by Blaine Rollins, CFA, 361 Capital

The good news is that in your yard, if you ignore it and don’t trim it then it keeps growing. For most investment portfolios, hedges don’t work this way as they also need to be actively managed. But while some portfolio managers are forced to be 95-100% invested at all times, I don’t invest that way. I get to pick and choose among the best assets that I can find in the world and when I can’t find anything, my cash will build up naturally. As this summer, and now earnings season, rolls along, I have done my best to find attractive equities, fixed income and commodities but it is getting more difficult. Earnings have been coming in better than expected but worries are rising and so we aren’t getting paid in the beats. Meanwhile, misses are getting punched. Over in Bond world, rising inflation, active central banks, and increasing credit worries make me want to run and hide. And commodities are a total wreck outside of the Energy complex. So, as my universe of great ideas continues to shrink, my cash will build and my natural hedge will grow. Just need to make certain I have a comfortable bench on which to sit patiently, until we can get back to fully invested.

Crazy week. Earnings hit, but comments and trade worries miss. POTUS tweets for a weaker U.S. dollar and no more Fed rate hikes. Something happened in Helsinki. The Chinese Yuan took a crane dive. Trade talks are going nowhere for the U.S., while other nations and continents are signing plenty of free trade deals. The Bank of Japan is up to something. It could be BIG. Look at your bond portfolio the past few days. If the BoJ gets Hawkish and steepens their yield curve, there will be global movements. Stay tuned here. Earnings continue this week with 40% of the S&P 500 reporting. Expect more of the same. Beats, misses and cautionary outlooks as inflation and trade war uncertainty clouds the forecasts. Now back to read some earnings releases next to my growing hedge.

Join me for this week’s webcast, 2018 Mid-Year Review, where I’ll discuss the first half of 2018 and what may lay ahead for investors. You can register here.

To receive this weekly briefing directly to your inbox, subscribe now.

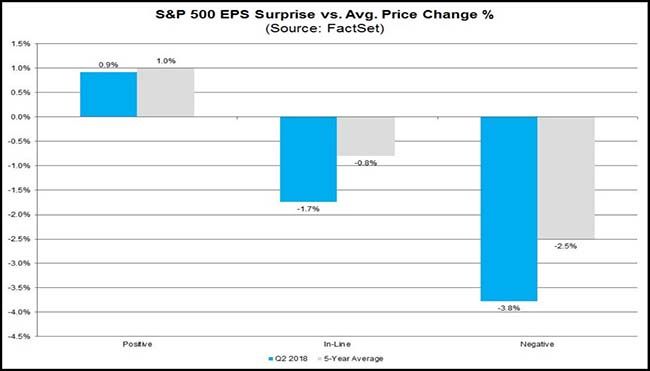

Perfect headline Barron’s…

…of the 75 S&P 500 companies that had reported earnings, 71 topped analyst forecasts. Those beats have been rewarded with an average gain of 0.9% on the trading day following the report, in contrast to last quarter when it seemed like every beat was seen as a chance to sell. Those earnings have helped the market compensate for the continued global worries by putting the focus squarely on the fundamentals, says Christopher Harvey, head of equity strategy at Wells Fargo Securities. “It’s hard to fight the macro overhang in between earnings season,” he says.

Portfolio Managers are now fully worried about Trade Wars…

With everything going on, can the markets also handle a Currency War?

The POTUS wants a strong U.S. economy but not the higher interest rates and the strong U.S. dollar that goes along with it. You can’t have one without the other.

U.S. President Donald Trump on Friday accused China and the European Union of “manipulating their currencies and interest rates lower.” The comments came after the yuan plunged to its lowest level in a year, with little sign of China’s central bank intervening to stem the slide. They also follow a decline in the euro this year and add to the calculus that European Central Bank policy makers might need to consider when they meet next week.

As the world’s largest economies open up a new front in their increasingly acrimonious game of brinkmanship, the consequences could be dire — and ripple far beyond the U.S. and Chinese currencies. Everything from equities to oil to emerging-market assets are in danger of becoming collateral damage as the current global financial order is assailed from Beijing to Washington.

The Market wants two more fed rate hikes…

The President doesn’t want any more hikes. I guess that we will find out if the Fed has taken a loyalty oath or not.

