by Equities Team, AllianceBernstein

As Facebook’s market capitalization has tumbled by $60 billion over two days, investors have refocused on the gargantuan proportions of US mega-cap stocks. Apple, Google and Facebook dwarf several major national market indices.

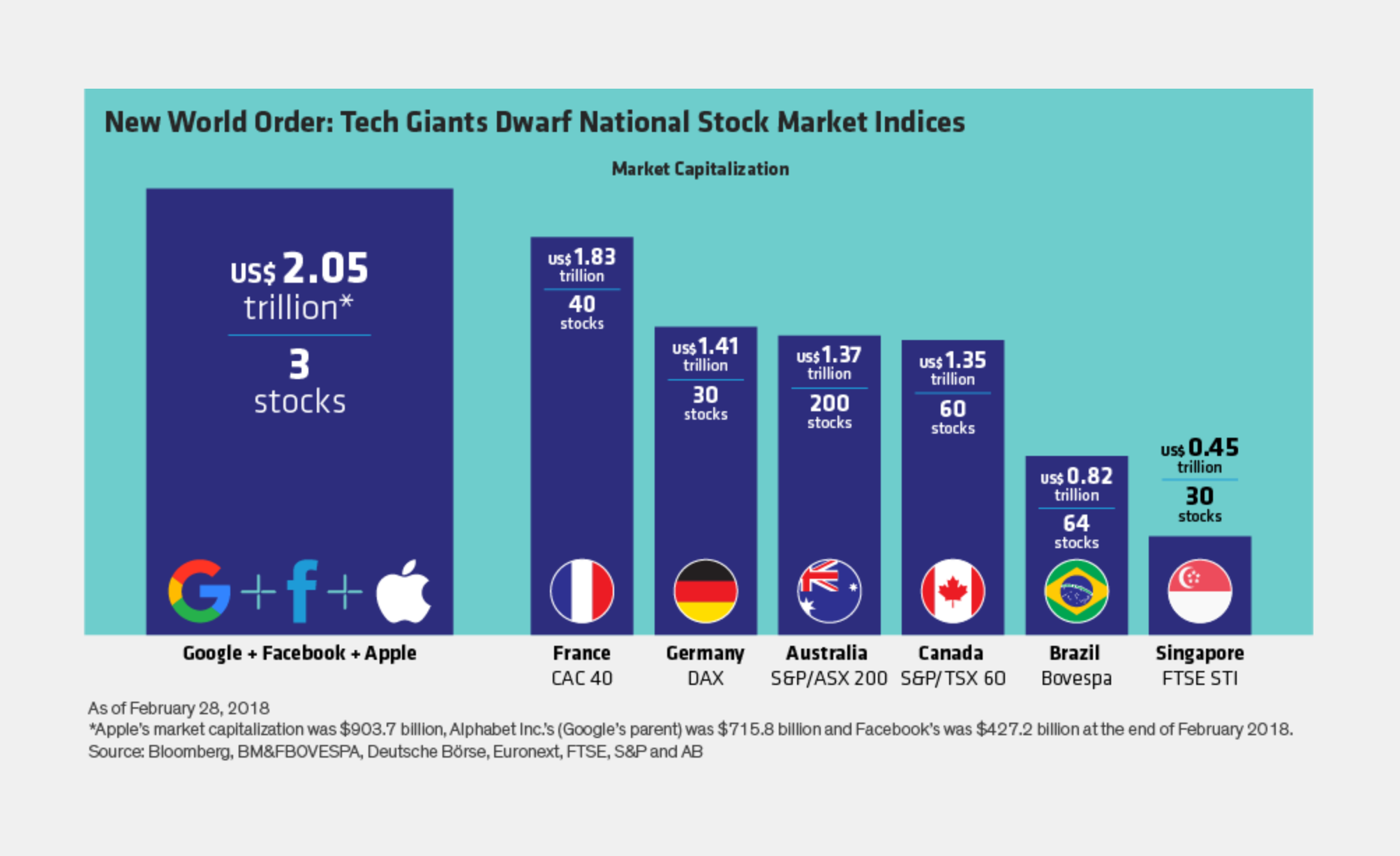

The combined market capitalization of Apple, Alphabet Inc. (Google’s parent company) and Facebook reached US$2.05 trillion (Display) at the end of February. That’s more than the values of the major market indices of France, Germany, Australia, Canada, Brazil and Singapore, each of which contains dozens of stocks.

There are compelling reasons for investors to own FAANG stocks (Facebook, Amazon, Apple, Netflix and Google), which have delivered strong returns in recent years. Yet there are clearly unique hazards to consider when companies become so big that even small market movements affect huge sums of money. For example, every time Apple shares move 1%, about US$9 billion shifts instantly.

Tighter scrutiny of Facebook over its breach of personal data is sending shock waves through the industry. It’s too early to say exactly how Facebook and other tech companies that handle user data will be affected by a potential tightening of regulation. It’s even possible, in our view, that increased regulation could ultimately end up favoring large companies like Facebook, as smaller companies may not have the resources to comply with increasing industry-wide regulation. But no matter how the regulatory story unfolds, the sharp decline of Facebook’s shares serves as a stark reminder that investors may need to apply special risk controls to invest effectively in a new world order dominated by colossal companies.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein