by Blaine Rollins, CFA, 361 Capital

Visibility of future market returns continues to decrease. While some companies posted exceptional profits last week, their stocks were surprisingly unrewarded. And if your company missed numbers, you received two handfuls of sand in your eyes. On the earnings calls, signs of top-line growth continued, but Q&A worries targeted raw material, transportation and labor costs. It is a good sign for the economy that costs are rising, but for stock pickers, you have to work hard to be on the right side of the operating leverage.

Meanwhile, some new tacks have been thrown in the earnings road. A now rising U.S. dollar looks to remove some of the tailwind that multinationals were looking forward to for the second and third quarters of 2018. Companies are still uncertain as to the metal tariffs which will hit on May 1st. And all eyes will be on China this week for progress on those trade talks. And why did Caterpillar suggest that the first quarter could have been a peak in the cycle? Talk about crushing your own stock after a stellar earnings print. On the geopolitical front, North Korea seems to be headed in a very positive direction, while Iran has taken a turn for the worse.

So one more very big week of earnings releases and then we can fully digest everything that we have been told over the last three weeks. But while the press will trumpet the very big year-over-year gains in the numbers for this last quarter, remember that stock prices are now focused on what earnings will do in 12 to 18 months from now. A lot will happen between now and then. Better get out a clean pair of goggles.

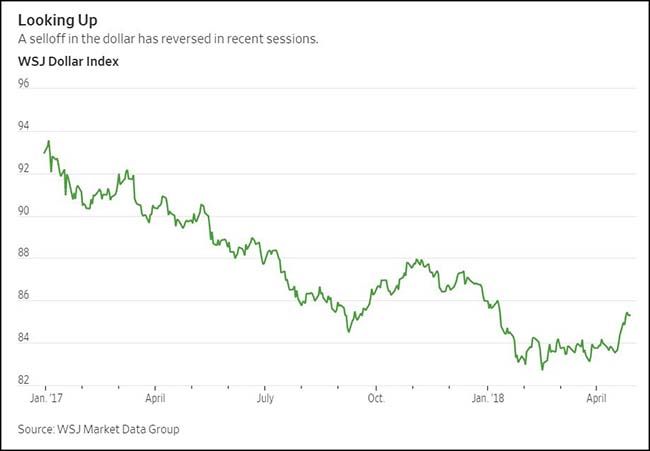

The U.S. dollar is strengthening again…

The dollar is now following Treasury yields higher and if it continues, there will be implications; commodity weakness for one, pressure on the foreign earnings of U.S. multinationals. This could explain the improved relative performance in small caps over large caps.

Signs of stronger U.S. economic growth and inflation are becoming a central focus of financial markets, helping lift the dollar to its highest level since January. Yields on the U.S. 10-year Treasury note last week crossed over 3% for the first time since 2014, evidence that part of the economy is returning to more normal conditions after a long stretch when bonds yields had hovered near historic lows.

The U.S. economy grew at 2.3% in the first quarter, according to government data released on Friday, expanding faster than the 1.8% analysts were expecting. A rise in the employment-cost index also signaled rising wages, analysts said. If Friday’s closely watched jobs report shows wage growth approaching 3%, as it did in January, that could provide more support that inflation may be beginning to stir.

Economists, meanwhile, are turning more skeptical that Europe can keep growing at last year’s pace. Recent data like German manufacturing and weaker Eurozone inflation have signaled a slowdown. U.K. growth also eased in the first quarter, while recent Japanese economic data has been mixed.

To receive this weekly briefing directly to your inbox, subscribe now.

Record earnings. Not record stock price performance…

Wall Street is running out of superlatives to describe the results. So far, roughly half of S&P 500 companies have reported. Nearly 80% of them have beaten consensus earnings forecast, according to Thomson Reuters I/B/E/S. Historically, companies exceed estimates 64% of the time.The beats are driving first-quarter profit estimates higher. As of Friday, analysts expected the S&P 500 to generate earnings growth of 25% from a year ago. At the start of the year, analysts expected a 12% growth rate. And yet, investors have mostly just yawned—either out of boredom or exhaustion. Since earnings began with the big bank reports on April 13, the S&P 500 is up just 0.2%.