(WSJ/Daily Shot)

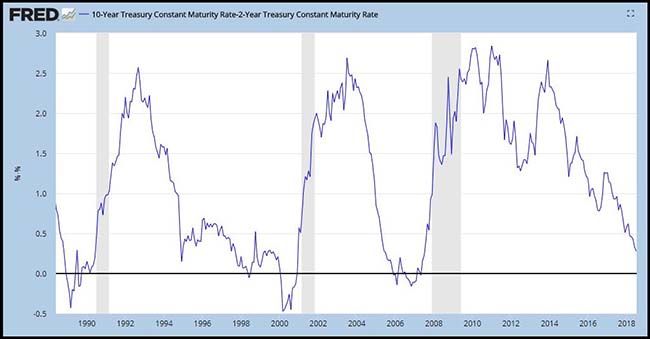

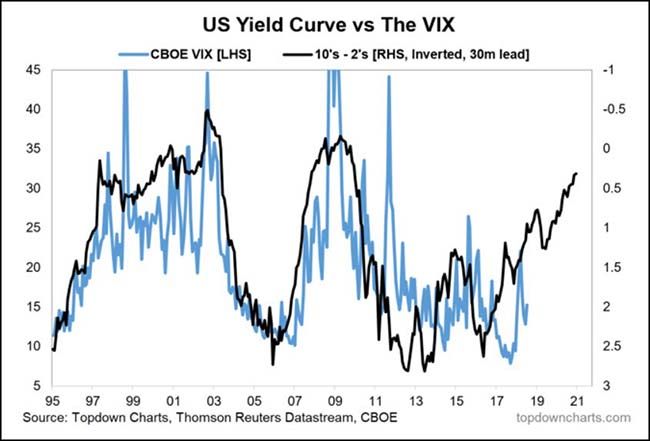

While the Yield Curve flattening remains at the top of everyone’s mind…

This potential action at the Bank of Japan could affect the global bond markets. Could global curves follow the Japanese curve? Or, will higher rates in Japan suck the liquidity out of all global financial instruments. Tread lightly Governor Kuroda.

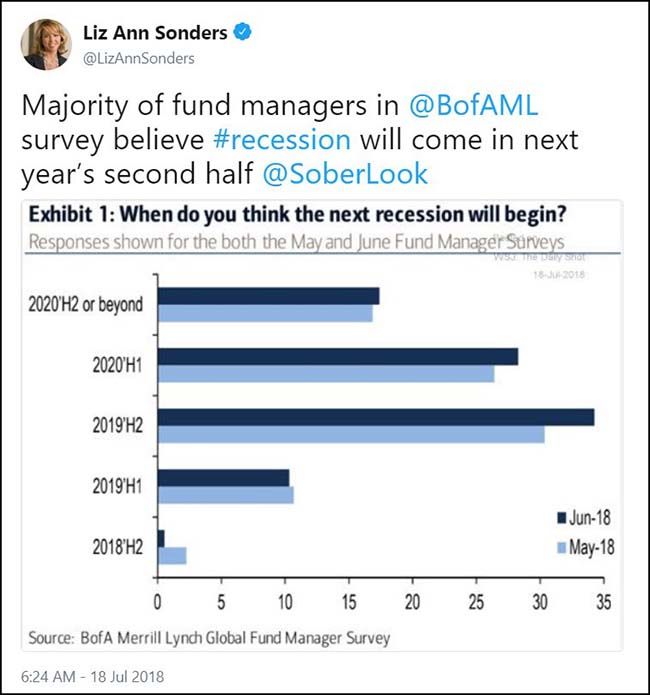

Portfolio Managers are eyeing late 2019 for the U.S. recession to begin…

This would line up perfectly with a late 2018 retreat in stock prices. One more time, how big is your hedge?

Past yield curve flattenings have also corresponded with rising volatility…

(@PlanMaestro)

(@PlanMaestro)

Not something a skittish bond investor wants to read right now…

One solution to improve liquidity would be to mark the price of bonds down 10-25%. I promise that liquidity will pick up.

Many bonds around the globe are becoming harder to trade, prompting some investors to shift to other markets and raising concerns about a broad decline in liquidity.

The median gap between the price at which traders offer to buy and sell, a proxy for the ability to move in and out of markets quickly, has widened this year across European corporate debt and emerging-market government and corporate bonds, according to data from trading platform MarketAxess. Trading in some derivatives has picked up as traders pull back from bond markets they view as increasingly unruly and expensive…

“The global tide of liquidity that quantitative easing spurred is now slowly, slowly moving in reverse,” said Nathaniel Rosenbaum, credit strategist at Wells Fargo Securities. “You’re starting to see small hot spots emerge in parts of the market that don’t have a natural support,” he said, such as pockets of Europe and Latin America.

Your earnings call keyword this Q2 isn’t ‘Trade’, but ‘Inflation’…

The two are related but inflation was heavily noted across the reporting companies and industries. Not great news for companies that can’t pass along or for customers who can’t pay up.

