by Adam Butler, Rodrigo Gordillo, and Michael Philbrick, Resolve Asset Management

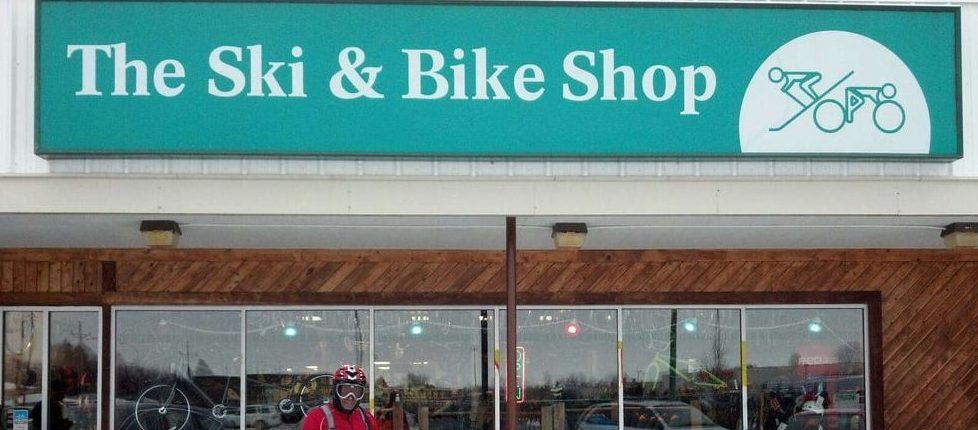

In most parts of Canada we have very distinct seasons. Some months of the year are temperate and relatively dry, while other months are cold and snowy. As a result, most Canadian towns of any size have stores that sell skis and bikes. Of course, they don’t inventory both skis and bikes at the same time. Rather, in the spring they sell off all their ski related inventory and set out their bike gear, and in the fall they clear out the bike gear to make room for skis. Pretty creative, right? Let’s observe a simplified example of bike sales and ski sales over several years.