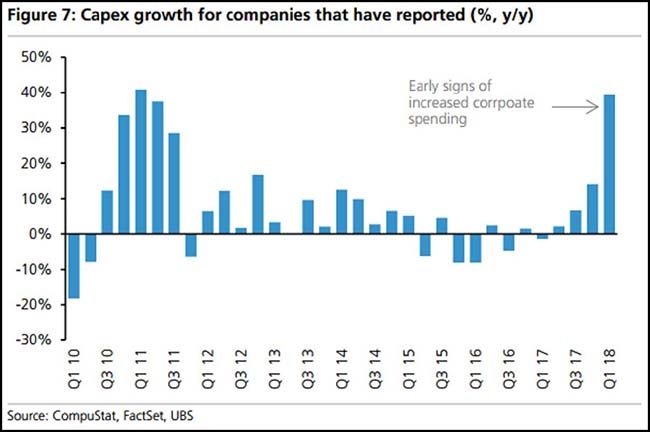

More important is that companies are rapidly reinvesting in Capex…

Among the 130 companies in the S&P 500 that have reported results in this earnings season, capital spending increased by 39 percent, the fastest rate in seven years, data compiled by UBS AG show. Meanwhile, returns to shareholders are growing at a much slower pace, with net buybacks rising 16 percent. Dividends saw an 11 percent boost.

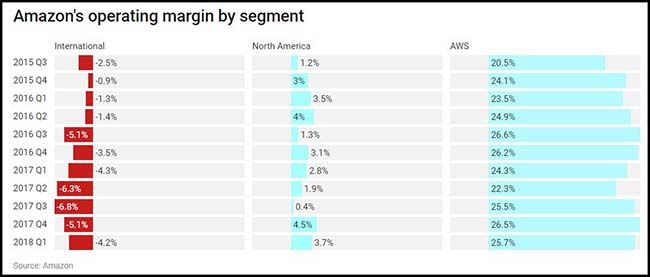

One of the best earnings drop last week was by Amazon…

Look at these margins in their cloud business. And they are raising prices 20% for their Prime pricing. That is $2b/year in increased operating profit to spend on their customers. Who wants same day delivery on everything?

Even Microsoft crushed it…

MSFT growth accelerated to +16%y/y (+14% cc) on track for strongest annual growth in over a decade as the combination of top line + op margin expansion (+200bps) at massive scale is every fund manager’s dream.

(Morgan Stanley)

MMM did the opposite…

3M Co. investors were bracing for a poor start to 2018, but they probably weren’t expecting it to be this rough.

The maker of Post-it notes plunged Tuesday after rising costs and weak demand for automotive and dental products prompted cuts to this year’s sales and profit forecasts. The revision came about a month after the company said organic growth was being hurt by challenges in the vehicle and consumer-electronics markets.

The diminished outlook adds to the pressures on 3M as it prepares for a transition at the top. The company said last month that Chief Operating Officer Michael Roman will take over for Inge Thulin as chief executive officer in July. Profit is also taking a hit from increased prices rise for crude oil and freight transportation.

“While a slower first quarter was telegraphed in March, weaker margins were not, and neither was a guidance cut to the high end of the range,” Steve Tusa, an analyst at JPMorgan Chase & Co., said in a report. “There are more questions than answers here now.”

And costs are rising too quickly for American Airlines to pass through to ticket prices…

American Airlines Group Inc. lowered its profit outlook for the year as the world’s largest carrier by traffic grapples with runaway fuel costs.

In the first three months of this year, the airline reported higher revenue amid strong travel demand, but rising fuel costs ate into its bottom line, a problem it sees continuing throughout the year. American said the average per-gallon price of jet fuel rose 24% from a year earlier.

The company now expects annual earnings of $5 a share to $6 a share, compared with its prior guidance of up to $6.50 a share. Analysts polled by Thomson Reuters had forecast earnings of $5.75 a share for the year.