“commodity inflation has picked up a bit. Certainly, we have seen a bit more in oil and in addition to that in aluminum; second, transport costs have also been under some pressure with the driver shortage in the United States; and then third, in international markets, as you know where we have seen some inflation – PepsiCo (PEP) CEO Indra Nooyi

“facing intense wage pressure and difficulty in finding the people that they need…. we can expect higher inflation and higher rates” – BB&T Corporation (BBT) CEO Kelly King

“We continue to see elevated commodity prices and as a result now expect inflation headwinds” – Stanley Black & Decker (SWK) CFO Don Allan

“the key issue is that inflation continues to run very quickly…it is inflationary for products and that inflation has not stopped.” – Fastenal (FAST) CFO Holden Lewis

“we already implemented an initial set of price increases in June, with an additional set of actions planned for the third quarter…we are acting with agility to implement price and cost actions to offset these transitory [tariff] headwind.” – Stanley Black & Decker (SWK) CFO Don Allan

“we are seeing more headwinds on cost inflation…And we are raising prices to offset that” – Electrolux (ELUXF) CEO Jonas Samuelson

“It’s hard to imagine that the current cost pressures could sustain a whole lot longer before manufacturers have to move much more significantly” – MSC Industrial Direct (MSM) CEO Erik Gershwind

“with unemployment at the level that it is in the U.S. and some of the international markets, it is a very competitive market for labor” – Domino’s Pizza (DPZ) CEO Richard Allison

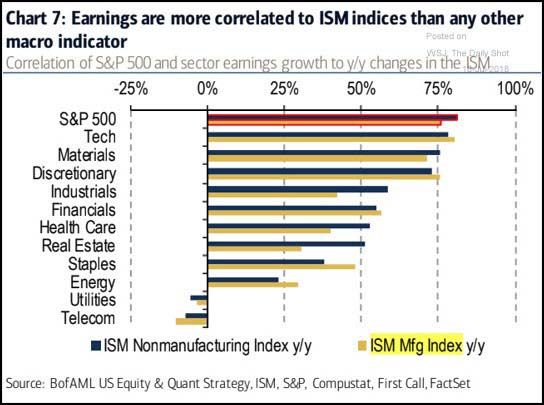

Reminder that the ISM data has a strong hand in earnings direction…

180 companies = 40% of the S&P 500 to report this week…

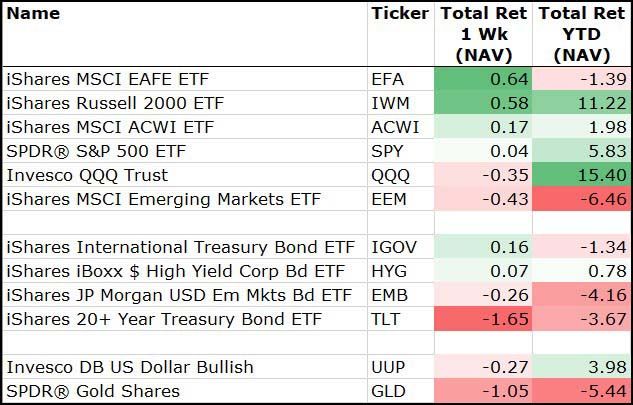

Big move was in Bonds which pulled lower on speculation that Japan is up to something BIG…

If the Bank of Japan moves to steepen its yield curve, it could have a global impact on interest rates and currencies.

Banks and Financials bounce after a disastrous start to the earnings season a week ago…

Someone forgot to tell Alcoa that Trade Wars are easy to win…

Commerce Secretary Wilbur Ross in March slapped a 10% tariff on aluminum and 25% on steel in the name of helping American metal manufacturers. But one problem is that downstream businesses can’t easily reconfigure global supply chains, and higher input costs are making them less competitive globally.

Consider Alcoa , the top U.S. aluminum manufacturer whose shares plunged 13% Thursday and another 3% Friday after the company reported that tariffs are crimping earnings. The tariffs could wipe out $100 million of income this year, equal to about 18% of profits last year. “Tariffs will not solve the challenges facing the aluminum industry,” Alcoa CEO Roy Harvey said on an earnings call…

Meantime, many businesses are delaying investments in the U.S. because of the uncertainty caused by the tariffs. Borusan Mannesmann, which produces pipelines for the oil and gas industry, was recently notified that Commerce had denied its application for a steel-tariff exemption. This has frozen its plans to invest $75 million in expanding production in Baytown, Texas.

Commerce also rejected an exemption for Plains All American, which is building a pipeline from the Permian basin to the Gulf Coast that will relieve a supply bottleneck. Inadequate pipeline capacity in the region has curtailed oil production and exports, which will frustrate Mr. Trump’s efforts to keep a lid on gas prices while applying sanctions pressure on Iran.

Steel tariffs achieving their desired impact…

Some grassroots tariff observations from an Indiana economist…

I’ve a friend who is a roofer and small business owner. The business is challenging, and involves dealing with the price of roofing a home or business, as well as hiring workers and buying materials like aluminum for roofing and gutters. Few people buy a new roof on a whim, so one would suppose that a price increase wouldn’t cost too much business. However, with the increase in aluminum and steel that accompanied the trade wars, he must charge between 15 and 25 percent more for much of his materials. That costs him business, and drops the margins on his jobs. This means fewer employees, less overtime and less investment in crew equipment for his small business.I hadn’t really expected steel and aluminum tariffs to affect roofing quite so quickly, and this conversation clarified to this economist how deep the disruptions might be.

