It’s been another volatile and unpredictable week for world markets. It had appeared that stock markets were on a seasonal upswing heading into earnings season but stocks have since suffered a setback after President Trump threatened to impose a 10% tariff on another $200 billion of Chinese imports.

Commodities have also been impacted even more severely by the ongoing trade war uncertainty. Copper, which is particularly sensitive to the Chinese economy, has been smashed from near $2.90/lb toward $2.70 over the last week. Crude oil, meanwhile, has levelled off in the $70-75 per barrel area for WTI. While trade uncertainty appears to have capped the upside for WTI, and sparked a nearly 6.0% one-day decline, another round of big weekly drawdowns, 6.7 mmbbls for API and 12.6 mmbbls for DOE, may provide downside price support.

The impact of trade related news and speculation on the markets comes and goes from day to day but recent comments from the Bank of Canada has provided the best perspective. Despite expressing general concern about the risks of a trade war to the Canadian economy, the Bank of Canada proceeded with a 0.25% interest rate increase anyway. In the statement, Governor Poloz noted that while some sectors may need to adjust to new tariffs, the overall impact on the economy is likely to be moderate and that Canada can still benefit from the spillover effects of a strong US economy.

Moving forward, there is a lot of corporate earnings news on the way that may put trade back in its proper perspective and give investors other things to think about. US Earnings season starts on Friday with reports from Citigroup, Wells Fargo and JP Morgan and really ramps up next week with more big caps companies reporting including Netflix and Bank of America on Monday. Canadian earnings season also begins next week starting with the railroads. When reports are released, investors may look as much at forward guidance and any comments related to exposure to trade wars or interest rates as at the actual results, so in many cases it may require more than a quick peek at the headline number to determine the market reaction.

In recent weeks, there has been a flow of capital away from markets at risk to disruption from a trade war including Chinese stocks, commodities and the shares of big multinational corporations headquartered in the US and elsewhere. Capital has been moving into sectors that are more focused on the US domestic economy and smaller cap companies. In this issue of Equity Leaders weekly, we highlight this shift in sentiment with comments on China-sensitive Copper and US health care stocks.

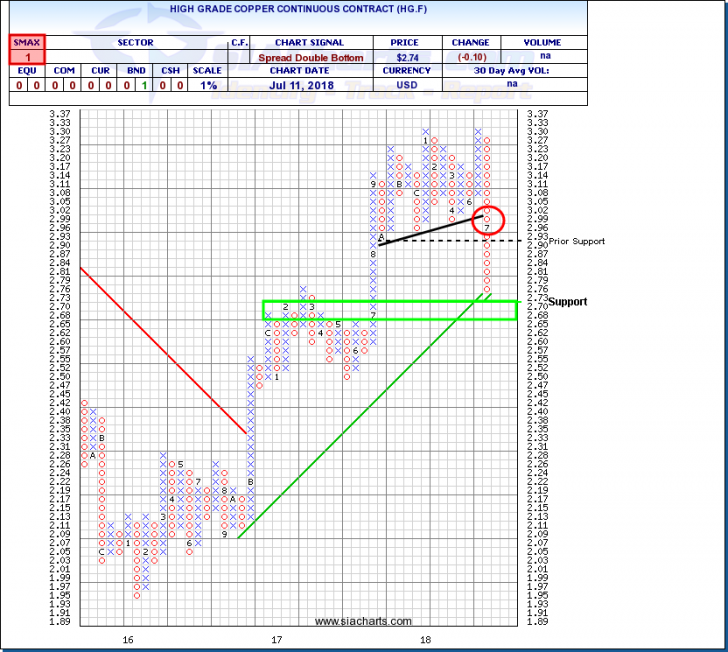

Copper Continuous Contract (HG.F)

Because it has so many applications and is used by a wide variety of industries, Copper is widely considered to be the commodity most sensitive to the world economy, earning the nickname “Dr. Copper” for its role as a barometer of economic conditions. In recent years, Copper has been particularly sensitive to changes in sentiment toward the Chinese economy with China having become a significant component of copper demand in its growth phase.

Copper had been struggling in recent months, but in the last week, it has gone into free fall. The breaks of round number and uptrend support near $3.00/lb was like a dam bursting, triggering a wave of selling that quickly pushed the price off a cliff, down through prior support near $2.90/lb and on toward $2.70/lb even as stock markets in the US and China stabilized. With a bearish SMAX score of 1, Copper is exhibiting weakness across the asset classes. Copper is approaching a potential support zone in the $2.65-$2.70/lb area which contains a number of previous column highs near the top of a previous congestion zone.

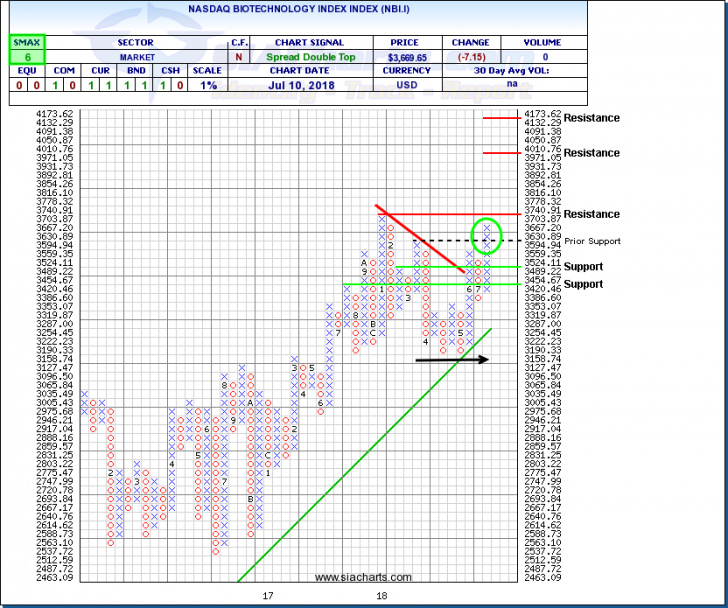

Nasdaq Biotechnology Index (NBI.I)

With trade war concerns flaring up in recent weeks, investors have been seeking sectors of the market that may be less exposed to tariffs and other trade actions. One of these areas which has attracted significant new attention is Health Care. Health Care services are delivered locally and the parts of Health Care which are more global like pharmaceuticals and biotechnology are based around specific treatments for specific applications. So far, the Trump trade wars have centred around commodity products like steel, forest products and manufactured goods like automobiles, while specialty products like biotech and pharmaceuticals have remained untouched to date.

After advancing through most of 2017, the NASDAQ Biotechnology Index started 2018 in correction mode. In recent weeks, the index has caught fire once again, rallying up from near 3,190 up toward 3,660. During this advance, the Index has broken out of a downtrend and cleared 3,630 which completed a bullish Spread Double Top and confirmed that the underlying uptrend has resumed.

The index next faces resistance at its previous high near 3,740, followed by the 4,000 level and then 4,175 based on a horizontal count from the recently completed pattern. Initial support moves up toward 3,490.