by Peter Chiappinelli, Multi-Asset, Asset Allocation Team, GMO

Executive Summary

Not too long ago, investors, consultants, and advisors in the asset management field struggled with the role of Multi-Asset Class (MAC) strategies. They were perceived as misfits, given their cross-asset mandate and their dynamic nature. Today, however, they are utilized and embraced in all sorts of different settings. Given our large footprint and multiple decades of managing MAC strategies, we looked at our client base and determined that there are five (six, if you count their use in Target Date Funds as a distinct usage) “buckets” that represent the ways in which investors appear to be using them: 1) Liquid Alternatives; 2) Core; 3) “Swing” Manager (in both a traditional policy benchmark setting, or as part of a Target Date setting); 4) Liability Driven Investing + Diversified Growth; and 5) a Real Return Strategy. This paper helps explain the driving rationale for each.

Introduction

Once perceived as misfits for investors, Multi-Asset Class strategies are now used for all sorts of portfolio solutions. Not too long ago, investors, consultants, and advisors in the asset management field struggled with the role of Multi-Asset Class (MAC) strategies, because these products, at first blush, appeared nonsensical. They were misfits. Professionals who had been trained to think in terms of well-defined style boxes, tracking error metrics, benchmark-centric frameworks, and formal re-balancing disciplines were often flummoxed by products that not only had multiple and varied risk exposures, but whose risk exposures could vary through time. MAC strategies triggered a barrage of pointed questions:

• “Where do they fit?”

• “How do I know what you’ll own next quarter? You’re constantly changing your stripes.”

• “How do I measure you? How do I know if you’re any good?”

• “How can I model you in a Mean Variance Optimization exercise?”

• “Where do I source capital to fund this thing? Is it more like equities? Fixed income? Cash-plus? Alternatives? What is it, exactly?”

That was then, this is now. Today, MAC strategies are well-established in both the psyche and practice of investment management. Ironically, the industry now has a different problem: MAC strategies are employed in such a wide variety of situations that anybody getting up to speed on them might be paralyzed as to how to actually begin to think about them.

We thought we could lend some perspective. While we are not the only asset management firm in MAC space, we have been at it longer than most. Our first strategy launched in 1988, giving us three decades’ experience of witnessing the different ways clients and their advisors and consultants have implemented these strategies. GMO’s Asset Allocation team manages a variety of MAC strategies with varying objectives and constraints; combined, we have over 450 MAC clients worldwide.

How do I use thee? Let me count the ways.

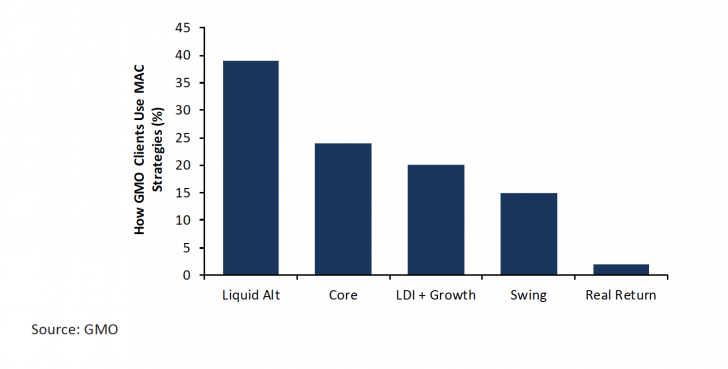

So, how many ways do our clients use MAC strategies? In total, we have identified five (or six, if you count Target Date Funds separately) distinct categories. Think of these as the five “buckets” or pie slices that clients and consultants often use to define their asset allocation or risk allocation frameworks. We don’t expect that the labels and descriptors we use in this paper are exactly in sync with the actual labels others use, but we trust you will be able to translate any subtle differences. We also acknowledge that there may be some overlap between categories. For example, the Global Tactical Asset Allocation (GTAA) bucket will seem similar to the “Swing” bucket, but there are nuanced and important differences (e.g., vehicle, liquidity, long bias).