Somewhat ironic that the Vice President’s hometown will be the most affected by the global Trade Wars that his boss launched…

According to the Brookings Institution, the Columbus area is the most export-reliant region in the country, with just over half of its economic output linked to foreign purchases.

“I’m very worried,” said Tom Linebarger, the chief executive of Cummins, who met with President Trump over dinner at the White House in January in a bid to dissuade him from introducing steel and aluminum tariffs or tearing up free trade agreements.

Linebarger, 55, warns of job losses ahead because thousands of jobs at Cummins and elsewhere in the area depend on trade.

“We will do everything we can to mitigate . . . the impact to jobs,” he said. “It’s very clear, though, that we’re not going to be able to mitigate everything.”

Pence’s hometown oozes internationalism: 40 foreign companies have a presence, more than half of them Japanese engines and auto-parts plants, employing almost 10,000 people. The area’s schools collectively speak 51 languages. The city ranks second in the nation in the per capita percentage of H-1B visas for foreign workers…

Now the aggressive pursuit of foreign trade that made this city a recession-busting economic miracle has made it decidedly vulnerable, with businesses already canceling projects and mulling the depth of job losses.

The Cummins plants, which produce engines, generators and other equipment, epitomize how deeply international trade has become rooted in cities and towns throughout the nation. Cummins alone has 25,000 different suppliers and also its own chain of distribution, both of them largely international. Its U.S. base is bolstered by operations in the United Kingdom, China and India.

Linebarger said the president’s trade war hits the company in two ways, affecting both its incoming parts, which will be subject to tariffs, and its own products, on which retaliatory penalties will be assessed by countries targeted by Trump.

For Cummins, the two most corrosive tariffs will be those assessed on steel and aluminum, which began July 1 and cover $48 billion of imports, and the proposed $351 billion of automobile and auto part imports. Both have been justified as necessary for national security.

Next door in Iowa, GOP Senator Joni Ernst lets the White House know that 25% of her state’s jobs are now caught in their global trade chess game…

“Mr. Navarro, America’s farmers are caught in the crosshairs of this game of ‘chess.’ Offhand comments like the ones that Mr. Navarro made in his interview with CNBC today disregard the people whose livelihoods depend on global trade. In Iowa alone, more than 456,000 jobs are supported by trade, and these new tariffs are threatening $977 million in state exports. That is no ‘rounding error.’ Those are real people – Iowans – who are waiting for terms to be negotiated, for new deals to be finalized. We need to lessen the pressure on these hard-working farmers, and let them sell their goods.

Is the GOP absolutely certain that it wants to hold the 2020 convention in Charlotte?…

Gov. Roy Cooper on Thursday asked President Donald Trump to halt the trade war because it is harming North Carolina’s farmers and manufacturers.

In a letter to the Republican president, Democrat Cooper said escalating tariffs have already damaged the state’s pork and tobacco farms, and that manufacturers could suffer from rising steel and aluminum prices.

“While North Carolinians support a level playing field for exports, the tariffs imposed by the U.S. Administration and retaliation by trading partners seem to uniquely target agriculture goods that are the foundation of our state’s economy,” Cooper wrote.

And in South Carolina, the trade tariffs are about to kill the golden goose…

Two decades later, the automaker has become the most important local job creator, earning the affection of a deep-red county where one in 10 people earns a living making vehicles or their parts.

The Spartanburg plant is BMW’s biggest in the world. It has helped draw more than 200 companies from two dozen countries to Spartanburg County. And the German company — not an American icon like Ford or General Motors — is now the largest exporter of cars made in the United States, turning the port of Charleston, S.C., into a hub for global trade.

But by setting off a global trade battle, President Trump is threatening the town’s livelihood. People aren’t happy.

“BMW saved Spartanburg and transformed South Carolina into a manufacturing mecca to the world,” said Mr. Britt, a member of the County Council. “When you mess with the golden goose, they’re family, and you’re messing with me.”