Most interesting tidbit from Harley Davidson was they are building a new plant in Thailand because of the end of the TPP…

Harley-Davidson Inc.’s chief executive officer said he decided to build a plant in Thailand when it was clear the U.S. would abandon the Trans-Pacific Partnership, the free-trade agreement President Donald Trump withdrew from last year.

The factory was the “Plan B” that Harley employed after the U.S. abandoned the trade pact with a bloc of 11 countries mostly in Asia, CEO Matt Levatich said in a phone interview.

“We would rather not make the investment in that facility, but that’s what’s necessary to access a very important market,” Levatich said of Thailand. “It is a direct example of how trade policies could help this company, but we have to get on with our work to grow the business by any means possible, and that’s what we’re doing.”

Harley has since said it will cut about 260 U.S. jobs as it closes a plant in Missouri due to a prolonged sales slump in its home market.

One more big week as 145 S&P companies report…

(@eWhispers)

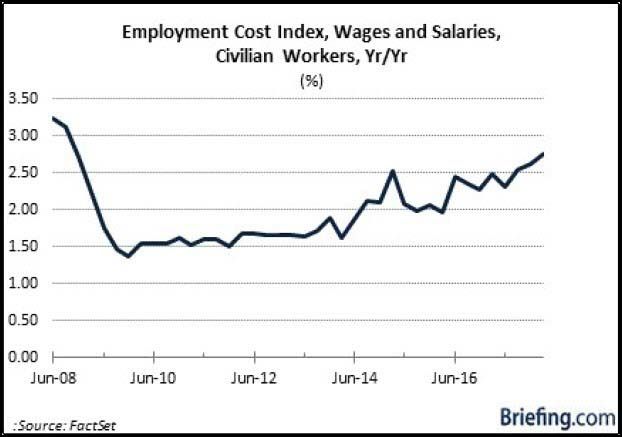

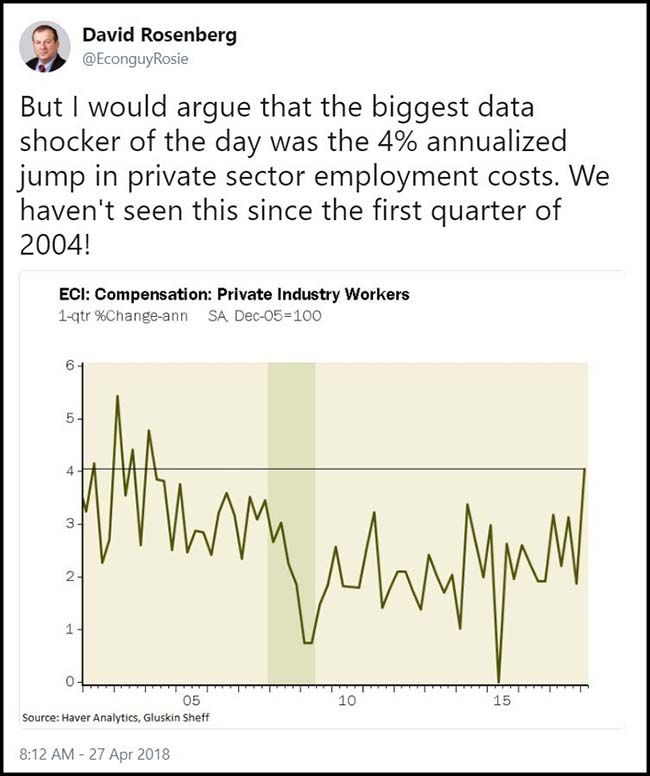

The tight labor markets expressed on the earnings calls continue to make its way through to the government statistics…

…the first quarter Employment Cost Index revealed compensation costs for civilian workers increased 2.7% for the 12‐month period ending in March 2018 compared to a 2.4% increase for the 12‐month period ending in March 2017. Wages and salaries were up 2.7% versus 2.5% for the 12 months ending March 2017.

The latest initial claims report also created some anecdotal angst about the potential for wage‐based inflation pressures to pick up. There were 209,000 initial claims for the week ending April 21, which was the lowest level of weekly initial claims since December 6, 1969, and a sign of a tightening labor supply that typically precedes wage increases.

