by Blaine Rollins, CFA, 361 Capital

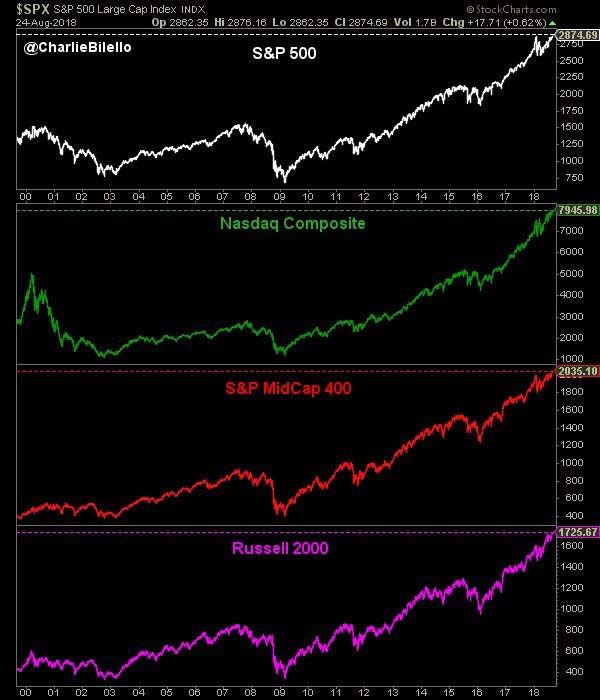

Most summer vacations will hit the end of the reel this week. It will be a slow time in the market as the news flow slows to a crawl ahead of the Labor Day weekend. But, not everyone is at the beach. Some are still trading stocks—those that did last week sent the U.S. bull market to its longest on record. After the dovish comments by top Fed geek, Jerome Powell, stocks enjoyed a broad lift to all time record highs. Large cap, mid cap, and small cap, if it was a U.S. broad based index, likely set its highest price ever on Friday. Going forward, trade worries and foreign political worries will still kick up some sand, but the U.S. credit markets remain strong, making it a bit easier to stomach equity risk right now. While Washington D.C. might remain tabloid material and the White House a reality show, the financial markets remain unconcerned right now. If the U.S. data continues to cool, the markets might wake up and decline in September. But for now, they are going to lean back in the lounge chair and enjoy that setting sun and final drink. Have a great week.

To receive this weekly briefing directly to your inbox, subscribe now.

So, about Fed Chair Jay Powell’s Jackson Hole speech, this was the phrase that paid…

“While inflation has recently moved up near 2 percent, we have seen no clear sign of an acceleration above 2 percent, and there does not seem to be an elevated risk of overheating.”

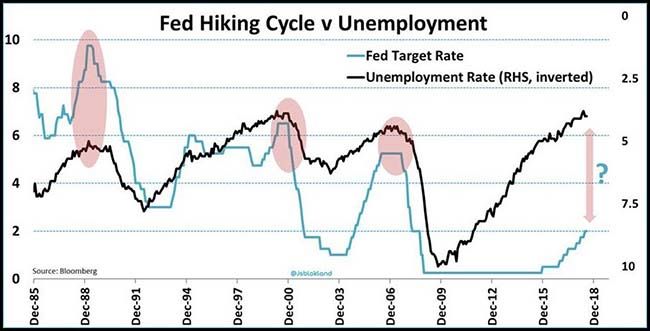

While it would appear that the Fed should continue to hike…

Powell wants to hand you a glass of warm milk and a blanket to let you know that he has this all under control.