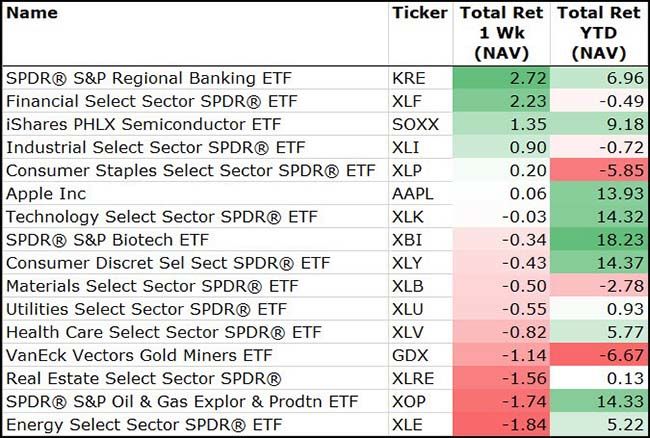

Michigan, Ohio and Indiana on alert this week as the U.S. and E.U. meet to discuss auto tariffs…

U.S. frozen meat lockers are full with fewer places to export…

The combination of trade risk and expanding meat supplies could result in “one of the biggest corrections we’ve seen in the industry in several years,” said Christine McCracken, protein analyst at Rabobank, one of the world’s largest agricultural lenders.

Some hog farmers and pork processors are beginning to scale back. Maschhoffs LLC, a privately held hog-farming company based in Carlyle, Ill., has put on hold $30 million in investments planned to expand its breeding operations and upgrade truck washes and other biosecurity measures.

“We’ve got too much capacity built in this industry if we’re not going to be exporting more product,” said Ken Maschhoff, the company’s chairman. He is instead considering expansion into Eastern Europe or South America—places where the company’s hogs perhaps can’t be raised as cheaply as in the U.S. but where he said trade policy isn’t so “geopolitically charged.”

Meanwhile, some analysts said, pork processors recently have reduced some hours at plants, and some plants even have turned away hogs, Ms. McCracken said.

California dairy farmers are drowning in milk…

Local dairy farmers are feeling the effects of the trade war with Mexico that started when President Donald Trump imposed tariffs on Mexico’s steel and aluminum…

While it’s only been six weeks since the tariffs started, the economic effect for local dairy farms has been brutal…

“The market in the last two weeks of June dramatically dropped,” Frank Konyn, owner of Konyn Dairy, said. “I am losing $1,400 a day, about $40,000 a month here in this dairy.”

The tariffs increased the price of milk coming from the United States, meaning more milk is staying in the local economy. And that’s bad for business.

“Because all those products are staying here at the market, there is a greater supply,” Konyn said. “And as a result of the great supply, the price goes down.”

According to the California Council of Milk Producers, losses for the industry surpassed $380 million in the last six weeks, though it notes that not all the losses can be blamed on the trade war.

Newsprint tariffs implemented a year ago are now causing newsroom layoffs and circulation cutbacks…

The price of newsprint has jumped to its highest level in a decade as tariffs imposed by the Trump administration on imports from Canada start to bite, causing US newspapers to further pare down print offerings and piling more pressure on the beleaguered industry.

Prices of the paper have risen almost one-fifth in the past year, according to the Foex US 30lb newsprint index, to $647 a tonne.

Printers and publishers blame the price jump on tariffs of up to 32 per cent on imports into the US following a petition last August by the North Pacific Paper Corporation, or Norpac. The company, based in Washington state, said its business was harmed by alleged dumping of subsidised Canadian newsprint into the US market…

Rising newsprint prices were cited by the Tampa Bay Times when it announced job cuts earlier this year. The publishers of the Pittsburgh Post-Gazette have told its union that the paper will cease printing two days a week from next month. And the Salt Lake Tribune is printing its local news section only three days a week, with reductions to number of the remaining pages.

