by Jim McDonald, Chief Investment Strategist, Northern Trust

SUMMARY

- Although investor concerns about global trade are elevating equity market volatility, company fundamentals remain strong

- Commodities have been affected more by geopolitical events than by tariffs

- The performance of lower-quality and emerging market debt seems to indicate that investors are not sensing fundamental weakness

OUTLOOK

There are no shortages of likely suspects for the increase in market volatility this year, and also reason to believe that the impact of fundamental changes are exaggerated by increased computerized trading. Our task, as always, is to determine what is noise and what is true fundamental change. The concern over a growth slowdown has yet to generate worrying signs in the markets. As shown below, despite recent economic reports falling short of expectations, credit spreads and emerging market currencies are showing relative stability. While investment-grade spreads have increased somewhat this year, tied to stock market volatility, they are still low and below the levels of a year ago. We are in the dodgy first quarter, where seasonal adjustment issues tend to skew economic reports downward. Surveys of companies doing business across the United States and Europe continue to reach new highs. Emerging market economic activity also has remained relatively steady compared with expectations.

Last month’s key focus was the ramp-up in tough trade rhetoric from the U.S. administration, which elicited retaliatory proposals from China. So far, the only policies that actually have been implemented are the steel and aluminum tariffs, from which notable countries were excluded. We have been concerned by President Donald Trump’s conviction on the issue about the probability of further tariffs targeted at China. Of late, the sentiment toward trade seems to have moderated some, and news reports are now suggesting that President Trump may even reconsider the Trans-Pacific Partnership (TPP) trade pact. Moderation of the rhetoric with China, completion of the North American Free Trade Agreement (NAFTA) and discussions around entering the TPP would be a welcome tonic for market sentiment.

Inflation measures in the United States have finally started to creep up, as expected, as low prices from a year ago have fallen out of the measure. Some inflationary pressures may be building as companies seek to raise prices, but it seems to be mostly a U.S. affair. Core inflation in Europe is stuck at 1.0%, and fell short of expectations last month, while core inflation in Japan is just 0.3%. The largest changes are happening in China, where consumer price inflation dropped from 2.9% to 2.1% last month. Financial markets aren’t pricing in a significant upshift in inflation (appropriately in our view), helping act as a limit on how fast the major central banks move to normalize policy. We expect one or two Federal Reserve rate hikes over the next year, below market expectations, as inflation remains contained and yield curve inversion concerns persist.

INTEREST RATES

- Treasury issuance has surged in recent months

- Short-term credit has become attractive

- We expect both the Fed and ECB to face headwinds to their desired pace of normalization

Because of the U.S. government’s increased financing needs, the Treasury Department has begun to issue bills, notes and bonds at a pace not seen since the financial crisis. The flood of Treasury bills, combined with the tax-reform-related selling of short-term credit and Treasuries, has caused short-term yields to spike. Absent inflation or rising inflation expectations, we believe the flatness of the yield curve will eventually prevent the Fed from raising rates at the pace it has forecasted. Because spreads have widened for nonfundamental reasons, we currently view short-term credit as attractive and have positioned portfolios short-to-neutral duration.

Recent eurozone economic data has been mixed, causing some investors to question the strength of the economic recovery. Despite this softer data, policy makers in Europe appear to believe the economic expansion remains strong. As such, we believe that the European Central Bank (ECB) is beginning to lean more hawkish; comments by committee members have signaled their desire to end quantitative easing this year. We believe rates will remain near historic lows in Europe, and that the persistent lack of inflationary pressures will cause the ECB to normalize rates at a slow pace.

