by Blaine Rollins, CFA, 361 Capital

If you have kids, then you are either back to making the morning lunches or maybe even driving them to college in a packed SUV this week. If you don’t have kids at home, then enjoy your umbrella drinks because it is going to be a slow one. The only hope will be for volatility traders will be a tweeting POTUS or maybe for a wild moose to get loose in the Jackson Hole lodge on Thursday or Friday.

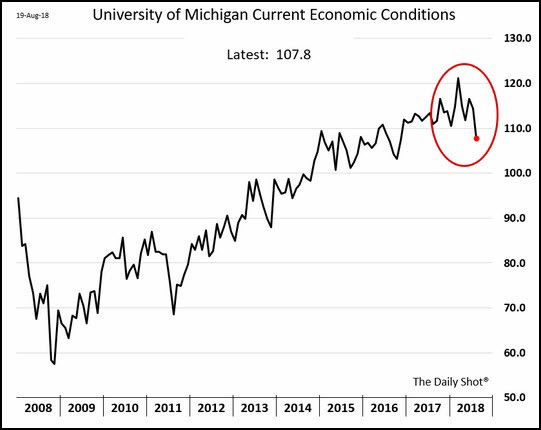

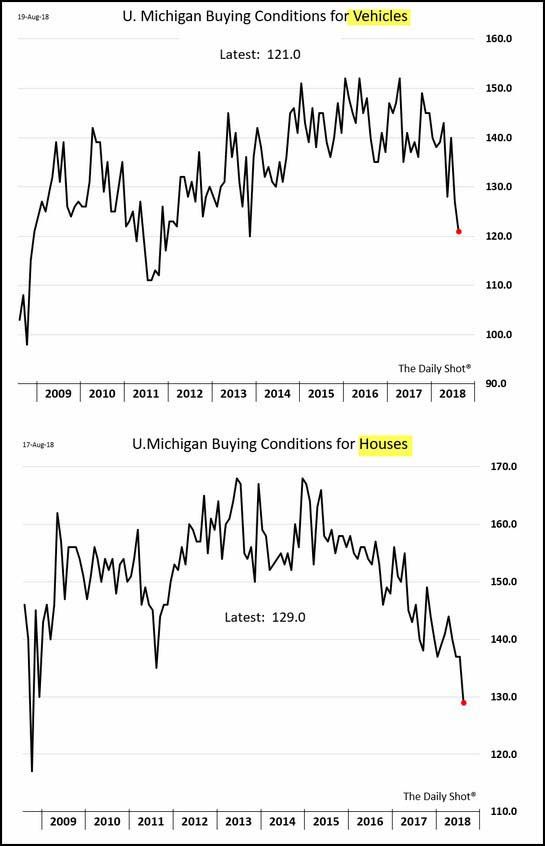

While economic geeks relearn how to put on a pair of waders, the rest of the world will be watching for what notes the Fed drops about future rate hikes. Emerging market equities, bonds and currencies will also be watching. Somewhere there must be a line for which Turkey will last longer—the Country or the Thanksgiving bird. Another Fall calendar reminder is that the U.S. elections are less than 80 days away. And, as we head into the elections, the U.S. economic data and sentiment surveys continue to dampen. GOP incumbents will be looking for any help in the economy whatsoever as November 6th approaches. Last week showed some big economic misses. The Philly Fed was soggy, Housing data bent a nail and the University of Michigan confidence surveys were shaken.

In the markets, it was a defensive week with Staples, REITs, Utilities and Healthcare outperforming, while Energy, Gold and Semis were sent to detention.

Have a great week wherever your bus takes you. And have fun kids.

To receive this weekly briefing directly to your inbox, subscribe now.

Emerging Markets still look better to vacation in than to invest in…

@Schuldensuehner: #Turkey rout continues w/ Lira keeps falling and 10y yields risings as Germany not considering financial aid for Turkey, spokesman says.

One Washington D.C. insider took our advice last week…

Interior Secretary Ryan Zinke in the Turkish Airlines lounge at IAD on Friday night. He later boarded a flight to Istanbul and traveled in business class, according to our tipster. A source told us he’s on personal travel.

(Politico)

Good thoughts from a top PM on Turkey and EM…

Debt has been a big issue for the emerging markets recently. What is your view of the financial crisis in Turkey?