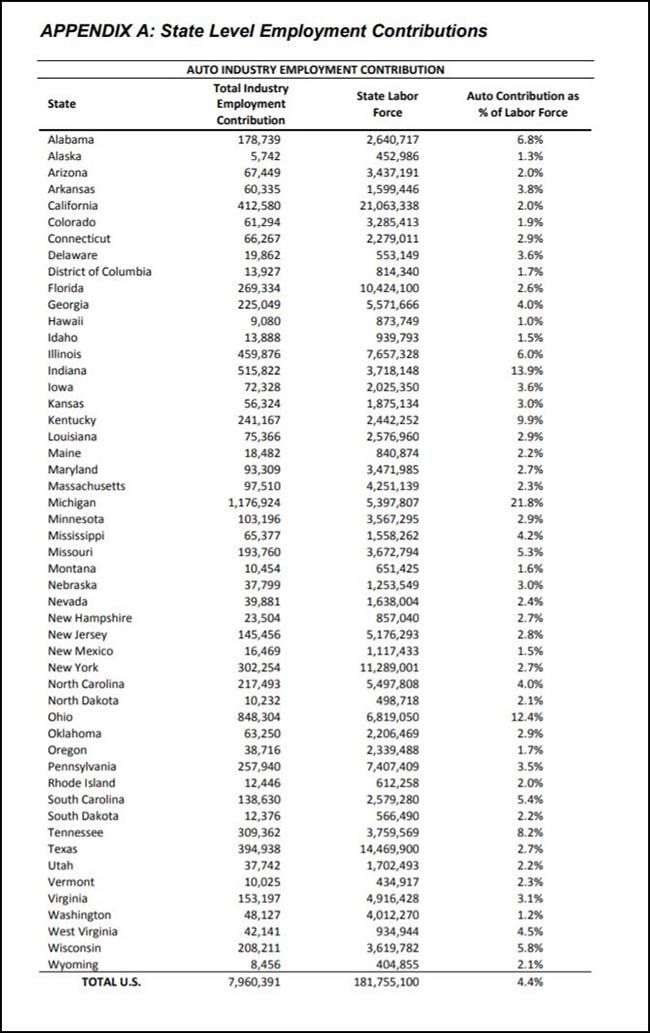

Fed Chairman Jerome Powell during Congressional testimony last week…

And while the U.S. fights its trading partners, the E.U. and Japan sign a major bilateral trade agreement…

President Trump called the European Union a trading “foe” last week, and on Tuesday European leaders replied by signing an economic partnership with Japan that will eliminate almost all tariffs on bilateral goods. The negotiations had dragged on for years, but Mr. Trump’s protectionism pushed both sides to reach a deal that shows how trade liberalization will increasingly bypass the U.S.

We wrote about the potential of the Japan-EU deal to put American food exports at a disadvantage when it was finalized in December. The removal of Japanese quotas and duties on European farm products will hurt American hog farmers, who currently enjoy a strong market position in Japan. EU processed-food exports are expected to grow by as much as 180%.

The biggest impact will be in manufacturing industries dear to Mr. Trump’s heart. In addition to removing tariffs, the deal will harmonize standards and remove nontariff barriers. As the U.S. raises duties on imported raw materials and components, its attractiveness as a manufacturing base will fall and supply chains will cut out American suppliers.

If China wants to retaliate away from tariffs, Hollywood is a blockbuster target…

China’s box office is a $8 billion business growing 20% per year.

(Bloomberg)

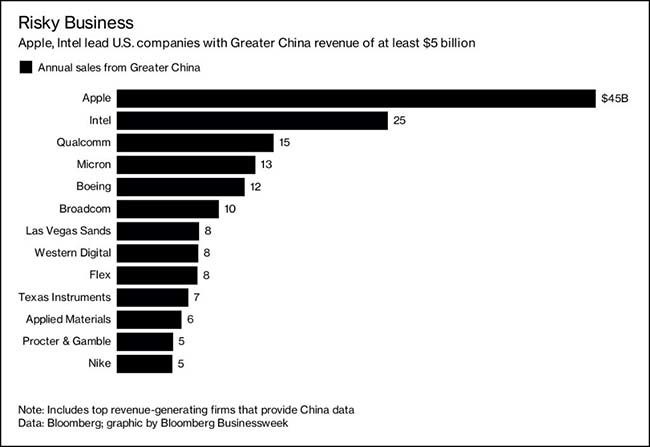

Some other big U.S. corporate targets if China wants to expand their scope of trade pain…

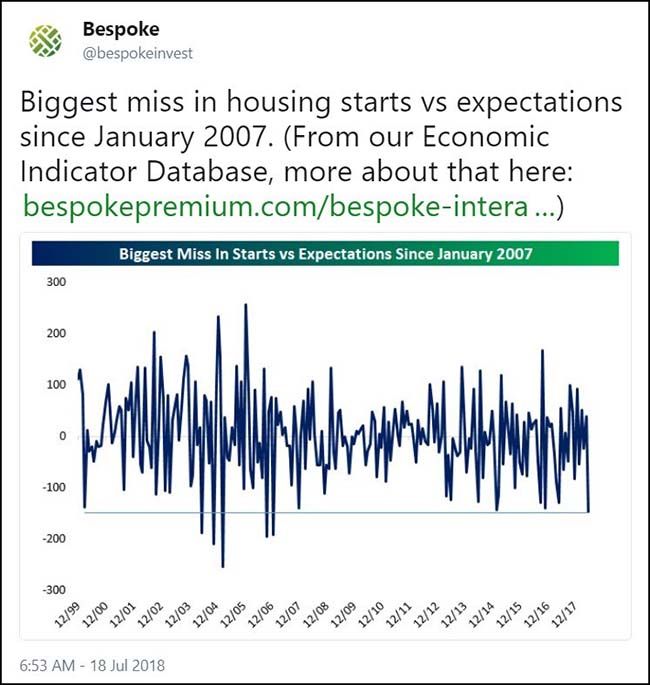

Looking at U.S. economic data, housing starts came up short last week…

Howard Marks has strong thoughts about FANG stocks…

“Yes. They are great companies, but ETFs may have accentuated the flow of capital into those stocks,” he said at the Delivering Alpha Conference in New York on Wednesday. “Things that are most hyped … produce the most pain.”

The investor is also concerned the rise of ETF investing is making FANG stock investing more risky as many of these funds are using the same “momentum” factor.

