by Stella Liu, Russell Investments

The world’s richest are getting richer. In fact, the top 1% in terms of wealth ownership are well on track to control two-thirds of the world’s wealth by 2030, as reported by the House of Commons library, a research arm of the UK’s parliament.12

In light of this growing inequality, is there a way to open up the playbook to all?

Let’s dig under the covers and see. For starters, according to Bloomberg3, the richest individuals are made rich through equity markets. However, recent research published by the National Bureau of Economic Research (NBER) has some surprising results on how well some of the richest individuals fare in the stock market.

Titled “Do the Rich Get Richer in the Stock Market? Evidence from India”, the study uses evidence from Indian stock portfolios. The evidence shows two seemingly counterintuitive findings:

1) The first finding is that investors who earned higher returns had, on average, smaller account holdings (and were therefore not very well off).

2) The second finding is that those investors with larger holdings (who were therefore better off), earned relatively lower returns, but earned them consistently. Instead of chasing high performance, they settled in to a long, slow, steady-but-positive grind.

Certainly, the findings in this paper are derived from one specific regional equity market. But we believe there are three implications that are much broader.

1. ) Compounding is our friend

The NBER research shows that the rich in Indian stock markets managed to do better than the smaller, more aggressive accounts, not because of top-tier performance, but because of a focus on a long-term horizon and steady and consistent growth. Compounding—the ability of an asset to generate earnings, which are reinvested to generate more earnings—can help to grow wealth. But compounding takes time, which, as simple as it sounds, is why we believe wise investors should focus on the long term. While we certainly don’t shy away from seizing opportunities, a key part of that long-term approach is the belief that winning in down markets is more important than winning in up markets.

2. ) Diversified asset class allocation is key to success

Running a successful investment portfolio is similar to keeping a healthy diet. In both cases, a well-balanced mix of ingredients is key to success.

A more diversified portfolio allocation, including real assets and in-between asset classes, may help provide a smoother absolute return pattern for investors. A smooth ride can help investors stick with a strategy for the long, slow, steady grind.

3.) Global exposure is equally important

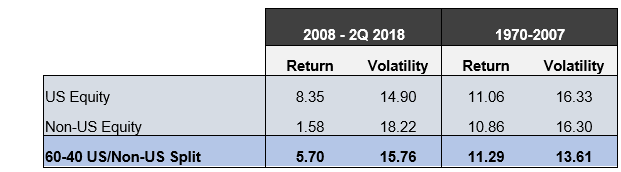

How far should an investor take diversification? We believe it is not only important to have a diversified portfolio within a home-country market, but internationally as well. The following chart shows that since 2008, global diversification has lowered returns and increased volatility compared to a U.S.-only approach. But it can be dangerous to only focus on a ten-year period. When we increase the time horizon, we see that prior to 2008, global diversification increased returns and reduced volatility, compared to investing in either strategy individually. In other words, global diversification won over the long haul.

Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

Source: U.S. Stocks: S&P 500® Index; Non-US Stocks: MSCI EAFE Index

Diversification and global exposure matter. Consider Japan. Our strategists currently like Japan regional equities as a diversifier, given what appears to be the reasonable fundamentals and oversold sentiment. Our strategists also are in favor of Japanese Yen, which is attractive in valuation and gaining cycle support and sentiment from speculative short positions. The added benefit, in our opinion, is that the Yen has provided diversification historically, so it gets a tick as a defensive diversifier on portfolio construction grounds. (More on our strategists’ outlook can be found here.)

We also find it beneficial to include emerging markets in portfolios. Emerging market equities can provide enhanced return potential and diversification while emerging market debt (especially local currency debt) can boost yield potential in the portfolios.

Slow and steady

The findings of the NBER paper seem more relevant than ever right now, as the S&P 500® Index recently hit the record for the longest U.S. bull market in history at nearly 3,500 days, rising more than 320% since March 9, 2009.4 This has created a valuation imbalance not seen since the late 1980s, as illustrated in the chart below.

Bull markets can be addicting, but high performance does not always beget further high performance. So consider the findings of the paper, where the greatest wealth was generated with a slow, steady approach. And consider a globally diversified, multi-asset allocation with a long-term horizon.

Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

Source: U.S. Stocks: S&P 500® Index; Non-US Stocks: MSCI EAFE Index; 10-Year Earning Valuations: Research Affiliates provided historical data for the Shiller CAPE.

1 https://www.theguardian.com/business/2018/apr/07/global-inequality-tipping-point-2030

3 https://www.bloomberg.com/view/articles/2017-08-28/how-the-top-1-keeps-getting-richer

4 https://www.cnbc.com/2018/08/21/us-markets-china-us-talks-jackson-hole-summit-on-the-agenda.html

*****