The bulk of this paper presents and defines these five categories of MAC strategy uses. To conclude, we provide a breakdown of our current global MAC clients, showing the percentage of clients using each of the five buckets we’ve identified.

Bucket 1 – Liquid Alternatives: Hedge Funds/Absolute Return/GTAA

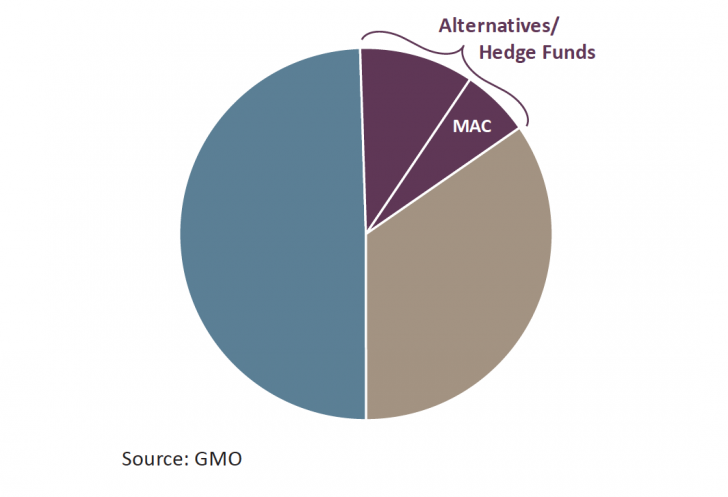

The most common use of MAC strategies across our client base is as part of a dedicated Alternatives program, which can go by many different names or labels, as shown in the diagram below.

• Often, we are part of a GTAA sub-allocation and paired with other managers. GMO’s particular valuation-oriented bias may be complemented with a momentum or sentiment-oriented manager, for example.

• Anecdotally, we have heard that clients and consultants use MAC strategies to get dynamic access to hedge-fund-like strategies or alternative risk premia without having to commit to a dedicated or fixed allocation. We are sympathetic to this motivation and have long written about the dangers of too rigid an approach to any “strategic” allocation to any asset class, traditional or alternative. Risk premia can vary over time, and therefore exposures should be managed dynamically.

• While not a requirement of this bucket, an appeal of many of these strategies is that they can offer daily liquidity. Other than the obvious comfort of having daily access to funds, this feature is useful in the context of managing a liquidity-constrained hedge fund allocation, in terms of rebalancing.

• These mandates are typically funded from an established Alternatives program, and MAC strategies sit next to the usual suspects of Alternatives (e.g., hedge funds, private equity).

• Even within the hedge fund category, our strategies tend to be differentiated, as they have a long bias vs. the many more typical long/short or market-neutral strategies. Our particular approach is also appreciated for its defensive characteristics.

• We offer a variety of MAC strategies, but our benchmark-free strategies are more typically used in this capacity. Their unconstrained nature and absolute return objectives and orientation can make them effective diversifiers to more traditional asset class exposures.

• Globally, roughly 40% of our MAC clients put us in this bucket. In reality, however, this is primarily a US phenomenon, where, for example, nearly two-thirds of our clients with assets greater than $25 million use MAC strategies in this manner.