(Briefing.com)

Private industry wage inflation is breaking out…

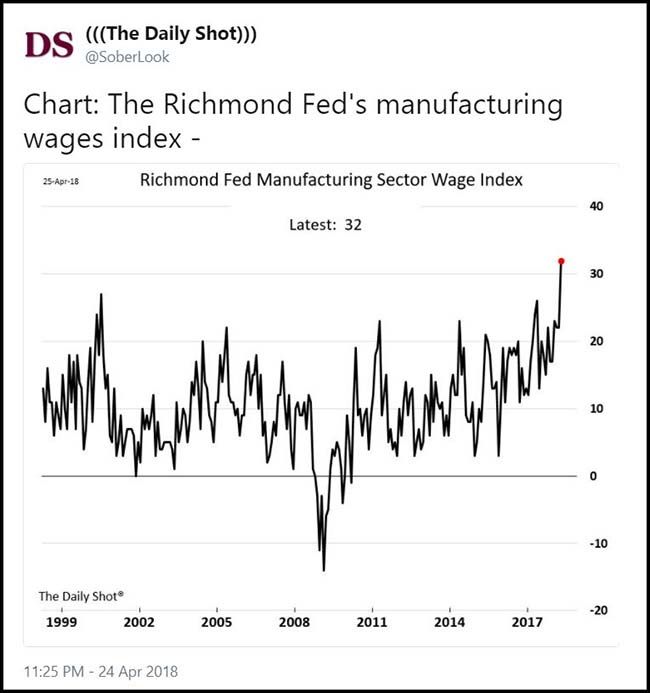

And more current survey data shows that the trend is not slowing…

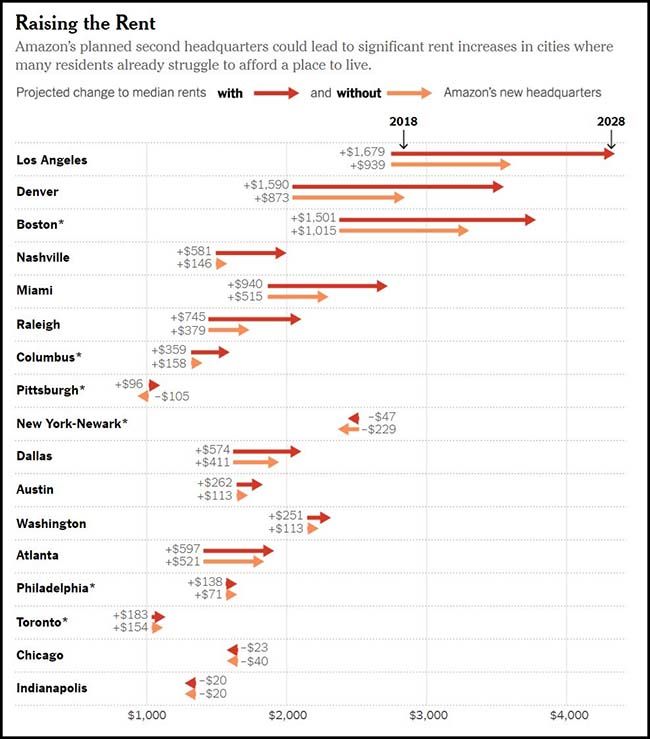

Speaking of rising wages, Amazon is getting closer to dropping $5b in annual wages into one North American city. Rental costs could go bonkers….

A new analysis from the real estate site Zillow estimates that rents in Nashville would rise 3.3 percent per year if the city landed the Amazon campus, almost four times as fast as currently projected. After a decade, that could translate into Nashville residents paying $400 more per month in extra rent because of the project.

Other cities could also see big increases if Amazon picks them. Monthly rents in Boston and Los Angeles could jump by even larger amounts in dollar terms — albeit from a higher starting point — reflecting a shortfall in rental housing construction. Denver — like Nashville, a midsize city that has seen brisk population growth in recent years — could see its already rapid rate of rent increases hit nearly 6 percent per year, triple the overall rate of inflation.