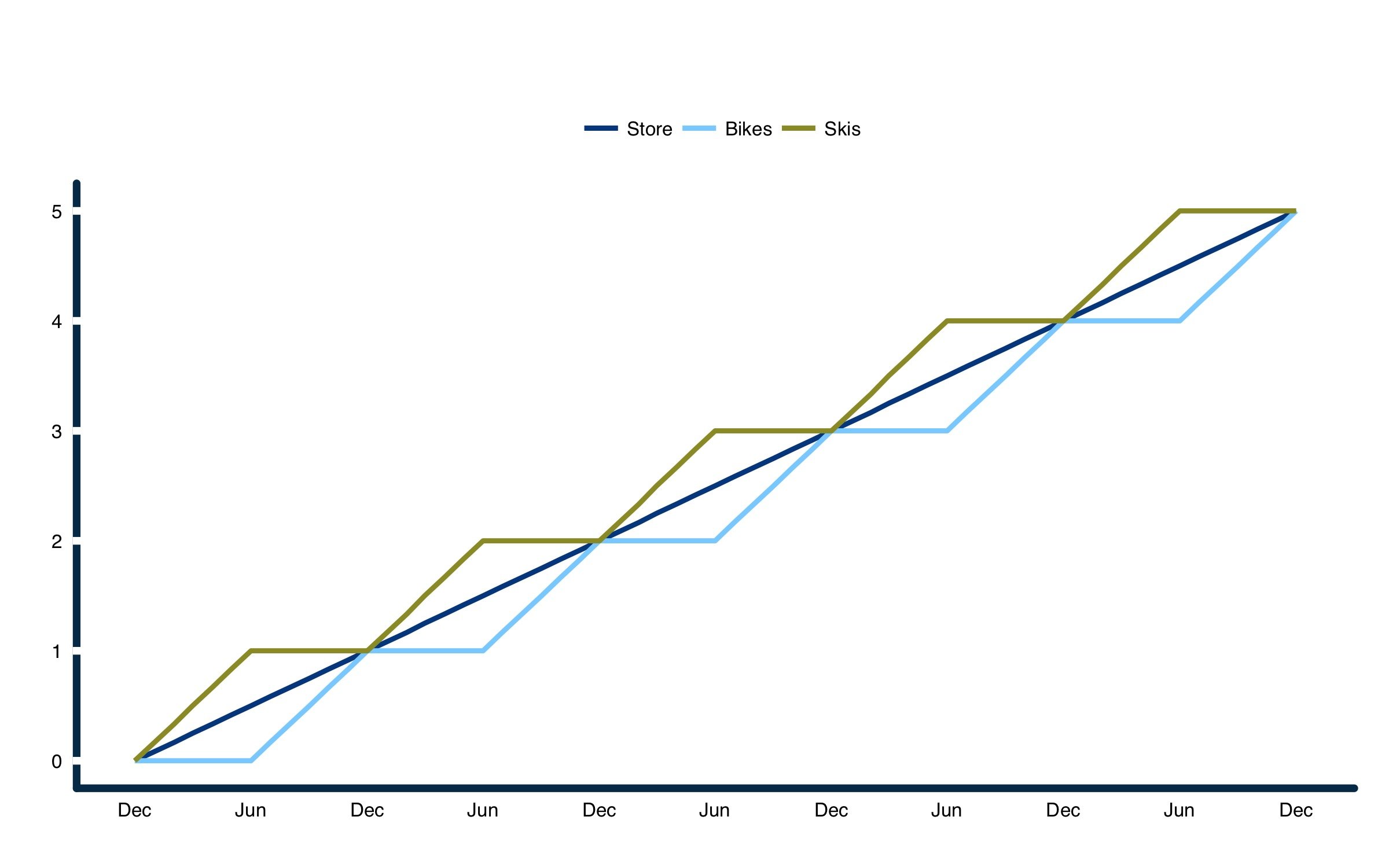

Figure 1. Sales of skis and bikes

Source: ReSolve Asset Management. For illustrative purposes only.

As winter approaches, ski sales accelerate while bike sales drop off. As summer approaches people stop buying skis, but ramp up their purchases of bikes. One line of business is thriving while the other is flat. In some years, winter might come late and produce very little snow, stifling ski sales.

But the subsequent spring might be warm and dry, and encourage bumper bike sales. This is the nature of diversification.

This same effect plays out in markets. Economic news that is good for one type of investment is often bad news for another. In fact, the hallmark of a diversified portfolio is the observation that one or more investments is disappointing you most of the time. A portfolio that consists of assets that all produce gains at similar times for similar reasons will probably produce their worst losses at the same time too.

Well Executed Diversification is Indistinguishable from Magic

The skis and bikes example above shows how deriving cash-flows from two independently profitable businesses, which produce returns at different times, reduces the variability of cash- flows throughout the year. This is helpful because it makes it easier for the business owner to manage investments in the business, and stabilizes the owner’s income. In other words, diversifying across two return sources – skis and bikes – lowers the overall risk of the business. Let’s examine why this is so important.

If the business owner simply wanted to reduce his risk, he could have abandoned the business altogether, and kept his savings in safe bonds or cash. But the business owner needs to take some risks to earn a higher income. Both the ski business and the bike business are risky enterprises on their own, with highly fickle cash-flows. Either one might have been too risky for the shop owner to earn a stable income. But when the businesses are combined, the resulting ‘portfolio’ of businesses is much more stable.