Turkish corporates are likely to default on their foreign currency bonds unless they restructure them. With oil prices rising and a strong U.S. dollar, Turkey will soon need to finance $100 billion a year, without any help from the private capital markets, which have shut the door in the wake of poor economic policies adopted by President Recep Tayyip Erdogan and his son-in-law economic czar. An International Monetary Fund bailout would have been the natural solution, but Erdogan is adamant that he does not want any help from “economic hit men.” Turkey has no choice but to implement a tough austerity program and reduce its fiscal and trade deficits and debts in foreign currencies—an anathema to Erdogan, who wants to pursue a growth agenda.

What does that mean for emerging markets?

We are nowhere near a bottom. Emerging markets should trade at far lower multiples due to their higher risk profile, but investors are enamored with their higher growth profile and pay up for it. When growth disappoints and risk resurfaces, they rush for the exits—as they are in Turkey. We sold our Turkish stocks as early as first-quarter 2016; risks were rising and we were not being paid to assume them. I would wait for a larger correction before jumping in.

(Barron’s)

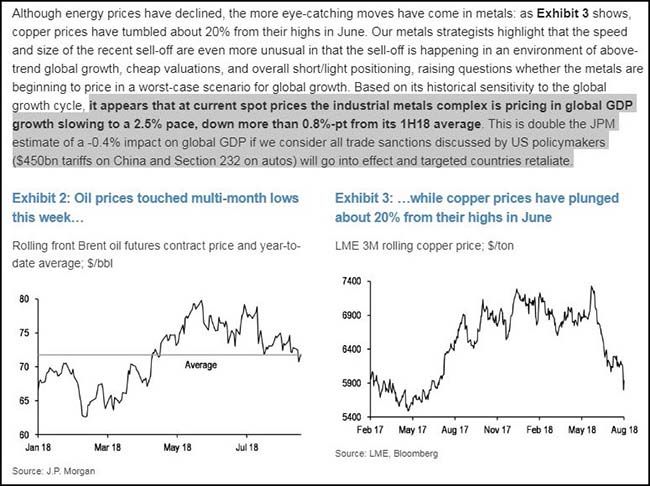

Want to know what is happening with global growth? Watch commodity prices…

@tracyalloway: Industrial metals pricing in GDP growth slowing to 2.5%. JPMorgan:

Consumers continue to lose their excitement…

(WSJ/DailyShot)

…especially for autos and houses…

The housing market is shifting toward the buyers…

After several years of rich home price gains, the market appears to have found a limit to what people can afford. Sellers are finally responding by lowering prices more often.

Approximately 14 percent of all listings in June saw a price cut, that’s up from a recent low of 11.7 percent at the end of 2016, according to a new report from Zillow. In addition, home price growth is slowing in nearly half of the 35 largest U.S. metropolitan markets.

Rising mortgage rates and affordability are behind the change. As the housing market recovered from its epic crash in the last decade, home prices began to gain slowly. And then they suddenly took off in the last few years.

(CNBC)

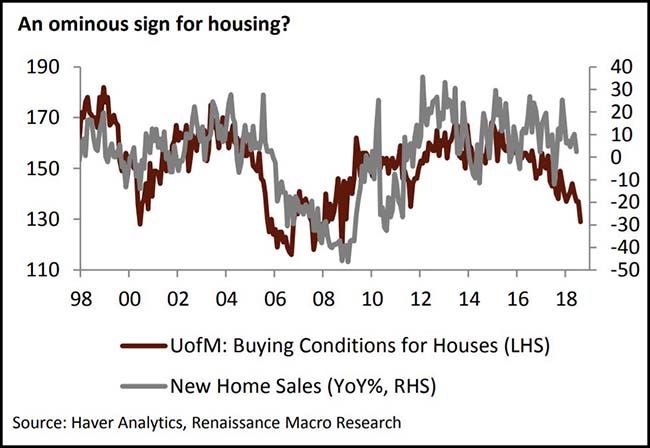

Will home sales follow?