“I definitely think it has the possibility of pushing us over the tipping point,” said Felicia Griffin, executive director of United for a New Economy, a Colorado nonprofit that has opposed the Amazon project.

Some potential locations would be less severely affected. Atlanta and Chicago, big cities that have made it relatively easy to build new housing in recent decades, would see only a small rent increase if they won the Amazon project.

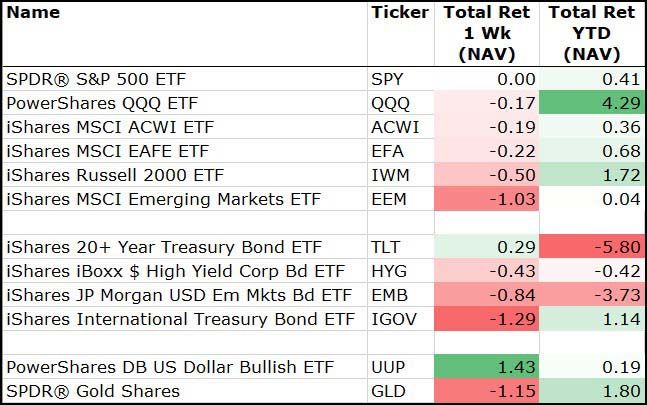

For last week, it was a tough one for stocks even with the blowout earnings…

(4/27/2018)

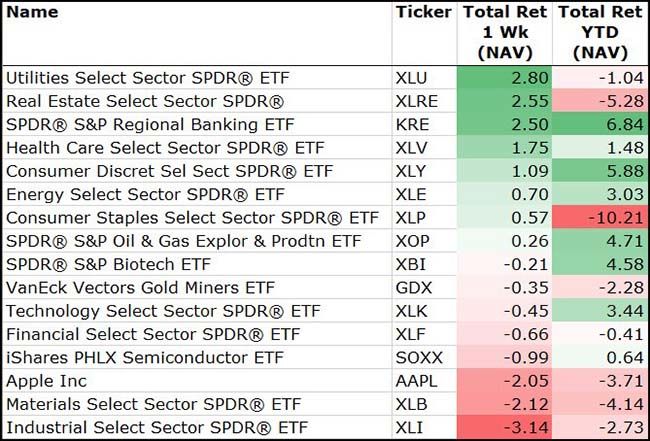

A risk-off week as Utilities and REITs were joined by Bank stocks in the green column. Industrials and Materials got bulldozed…

(4/27/2018)

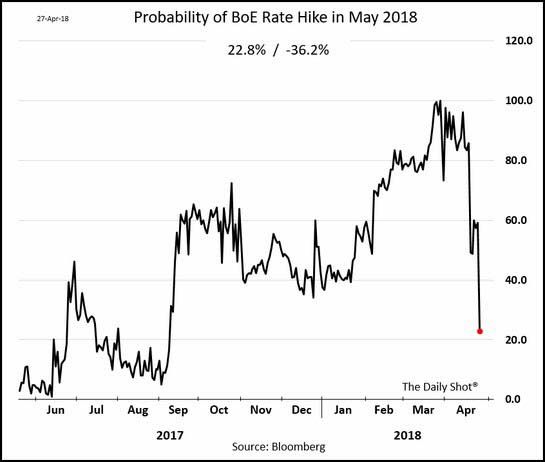

The U.K. economy looks knackered…

The United Kingdom GDP report showed a much slower than expected growth of +0.1%. As a result, expectations for a mid-year Bank of England rate hike collapsed taking the British Pound and bond yields with it.