Bucket 2 – Core Holding

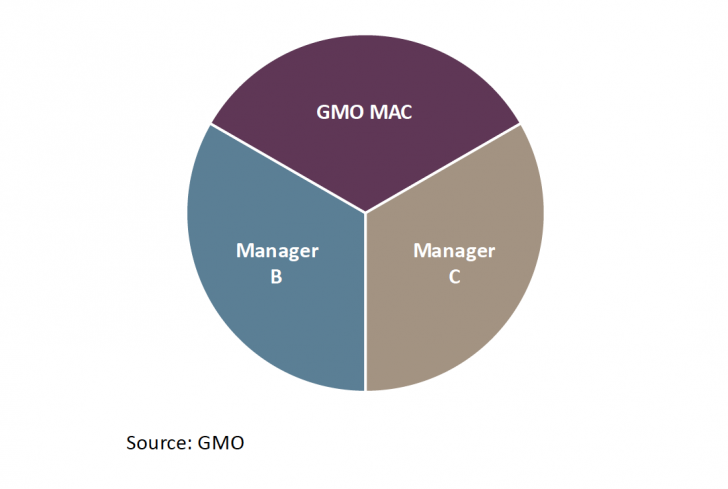

For a smaller but notable number of clients, our MAC strategies are seen as something akin to an “Outsourced CIO” whereby we manage a significant portion of the overall portfolio (perhaps split with one or two other MAC managers, as illustrated in the diagram below). We deliberately put this phrase in quotation marks because we are not officially a named CIO, but our strategies capture the spirit of the exercise.

• This “Core” approach fits because the objectives of the strategy align with the core mission or objective of the client’s entire asset pool (e.g., generate 5% real returns within a 5% to 10% volatility band, or outperform a strategic benchmark by 1% to 2% annualized, with a specific tracking error budget). For Core, clients seem willing to use either our benchmark-free or our benchmark-sensitive strategies, as both fit well as “complete” solutions; in choosing between the two, it often comes down to a client’s tracking error tolerance or preference (i.e., the measure of freedom given to managers).

• Here, too, one of the appeals of MAC portfolios is the dynamic access to hedge-fund-like strategies or alternative risk premia without having to commit to a dedicated program, which smaller plans are often hesitant to do for lack of scale or staffing.

• As before, our particular valuation-based approach and often defensive posturing suits Core mandates well given that in this particular setting we would be managing a large proportion of a client’s asset base.

• It would be fair to claim that using MAC strategies as Core is primarily (although not exclusively) a small-plan phenomenon. Of the small plans (i.e., less than $25 million) we surveyed, almost 40% identified Core as the main role, but for larger US investors and for non-US clients, this behavior is not nearly as common. (Note: This survey data is looking strictly at institutional, not retail usage. However, there is ample evidence that MAC strategies are often used as Core holdings by retail investors and/or their advisors in the US, UK, continental Europe, and Australia.)

Bucket 3 - Swing/Opportunistic

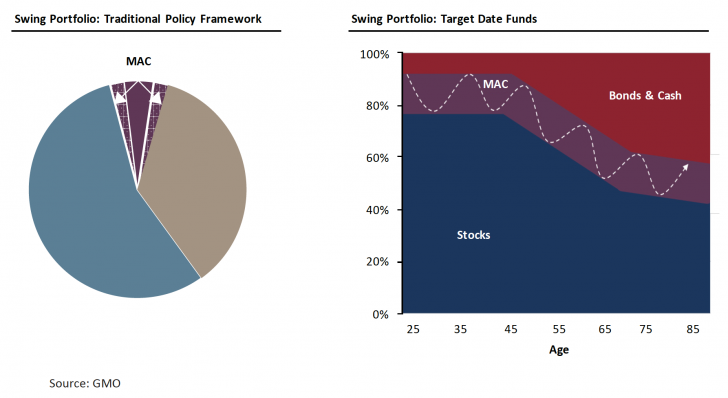

Investment committees with a static or strategic benchmark (e.g., 60% stocks/40% bonds) employ our portfolios as a way to make indirect dynamic asset allocation “swings” that they are either uncomfortable making or unwilling to make directly, at least in a timely manner. Even if committees are willing to make shifts, they are often hesitant to do so in a meaningful way, raising the question, “Why bother?”

• Swing managers (sometimes referred to as Satellite or Opportunistic managers) are free, typically, to move into equities, bonds, cash, or alternatives as well as other out-of-benchmark asset classes. This fluidity and ability to move relatively quickly is highly valued given that mispricings and frenzied panics of the market are difficult to exploit by the more deliberative and slower-moving nature of investment committees.

