by Blaine Rollins, CFA, 361 Capital

Hopefully you have seen the movie “Inception” as it is one of the greatest. Last night, when I decided to break away from the kids and shaved iced to give a quick update on the markets, I couldn’t stop thinking about how the last month reminds me of the van scene from “Inception”. The final kick is coming to wake the actors up, but it is all happening in super slow motion with several external events that are making us crush the theater armrest in anticipation. Similarly, in the markets we can now see the increasing damaging effects of the global trade wars, increasing political uncertainty in Washington D.C., and the new outrage at Facebook causing investors to throw their portfolios off the bridge just like the van in the movie.

When the market was trading at 20x earnings, it was priced for perfection. Equity valuations were not ready to absorb any amount of uncertainty in price, volume and margin changes due to these new global tariffs. We knew that after the volatility event in early February that the market would need to test its higher and lower bounds before it made its next move. While we didn’t think that it would happen this quickly, very few also anticipated that the White House would shoot the U.S. economy in its own foot.

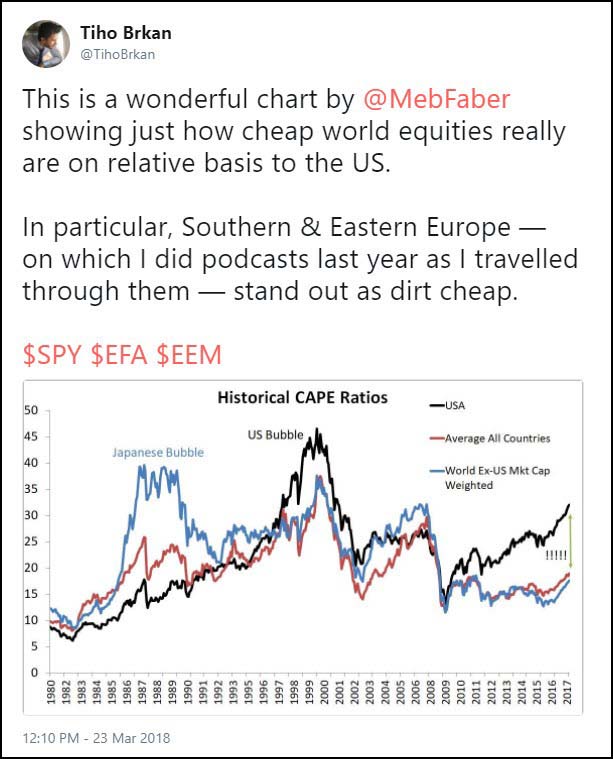

So, what do you do from here? With uncertainty up, portfolios should have higher cash and lower risk positioning. We have no idea if this is just the start of a multi-year trade war, or if it will all be over next month, but your portfolio will hate you if the world continues to move against the largest U.S. exporters. If you are forced to be 100% long equities, then you will be looking to lift Small Cap exposures that will be less affected by the trade wars and International Equities that can win from new trading alliances against U.S. goods.

Commodities continue to act well as the U.S. dollar sinks and investors look for hard assets to own. And if you really think that things will slow down as hard as Stephanie Pomboy thinks, then you have to start thinking about long duration bonds again. (I haven’t crossed that bridge yet as I need to see more credit and loan problems.)

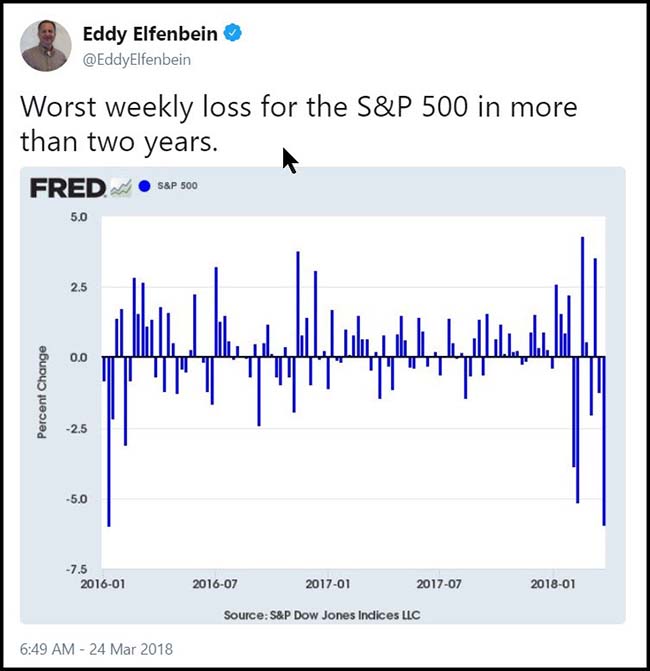

That’s all I have in me right now. Let’s see how last week’s 6% down move in the S&P 500 acts this week. You would expect a partial bounce at the minimum unless a new dumpster fire emerges from Washington D.C. or Menlo Park. Fun times! Now, where is my green tea shaved ice?