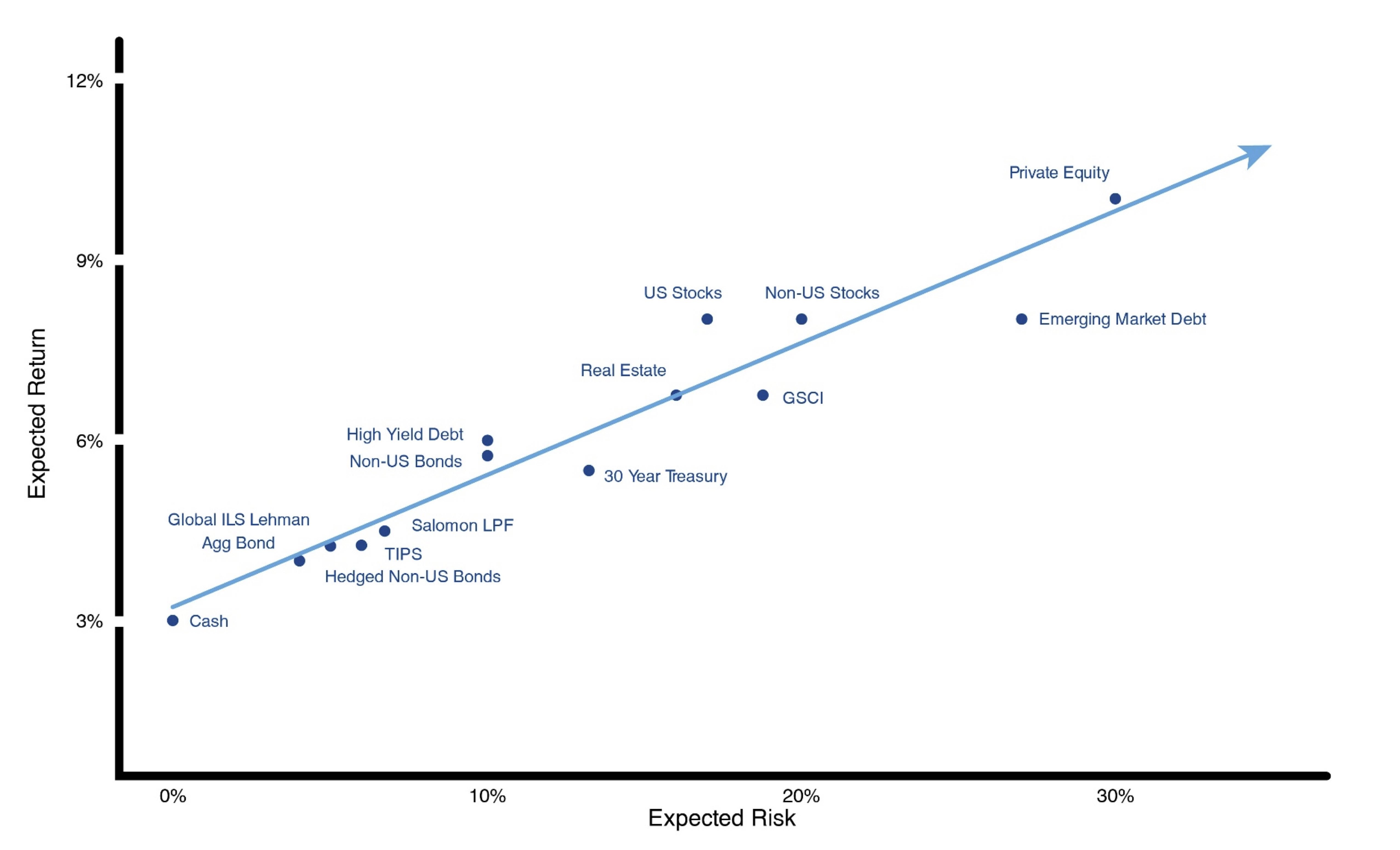

The skis and bikes example extends quite intuitively to the domain of investment portfolios. In investing, it is a simple thing to build a low-risk portfolio by holding lower risk assets, like short- term government bonds. Unfortunately, this portfolio would not be expected to generate much in the way of returns. Remember, the reason investors own higher risk assets like stocks instead of clinging to the safety of short-term bonds or cash is that higher risk assets are expected to produce higher returns. Figure 2 illustrates this relationship for a broad universe of global asset classes.

Figure 2. Return vs. risk for global asset classes  Source: Bridgewater AssociatesThe long-term return we can expect to earn from any one investment is proportional to that investment’s risk. If we seek to lower portfolio risk by investing a large portion of capital in lower risk assets, this will necessarily lower the expected return on the portfolio.

Source: Bridgewater AssociatesThe long-term return we can expect to earn from any one investment is proportional to that investment’s risk. If we seek to lower portfolio risk by investing a large portion of capital in lower risk assets, this will necessarily lower the expected return on the portfolio.

In order to generate returns above cash, investors need to take on risk.

The magic of diversification is that it allows investors to keep more of their money invested in higher risk assets, with commensurately higher expected returns, while lowering the overall risk of the portfolio.

Skip ahead and go right to the whitepaper at this link

Diversification in Theory

The central advantage of diversification is that it allows investors to hold many risky assets, while maintaining a tolerable level of portfolio risk. But many investors express confusion about how two investments can both be expected to rise in value, even while they are uncorrelated. After all, if they are uncorrelated, shouldn’t we expect them to move in different directions? The skis and bikes example offers some perspective on this apparent contradiction. The revenues accumulated from both skis and bikes are rising over time. But they are rising at precisely opposite times. As a result, the shop owner can even out his revenue streams across the different seasons of the year.