(@RenMacLLC)

Speaking of downside housing risk…

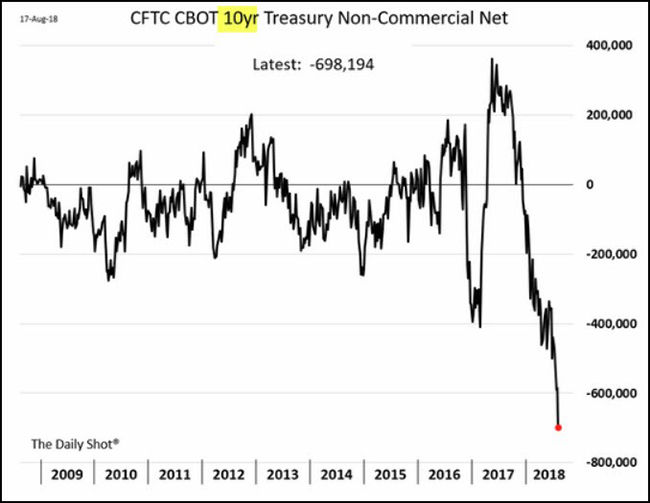

Jeffrey Gundlach points out the sizable short position in Treasuries…

|

|

(WSJ/DailyShot)

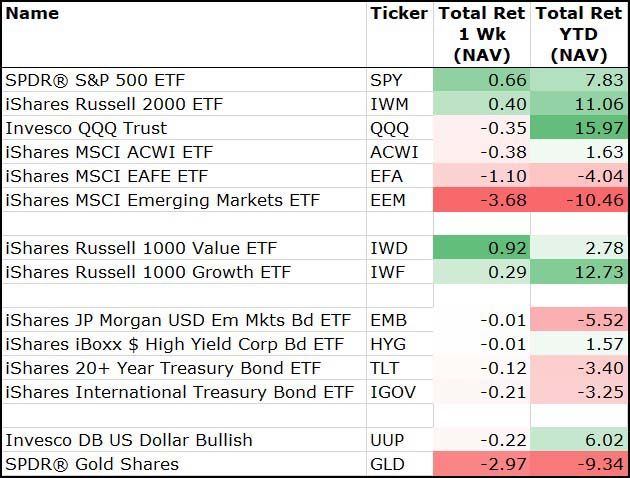

For the week, U.S. stocks again led while International lagged…

And Value stocks continued their charge higher. Gold continued its freefall.

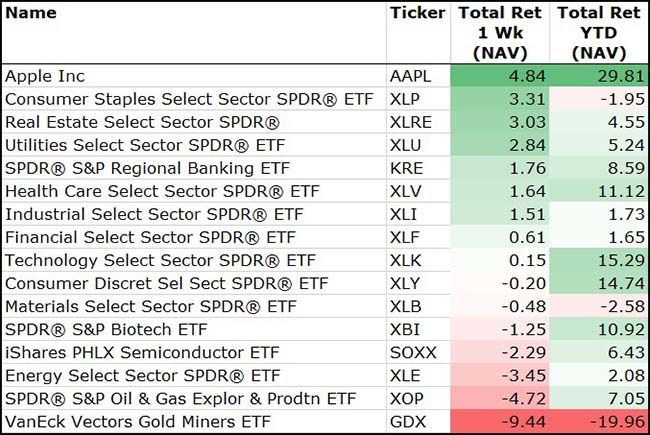

Last week showed Defensive groups again outperforming the equity market…

And don’t forget that Apple Inc is now considered a defensive food stock on days when technology stocks decline.

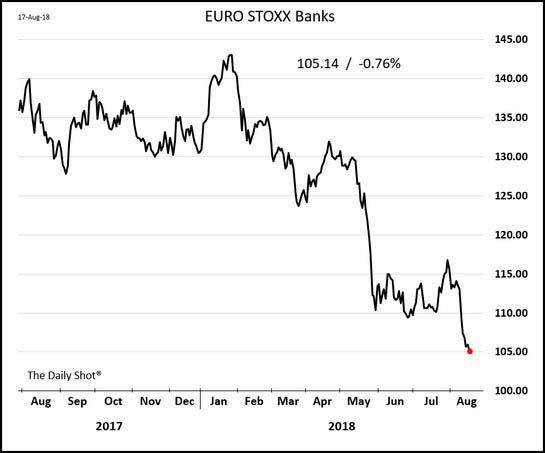

Holy ATM! It has been a terrible year to invest in European Bank stocks…

Crispin Odey has an idea why…

“They have been the serial lagging sector, luring every year value investors to their deaths,”

“Banks are watching all their profitable activities –- foreign exchange, consumer finance, small company lending -– being taken away by fintech companies and peer-to-peer lenders,” Odey said. “This is frightening for investors because it does not make for repeatable economic growth.”

