How to Run a Successful Retirement Education Campaign

by Steve Johnian, Commonwealth Financial Network

Many employees struggle with saving for retirement for a variety of reasons. For starters, they face incredible inertia when it comes to simply enrolling in a retirement plan. Lack of financial knowledge is another big barrier that stymies their ability to properly manage their day-to-day personal finances and—for those who have enrolled in a retirement plan—put enough aside for their future and properly allocate their investments.

As these problems tend to spill over into the workplace, retirement education campaigns can go a long way to break down some of the barriers that prevent employees from adequately preparing for retirement—while also increasing employee productivity at work.

According to the 2017 Retirement Confidence Survey from the Employee Benefit Research Institute (EBRI), 30 percent of workers worry about their personal finances while on the job. More than half of those same workers believe they would be more productive if they could cut back on such worries. In fact, a majority of EBRI survey respondents indicated that education programs around retirement would help them spend their time more wisely during work hours.

This feedback presents a tremendous opportunity for advisors to get plan sponsors’ buy-in to educate retirement plan participants about financial freedom and a secure retirement—especially if such a program would help improve productivity. Advisors who take up the effort, however, face the challenge of effectively conveying their message to employees in various stages of life.

Different generations have different needs for developing and sustaining a stable financial future. Members of Generation X, for example, seem to be pretty good at saving for retirement—in fact, they’re sometimes called the 401(k) Generation. Millennials, on the other hand, continue to lag behind for a number of reasons, including less disposable income due to crippling student loan debt.

The differences between the groups present a challenge—and an opportunity—to advisors. Where employees’ educational needs vary, advisors can develop tailored messaging that speaks to and resonates with the audience they’re trying to reach. In general, millennials want guidance on what they should focus on first, Gen Xers like prominent data and facts, and baby boomers are looking for a holistic financial plan, not just help with their retirement savings. The more you can customize your campaign with content targeted to a person’s individual situation and life stage, the more effective you will be at helping participants understand their own next steps and take action.

While there are a number of generational differences to consider, advisors should be sure to look at areas of overlap among the generations as well. All participants need the same information about the retirement plan, the importance of contributing enough to get the employer match, asset allocation, and the power of compounding. Ultimately, everyone needs to understand what they should do next.

So, how can you create a retirement education campaign that helps your plan sponsor clients communicate with plan participants most effectively?

1) Do your research. As you begin to plan your campaign, you’ll need to have an in-depth understanding of the retirement plan you’re working with. Learn about its design and features, including things like:

- The structure of the employer match

- A Roth provision

- An after-tax contribution account

- Auto-enrollment and auto-increase features

- Re-enrollment

- The investment and default options

Plan features like auto-enrollment and re-enrollment can help boost participation, and an auto-increase feature can help increase savings rates. As it is, according to Fidelity, the average 401(k) account balance in the third quarter of 2017 was just $99,900.

Combine this information with data about the participants’ demographics. Understanding the generations of the workforce and the plan’s features together will inform how you segment your communications and determine corresponding content. After all, participants tend to engage more with messages that mean something to them and their own situation.

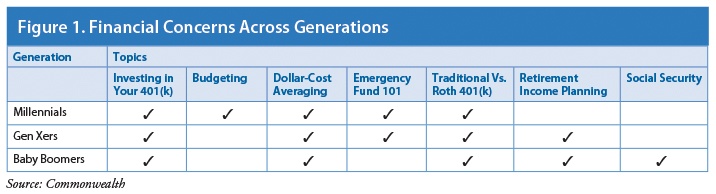

2) Focus on the topics that matter most. Each generation has its own financial priorities, so your campaign should aim to educate retirement plan participants based on the topics that are top of mind for them, depending on whether they are nearing retirement or just starting their careers. For example, millennials are the most indebted generation, largely due to their student loans. They could benefit from learning about balanced budgeting to both manage their debt and save in a 401(k). The chart below shows the topics that are most important to individuals across generations.

3) Leverage your resources. Whether you have many plan sponsor clients or just one, running a retirement education campaign takes up time. You can make it more efficient by knowing where to find relevant resources for when you need content, information about the plan, or ideas for streamlining the process.

- Your RIA–broker/dealer: To help you find the right resources to support your campaign, try leveraging the materials that may be offered by your RIA–broker/dealer. At Commonwealth, we have developed a number of items, including participant newsletters, videos, and other customizable materials, to help our affiliated advisors educate plan participants and add value to the service they offer to their plan sponsor clients.

- Plan provider: Retirement plan providers and recordkeepers put a lot of effort into supporting retirement plan education. They can provide a variety of resources on everything from technology to educational content to help you run education meetings. Providers may also be able to help you set up a campaign calendar and deployment strategy.

- Other participants: Don’t forget that the employer and other participants can be a resource as well. Try providing specific examples or testimonials from employees about how they benefited from enrolling in their 401(k) plan.

These three elements can help you create a repeatable process for your retirement education campaign across your book of plan sponsor clients. But you’ll also need a strategy for deployment. One paramount strategy is to take a multichannel approach. This includes things like:

- Group education meetings

- E-mail communications

- Webinars

- Videos

- Smartphone apps

You’re likely to find that using different communication methods for different generations can be more effective. Millennials are considered an informal and collaborative generation. Also known for checking their phones 43 times per day, they tend to embrace technology and the most modern ways of communicating, usually by mobile means. Gen Xers and baby boomers, on the other hand, are often more appreciative of targeted e-mails and in-person meetings. They tend to be stressed, as they juggle many different responsibilities, so they prefer to be communicated with in a very focused and brief way.

You may find that some communication strategies work better than others, or maybe you need to work within the confines of a plan sponsor’s preference or recordkeeper’s capabilities. The key is to build a consistent presence. The elements of a successful campaign should be:

- Targeted to specific groups of employees or generations

- Layered with topics that are beneficial for everyone, as well as ones that reach specific groups

- Brief so that your message is well received

- Frequent so that employees receive the same message consistently

It can be challenging to motivate employees to savefor a time in their lives that may be many years away. A tailored campaign strategy that addresses their unique concerns can help them get the message. If you can educate retirement plan participants in a way that inspires them to take action, you will help them be better prepared for retirement, regardless of the life stage they are in.

Have your plan sponsor clients expressed interest in programs to educate retirement plan participants? How would you structure a retirement education campaign to be effective for a multigenerational workplace? Please share your thoughts with us below.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network