by Blaine Rollins, CFA, 361 Capital

Market risk remains elevated up here as U.S. interest rate increases put further pressure on all other asset prices. While equity markets moved higher last week providing some calm in the world, Emerging Market currencies remained highly volatile. Rising oil prices and ongoing global trade talks continued to add uncertainty to those investors evaluating their EM weightings. If it was just one currency or country, then it would be easier to make a call. But when Argentina, Malaysia, Brazil, Turkey and Iran’s currencies and financial markets replicate yo-yo’s, then it is time for the less risky to watch and wait.

It was reported over the weekend that some horse trading was occurring between the U.S. and China over China’s telecom equipment player ZTE and U.S. farmers’ soybeans. If this continues, it could lead to reduced tensions for global trade. Equal progress on NAFTA and with Europe would also make the markets very happy. But in the meantime, the markets are highly skeptical as evidenced by the lack of buying interest in U.S. stocks. Sure, some indexes may have broken out last week from their recent downtrends, but it definitely lacked high conviction. But prices can go up as selling abates which is what happened last week. So let’s wait to see what the news flow and markets have in store for us this week.

To receive this weekly briefing directly to your inbox, subscribe now.

To receive this weekly briefing directly to your inbox, subscribe now.

Within the market, the Industrial sector appears even more troubled…

Where did all the buyers from last year disappear to? Still dreaming of all that money we made in Caterpillar last year.

Small caps definitely act better than large caps thanks to the strong U.S. Dollar…

Small caps definitely act better than large caps thanks to the strong U.S. Dollar…

But again, it would sure be nice to see some explosive volumes attached.

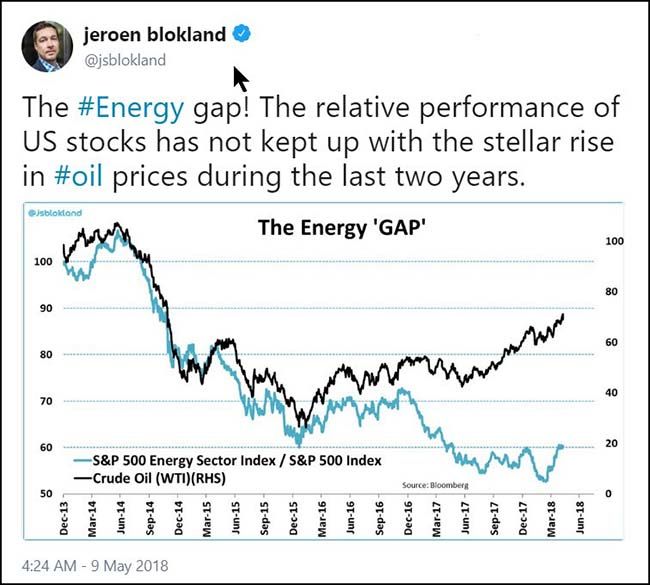

Energy stocks is where much of the upward buying pressure of the market is being expressed…

Energy stocks is where much of the upward buying pressure of the market is being expressed…

With this underperformance gap between Energy stocks and Crude Oil, will the group continue to be bought?

With this underperformance gap between Energy stocks and Crude Oil, will the group continue to be bought?

As the U.S. economy continues to move higher, the seat temperatures inside the Fed continue to rise…

As the U.S. economy continues to move higher, the seat temperatures inside the Fed continue to rise…

“In the US, the economy is moving beyond full employment and despite growth slowing down, growth is still roughly 1pp above our estimate of the long-term trend. Also, core PCE inflation reached 1.9%. In order to avoid too much of an inflation overshoot in the future, our economists think tighter financial conditions will be needed to stabilise unemployment by 2019. This is likely to put more pressure on both risky assets and bonds.”

(Goldman Sachs)