If you own Oil and Energy stocks, then you are watching this chart closely…

(@kkernttb)

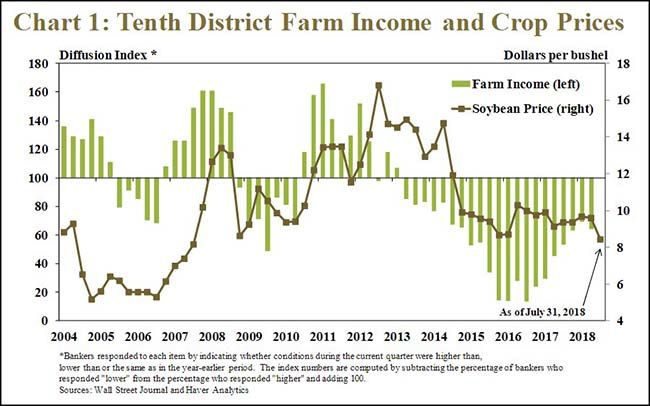

New Kansas City Fed survey shows lower grain prices negatively impacting the Ag economy…

A sharp drop in the price of corn and soybeans contributed to a bleaker view of the District’s farm economy in the second quarter. For many agricultural borrowers, cash flow already had been a significant concern, but likely was exacerbated by the recent drop in prices amid ongoing uncertainty surrounding the future for agricultural trade. Interest rates on farm loans of all types continued to edge higher, but the value of farmland still only declined at a modest pace. If crop prices remain low through harvest, many farm borrowers likely will face additional increases in financial stress and the future path of agricultural credit conditions may hinge on the strength of farmland markets.

(KC Fed)

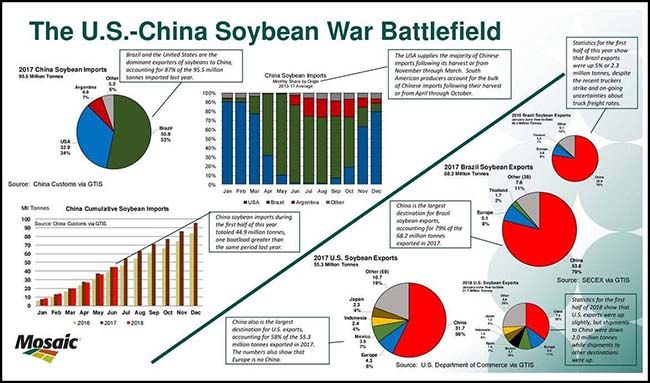

Brazilian farmers are now ripping out other crops to plant soybeans…

Shifting trade flows are redefining the Brazilian landscape, spurring more farmers to align their crops with Chinese appetites. The nation’s soy plantings have expanded by 2 million hectares in two years – an area the size of New Jersey – while land used for cane shrank by nearly 400,000 hectares, according to government data.

China’s growing demand for meat has supercharged soy imports for animal feed. The Asian nation paid $20.3 billion last year for 53.8 million tonnes of soybeans from Brazil, nearly half its output — and up from 22.8 million tonnes in 2012.

A new 25 percent Chinese tariff on U.S. soybeans – a retaliation for U.S. levies by President Donald Trump – is expected to boost Brazil’s soy exports to an all-time record this year.

The big fertilizer company, Mosaic, has all the soybean data drawn for you…

(@Financial_Orbit)

Thoughts on the global trade wars from a key player…

The U.S. economy will be hit many times harder than the rest of the world by an escalating global trade war, according the chief executive officer of A.P. Moller-Maersk A/S.

Soren Skou, who runs the world’s biggest shipping company from Copenhagen, said the fallout of the current protectionist wave “could easily end up being bigger in the U.S.” Tariffs could slow global annual trade growth by 0.1 to 0.3 percent, though for the U.S. the effect could be “perhaps 3 or 4 percent,” he said at a presentation at Maersk’s headquarters on Friday. “And that would definitely not be good.”