To receive this weekly briefing directly to your inbox, subscribe now.

S&P 500 plunges right to the 200-day moving average. Now will it hold?

Seems like this always happens when half of Wall Street is gone…

For the week, Large Cap U.S., Financials, HealthCare, and Tech were the worst performers…

Limited hiding places in Energy stocks and Foreign currencies. Consumer Staples stocks now the worst sector YTD.

More painful to look at the Dow Mega-Caps which HATE the new trade wars…

Another friendly reminder that the U.S. Government is sucking cash out of your portfolio this week (also, not bullish)…

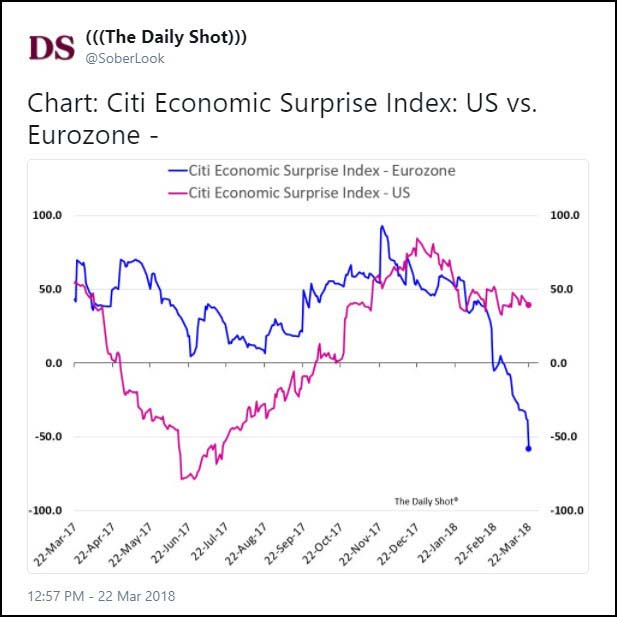

Euro expectations got too far ahead of themselves and are now coming back to Earth. How can the U.S. not be next?

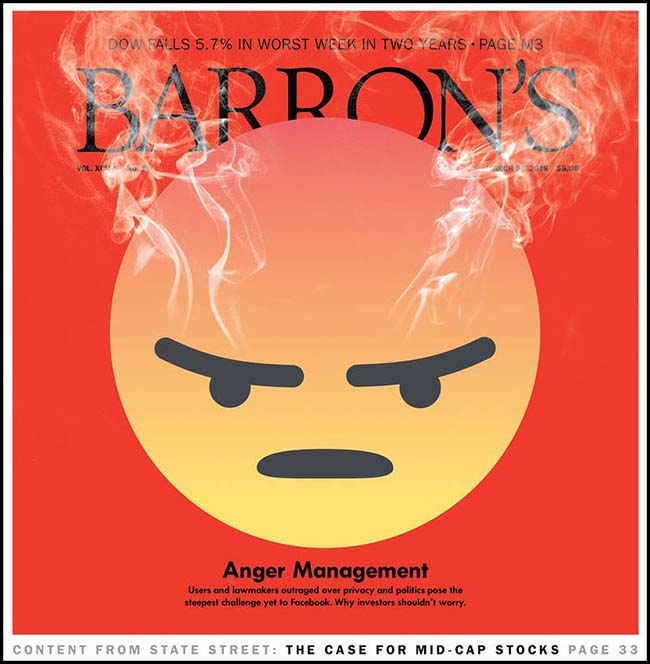

Stephanie Pomboy sticks to her cautious guns in Barron’s. Keep an eye on what triggers she is looking for…

What are you watching for?

Signs of credit market stress. The investment-grade market is the worst-performing sector in the U.S., relative to stocks. Again, we have $1 trillion in issuance still to come. It’s very important to watch how the market digests that. You know, the stock market is utterly dependent on free money, which drove it in the face of lackluster economic and earnings growth. The idea that we can suddenly reverse quantitative easing and have no knock-on consequences for stocks seems a little pie-in-the-sky. If QE was designed to incentivize risk and expand the pool of credit, QT [quantitative tightening] should necessarily beget the reverse.