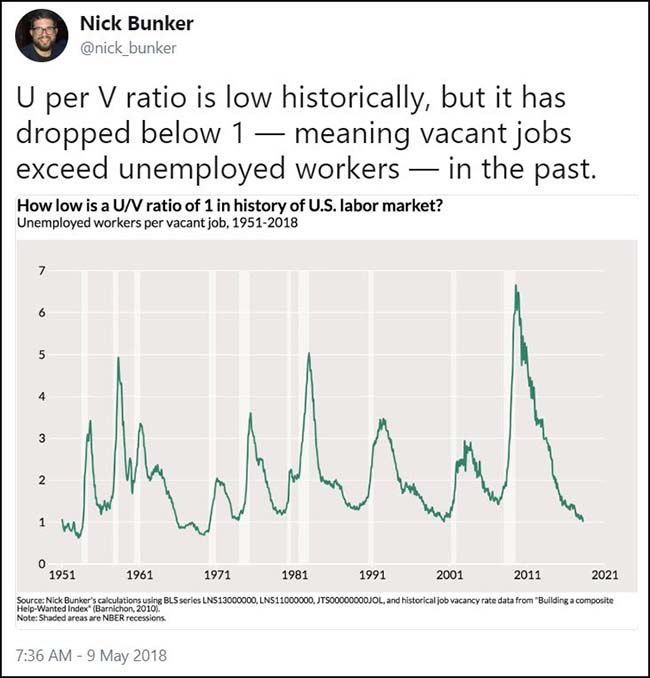

Jobs data now shows more vacant jobs than unemployed workers…

The CEO of J.P. Morgan thinks the growth could push the Fed to move beyond market expectations…

The CEO of J.P. Morgan thinks the growth could push the Fed to move beyond market expectations…

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said it’s possible U.S. growth and inflation prove fast enough to prompt the Federal Reserve to raise interest rates more than many anticipate, and it would be wise to prepare for benchmark yields to climb to 4 percent.

“It might force the 10-year up” if the Fed boosts short-term rates more than expected, Dimon said in an interview with Bloomberg Television’s Stephen Engle in Beijing, referring to the yield on 10-year Treasury notes. “You can easily deal with 4 percent bonds and I think people should be prepared for that.”

And Goldman Sachs sees this pressure reducing the average return to investors…

And Goldman Sachs sees this pressure reducing the average return to investors…

“The environment for investors is less pleasant than last year. Although growth is strong, corporate earnings have been on a tear, and both inflation and interest rates remain historically low, all of these tailwinds are abating at the margin. Perhaps more fundamentally, if financial conditions need to tighten to limit the overshoot of full employment, this is likely to mean a downward price adjustment for a weighted average of government bonds, corporate credit, and equities. Effectively, the overall size of the pie is set to shrink, and in that environment it will get harder to generate good risk-adjusted returns for all but the savviest investors.”

Meanwhile, the 10-yr vs. 30-yr yield is planking…

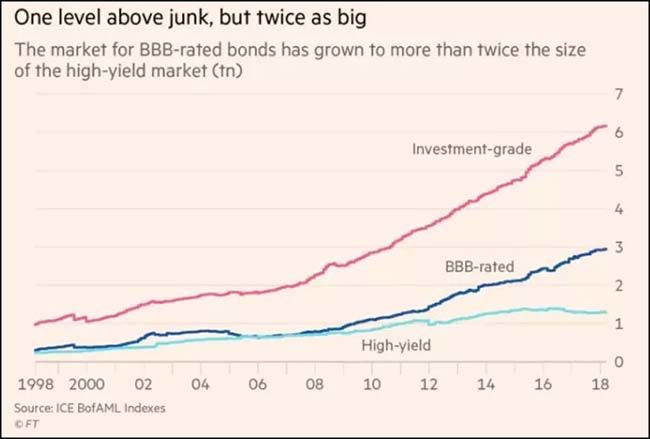

If the credit markets continue to take on more risk, then the Fed had better raise interest rates so they can do all they can to further build their toolbox to fight the next recession…

The average rating of the US investment-grade debt market has also deteriorated sharply in recent years, with triple B rated bonds — the lowest investment-grade rating — representing 42 per cent of overall issuance last year, the highest on record, according to Morgan Stanley.

In fact, the biggest investment-grade bond index today has more than $2.5tn of triple B rated bonds, up from about $700bn a decade ago and larger than the entire US high yield universe.

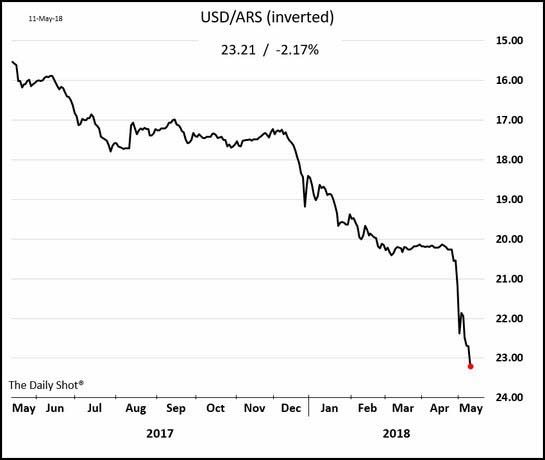

Will Argentina be the first Emerging Market to fall over?

