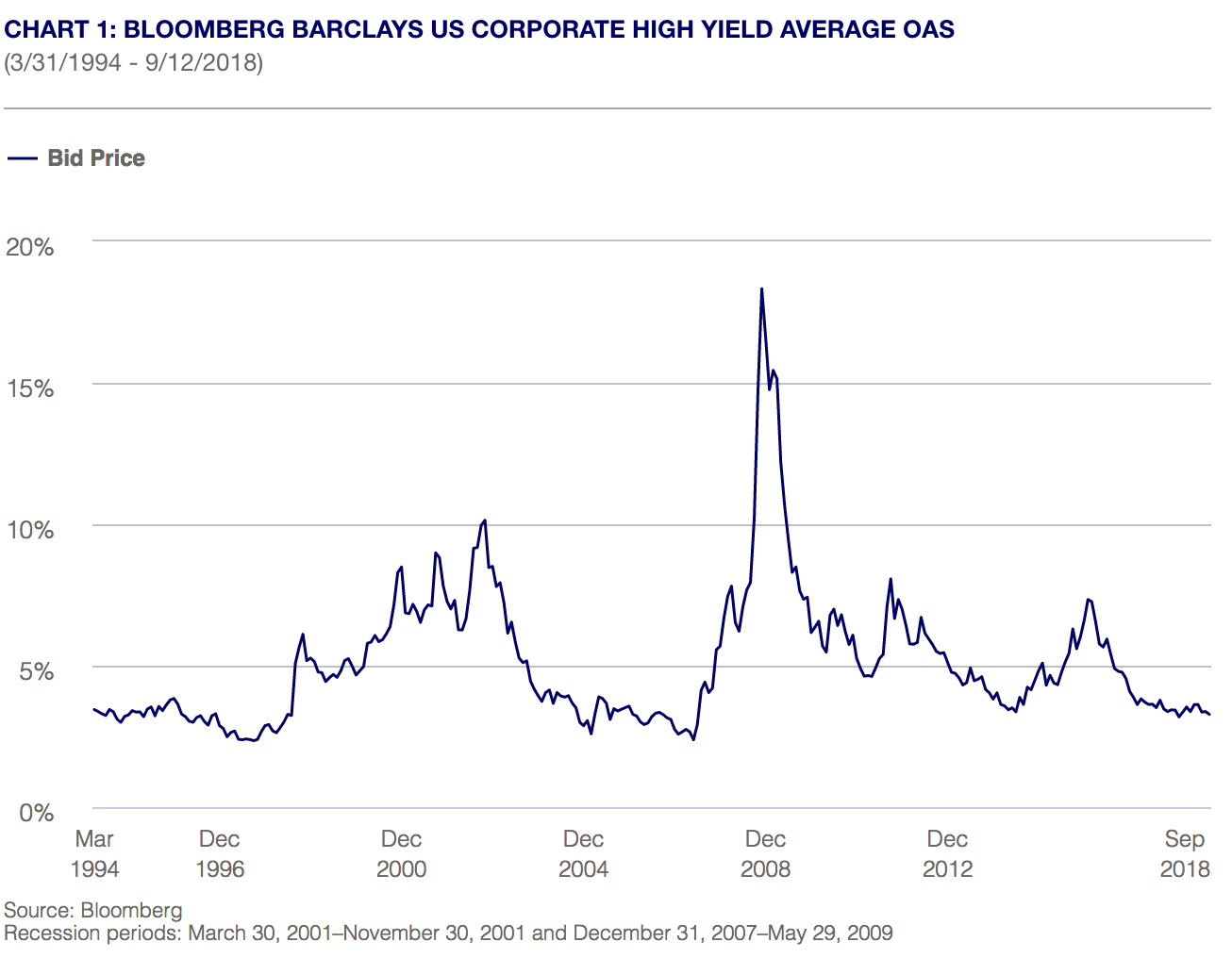

The problem is that if high yield is a safe haven for now, it may not be for long. At 3.30%, junk bond index spreads are quite compressed and well below their long-term 5.13% average. Event risk is never far off, and it’s far from clear that the goldilocks of good economic growth and low inflation will last, given how far advanced we are in the economic cycle. The U.S. Federal Reserve has been steadily raising its benchmark target rate for nearly three years and late last year started reducing its swollen balance sheet following successive rounds of asset purchases. Recent unemployment and wage data suggest that the Fed will continue to tighten monetary policy. Higher rates crimp affordability for increasingly pricey housing, which is already slowing on a variety of metrics. As a result, that industry’s significant multiplier effects on the U.S. economy are also increasingly muffled.

Internationally, the European Central Bank expects to keep its current policy rates—including a negative 0.4% deposit rate—at least through the middle of 2019, but also plans on ending its own “quantitative easing” program by the end of this year. Indeed, major central bank liquidity growth is on track to turn negative in January 2019 for the first time since the Global Financial Crisis, according to BofAML. How markets react to less accommodative, if not necessarily tighter, monetary policy in advanced economies beyond the U.S. remains to be seen.

As for event risks, news headlines will make hay of the mid-term elections, particularly if Democrats regain control of the House of Representatives, as mid-September RealClearPolitics average polling data suggest. Washington D.C.’s political kabuki would shift into overdrive were Congressional Democrats to start proceedings to