by Richard Turnill, Global Chief Investment Strategist, Blackrock

Richard explains why investors in UK assets should expect a bumpy ride as UK-EU Brexit negotiations unfold.

The UK’s new Brexit white paper should allow negotiations over the terms of its future relationship with the European Union (EU) to move forward. Yet we could see UK-EU relations deteriorating before improving. Investors in UK assets should expect a bumpy ride.

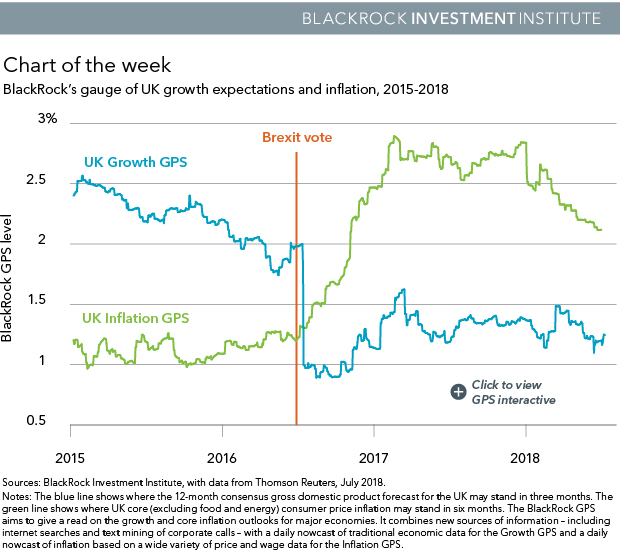

Our BlackRock Growth GPS for the UK shows growth expectations have only modestly recovered from the heavy blow the Brexit vote dealt to the UK economy. See the blue line above. Meanwhile, our UK Inflation GPS (green line) shows inflation ticking lower but remaining much higher than before the Brexit vote, mostly due to a weaker British pound pushing up import prices. UK growth has been significantly lagging the rest of the G7, but may have recovered enough to allow the Bank of England to raise rates in August, we believe. Subdued growth combined with elevated inflation is typically a challenging backdrop for risk assets. UK stocks have been resilient recently, aided by domestic stocks’ global orientation and an M&A uptick. Yet political uncertainty looks set to stay elevated in the second half.

Our Brexit base case

The UK’s Brexit proposal would see the country effectively retaining full access to the EU single market for goods but losing access for services. It is closer to a “soft Brexit” than many had anticipated, angering some in the pro-Brexit camp. The proposal reflects the UK government’s gradual realization that any alternative would be highly disruptive for the manufacturing sector and would leave issues surrounding its land border with EU member Ireland unresolved. The UK has shifted its stance on previously non-negotiable issues, such as accepting alignment with European regulations and judicial rulings. This allows talks to move forward for now. Yet there’s a major unresolved problem: The EU has stated that “cherry-picking” EU-membership principles to abide by would be unacceptable.

We see Brexit noise getting louder as the March 2019 date for the UK’s exit nears. The EU will need to decide if it’s willing to accept a tailored agreement. The alternative is forcing the UK to choose between a limited free-trade deal or full adherence to the EU’s four freedoms, including free movement of people, at the risk of a negotiation breakdown. Our base case: Pressure to avoid a no-deal outcome leads to a compromise later this year. We expect an extended transition period starting in March 2019, with key future-relationship decisions kicked down the road. We see nearer-term wildcards too, such as a possible leadership contest in the UK’s ruling Conservative Party.

Key to weathering the Brexit noise

Greater resiliency in portfolios is key amid Brexit volatility and other risks (see our midyear outlook). We are underweight UK equities, and favor overseas earners that can benefit from faster-growing economies and currency weakness. We would avoid UK banks, which tend to be sensitive to Brexit news. We prefer U.S. and emerging market (EM) equities on higher earnings growth. We do not expect UK government bond yields to rise materially amid political uncertainty. We see UK real estate fundamentals staying strong, but focus on the highest-quality assets. We expect the pound to be volatile, with potential downward pressure until a Brexit resolution nears.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog

Copyright © Blackrock