(@jsblokland)

U.S. stock prices took Fed Powell’s comments hook, line and sinker…

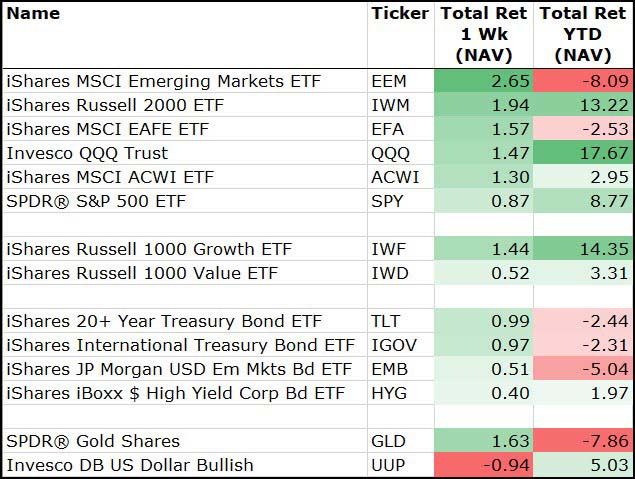

For the week, the big strength was in overseas assets as the U.S. dollar took a 1% hit…

(8/24/2018)

Among sectors last week, Energy, Semis and Biotech ripped (risk on!) while defensives lagged…

(8/24/2018)

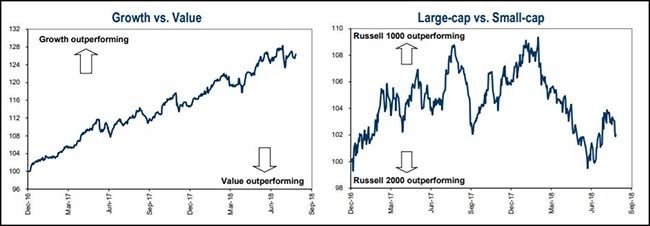

Over the intermediate term, growth continues to beat value…

While small cap is continuing to arm and leg wrestle large cap.

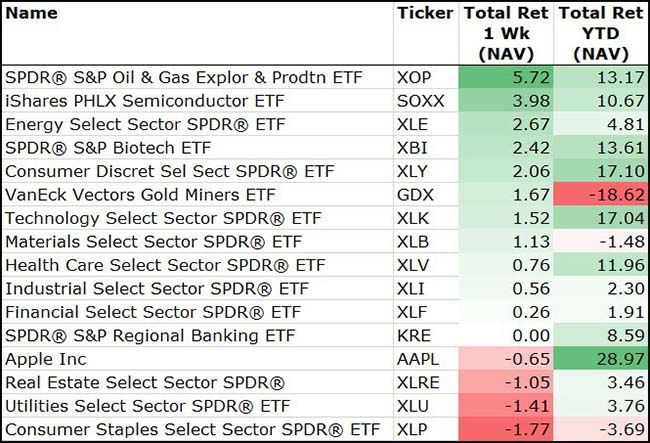

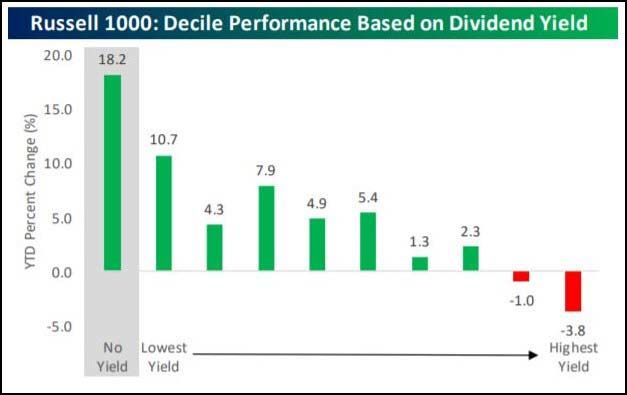

T-Bill yields are now easily outpacing dividend yields but few care…

(WSJ/DailyShot)