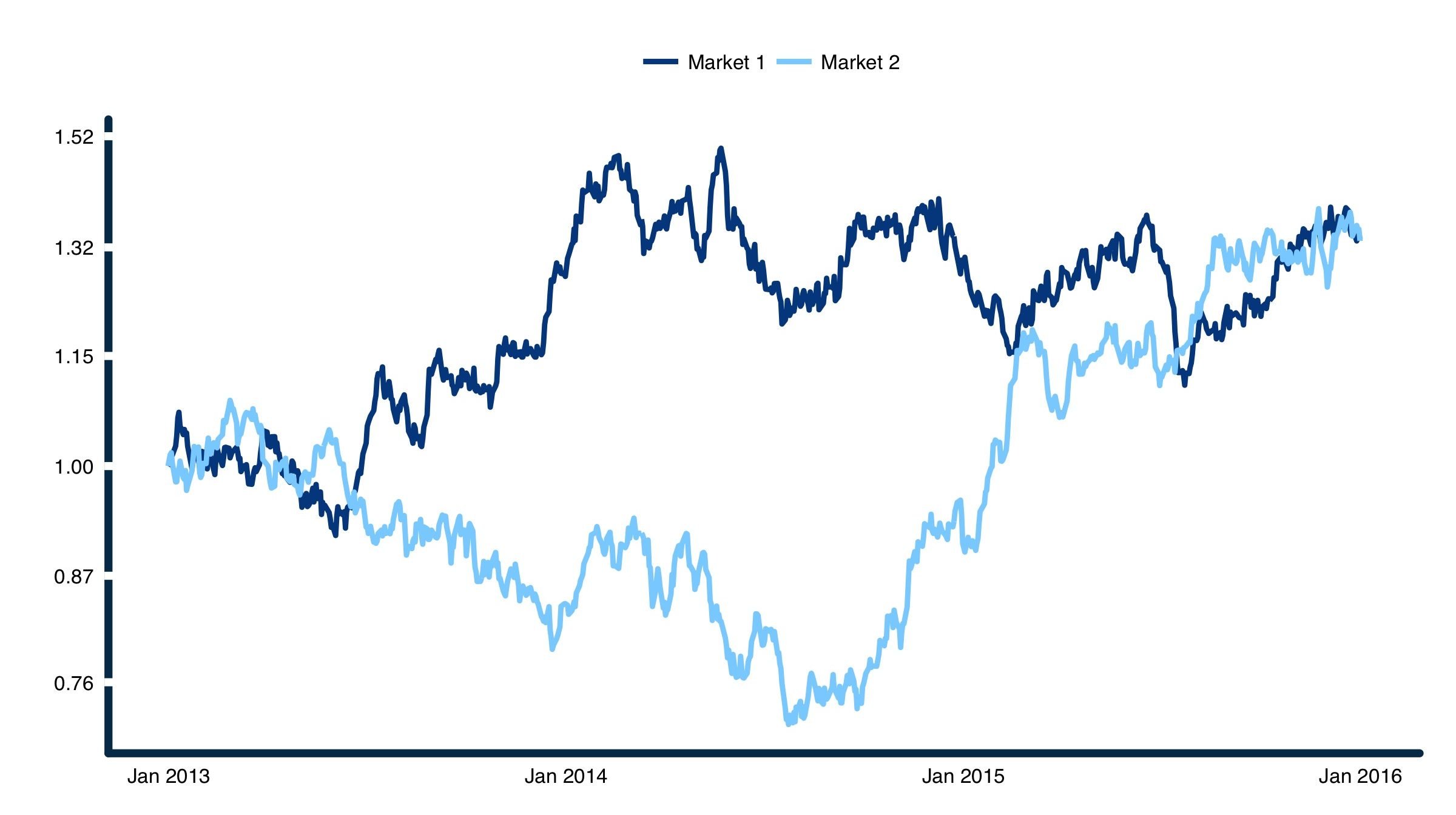

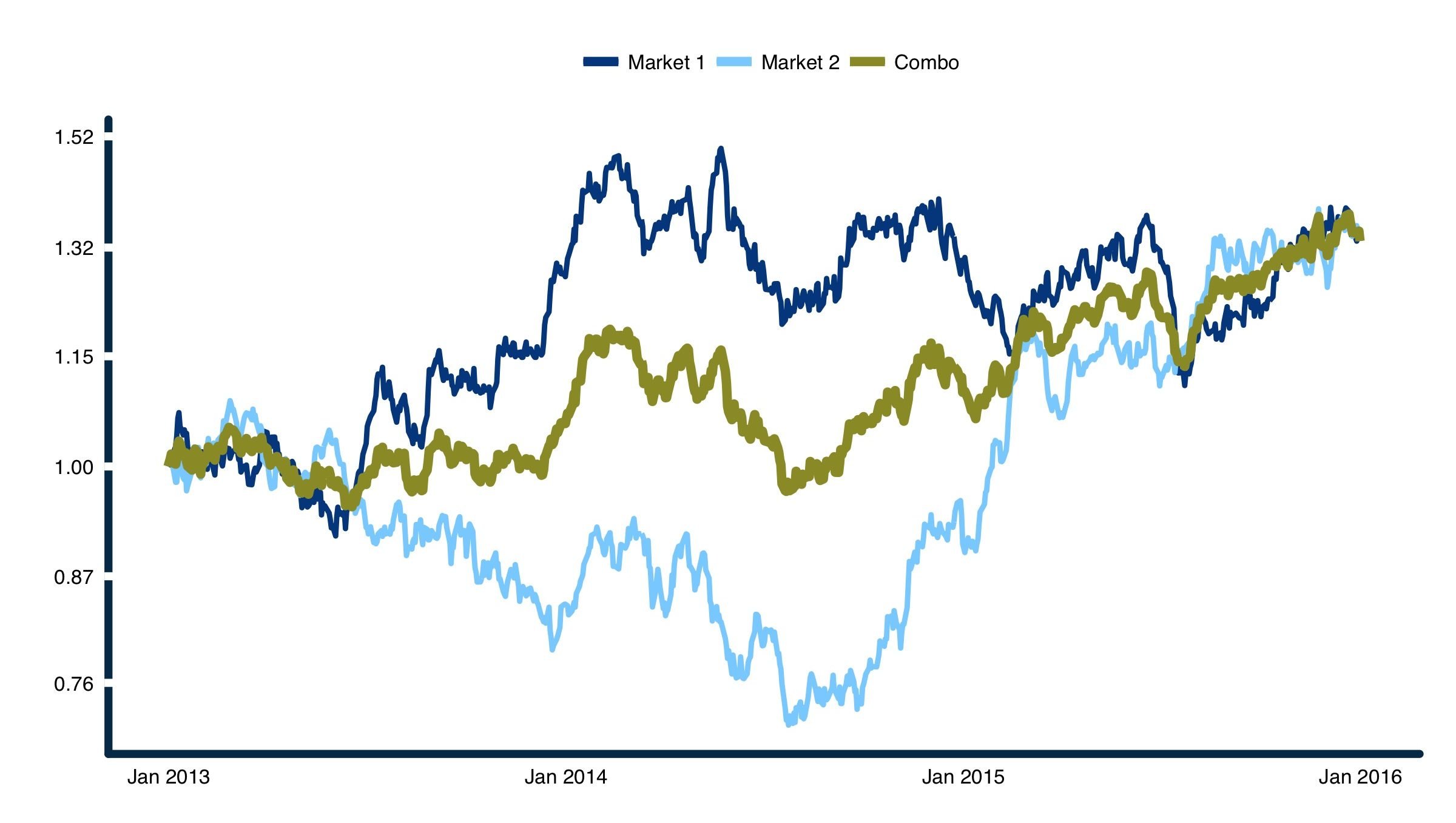

Now let’s apply this same phenomenon to two investments. In Figure 3. below both Market 1 and Market 2 grow at the same rate of 10% per year for three years. We know this is true because the assets’ prices begin and end in the same place. In addition, the assets fluctuate the exact same average amount from day to day – that is, they have the same “volatility”. However, Market 1 and Market 2 take a very different path to the same final destination. Market 1 shoots up early on but then returns flatten out and become choppy. Market 2 endures a steady decline over the first half of the period, but then shoots higher. Market 1 inflicts a 26% maximum peak-to-trough loss while Market 2 forces investors to endure an even steeper decline of 34% before recovering.

Figure 3. Two uncorrelated markets

| Market 1 | Market 2 | |

|---|---|---|

| Compound Return | 10.0% | 10.0% |

| Volatility | 20.0% | 20.0% |

| Return-Risk Ratio | 0.5 | 0.5 |

| Maximum Peak-to-Trough Loss | -26% | -34% |

Source: ReSolve Asset Management. For illustrative purposes only. Simulated results.

To make this example more real, assume that the markets in Figure 3. represent the returns to a long-duration bond index [Market 1] and a diversified stock index [Market 2] over the three-year period from April 2013 through March 2016. By the middle of the period, investors in the stock index are extremely anxious, as their wealth has declined by 25%. They are also envious of investors in bonds, who have outperformed them by over 50%. Meanwhile investors in bonds are convinced that their outperformance was inevitable in retrospect, given their superior talent and good sense. Of course, by the end of the period those investors in stocks who kept faith with their investment ended with exactly the same wealth as investors in bonds.