• MAC strategies are of growing use in the Defined Contribution world, as investors are waking up to the absurdity of static or pre-determined glide paths of Target Date Funds (TDFs). Examples of this monolithic, often harmful approach, abound, with one of the most damaging occurring in 2008, when TDFs made no adjustments to outrageously overpriced global equities (P/E ratios in the US hit the second highest ever recorded in American history).

Today, these funds appear to be making the same mistake with bonds. A little over a year ago, the auto-pilot nature of most glide paths was actually to buy more bonds – often benchmarked to the Barclays U.S. Aggregate Index – as bond yields hit their lowest levels in 140 years! The Barclays Agg was actually extending duration, when any prudent investor would have been shortening it. In many parts of Europe and Asia, bond yields were hitting 500-year lows, and many TDFs were actually rotating into these bonds, not away. Honestly, you cannot make this stuff up! The Swing strategy, especially a valuation-based one like GMO’s, can tilt the asset allocation away from dangerously-priced asset classes and toward more attractively-priced ones. Our tendency to “protect on the downside” is really the primary motivation for integrating our MAC strategies into a glide path.

• There is a tendency to have a long bias to these types of strategies. This bucket is typically funded from both stocks and bonds, but there is an openness, if not an expectation, to having these Swing managers become defensive, raise cash, and even allocate to alternatives. There is also an expectation that these strategies can move relatively quickly and, for DC schemes, there is a need to operate in a daily pricing environment, so daily liquidity is more relevant.

• Between 15% and 20% of our US MAC clients (depending upon size) drop us into the Swing bucket.

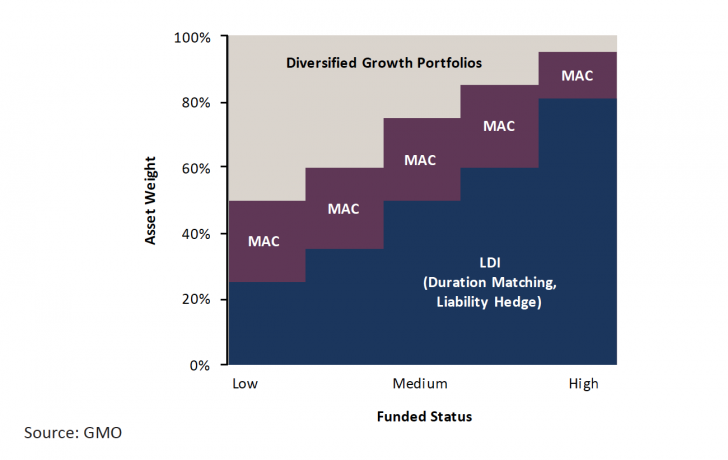

Bucket 4 - LDI + Diversified Growth Fund Framework: Equity Substitute

The typical LDI + Diversified Growth Fund structure is thus: a liability-hedging portfolio of assets (most often, a portfolio of long-duration bonds that match long-duration liabilities, therefore dampening funded status volatility) is combined with a risk-seeking growth portfolio, where MAC strategies typically reside. Often, as illustrated in the diagram below, an LDI framework follows a de-risking glide path (quite distinct from a Target Date glide path) where the pension is increasing the hedge (the portion of the pension that is duration-matched) as the funded status improves.

• Using MAC strategies in LDI frameworks is a growing phenomenon in the US, and a well-established one outside of the US. Our largest MAC strategy, Benchmark-Free Allocation is certainly used in the US for LDI purposes, but is much more prevalent in the UK and continental Europe. Almost two-thirds of our non-US clients are using the strategy in this manner, and we think this is completely reasonable given a return target of 5% real and a “soft” volatility range of 5% to 10%, dramatically lower than an all-equity portfolio.

• Clients often have “equity-like” return expectations for MAC portfolios, but they tend to expect more efficiency (i.e., lower commensurate volatility).

