by Blaine Rollins, CFA, 361 Capital

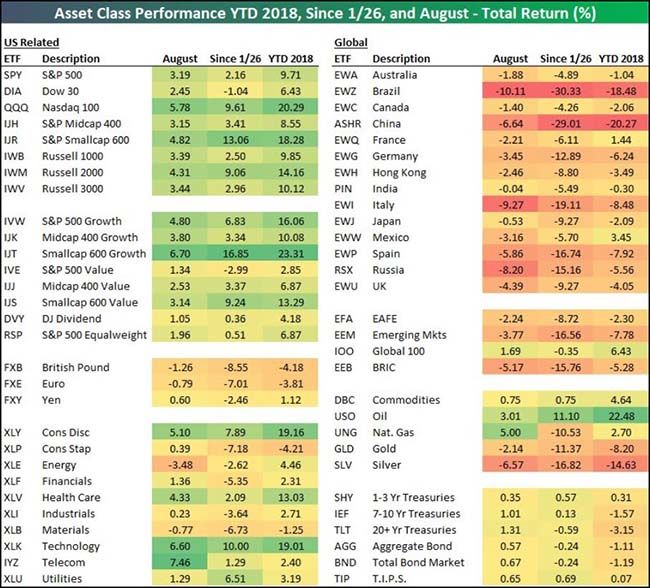

As you return to the markets, you will notice several clearly defined directions. Growth, Nasdaq, Small Cap and Consumer Discretionary stocks continue their moves higher, while Foreign Currencies, Bonds and Stocks continue to trend lower. Multinationals face headwinds with currency and slowing international growth, while U.S.-centric stocks seem to get all the buying attention. U.S. economic data remains positive (as evidenced by the recent ISM manufacturing numbers), but U.S. consumer strength appears to be flattening. Developed International data is slowing and Emerging Market data is grinding to a halt. Of course it doesn’t help that some leading emerging markets are now seeing inflation and interest rates soar, while currencies continue to decline. The IMF had better keep their travel calendars free because it will be a busy five months.

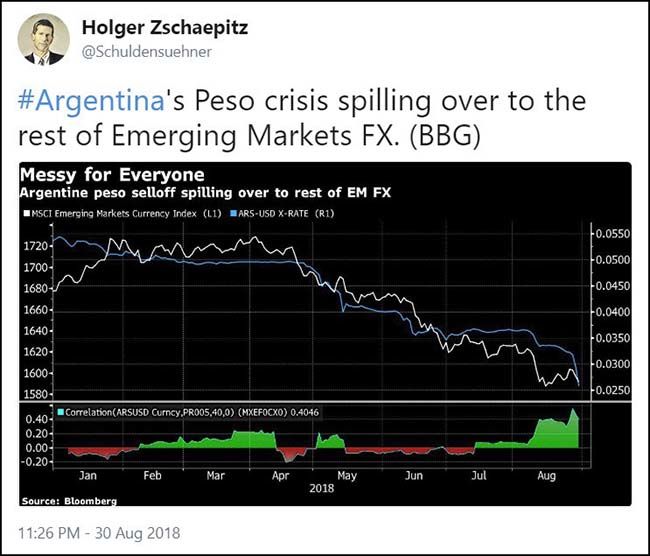

Market prices today suggest that some contagion is happening. Emerging market currencies are moving in tandem (even the better economies with fewer problems). But as the U.S. dollar strengthens, commodities become more expensive and capital flows become more skittish. Of course we haven’t even mentioned tariffs or global trade fights which are likely to further pressure global growth. For now, most U.S. stocks are ignoring the more global picture. It would seem difficult for this continue unless you believe that more dollars will push into the best performing assets. I still have one foot on the gas and one on the brake and have no problem raising cash or hedging underperforming assets. We will all earn our keep for the last five months of this year.

To receive this weekly briefing directly to your inbox, subscribe now.

Hope you rested this summer. Time to buckle up…

Despite being holiday shortened, next week should be action packed. The big question is whether the President the next $200 Billion in tariffs on Chinese goods before the week is out. Conference season starts and the calendar is packed, it seems like anyone and everyone is presenting. Federal Reserve officials return to the speaking circuit providing perspective on the normalization path. The first week of the month brings a massive economic data dump that culminates with the Friday’s Nonfarm Payrolls report.