CREDIT MARKETS

- Credit markets are flagging few concerns about fundamentals

- Lower-quality and emerging market debt have outperformed

- We remain modestly overweight credit markets in aggregate

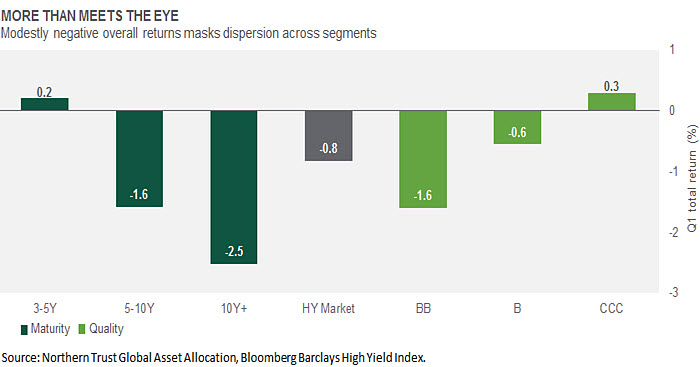

A number of drivers have increased financial market volatility in the first quarter – including higher interest rates, escalating trade rhetoric and technology sector weakness. But credit market concerns haven’t been a concern. In fact, the high yield market has been quite calm in aggregate, with option-adjusted credit spreads tighter this year (3.32%) than at the end of 2017 (3.43%). Segmenting the high yield index by both maturity and quality reveals the true drivers of first quarter returns (see chart). While the index fell by 0.8%, longer-duration and higher-quality credit securities had much greater losses. This implies investors are less concerned with credit fundamentals and that returns have been more driven by the year-to-date increase in interest rates. Simply put, CCC-rated issues and distressed sectors would not be outperforming if investors sensed fundamental weakness.

Related, emerging market debt had the best performance of all major asset classes in the first quarter – returning 4.4%. Again, this typically doesn’t happen if investors are concerned about fundamentals. We remain overweight credit markets in aggregate – with our overweight to corporate high yield more than offsetting our underweight to emerging market debt. We do recognize emerging market debt’s recent outperformance and the fairly constructive emerging market outlook, but remain comfortable getting our credit exposure through corporate high yield.

EQUITIES

- Earnings have grown rapidly over the last three years

- Better earnings have lowered overall valuations

- We favor developed ex-U.S. and emerging market equities

Global equities retreated last month as concerns relating to global trade disrupted the positive bottoms-up narrative and contributed to still-elevated volatility. As we enter first quarter earnings season we will see whether strong revenue and earnings growth can return investors’ attention to company fundamentals. In the United States, first quarter earnings growth of 17% is aided by a roughly 7% boost from tax reform. But underlying trends, including revenue growth of better than 7%, remain strong. Earnings revisions also have been strong globally, with the exception of the eurozone (which to some extent is being hindered by the stronger euro).

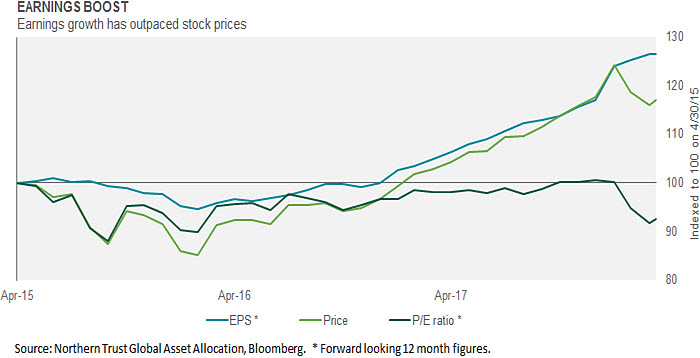

The combination of higher earnings and now-lower stock prices has improved valuations globally. Global earnings over the last three years have outpaced the rise in stock prices (see chart), leading to a lower forward earnings multiple – consistent with our view that earnings need to drive equities. This improvement in valuation is observable in the United States, Europe and emerging markets. While we moderated our overweight position in equities last month to account for increased risk, we remain overweight equities globally, emphasizing developed ex-U.S. and emerging market equities.