Will Argentina be the first Emerging Market to fall over?

Perhaps inevitably, adverse developments have now arrived. U.S. interest rates have edged up, reducing the attractiveness of Argentine debt; President Trump’s trade policies threaten Argentina’s exports; and the dollar has appreciated, making it costlier to repay dollar debts. It’s harder for Argentina’s economy to grow, leading anxious investors to dump pesos.

What is to be feared is the possibility that what’s happening to Argentina could happen to other nations. For the past two years or so, international investors have poured money into “emerging market” countries, such as Argentina, Brazil, Mexico, India, China and Indonesia. In 2017, inflows to 25 of these countries totaled $1.2 trillion, according to the Institute of International Finance, a research and advocacy group for global financial institutions.

If these inflows slowed significantly — or stopped altogether — there would be negative consequences for the wider world economy. Countries might have to raise interest rates to defend their currencies against crippling depreciations. At some point, herd behavior might take over: Investors would buy or sell financial instruments (stocks, bonds, currencies and the like), mainly because they thought that others were going to buy or sell the same instruments.

The Argentinian Peso is not making anyone feel good right now…

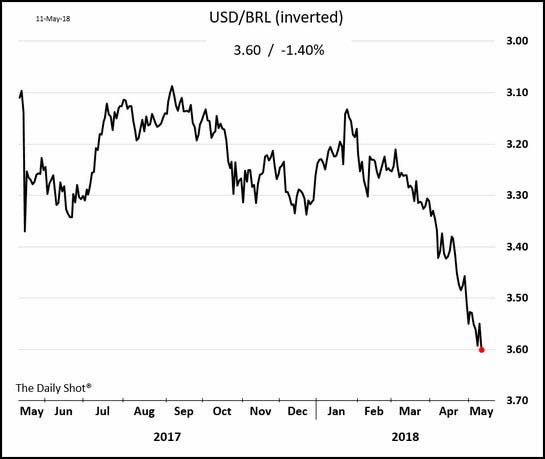

Unfortunately, the Brazilian Real is tracking its neighbor to the south…

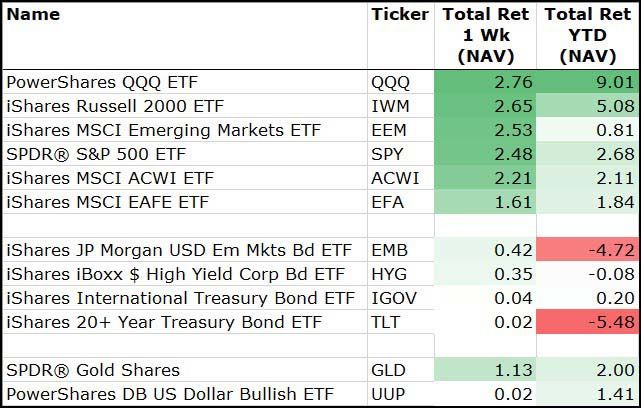

For last week, all assets bounced higher with U.S. equities leading the way…

For last week, all assets bounced higher with U.S. equities leading the way…

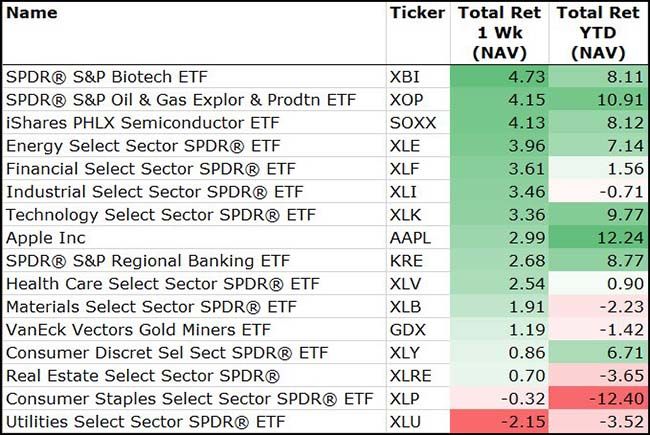

Biotechs, Energy and Semis all posted +4% weeks…

While defensive Utilities and Staples continued to generate losses.