(WSJ/Daily Shot)

And Barry Sternlicht suggests that it will get worse for the U.K…

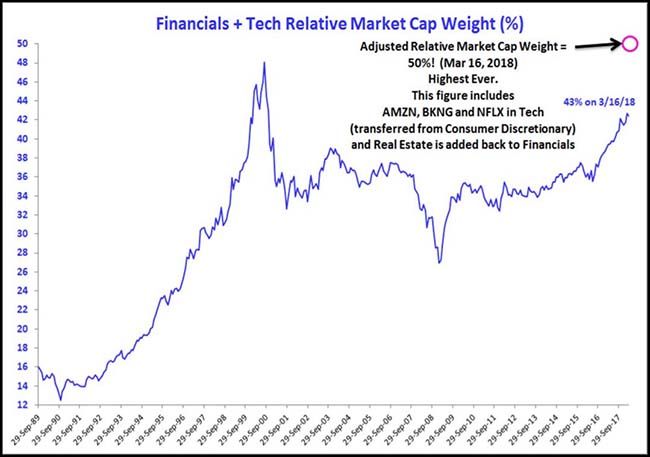

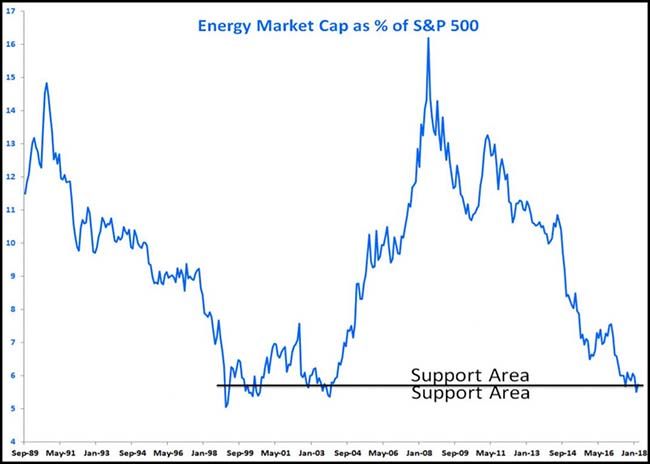

John Roque is one of the top thinkers in the market…

After years on the sell side, he jumped to the buy side last decade so we don’t get access to his thoughts like we used to. (Time for a twitter account John?) Whenever he speaks, writes or presents, go out of your way to digest the info. Here are some slides that came out of a presentation last week. Easy enough to spot the paired trade here.

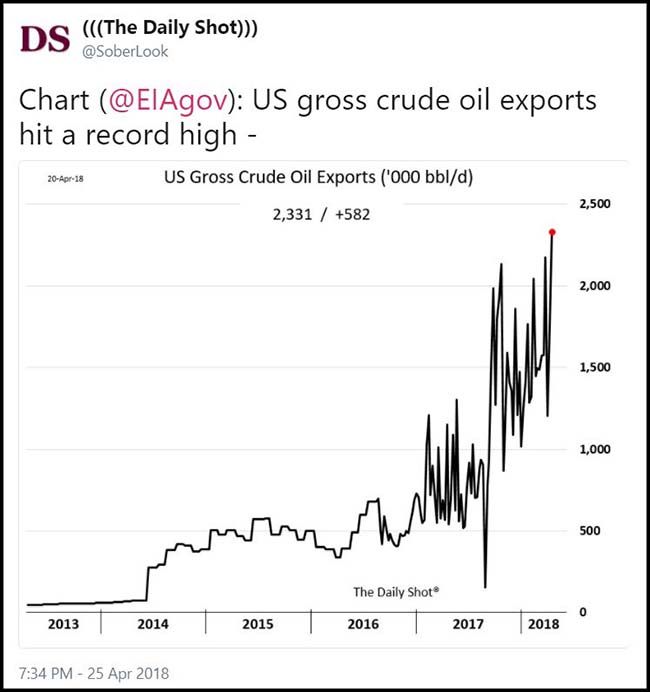

U.S. crude oil exports are exploding which will benefit nearly every stock in the Energy sector…