“A conspicuous number of ETFs are concentrated in the same stocks,” he said. “When things go cold … who is going to buy it?”

Marks later explained in an interview with Scott Wapner on “Closing Bell” that while it looks like these ETFs are “perpetual motion machines,” there really is really no such thing.

“If and when it ends, it will end worse for the stocks that have had momentum and for the ETFs that hold them than for the rest,” he said.

Speaking of FANG stocks…

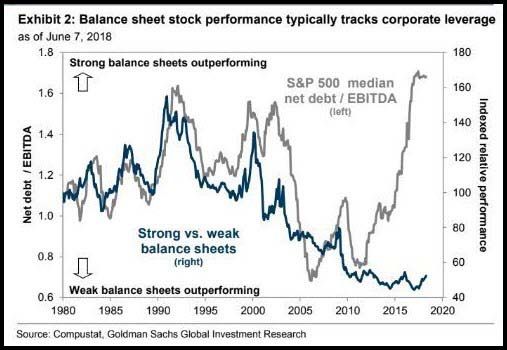

Strong balance sheet stocks look a little left behind…

Cool chart alert…

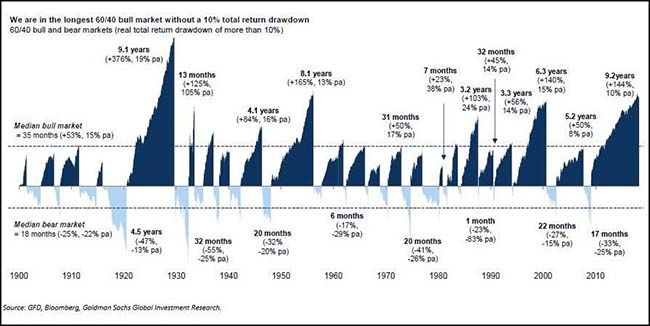

For a 60/40 blended stock/bond portfolio, this has been the longest duration bull market ever…

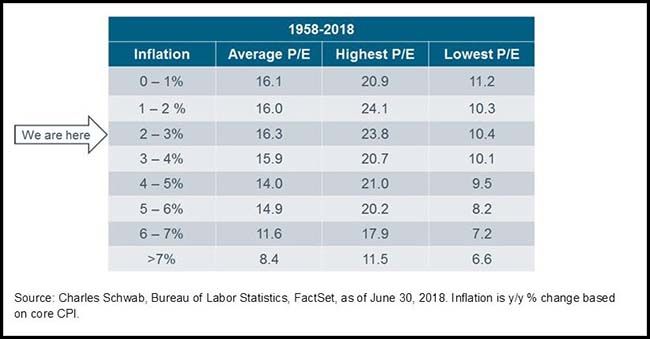

U.S. stocks don’t look too expensive now…

But if those Q2 earnings calls and releases are correct and inflation continues to run, we are going to have multiple compression.

Don’t worry about the NFL. New data shows they are growing well above U.S. GDP…

We know this because the Green Bay Packers released their annual report this week. Because the Packers are the league’s lone community-owned team they are required to open their books. It is the best window the public gets into the NFL’s actual financial health.

And the Packers financial records suggest the NFL is doing well. According to the report, the amount of money the NFL distributed to teams grew from $7.8bn in 2016 to $8.1bn in 2017, meaning the league added to its estimated $14bn in overall revenue. This was a 5% increase and far from the great economic rot referenced by Trump. The report pointed to a $50m streaming deal with Amazon as a sign of the NFL’s continued financial boom. In fact, the Amazon deal has been expanded two more years for a total of $130m…

“NFL owners are minting money thanks to hefty TV contracts and a favorable labor deal with the players,” Forbes gushed in its report, noting that the $3.2bn in income the league took in last year “is $500m more than the combined earnings” of all NBA, NHL and MLB clubs.

The average MBA cost may have just peaked…

They came for the low cost and stayed for the experience — and the low cost. On Sunday (May 13), the first 76 graduates of the University Illinois’ Gies College of Business iMBA will receive their degrees in a convocation ceremony at the school’s Champaign campus, the culmination of two years’ hard work that came with a tuition bill that was by far the lowest of any major university’s online MBA: $22,000.

The Illinois iMBA program launched in January 2016 as a partnership with the online education platform Coursera. Styled as a “reimagining of the online MBA,” the program aims to “deliver quality affordable education at scale,” says Dean Jeffrey Brown, and encourages students to try for free single “stackable” classes that interest them rather than a linear slate of coursework, then pursue a degree if they decide they like the format and quality. It’s a model that the school says has been rated excellent or good by 98% of student participants; it certainly helps keep satisfaction levels high that classes in the iMBA are taught by the same faculty that teach Illinois’ on-campus MBA, a program ranked in the top 50 by U.S. News & World Report and nearly that by Poets&Quants. Enrollment, meanwhile, has climbed quickly and steadily, and now stands at about 1,100 students, with hundreds more to join in the fall.