The auto tariff threat is causing a pull-forward of auto sales and thus a spike in used car prices…

The Manheim Used Vehicle Value Index, increased 5.1 percent in July over the same month last year. July used car prices were also up 1.5 percent over the June prices, and the index is at its highest point since it first started tracking used sales in 1995.

“This kind of thing does not happen in July,” Smoke said. “Fundamentally we have been seeing for 8 straight weeks now used prices gain in value … a depreciating asset that should have lost 1 percent of value has instead gained 2 percent.”

July is historically a slow month for used car sales. The market is driven by tax refund season, so its biggest months tend to be March and April.

While the tariffs on new car sales haven’t been enacted yet, the mere threat appears to be driving up prices on new cars. Auto dealers at the Manheim auction Aug. 10 theorized that consumers who might be in the market for a car in the next six to nine months are buying now to hedge against possible rising prices.

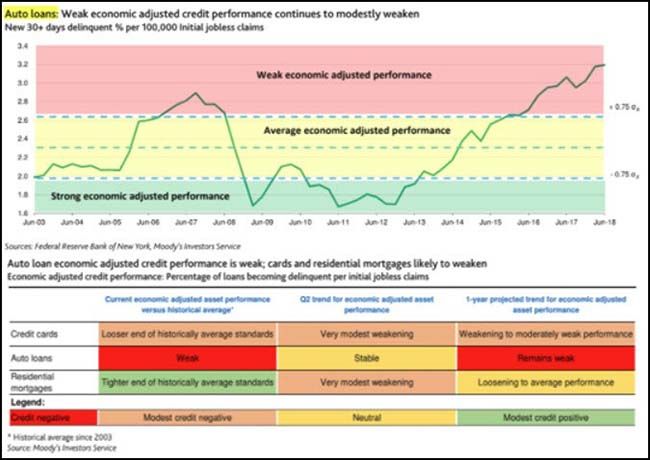

We weren’t the only ones worried about the rise in auto lending…

Now Moody’s is getting concerned. Maybe with rising auto prices, consumers should trade down and pay off their auto debt.

(WSJ/DailyShot)

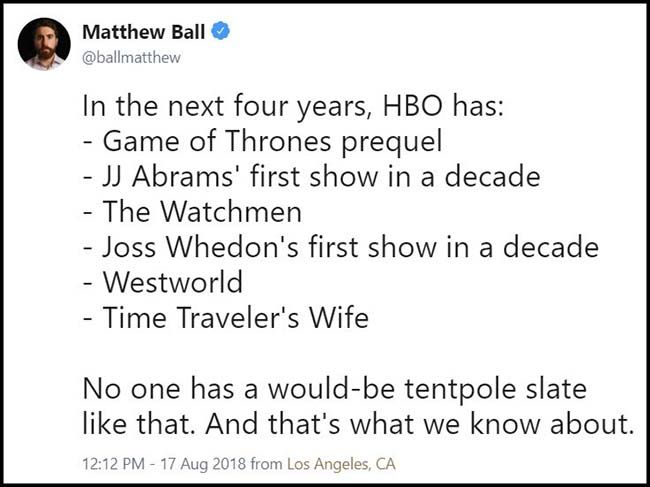

AT&T should treasure HBO like Gollum treasures The Ring…

Cut out these coffee and sugar charts and ask your barista for a 30% discount on that next drink…

If they refuse, then tell them you will be forced to buy Starbucks in your trading account.