impeach President Trump, but it would be a purely symbolic exercise if Republicans maintain control of the Senate. While plenty of observers routinely liken the potential outcome to the Nixon administration, Thornburg’s Danan Kirby points out that the far likelier parallel is the 1998 impeachment of Bill Clinton in the House and his subsequent acquittal in the Senate. U.S. markets were volatile during that period, but mainly due to the collapse of Long-Term Capital Management and the Russia debt default.

The bigger event risk is an escalating trade war, given its potential to spur inflation and dampen economic growth. Another is the current downdraft in emerging markets. It has yet to materially impact the U.S., but it certainly could. Not only would slower developing country growth mean less foreign demand for U.S. exports and multinational earnings, but if credit defaults in emerging markets start piling up, the spillover may not be easily contained, just as 20 years ago Russia’s default was followed by defaults in Argentina and Ecuador.

To be sure, emerging market corporates have been far better in recent years about issuing local currency-denominated debt. “Still, roughly two-thirds of corporate bonds in developing economies maturing annually are denominated in U.S. dollars and other foreign currencies,” McKinsey & Co. reports, citing data from the Institute of International Finance.1 “This creates additional risk, because debt service costs will soar if the local currency depreciates (and the company does not have revenue streams in the foreign currency).” Emerging market currencies have, of course, been pounded of late, as carry trades unwind and reserve currency flows make their way back to Japan, Europe and especially the U.S., given the greenback’s increasingly favorable rate differentials.