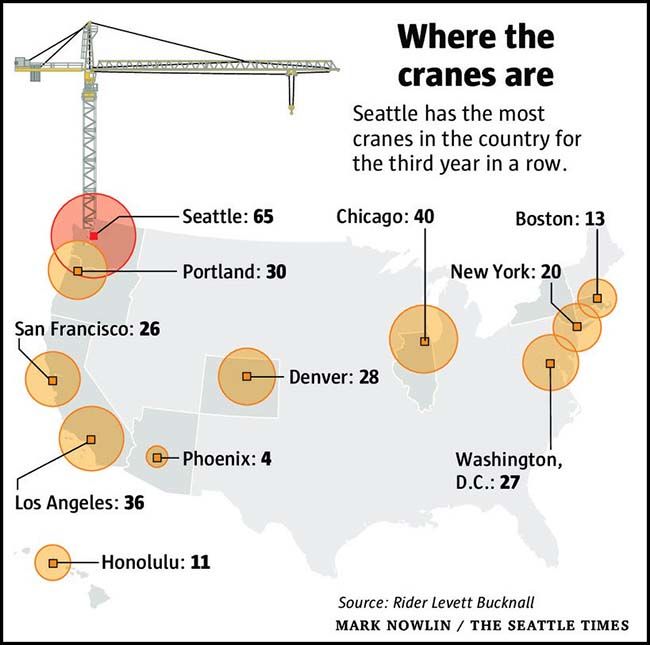

Cranes are still a growth business…

What are all of Seattle’s cranes building? Mostly apartments, as has been the case for years. That has finally helped cool down what had been a scorching rental market.

Of the projects using cranes, 27 are mixed-use (typically residential with some retail space on the ground floor), 17 are solely residential and 11 are commercial developments like offices.

Globally, Seattle still pales in comparison to the type of construction going on in other parts of the world. Dubai has an unbelievable 1,182 cranes while Sydney has 346. In North America, Toronto leads with 97 cranes.

(Seattle Times)

And yes, it has never been this hot in Denver…

100 degree days were rarity when I was a kid. Now they seem frequent. I have no idea how Texans go outside in the summer.

Traditionally, July 20 is the hottest day of the year in Denver, with five 100-degree days in the city’s history. In the foreseeable future, Coloradans can expect to see incremental temperature increases that can contribute to seasonal changes, including shorter winters, earlier springs and more severe weather, Rydell said. Already this year, eight daily high-temperature records have fallen or been tied, according to NWS data.(The Denver Post)

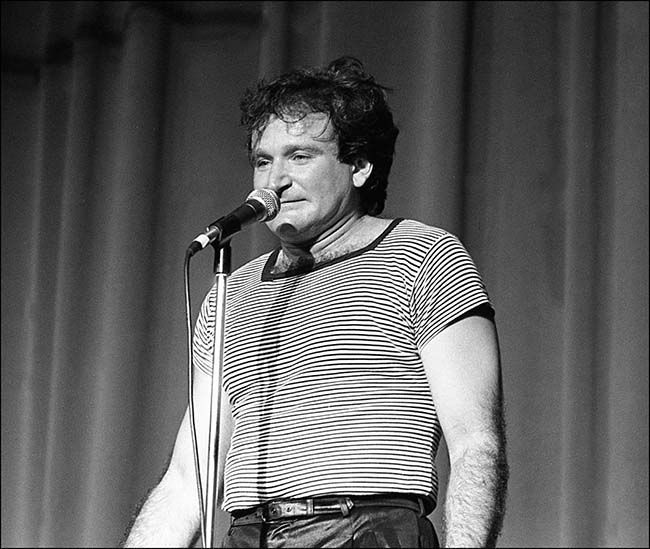

Finally, the HBO documentary on Robin Williams is ‘Extraordinary’…

I have never seen those outtakes from Mork & Mindy and Sesame Street. What an insight to his genius.

Despite its title, “Robin Williams: Come Inside My Mind” is a straightforward, conventionally assembled documentary biography of an eccentric, decidedly idiosyncratic comedian and actor. At times that’s a limitation, but overall it’s a good thing. Simply watching Williams in action is probably more interesting than any concerted effort to get inside his head or dissect or approximate his method.

And the nearly two-hour “Come Inside My Mind,” directed by Marina Zenovich and premiering Monday night on HBO, delivers the archival goods: copious clips from Williams’s stand-up performances, movies, interviews, his 1988 turn in “Waiting for Godot” at Lincoln Center and the seminal “Mork and Mindy,” debuting on television in 1978. There are ups and downs, particularly among the feature films, but we get to see the irrepressible, unpredictable, inventive Williams on top of his game often enough that the documentary flies by.