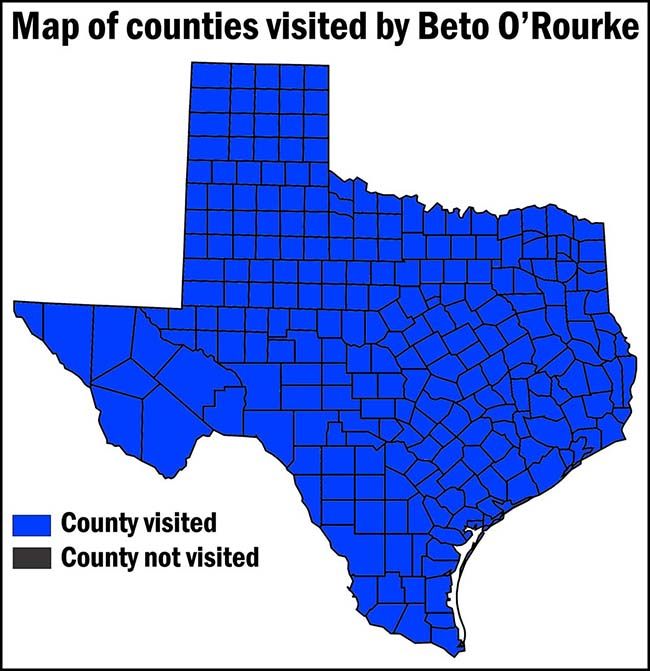

No matter your politics, you have to be impressed by his tenacity…

I have a question…

With the school year returning to most households this month, let’s remember these facts as we attend Back to School night…

Percentage of US public-school teachers who spend their own money on school supplies : 94

Average amount a teacher spends each school year : $479

Percentage change since 2008 in the average US public-school teacher’s salary : –4

Percentage change from 2010 to 2017 in the number of foreign teachers arriving annually to work in US public schools : +140

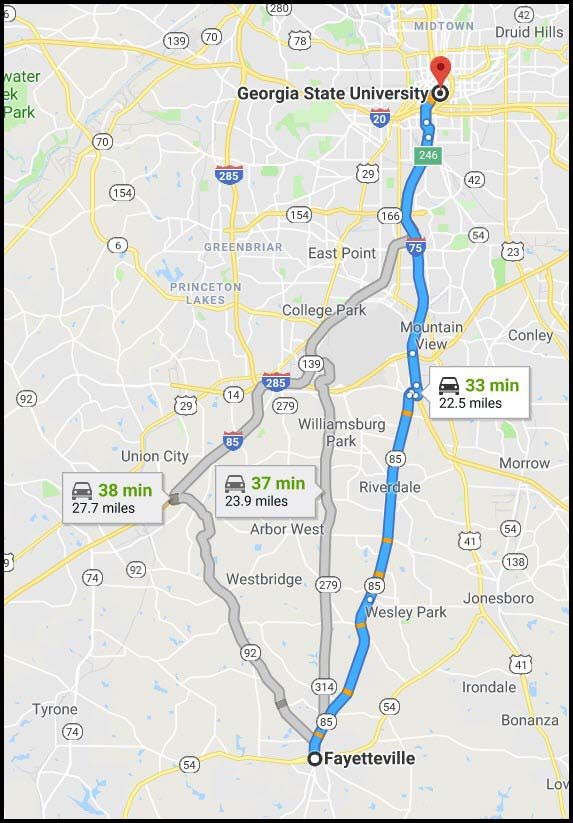

Check the below routes for traces of broken noodles and plastic wrappers…

With classes starting this week at Georgia State, even Sheriff Rosco P. Coltrane should be able to solve this crime.

A 53-foot tractor trailer filled with about $98,000 worth of ramen noodles was stolen from a Chevron gas station in Fayetteville, Georgia authorities told ABC News.

The driver had parked the tractor trailer on July 25 after receiving permission from the owner of the gas station to leave it there for several days, said Lt. Allen Stevens, public information officer for the Fayette County Sheriff’s Office. The driver later returned to the location on Aug. 1 to find the carbohydrate-filled vehicle missing, Stevens said.

There are no suspects at this time, Stevens said.(ABC News)

Finally, a great read for those kids first attending or returning to college…

My focus is on optimal ways to socialize, to prioritize, to pick up skills integral to any career and to open up exciting opportunities both en route to a degree and after you’ve acquired it. Not nearly enough of the roughly 20 million Americans who are beginning or resuming college over the coming weeks pause, in their trepidation and exhilaration, to think about that…My friend Eric Johnson, who provides guidance to underprivileged students at my alma mater, the University of North Carolina at Chapel Hill, put it to me this way: “The more you regard college as a credentialing exercise, the less likely you are to get the benefits.”

Johnson is as thoughtful and insightful about higher education as just about anyone I’ve come across. The wisest students, he said, “move into a peer relationship with the institution rather than a consumer relationship with it.” They seize leadership roles. They serve as research assistants.

And they build social capital, realizing that above all else, they’re in college “to widen the circle of human beings who know you and care about you,” he said. That’s perfectly put.

Copyright © 361 Capital