by Blaine Rollins, CFA, 361 Capital

As U.S. and China trade talks continue to dissolve, the barrier to rising global growth gets taller and longer. Last week, President Trump wanted 25% tariffs on $200 billion in Chinese goods. Of course, at the end of the day, this is either a $50 billion tax on the U.S. buyers of these goods or an end to the availability of the goods. China says that it will not be threatened into negotiations and it is content to not trade with the U.S. So in the short term, this trade stubbornness will shrink global growth as two big players re-work their trade flows. In the long term, this dispute will come down to who has the better set of cards. Will it be Chinese consumer demand for U.S. goods? Or the flexibility of U.S. supply chains to quickly adapt and cut China out of the loop.

Meanwhile, bond yields continue to inch higher as U.S. economic data remains solid and the outlook for Treasury issuance grows. Fed Governor Brainard warned about U.S. economic strength last week and suggested that rates will continued to be raised. (And Goldman Sachs pulled out the image of a frog in slow boiling pot of water.) It will be a slow week of corporate news but a big one of Trade and Political news. Keep caution in your thoughts. And, don’t forget to “eat yer meat or you can’t have any pudding”.

To receive this weekly briefing directly to your inbox, subscribe now.

The U.S. will put itself at a disadvantage to not trade (consume or supply) in the future with China in these 10 industries…

Beijing identified 10 industries to become globally competitive in by 2025, and globally dominant during this century. Robotics, new-energy vehicles, biotechnology, aerospace, high-end shipping, advanced rail equipment, electric power equipment, new materials (exp. screens and solar cells), new generation information technology and software (integrated circuits and telecommunications devices), and agricultural machinery. In 2017 China published a development strategy for Artificial Intelligence, with a stated goal to lead the world by 2030.

(EricPeters/OneRiverAM)

The ongoing trade dispute continues to decimate Chinese stocks…

While the White House loves this chart, the Chinese government could probably care less about it because they are playing the long game.

Soybeans remain in the Trade War spotlight…

Current prices are getting much worse for U.S. farmers to the direct benefit of Brazilian farmers. And the U.S. midterm elections are only six weeks away.

Speaking of the U.S. midterm elections, time for a revisit to Elkhart, Indiana…

The city calls itself the “RV Capital of the World” — more than 80 percent of the vehicles sold in the United States are made in Elkhart and the surrounding area, according to the RV Industry Association — and Mr. Trump’s tariffs on imported steel and aluminum are increasing costs, diminishing demand and causing concern that a 10-year boom cycle could be waning.

Shipments of motor homes were down 18.7 percent in June compared with a year ago, and shipments of smaller trailers and campers were down 10.5 percent, according to the RV Industry Association. Motor home shipments were down 6.5 percent in July, but overall shipments were up 10 percent compared with the same month last year. Some companies have cut back to four-day workweeks. Amid strong job gains nationally, hints of rising wages and solid overall economic growth, Elkhart’s health is decidedly ambiguous.

(NY Times)

It was a very good run of U.S. economic numbers last week…

August economic data out this past week was almost one-way positive: U.S. industrial production rose 0.4%, above the consensus of 0.3%; consumer prices rose 0.2%, below expectations of 0.3%; and the producer-price index also came in lower than anticipated.

The inflation numbers were soft enough to give some investors hope that a second Federal Reserve interest rate hike in December—after the near-certain hike on Sept. 26—is less likely, notes Doug Ramsey, chief investment officer at the Leuthold Group.

On the confidence front, the preliminary September University of Michigan sentiment index rose to 100.8 from 96.2 in August, well above the 96.6 consensus and the second-highest level since 2004. Meanwhile, the Index of Small Business Optimism from the National Federation of Independent Business was 108.8 in August, the best reading ever. Only August’s retail sales were below consensus, but even there July’s numbers were revised up.

(Barron’s)

Tim Duy wants you to listen closely to what Fed Governor Lael Brainard said last week…

If you lean in, you won’t hear her say “Carpe Diem”. Instead you will hear her warn that she is going to raise the Fed Funds rate every chance she gets.

Brainard is clearly concerned about the stability of the inflation outlook:

At 3.9 percent, the August unemployment rate was about 1/2 percentage point lower than the previous year. If unemployment continues to decline at the same rate as we have seen over the past year, we will soon see unemployment rates not seen since the 1960s. Historically, the few periods when resource utilization has been at similarly tight levels have tended to see elevated risks of either accelerating inflation or financial imbalances…So far, the data on inflation remain encouraging, providing little signal of an outbreak of inflation to the upside, on the one hand, and some reassurance that underlying trend inflation may be moving closer to 2 percent, on the other…The past few times unemployment fell to levels as low as those projected over the next year, signs of overheating showed up in financial-sector imbalances rather than in accelerating inflation. The Federal Reserve’s assessment suggests that financial vulnerabilities are building, which might be expected after a long period of economic expansion and very low interest rates.

Meanwhile, Lael wants you to listen to Radiohead…

So 3%+ should be a given for 2-year Treasury yields in 2018…

(WSJ)

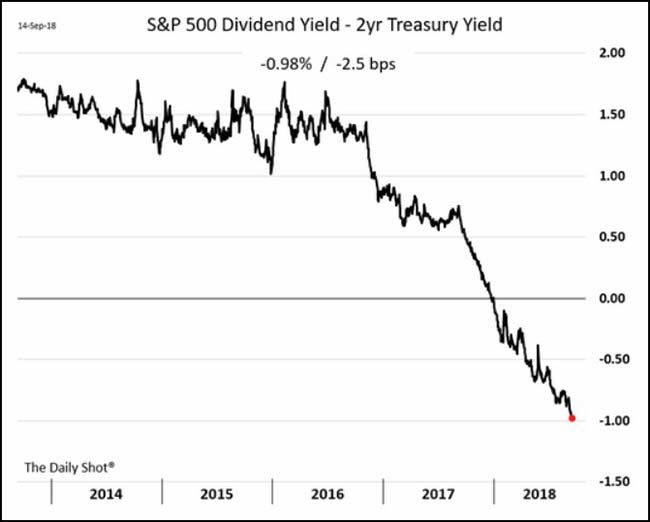

Goodbye to any yield advantage of dividend paying stocks….