REAL ASSETS

- Commodities have reacted more to geopolitical events than tariffs

- Commodity prices would ultimately suffer in a full-on trade war

- We remain strategically allocated across all real assets

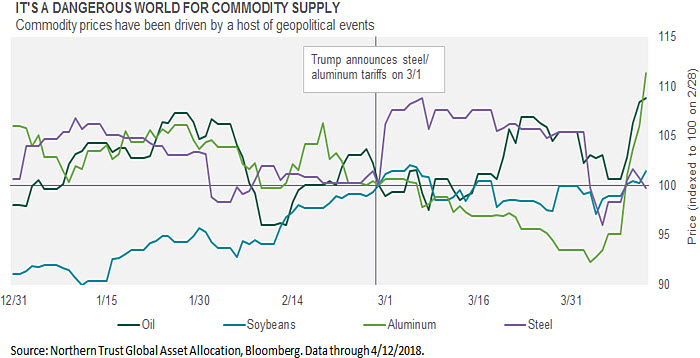

While tariff talk has dominated the headlines, actual commodity price movements have been affected more by other geopolitical developments. After the steel and aluminum tariff announcements on March 1, aluminum prices actually fell by as much as 7% over the next month. It was the sanctions placed on Russia that caused aluminum prices to spike by 17%. Specifically, Rusal – a Russian aluminum company that represents a large portion of global supply – saw its U.S. assets frozen. Steel prices did jump after the tariff announcements, but have since retreated. Soybeans – one of the targets of the announced (but not yet implemented) Chinese retaliatory tariffs – have seen flat prices over the past six weeks as well. Finally, oil prices, not directly affected by any tariffs, have moved higher in response to increased potential for conflict in the Middle East.

We remain allocated at strategic levels in natural resources (as well as global real estate and listed infrastructure). We believe a full-on trade war would have zero winners – not even commodities, which we believe would suffer more from falling demand due to rising uncertainty than they would benefit from protectionist measures. In fact, other than the unique price patterns of aluminum, we have seen commodity prices rise on days where tariff concerns cooled and fall when tariff rhetoric ratcheted higher.

CONCLUSION

Much of this month’s investment strategy debate focused on the global growth outlook in the wake of some wobbling in the data and tensions around trade between the United States and China. Relying on our theme of Entrenched Growth has paid dividends in recent years during similar periods – allowing us to stand firm during the inevitable periods of softer data. While each quarter that passes brings us closer to the eventual end of the expansion, we aren’t seeing signs yet that would lead us to conclude that a recession is on the horizon. In addition to feedback from companies about their level of business activity, financial market indicators aren’t showing much stress. While we have seen a modest increase in investment grade credit spreads this year, they are still down from a year ago, and the behavior of the high yield market is further confirmation of investor confidence in the economic outlook.

We are entering the reporting period for first-quarter earnings, which should be strong globally. Consensus earnings expectations (which are usually high by 5 percentage points or so) call for earnings growth of nearly 19% in the United States this year, 15% in emerging markets and 9% in Europe. Importantly, expectations have been rising over the last several months in all regions except Europe, which is likely being held back by euro strength. Strong earnings growth in recent years has ameliorated some concerns about elevated valuations. U.S. equities are trading at 16.8 times forward earnings, compared to a historic median of 15.2 times. Developed markets ex-U.S. are trading at 13.8 times, in line with the historic median of 13.9, while emerging markets are trading at 11.9 times earnings, as compared with the historic median of 10.8 times. These are not heroic valuation levels, especially in an environment where we expect interest rates to remain contained.

As such, we remain overweight equities and underweight bonds – with the underweight to bonds being driven by a lower return potential as opposed to concerns about rising rates. Our primary risk cases are unchanged from last month – the potential for a central bank mistake and the risk of a trade war. We have two meetings of the Federal Reserve over the next two months, so we will have plenty of new information to help us gauge its likely path forward. We will also likely see much discussion on the trade front, from tariffs to NAFTA to the potential discussions of the United States rejoining the TPP agreement. With the increased volatility experienced so far this year, these risks are increasingly being assessed and priced in by investors. As always, we will look forward to updating you on our thoughts in coming months.

-Jim McDonald, Chief Investment Strategist

IN EMEA AND APAC, THIS PUBLICATION IS NOT INTENDED FOR RETAIL CLIENTS

© 2018 Northern Trust Corporation.

This material is intended to be for informational purposes only and is intended for current or prospective clients of Northern Trust. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Source for market data in commentary is Bloomberg, unless otherwise stated. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based on proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Investments can go down as well as up. Past performance is not a reliable indicator of future results.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors Inc., 50 South Capital Advisors, LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited.