by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

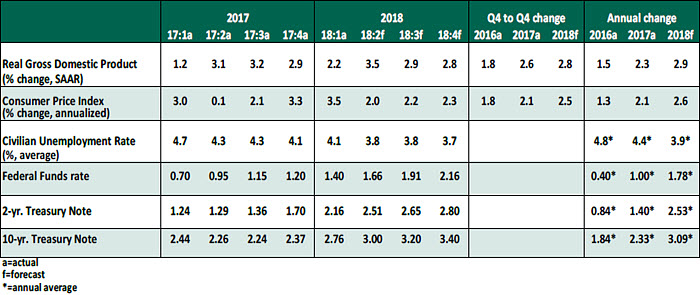

Strong growth and employment reports affirm Northern Trust’s positive outlook for U.S. economic performance in the rest of 2018.

Amid a busy month for economic news, a significant policy event occurred: the Section 232 tariffs on imported steel and aluminum went into effect on June 1, 2018. A tariff action of this size has not been seen since the Great Depression. It is likely to be followed by tariff actions specifically targeting China. We have entered a new era in foreign trade.

Tariffs are economically significant, as they can impact both output and inflation. The United States is a net importer, and our economy cannot easily realign to replace all imports with domestic production. Tariffs increase the costs of raw materials and finished goods, and they will eventually flow through to the various price indexes.

The steps taken this week are moderate in scale. However, with each trade action, the prospect of unintended consequences increases. We have not yet taken the step of raising our forecast for inflation, but trade frictions place the risks to the upside.

Key Economic Indicators

Influences on the Forecast

-

- Gross domestic product (GDP) for the first quarter was revised slightly downward to 2.2% growth (from a 2.3% initial estimate) after adjusting for inflation. Despite the negative revision, this remains a stronger growth rate than had been anticipated. The revision confirmed strong growth in business investment, which was revised upward to a 9.2% annual pace.

-

- Consumer spending grew 4.9% year-over-year in April, exceeding expectations. Nominal personal income grew by a robust 3.8%. We believe the second quarter will be the strongest one for GDP growth this year, led by consumer spending. “Nowcasts” of annualized second quarter growth are very strong; the one produced by the Federal Reserve Bank of Atlanta is well over 4%.

-

- The May employment report revealed a headline unemployment rate of 3.8%, matching a low rate last seen in 2000 (and before that, 1970). Hourly wages grew by 2.7% year-over-year, an indication that wage pressures are beginning to emerge. Labor force participation is running above its age-adjusted trend, suggesting a further depletion of slack in the labor market.

-

- Inflation readings remain normal. At its last meeting, the Federal Open Market Committee (FOMC) set market expectations that core personal consumption expenditure (PCE) inflation would “symmetrically” exceed its 2% target. As of April, core PCE gains over the last twelve months remained at 1.8%. Stronger spending by government and consumers will stress productive capacity and will likely give inflation a boost beyond the 2% target in the quarters ahead. And as mentioned earlier, any escalation of trade restrictions will not help.

-

- The yield on 10-year U.S. treasuries appeared to settle at a rate of above 3% in May, a symbolic indicator of a market expectation of continued growth and inflation in the U.S. Rates then fell below this mark in a flight to quality during brief political tensions in Italy. The situation was resolved quickly, and yields are rising once more. This incident serves as an illustration of the sensitivity of the market to any potential shock.

-

- Oil prices appeared to reach a peak in May, with West Texas Intermediate crude oil reaching $72 per barrel before receding. The Organization of the Petroleum Exporting Countries (OPEC) and Russia indicated a willingness to increase production, which helped to calm market fears of the loss of Iranian oil output as its sanctions come back into force.

-

- At the next meeting of the FOMC on June 12-13, another 0.25% increase to the federal funds rate seems certain. In addition, we expect that strong employment readings and firm inflation will give the FOMC confidence to raise rates two further times this year.

northerntrust.com

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

Copyright © Northern Trust