(Jones Trading)

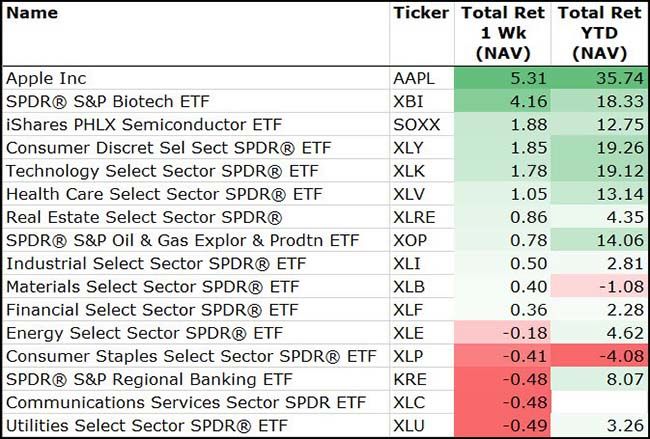

Last week was another repeat performance of this year’s strongest assets leading…

(8/30/18)

And then there was Apple…

(StockTrader.com)

Bespoke’s list of August returns also shows that YTD momentum has continued…

(@bespokeinvest)

Bond investors are beginning to see significant losses pile up in their Argentinan holdings…

One of the bond market’s biggest investors has seen its flagship funds battered by the turmoil in emerging markets unleashed by Argentina’s spiralling financial crisis.

Losses at Franklin Templeton, the US investment group, have underlined how the crisis has wrongfooted many of the market’s best-known names and left investors wary of diving back in. This is despite talks on Tuesday between Buenos Aires and the IMF over a revised $50bn bailout package.

Franklin Templeton funds have lost $1.23bn in the past two weeks on just three of its biggest Argentine positions, according to FT calculations.

Currency problems in Argentina remain contagious to other Emerging Markets…

More broadly, Emerging Markets bonds now in a bear market…

This was one of the hottest asset classes in the world last year.

It doesn’t help that Turkey’s inflation rate has doubled this year…

Is it time to get involved in the Emerging Markets yet?

While poor economic fundamentals, such as muted growth and excessive reliance on external debt, have played an important role in revealing vulnerable areas of EM as global financial conditions tightened and the US dollar appreciated, what we are now seeing is overwhelmingly a technical and liquidity phenomenon, including forced sales and repeated pockets of illiquidity.

The big question facing investors — whether they are looking to maintain, increase or reduce exposure — is the extent to which awful technicals and liquidity increases the pain for EM economies and asset prices, thereby sapping investor sentiment further.

You can already see this potential dynamic playing out in Argentina, which also faces an important presidential election next year. The sharp currency drop is aggravating the debt servicing burden for the private and public sector, undermining growth, discouraging new capital inflows and threatening large-scale capital flight. It also pressures domestic banks, further complicating what, for historical reasons, is already a fragile trust relationship with the IMF.

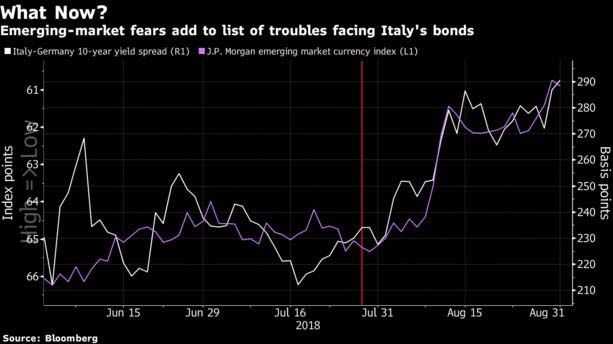

Even Italy is feeling some Emerging Markets contagion?

Italian yield spreads moving in lockstep with emerging market currencies…

Italian stocks also went from best to worst this year…

What a dramatic reversal of fortune for Italian stocks, which have gone from being the market’s darlings in the spring to a pariah status less than four months later.

The country’s FTSE MIB equity benchmark has become the second-worst performing western European stock index in 2018, dropping from its top rank earlier in the year, as a coalition government formed by populist parties is scaring off investors.

After leading gains across the region’s benchmarks, the FTSE MIB began sliding from a 9 1/2-year high reached May 7, about the time the Five Star Movement and the League started talks to form a government following inconclusive elections in March.