Remember that both Market 1 and Market 2 have the same expected average returns over the long-term. However, they move in different directions at different times for different reasons. In other words, they are uncorrelated. If we expect the same average outcome from both markets, and they are different, then we should take advantage of the opportunity for diversification. Consider the experience of an investor that places half of her capital in Market 1 and half in Market 2 over the same period.

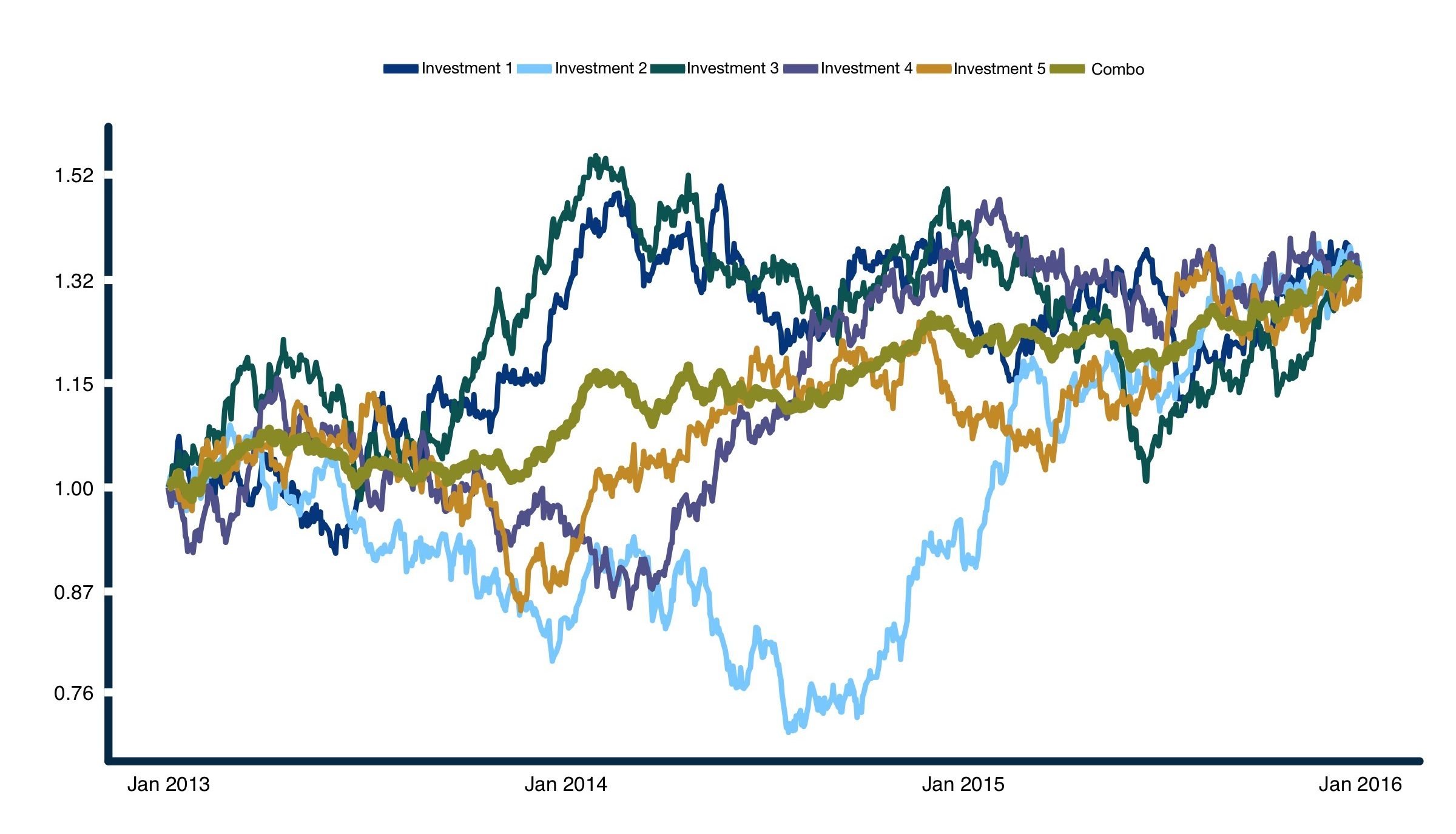

Figure 4. Combining two uncorrelated markets

| Market 1 | Market 2 | Combo | |

|---|---|---|---|

| Compound Return | 10.0% | 10.0% | 10.0% |

| Volatility | 20.0% | 20.0% | 13.7% |

| Return-Risk Ratio | 0.5 | 0.5 | 0.73 |

| Maximum Peak-to-Trough Loss | -26% | -34% | -18% |

Source: ReSolve Asset Management. For illustrative purposes only. Simulated results.