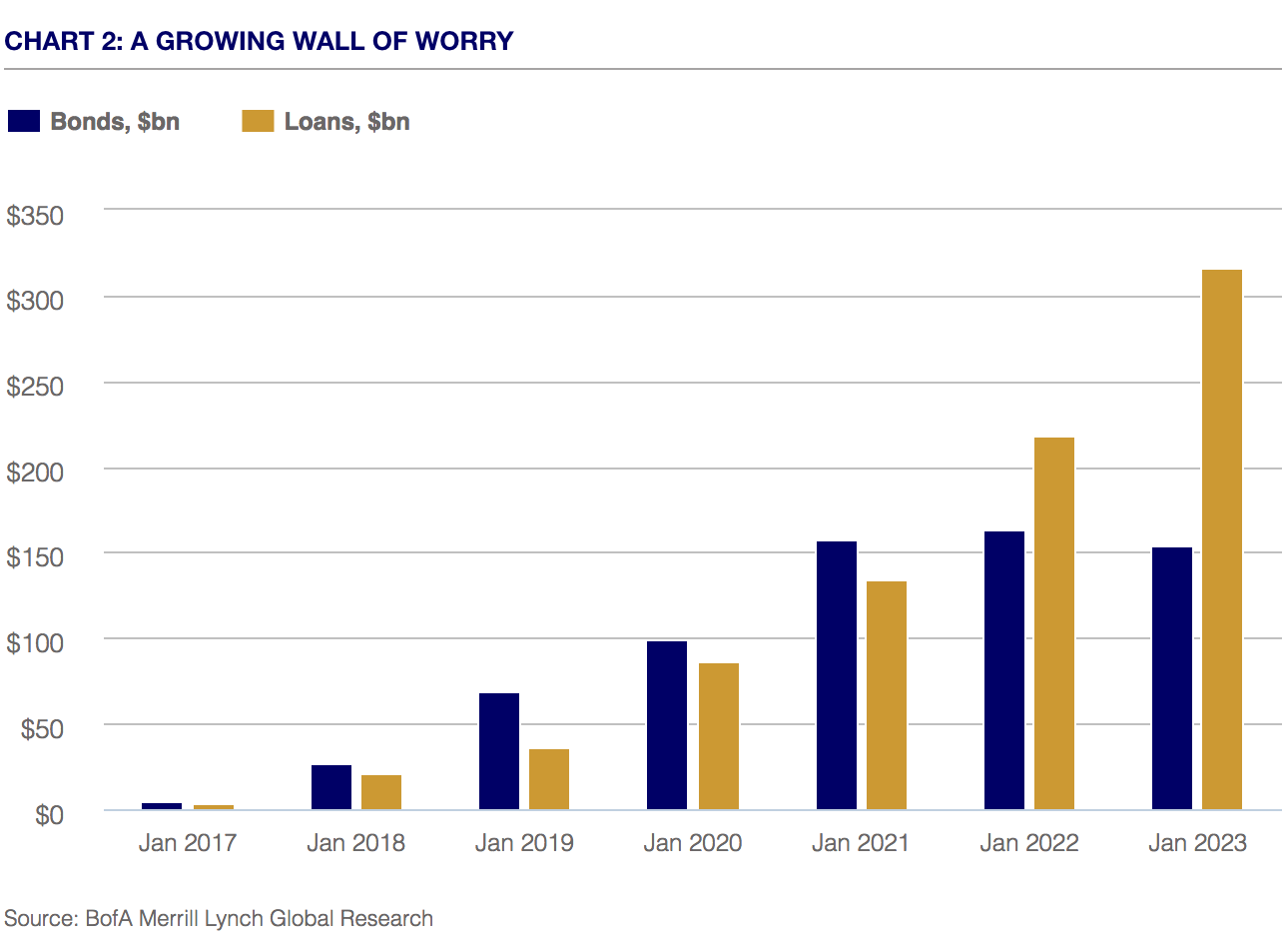

Debt Maturity Avalanche

In the U.S., McKinsey forecasts the share of speculative-grade bonds maturing in 2020 at 27%, up from 11% last year. That’s a $180 billion in 2020, though again, if current issuance trends hold, the amount will be even greater. But who’s to say today’s trends will hold? Issuers from challenged sectors such as retail and energy will likely be even more challenged in refinancing their maturing debt, particularly if rates continue to rise and the Fed’s “new neutral” rate isn’t as low as currently assumed.

This isn’t to say high yield is bound to hit the wall in short order. But if tight high-yield spreads start to loosen, they can spike fast, “as investors scramble to get out of the worst stuff first,” Erickson points out, recalling that spreads spiked to nearly 20% in the Global Financial Crisis a decade ago.

High yield bonds certainly have a place in fixed income portfolios, but they should offer individually compelling risk/reward propositions that combine with, and balance, other portfolio securities, helping the overall portfolio perform in a variety of economic and market climates. They may appear low-risk and seaworthy now, but sirens shouldn’t be mistaken for safe havens.

1. Rising Corporate Debt: Peril or Promise? McKinsey & Co., June 2018.