NVIDIA’s quarterly earnings beats help to show why the stock has significantly outperformed over the last three years…

@bespokeinvest: This quarter, NVIDIA $NVDA reported an almost unprecedented 11th earnings triple play in a row dating back to Nov. ’15. Beat EPS, beat revs, raised guidance. These are the prior 10 from our Earnings Screener https://t.co/vFFMKBVnKu

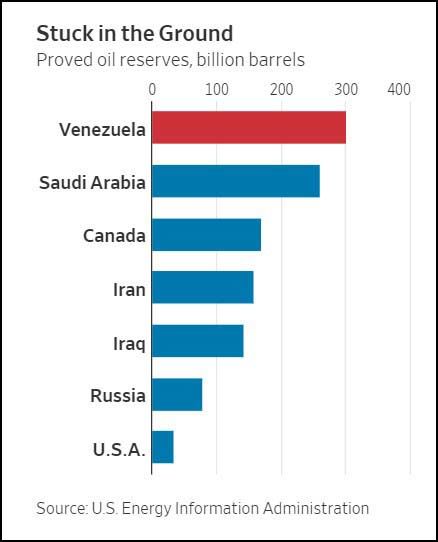

Something that you may not know…

Something that you may not know…

Venezuela has more reserves in the ground than Saudi Arabia. Someday, someone in their country will put together a better plan to get to it.

Barron’s is watching oil prices rise and raising their hand…

Four of the past five recessions—1973, 1980, 1990, and 2008—were preceded by a sharp increase in the price of oil. Since last summer, the Brent benchmark oil price has soared by about 50%, to nearly $78 per barrel.

More increases could be coming. Additional sanctions on Iran imposed by the Trump administration will limit that country’s ability to supply world markets, while the deteriorating situation in Venezuela could mean further cuts in its production.

The Saudi energy ministry has said it will help “mitigate the impact” of potential shortages, but this may not amount to much. After all, Saudi officials are reportedly targeting an oil price as high as $100 per barrel to support the valuation of Saudi Aramco before its initial public offering.

If the Saudis get their way, average U.S. gasoline prices could rise above $4 per gallon, or about 40% higher than today. Unlike past episodes, the potential doubling of the price of oil since last summer won’t likely dent the U.S. economy’s momentum. Instead, the impact would be felt in who spends what.

Households will have less free cash to spend, but businesses will offset their restraint with additional capital spending. States at the heart of the shale boom, especially New Mexico and Texas, will grow faster than the rest of the country. The difference is the shale revolution.

The Wall Street Journal is also noting the rising prices at the pumps…

Drivers gearing up for trips this summer face escalating prices at the gasoline pump, an early sign that $70-a-barrel oil is starting to reach into consumers’ wallets.

Average U.S. retail gasoline prices are climbing toward $3 a gallon, the most expensive in more than three years. The national average was around $2.86 at the end of last week. In states such as California and Washington, prices have already breached the $3 level after rising 24% and 17%, respectively, from a year ago.

Economic growth has boosted demand for oil. If that growth continues, most consumers should be able to afford to pay more to fill up their tanks. But conflicts in oil-producing regions could mean even higher gas prices, posing a threat to U.S. growth as the cost of fuel and gasoline weighs on drivers, airlines, delivery companies and other big consumers.

“Prices at the pump are quite high especially as we enter the driving season,” said Gregory Daco, chief U.S. economist at Oxford Economics. “That’s going to be one of the channels where you see a hit to people’s disposable income and spending.”

Rising fuel costs can also feed inflation and pressure interest rates. Even though the Federal Reserve typically looks past volatile energy prices in the short term, higher energy costs help shape consumer confidence. And with the central bank poised to be more active this year, rising energy costs pose an additional risk to the economy.