When we examine the full three-year experience of a diversified investor relative to investors with concentrated investments in just one market, it’s clear that diversification produces a gentler ride. While the diversified portfolio produced the same return, it did so with about 1/3 less volatility. Even better, because the declines in the two markets occurred at different times, the diversified portfolio achieved its returns with a 40% smaller peak-to-trough loss than that endured by investors in either of the individual markets.

However, while it’s clear with the benefit of perfect hindsight that diversified investors were better off over the entire period, it’s illustrative to revisit how each investor might have felt half-way through. At that time, investors who chose to diversify were probably regretting their decision, as Market 1 had produced about 25% in extra returns. They were wishing that they had never even heard of Market 2! Only after the completion of the period, once Market 1 experienced its own 26% decline, would diversified investors finally have felt vindicated.

What makes investing so incredibly challenging is that we can’t know for sure in advance whether two investments will produce the same returns, or whether one investment will produce higher returns than another. And even if there is a high degree of confidence that one investment will beat another in the long term, there is no guarantee that returns will converge over a time horizon that investors can live with. For example, over the two decades from 1981 through 2001, safe U.S. government Treasury bonds produced higher returns than stocks, without inflicting the pain and anxiety of two major bear markets1.

Ironically, this uncertainty about the true average return is actually a good thing. If investors knew the true average return of their investments in advance, it’s likely that these investments would attract a lot more capital. This would drive the price of the investments so high that future investors would necessarily earn a much lower return.

As a thought experiment, it’s interesting to see how introducing more uncorrelated investments can make the experience even smoother. For example, in the event an investor could construct five uncorrelated investments with the same 10% expected compound return and 20% volatility, an equally weighted portfolio would have the same return, but less than half the volatility, of any of the individual investments. Even better, while the average peak-to-trough loss of each individual investment is close to 30%, the peak-to-trough loss of the portfolio is well under 10%.

Figure 5. Combining 5 uncorrelated sources of return

| Market 1 | Market 2 | Market 3 | Market 4 | Market 5 | Combo | |

|---|---|---|---|---|---|---|

| Compound Return | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% |

| Volatility | 20.0% | 20.0% | 20.0% | 20.0% | 20.0% | 8.7% |

| Return-Risk Ratio | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 1.14 |

| Maximum Peak-to-Trough Loss | -26% | -34% | -30% | -27% | -25% | -7.2% |

Source: ReSolve Asset Management. For illustrative purposes only. Simulated results.

As you can see, the “Holy Grail” of diversification is the ability to introduce streams of investment returns from many diverse sources. The emphasis here is on the word ‘diverse’, as it is unhelpful, from a diversification standpoint, to add many investments that are highly correlated. However, the diversification advantage from adding many uncorrelated investments to a portfolio is indistinguishable from magic.

Skipping to the Punch-Line

So far this is just theory. Let’s face it, few investors care about esoteric objectives like maximizing the diversification opportunity in a portfolio. Investors care about results.

