by Doug Kass, Seabreeze Partners Management

This morning the futures (S&P and Nasdaq) are, as is the custom, higher.

The markets continue to ignore a number of cautionary signposts/macroeconomic events/concerns and are benefiting from the float shrink of 5-7 years of corporate share buybacks, the dirty water of liquidity (contributed by the world’s central bankers), the heightened role of price momentum based and other (risk parity) quant strategies and the rising popularity of passive, index funds.

Adding significantly to the demand for stocks are central banks (most notably BOJ and the Swiss National Bank) who, through their active equity investing, make them the sovereign equivalent of Fidelity Management as they have become one of the dominant investors of our time.

Moreover, in a backdrop of reduced retail activity (in individual stocks, save whatever is the speculative play du jour), materially reduced mutual fund turnover and the lower role of active hedge funds (they too have mostly become quants) the demand v. supply equation for equities continues to favor buying over selling.

Bouts of selling are quick – and when stocks trade lower the buy on the dip crowd makes its rescue and arrests the drop.

Finally, probably 4-8 very large (long biased) macro funds are likely dominating what little activity/volume there is, buoying stocks as the water sloshes around in the bathtub of equities.

The sort of cautionary technical signs – like a lagging Russell Index (yesterday) – no longer provide the historical predictive role that has been the case in the past. Iomega-like speculation in stocks like NIO and TLRY are viewed as normal. And the breakdown in selected, market leading technology stocks and the lackluster performance of financials are dismissed as “one offs” by the bullish cabal.

Reactionary technicians find the markets to be titillating (scoffing at the anticipation of untoward fundamentals) and unconcerned about reward v. risk or, arguably rising economic ambiguities (low interest rates and a narrowing yield curve), the unprecedented lack of cooperation between world powers (in a flat and interconnected world), large public and private debtloads, the unstable political setting, the failure of fiscal policy to trickle down, the divergence between the S&P Index and other world (emerging) markets, orange and black swans and the global pivot of monetary policy.

In particular, the fact that the rising wave of debt and central bankers’ liquidity injections have failed to produce steady wage growth and productive investments in the real economy go unnoticed by those that worship at the altar of stock price momentum.

And I will remind everyone, what caused the ten percent correction in late January/early February was the rise in interest rates. Well, today, we are right back a fresh ten year high in the yield on the two year note and the ten year Treasury yield is back to 2.99%.

How long this investment bliss and consistent buying continues is anyone’s guess but the degree of complacency (and the absence of fear and doubt) are off the charts.

Signs Of A Problem

In “The Bear in the Market Is Roving Right Now,” Jim “El Capitan” Cramer zeroes in on the developing carnage in selected groups.

“We’ve got roving bear and bull markets all over the place and they have come to define what happens every day including today.

That’s a big change from my previous view of this market where I had held that there are roving bull markets and when stocks weren’t in bull mode, they rested.

No, I am not saying that the market’s become too treacherous for most people to handle.

I am saying that there are some incredible declines that must be addressed because they are so glaring and, at times, so nasty, particularly when they occur intraday.”

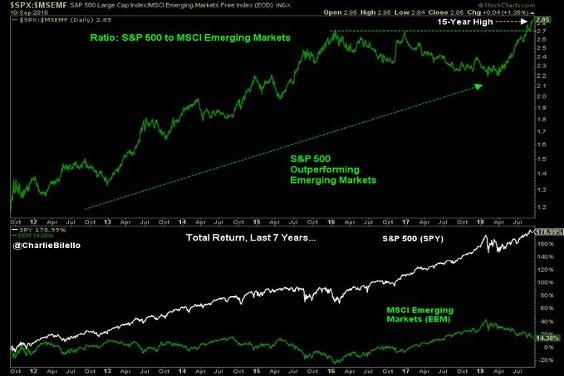

The bear market not only can be seen in Intel (INTC) , Micron (MU) and Facebook (FB); it can be seen, as I have cautioned, in other regions in the world. Indeed, the divergence between the S&P 500 Index and the MSCI Emerging Markets Index hit a 15-year high this week. As meaningful and looking out over the last seven years, the S&P Index is up by nearly 180% while the emerging markets are only up 14%:

Source: Pension Partners

Again, from Jim:

“If you want to see what a textbook bear market looks like, consider the emerging markets with the Hang Seng from Hong Kong, down 21%, Russian, down 20%, Greece, off 29%, the Shanghai index of mostly larger capitalization stocks is off 26%, and the Shenzhen, with smaller cap stocks is off 31%.”

As I wrote late yesterday, Wednesday’s strength in consumer staples (such as Kraft Heinz (KHC) , PepsiCo (PEP) , Unilever (UN) and Procter & Gamble (PG) ) and a drop of two basis points in bond yields may be construed as a risky backdrop and indicative of concerns regarding a slowdown in the rate of domestic economic growth. Also, weakness in regional bank stocks (I issued a cautious warning yesterday on bank third-quarter earnings) and the foundering FANG are not healthy signposts.

While the constant flow of corporate buybacks and the stronghold of fearless investors in ETFs continue to provide a tailwind to our markets, it remains my belief that the large stock declines Jim mentions above may broaden out and that we already may have experienced the highs in the Nasdaq and the S&P indices for the year.

Both the bull market and the economic recovery are long in the tooth and face the challenges of a pivot in global monetary policy, competition from ever-higher risk-free rates of return (the one-month Treasury bill yields more than 2.00% compared to the S&P 500 dividend yield of about 1.80%) and a number of other possible adverse outcomes in the economic, political and policy spheres.

Bottom line

Regardless of one’s market view, if you left early please make sure to read El Capitan’s late Wednesday synopsis of the market. It has a lot of merit, it’s a great read and provides pithy food for thought.

Market tops are processes and, from my perch, I believe that since late January 2018 we have been making an important one