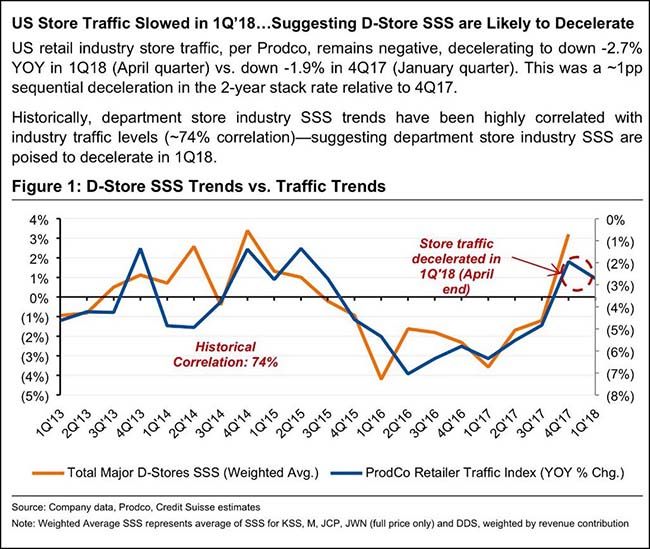

Related? Credit Suisse is now noting a slowdown in department store sales…

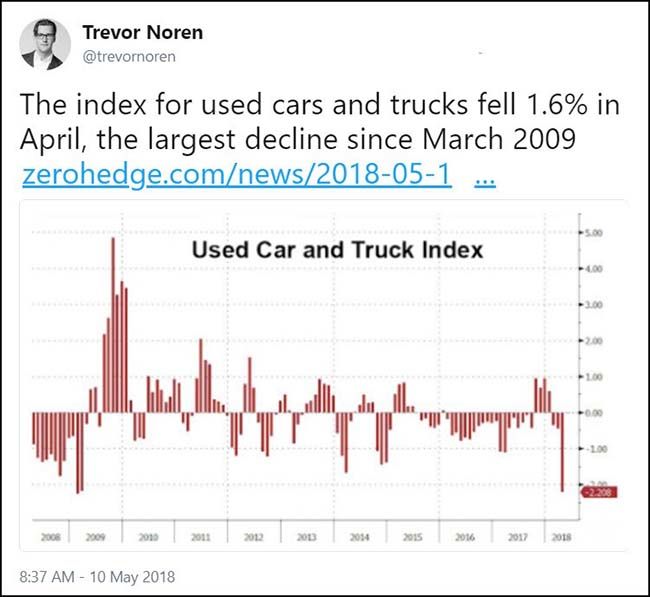

What gives here? Last week’s CPI showed a surprising drop in the prices for used cars and trucks.

Could new product introductions be the reason?

Could new product introductions be the reason?

Fiat Chrysler Automobiles NV and General Motors Co. have trimmer, high-tech trucks coming this year that will fetch top-dollar prices. For now, the automakers are dialing up discounts on outgoing models.

Average incentives on the Ram 1500 pickup reached an eye-popping $7,173 last month, up almost $900 over last year, according to dealer data compiled by J.D. Power and obtained by Bloomberg News. GM jacked up discounts on the Silverado 1500 by almost $2,200 to an average of $6,517.

Detroit has room to deal on its full-size trucks, which analysts estimate haul in more than $10,000 in profit per pickup sold. GM, Fiat Chrysler and Ford Motor Co. deliver more than 2 million of them a year in the U.S., generating annual revenue of more than $90 billion. The new Chevy and redesignedRam are lighter-weight and boast big touch screens and fuel-saving powertrains. The companies plan to price for that added content once they clear inventory of outgoing pickups from showrooms.

“We will see a lot of discounting as they move out the old models to make way for the new ones,” Michelle Krebs, senior analyst for researcher Autotrader, said in an interview. “These incentives could get even richer in the summer.”

Maybe one of the biggest labor shortages in the world right now: airline pilots…

Chinese airlines are buying foreign flying schools and poaching pilots, amplifying a talent shortage that has affected airlines in other regions.

“The growth in Chinese aviation is unprecedented in our lifetimes and probably in history,” said Paul Jebely, a Hong-Kong-based lawyer specialising in aviation. “There have been more aircraft ordered than there are pilots to fly them. ”

The squeeze on flying talent has triggered flight cancellations, dented profits and threatened the industry’s ambitious growth targets around the world.

Emirates is the latest major airline to feel the impact of a war for aviation talent with the Middle Eastern carrier cancelling flights and grounding aircraft this month due to a shortage of about 125 pilots.

“We’re a tad short of pilots,” Tim Clark, Emirates chief executive, said last month in a moment of understatement, adding that Chinese carriers were offering extremely competitive packages to pilots to move to Shanghai or Beijing…

“Chinese airlines have raised pay dramatically,” said Dave Ross, the president of Wasinc International, which helps Chinese airlines find foreign pilots. Mr Ross said pilots coming from Central or Latin America, and some places in Europe could quadruple their compensation in China.

The starting salary offered to foreign pilots in China has jumped over the past 10 years from $10,000 per month to $26,000 per month, tax free, and was still rising, he said.