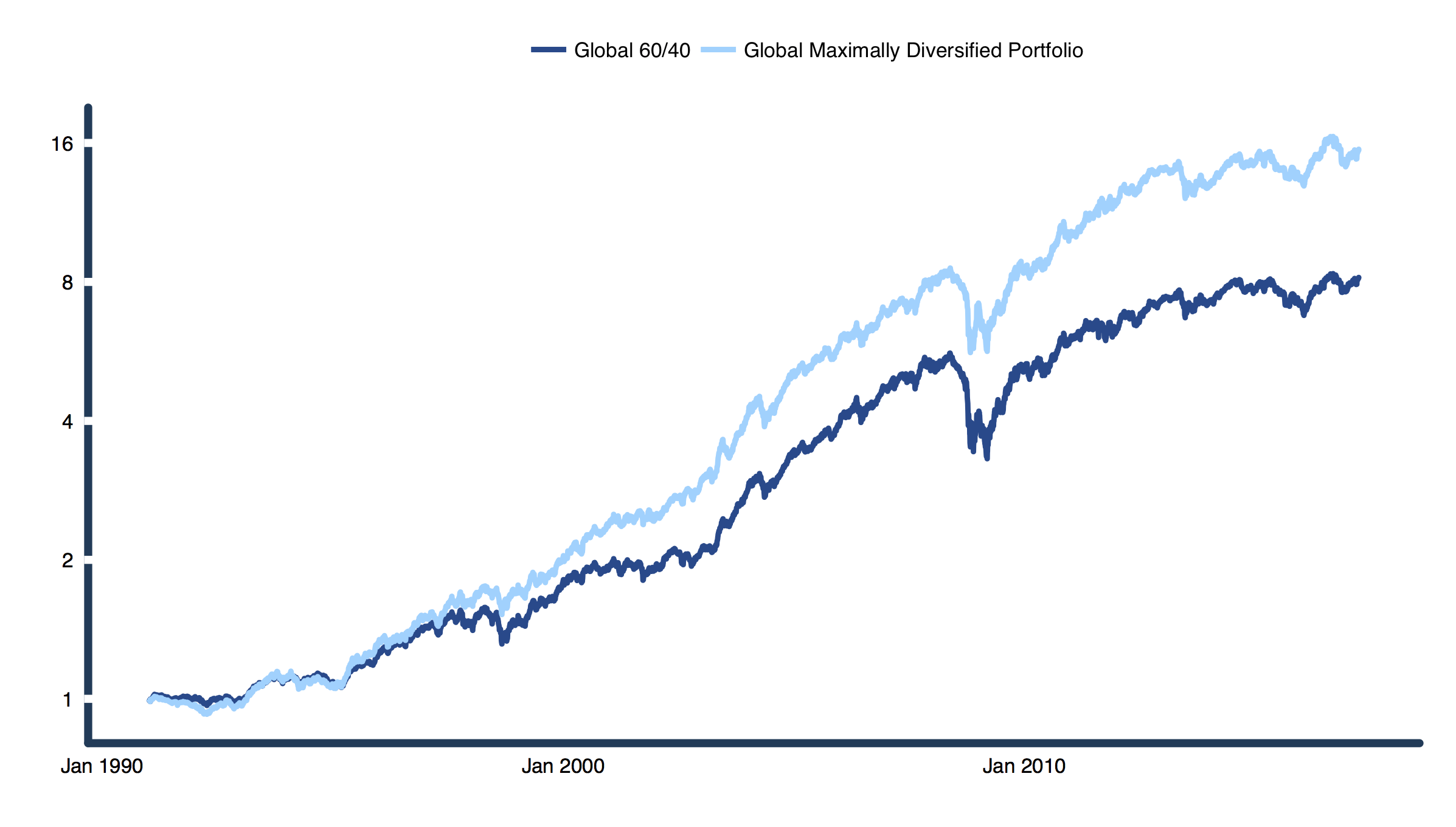

Specifically, they want to maximize the probability that they will achieve their financial objectives. But the fact is, expected risk-adjusted performance is a good proxy for this probability where investors have reasonable goals. In Figure 6, we examine the historical character of the global 60/40 portfolio and a maximally diversified global portfolio over the past quarter century to see what diversification means in terms of real dollars and cents.

Figure 6. Global Risk Parity vs. Global 60/40 portfolio, scaled to 10% volatility, 1991 – 2017

| Global 60/40 | Strategic Global Risk Parity | |

|---|---|---|

| Compound Return | 8.32% | 10.97% |

| Sharpe Ratio | .62 | .86 |

| Volatility | 10.00% | 10.00% |

| Max Drawdown | -40.95% | -34.40% |

| Beta to US Balanced | 74.33 | 48.34 |

| Alpha to US Balanced | 2.05% | 6.33% |

Source: ReSolve Asset Management. Data from CSI, MSCI, S&P Dow Jones Indices, Deutsche Bank. The Strategic Global Risk Parity portfolio allocates to four regional equity market indexes, U.S., international developed and government bonds, global REITs, a broad commodity index, gold, U.S. TIPs. The portfolio is weighted such that assets contribute equal risk to the portfolio based on pairwise complete covariances over the life of the assets since 1991. Simulated results.

This is where theory meets economic reality. The enhanced diversification properties of the Global Risk Parity portfolio produce higher returns when scaled to the same level of risk as the Global 60/40 portfolio. In fact, over a quarter century the Global Risk Parity portfolio produces almost twice as much wealth at the same level of volatility, and with a smaller peak-to-trough loss (Max Drawdown) along the way.

The material above is just the tip of the iceberg. Has there ever been a more important time to become an expert in diversifying your risk? Download the whitepaper now!

Copyright © Resolve Asset Management