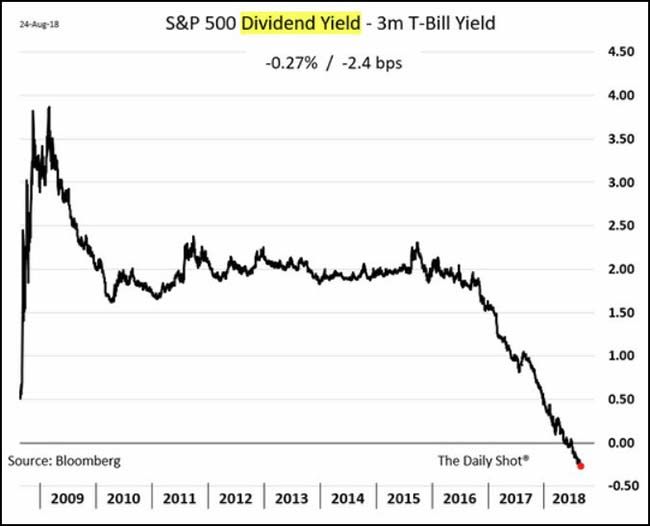

In fact, dividend investors are only allowed in the kiddie pool this summer…

(@SeanBrodrick)

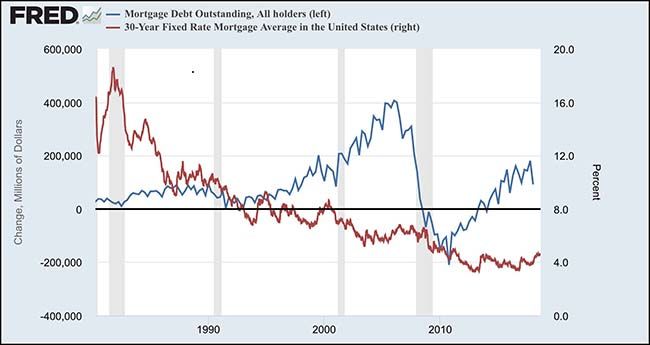

Mortgage rates are now on the rise…

Which is definitely beginning to take the winds out of the sales of the U.S. housing market.

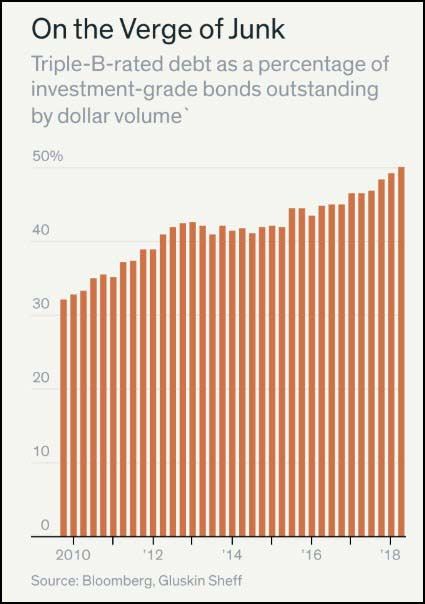

Another interesting worry is the leverage buildup among BBB credit issuers…

Shouldn’t they be firming up their balance sheets and climbing the credit ratings ladder at this point in the economic cycle?

Many investors think of all investment-grade debt as low-risk, unaware that BBB credits now make up nearly half of the $6 trillion investment-grade world. In contrast, in 2008, amid the financial crisis, they accounted for less than a third of the total.

The BBB crowd isn’t just bigger now; it’s also riskier. Since the crisis, leverage, measured by debt divided by annual average earnings before interest, taxes, depreciation, and amortization, or Ebitda, has increased markedly for BBB credits. It now averages 3.2 times Ebitda—a gauge of cash flow—compared with 2.1 in 2007. A record 37% of companies have debt that is five times or more their Ebitda, notes Pomboy.