That 2.75% yield on the 2-year Treasury note doesn’t look like a bad deal these days for someone that wants little risk in their portfolio.

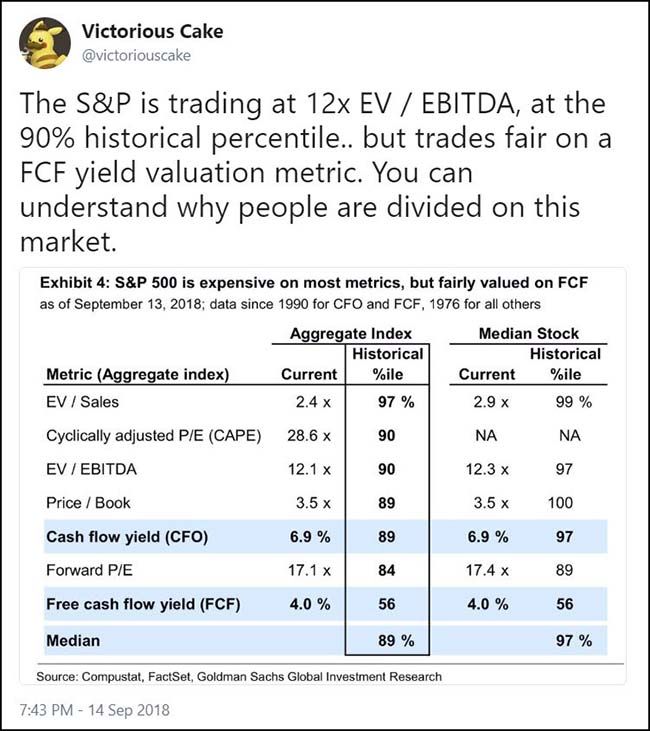

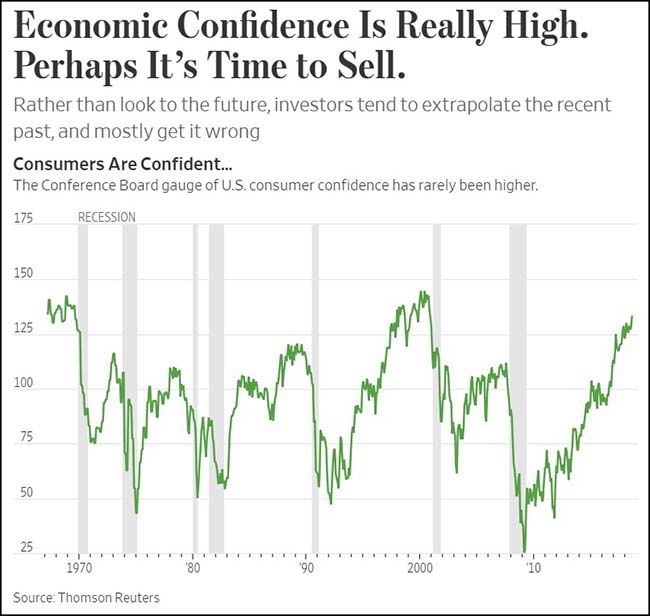

By most measures but Free Cash Flow, the S&P 500 looks stretched…

With interest rates rising and economic uncertainty increasing, you won’t find me standing in your way of this suggestion…

Or as the saying goes, “Sell when you can, not when you have to.”

(WSJ)

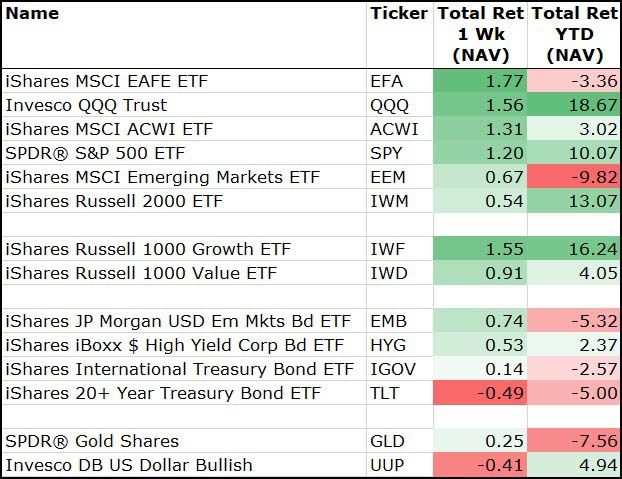

For the week, International Assets outperformed as the U.S. dollar fell…

Growth and High Yield also did well, while safe Treasuries underperformed.

(9/14/18)

Among sectors, Energy, Tech and Industrials led last week…

Banks and Financials continued to lose ground.

(9/14/18)

As the November election nears, here is one ballot issue that all Coloradan’s and Energy participants will be watching closely…

Finally, if you have been wanting to buy and fly a drone, wait no longer because this piece of tech is incredible…

DJI’s Mavic 2 drone can avoid obstacles in all directions (DavidPogue)

Copyright © 361 Capital