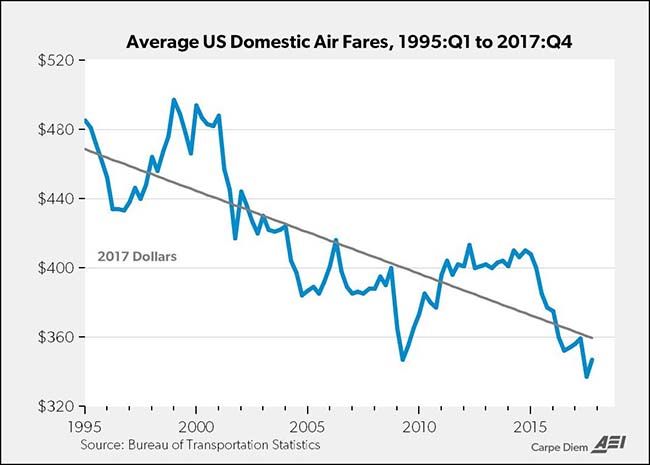

If pilot wages are on fire, and oil prices are rising, then shouldn’t airline prices be moving higher?

Farmers out here in the South Central plains are in for a tough year unless it starts raining…

After three fairly wet years, a drought ranging from “severe” to “exceptional” has descended on the southern Great Plains of Colorado, Kansas, New Mexico, Oklahoma and Texas, according to the U.S. Drought Monitor at the University of Nebraska-Lincoln. Home to one of the nation’s most fertile farming areas—crop production in the Texas region alone generates about $12 billion in economic activity—observers say the drought could punish the agricultural sector, affecting everything from cotton to cattle to farming-equipment sales.

“It’s going to be in the billions in terms of crop loss,” said Darren Hudson, director of the International Center for Agricultural Competitiveness at Texas Tech University in Lubbock.

A semiarid region, the southern Plains region has seen drought conditions for much of the last decade, but the severity of this latest dry spell is of particular concern. For many farmers here, the sudden falloff in precipitation is reminiscent of the devastating drought of 2011 when Texas agriculture lost $7.6 billion, the worst losses on record in the state.

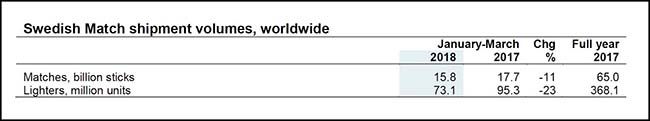

So the world’s largest Match and Lighter company is hitting a wall. A brick wall…

Swedish Match (a tobacco company with no cigarette brands) owns the world’s biggest match and lighter business. If you live in Latin America, Asia-Pacific or Europe you have almost certainly used the products. Here are the main brands:

Matches: Solstickan, Swan Vestas, Tres Estrellas, Fiat Lux, Redheads

Lighters: Cricket

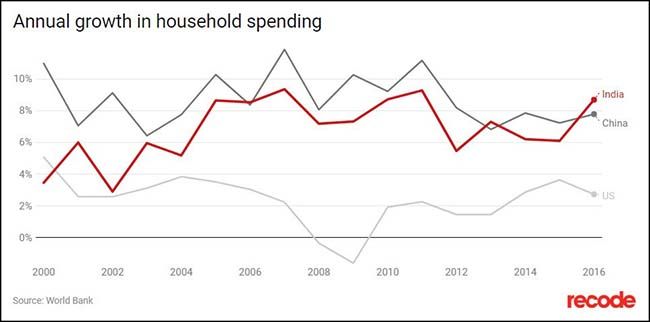

Walmart bought into India last week. This chart show why…

Walmart bought into India last week. This chart show why…

It’s official, the World Cup is only a month away…

Here are 8 things I cannot wait to witness:

1. The Portuguese LeBron James vs. the Argentinian Stephen Curry

Soccer’s two greatest players present a clash of styles not unlike the biggest rivals in the NBA. Cristiano Ronaldo of Portugal is a man most comfortable flexing after single-handedly smiting his foes, with jersey off and eight-pack out, in a celebration that is less a spontaneous outburst of joy than a validatory testament to his own magnificence. The 5’6’’ Lionel Messi of Argentina has the scruffy, unassuming demeanor of a video game store clerk, yet he is able to accelerate into slivers of space with such velocity that only pairs of smoking football boots are left where defenders once were. If either player leads his team to glory, it could settle the “greatest” debate once and for all.

Think you know the world’s biggest game and the global financial markets?

361 Capital World Cup Challenge

Choose the four final teams, the 2018 FIFA World Cup Champion and the country that you believe will generate the highest return during the World Cup (June 14 – July 15), as measured by the local market index.

The winner will be determined by the number of correct picks of the semifinalist teams and winning team. Tie breaker will be determined by the country market prediction.

Winner will receive an official soccer jersey of their choice.