(Barron’s)

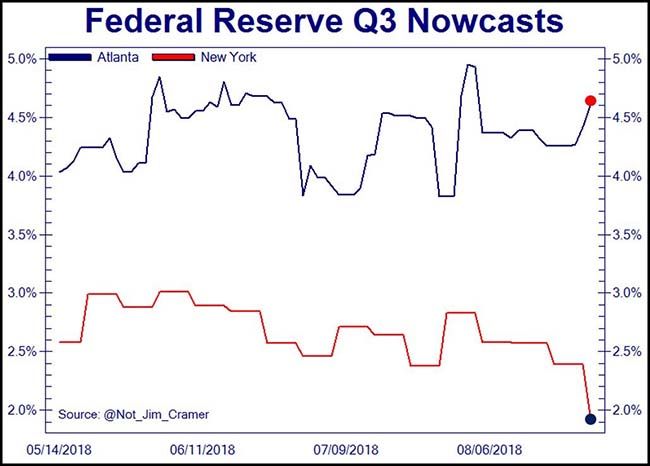

It must be a difficult time to analyze the future economy…

The Atlanta and New York Fed economists aren’t even studying from the same book.

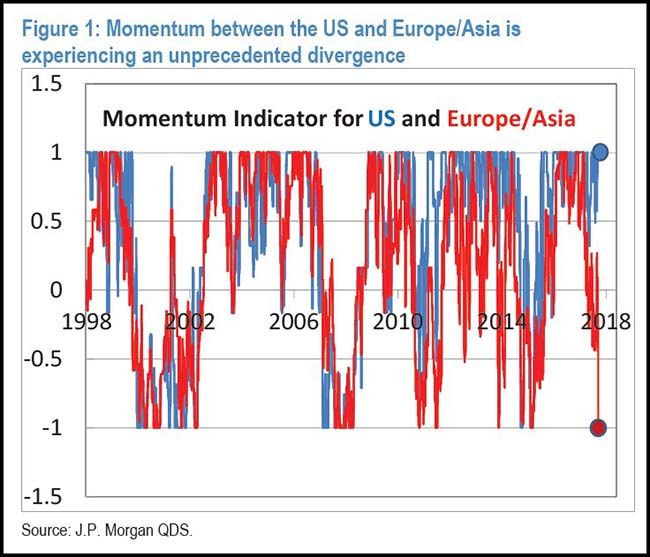

Marko perfectly explains the significant difference between U.S. and International equity assets…

In summary, buybacks are creating a shortage of U.S. stocks, the Fed is creating a shortage of U.S. dollars, and Trump’s trade wars and sanctions are further boosting the U.S. Dollar.

(Marko Kolanovic, JPMorgan)