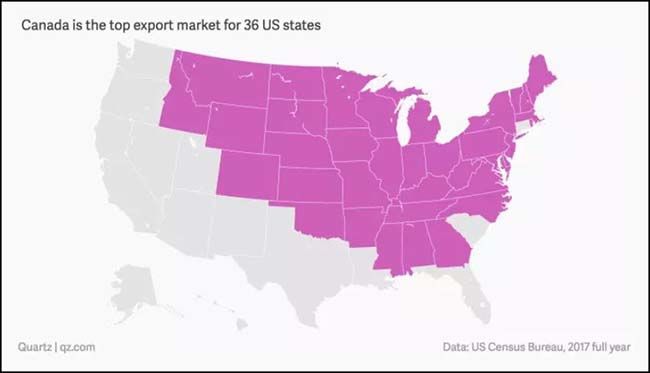

As for global trade, The North American fuse has been lit…

• Friday’s notification to Congress begins a 30-day countdown for the administration to provide the full text of a trade deal. For now, little is known about the details. Congress and business could raise objections if the fine print contains what they see as unpleasant surprises.

• Once text has been provided, Congress has 60 days to consider it. Friday’s notification begins a process that could potentially result in a new deal by the start of December, but only after a congressional vote.

Hopefully Canada will join the North America trade agreement…

A quick reminder that Canada is the top exporter for most of the U.S.

With or without NAFTA, Vancouver, B.C. real estate is in for a significant slide…

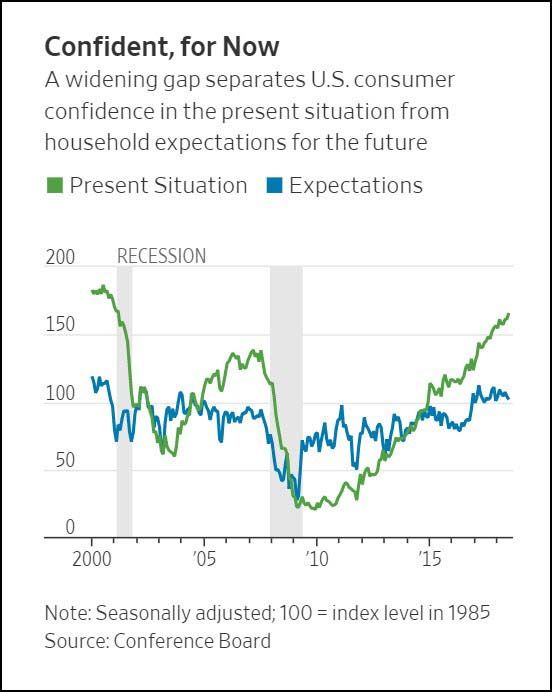

U.S. consumers are beginning to hedge their future outlooks…

“Consumers’ assessment of present-day conditions improved, suggesting that economic growth is still strong,” said Lynn Franco, the Conference Board’s director of economic indicators. “However, while expectations continue to reflect optimism in the short-term economic outlook, back-to-back declines suggest consumers do not foresee growth accelerating.”

Some 43.1% of survey respondents in July said jobs are plentiful, the highest share since March 2001. The number of households describing current business conditions as good also rose in July, to 38%.

Consumers’ own buying plans, however, were mixed. More said they planned to purchase a car in the next six months compared with June, but fewer said they planned to buy a house or a major household appliance.

The discount stores are noticing difficulties among their customer base…

Dollar General Corp. and Dollar Tree Inc. reported stronger sales in the latest quarter as the dollar-store chains benefited both from new openings and from customers spending more money and shopping more frequently.

But while the U.S. economy is strong and personal income and consumer spending are up, executives from both chains said Thursday that their customers are feeling intensifying pressure from rising rents and other monthly expenses. Discount retail chains, which often have low-income customers, are more sensitive to raising prices for discretionary products than are other retailers…

“While the economy is doing very well, our core customer continues to struggle because normally, her expenses outstripped her wage growth,” said Dollar General chief executive Todd Vasos on a conference call with analysts.

It won’t help that the White House cancelled the 2019 pay increase of +2.1% for Federal employees…

But as the data shows, recent manufacturing data in the U.S. remains very strong…

(@M_McDonough)

Which is why the Fed will raise rates this month…

(WSJ/DailyShot)