• This strategy is typically funded from traditional long, pure equity beta categories.

Bucket 5 - Real Return/Inflation Hedging

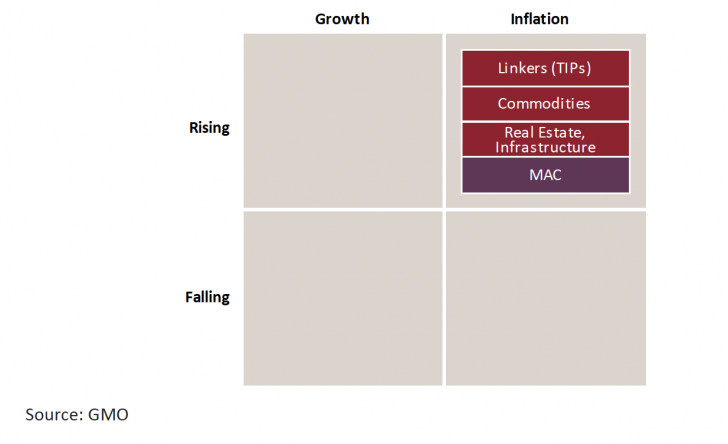

Finally, we do have clients who fit MAC strategies into Real Return buckets, also sometimes called “Inflation Hedging” buckets. Real Return buckets are often used by institutional pools that are organized around macro-economic risks, or risk allocation frameworks, such as inflation or depression risks.

• Most other products in the general category of Real Return tend to have exposures to the usual suspects of REITs, TIPS, and commodities as a strategic holding, partly because these asset classes are perceived by the market as traditional inflation hedges.

• While it is true that many of our strategies have “inflation-plus” return targets, they are not managed as inflation hedges and are not obligated in any way to own any of the usual suspects noted above. Frankly, we believe that traditional equities are real assets, as well; so, historically, we’ve had a bias toward equities. (I know that will sound odd to many of our clients out there, given our current and often bearish view on stock valuations!) Having said that, if we found ourselves in a situation where we had the same expected returns from nominal bonds and inflation-indexed bonds, we would likely have a slight bias toward indexed bonds due to their likely better response to unanticipated inflation.

• Only a very small proportion of our MAC client base uses us in this manner, but it is worth noting nonetheless.

Conclusion

The chart below provides a visual summary of how these MAC strategies are used by our clients. How do they use thee? Let us count the ways. Not only is there not a single answer, but the ways in which MAC portfolios are used continues to morph and adapt. It is both intriguing and gratifying to see how products and strategies that, 30 years ago, were once the problematic “misfits” of the industry are now considered integral, mainstream, and, dare we say it, problem solvers.

End Note: Many consultants and clients use different descriptive labels or even have different buckets entirely. We are happy to provide information that will direct you to further reading on this topic.

1 See “I Want To Break Free, or, Strategic Asset Allocation Is Not Static Allocation,” James Montier, May 25, 2010. This white paper is available at www.gmo.com.

2 “The Retirement Challenge and GMO’s Perspective,” Peter Chiappinelli and Jim Sia, Spring 2015. Contact your GMO representative for a copy of this presentation.

3 “Beware The Wu Wei of Passive Bond Investing,” Peter Chiappinelli, March 2017. This paper is available at www.gmo.com.

Peter Chiappinelli: Mr. Chiappinelli is a member of GMO’s Asset Allocation team. Prior to joining GMO in 2010, he was an institutional

portfolio manager on the asset allocation team at Pyramis Global Advisors, a subsidiary of Fidelity Investments. Previously, he was the

director of institutional investment strategy and research at Putnam Investments. Mr. Chiappinelli earned his MBA from The Wharton

School at the University of Pennsylvania and his B.A. from Carleton College. He is a CAIA charterholder, and was the founding President

of the CAIA Boston chapter. He is a CFA charterholder.

Copyright © GMO