How should investors position themselves?

Gaming when the unsustainable will finally be revealed as such is obviously tricky. My job is to identiat’s unsustainable and where the signals are. My own inclination would be to keep my powder dry; wait for the opportunities that will present themselves. If I were a long-only manager, I’d be underweighting U.S. risk assets versus, let’s say, emerging markets and hard assets. You could hunker down in commodities: The CRB Index, on a relative performance basis, is near the lowest it has ever been.

(Barron’s)

This is the most uncomfortable chart that I saw last week…

Equities move violently up and down and I take notice. But when the credit markets start moving quickly, I start looking around for my helmet.

This breakout in Gold just might be bearish for everything else that you own…

Facebook didn’t help things last week…

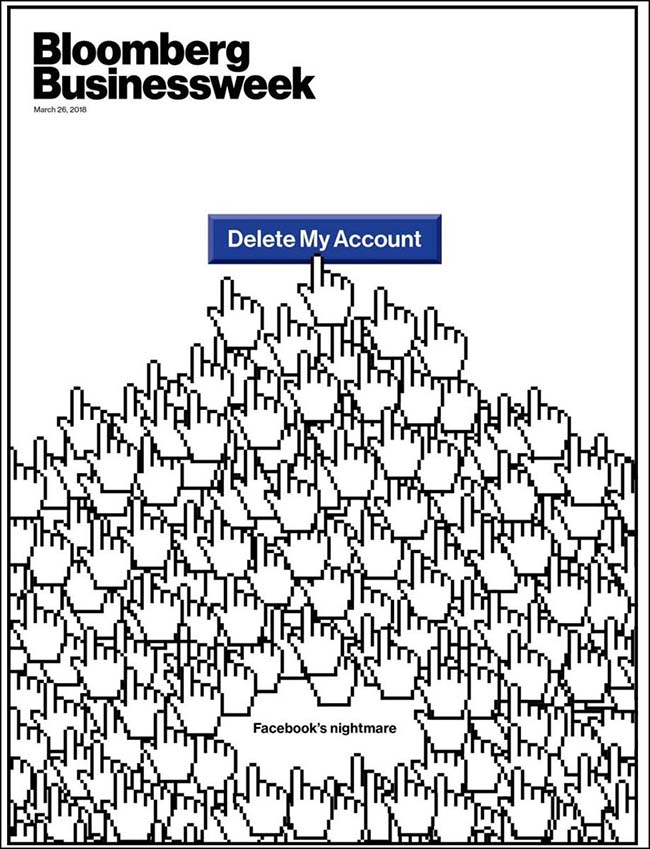

Bloomberg/Businessweek goes one step further…

If only everyone would have listened to Jim Carey in February, they could have saved themselves a lot of pain…

(@cperruna)

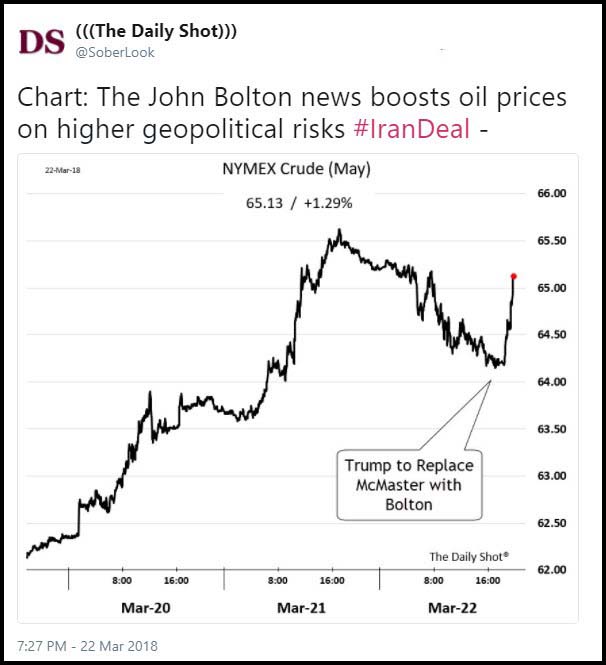

And if you have to own U.S. equities, the new National Security Adviser just might fire up the energy stocks…

Now back to your Spring Break…

Copyright © 361 Capital