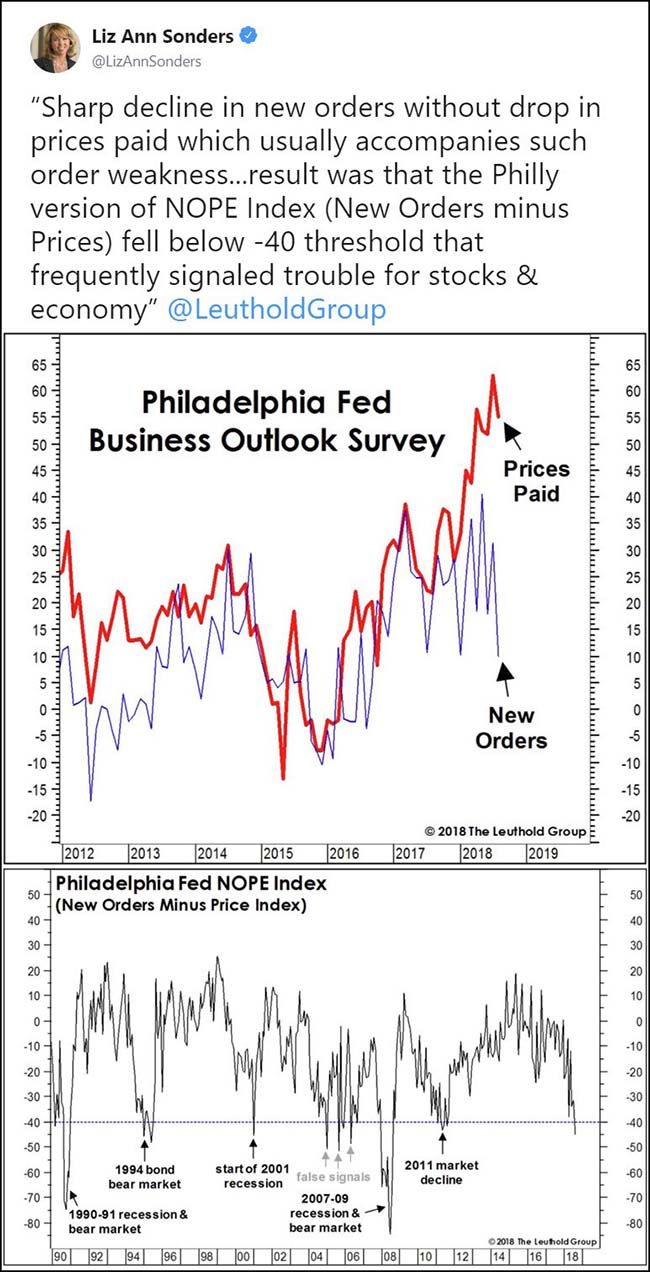

But as the Leuthold Group points out, it is not a positive for prices paid to outrun future new orders…

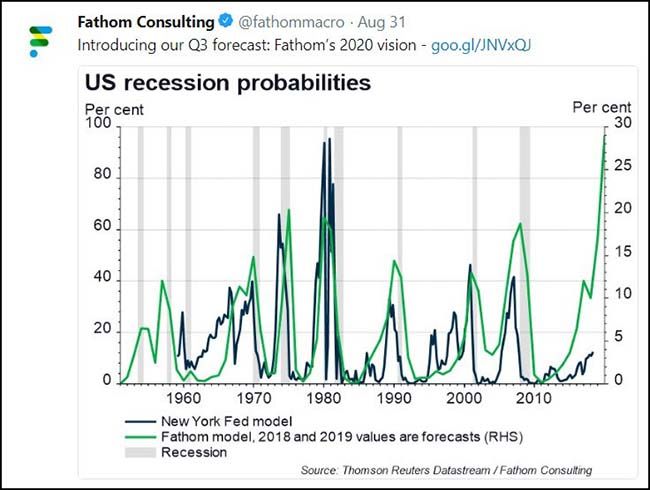

And if you are a Fathom client, you should check in on their models which suggest trouble on the horizon…

Winter is coming to Colorado…

So could HBO send us the new season of Game of Thrones early?

Will this rule change save baseball?

Two academics—one a game theorist affiliated with New York University, the other a computer scientist—think so. They created a rule change they believe will make baseball a more exciting sport—and cut almost a half-hour out of a nine-inning game.

It’s called the Catch-Up Rule, and it’s the work of NYU game theorist and professor Steven J. Brams and computer scientist Aaron Isaksen. It’s pretty wild stuff, and I need you to keep an open mind. Let’s really think about it. No croaking at me like you’re a frog on a lily pad.

Here’s the deal. The Catch-Up Rule is actually fairly simple. When the game is 0-0 or tied, baseball is played exactly as it is today—three outs per side. But when the at-bat club has or takes a lead, it gets two outs instead of three.

If you know anyone with a due date this week, I have a baby name suggestion for you…

Finally, for fans of Alfred Hitchcock…