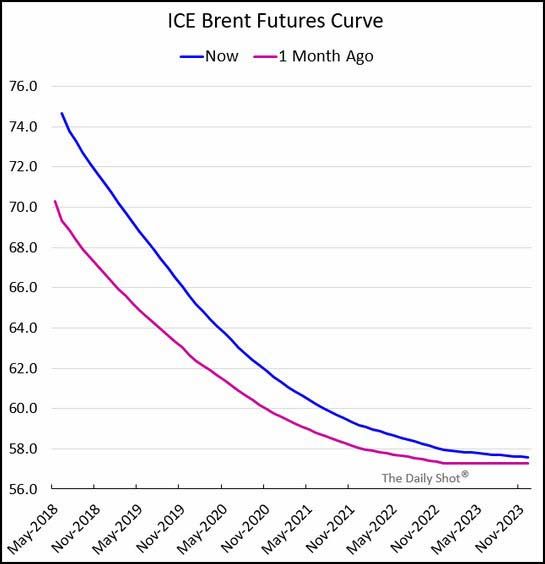

And current prices are running significantly above future prices, so there is profit to be made on that future production…

(WSJ/Daily Shot)

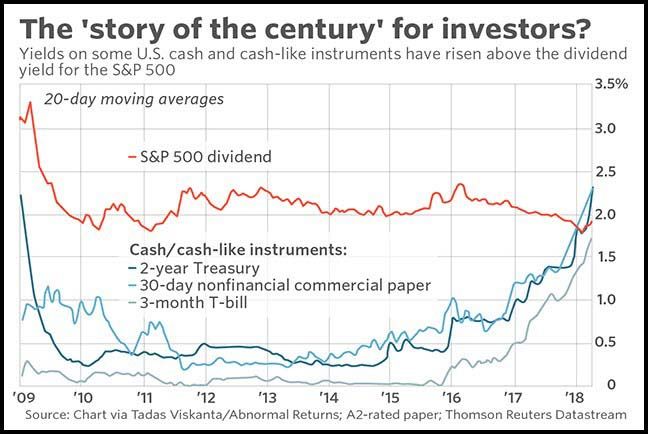

Who hasn’t been touted stocks as a yield replacement play? Well, no longer…

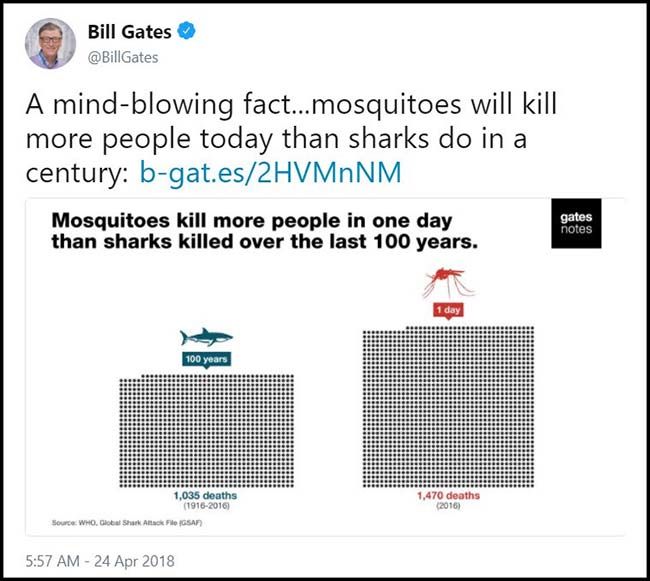

Here is something that you probably didn’t know…

(Bill Gates)

And here is something else that you didn’t know…

Esports—aka competitive video-gaming—is the world’s fastest-growing spectator sport. Last year, esports tournaments and live streams drew 258 million unique viewers. Put another way, more people watched other people play videogames in 2017 than all NFL regular-season games combined. Esports tournaments have sold out Madison Square Garden and World Cup stadiums. Competitive gamers like those on Team Dignitas can earn over $2 million in annual salary, plus more from endorsements and prize money. The 76ers became the first American sports franchise to own an esports team when they purchased Dignitas in 2016. Other franchises, from the Golden State Warriors to the New England Patriots, have followed their lead.

Finally, my best advice to any new parent would be to read to their child every day…

“People would stand in line for days and pay hundreds of dollars if there were a pill that could do everything for a child that reading aloud does. It expands their interest in books, vocabulary, comprehension, grammar, and attention span. Simply put, it’s a free ‘oral vaccine’ for literacy.” —Jim Trelease

Copyright © 361 Capital