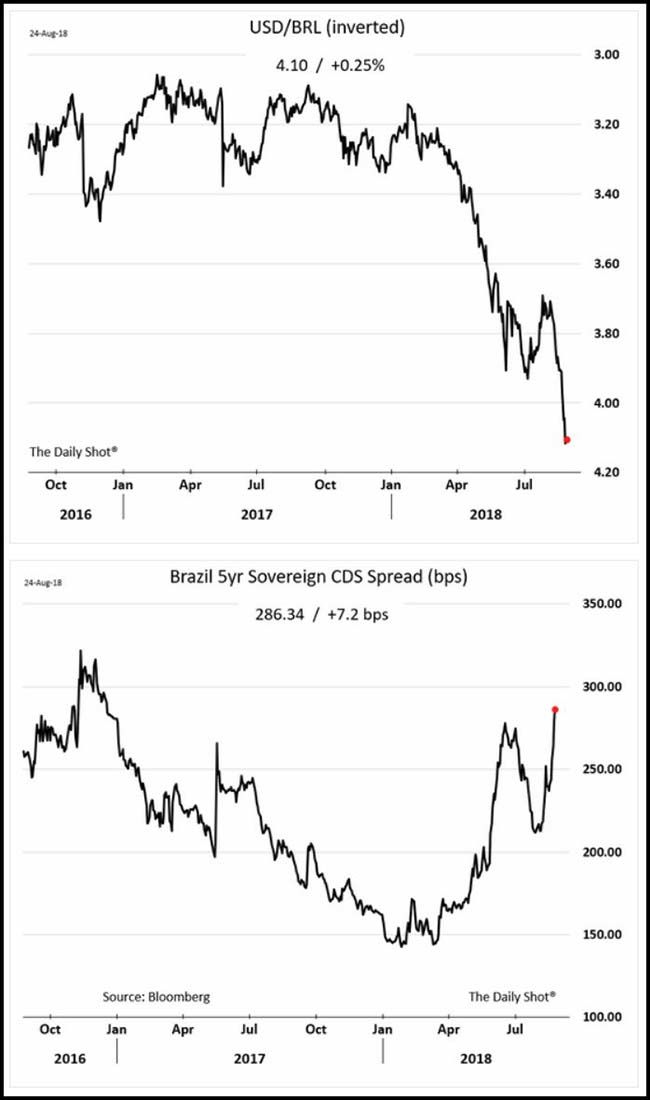

Speaking of International worries, Brazil is having a rather quiet crisis…

(WSJ/DailyShot)

Sanderson Farms processes meat. The global trade wars are hitting their chicken number hard…

We believe our lower average selling prices domestically reflect to some extent pressures from lower wholesale prices for, and abundant supplies of, competing proteins. We believe uncertainty regarding trade negotiations abroad has negatively impacted export demand.

• Boneless breast meat prices -26.6% y/y

• Bulk leg quarter prices -12.0% y/y

• Jumbo wing prices -35.4% y/y

(TradeTheNews.com)

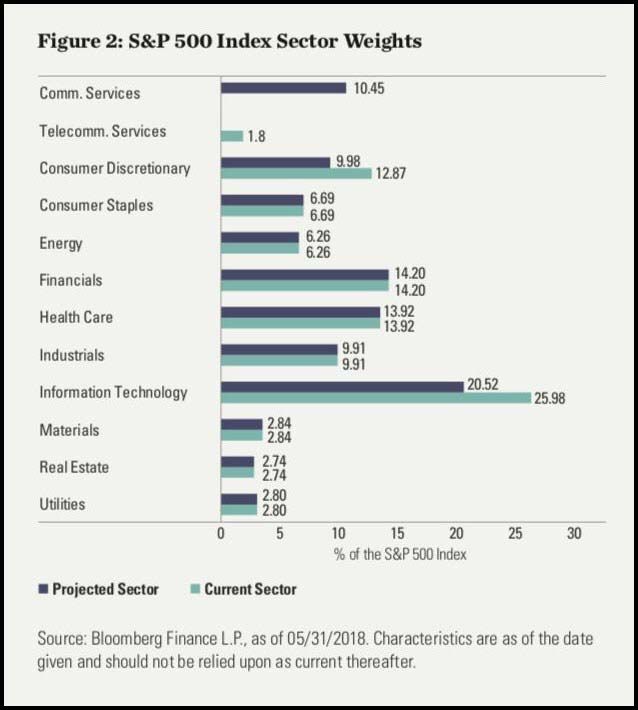

While you sit in the sand this week…

Don’t forget to think about the big sector re-weighting that is going to hit when you return to the office. Communication Services is going to get its own sector and steal many weights from Tech and Discretionary.

Congrats Denver International Airport. Now reel in that Amazon HQ…

Denver International Airport will soon offer service to 200 destinations worldwide, becoming the fourth airport in the country to hit that mark.

In addition to new international flights to Paris and Zurich, DIA has experienced significant growth in domestic air service. Four airlines added flights to 17 U.S. destinations this year, according to a news release.

There are now nonstop flights to 175 destinations in 46 states and the District of Columbia from DIA. That number is one destination behind Chicago O’Hare International Airport and Dallas Fort Worth International Airport, which are tied as the facilities with the most domestic service.

Twenty-five international destinations in 11 countries can be reached directly from DIA. Twenty-three carriers operate at the airport.

Finally, the Tweet of the Week…

As well as the best movie to wrap up your summer.