by Christopher Doll Vice President, PowerShares Sales & Strategy, Invesco Ltd. Invesco Canada

February’s increased volatility impacted both equities and fixed income, reminding all investors of the havoc that shifting interest rates can have on their portfolios. The correction occurred as U.S. bond yields headed higher, signaling a sell-off in the debt markets while also making equities less appealing.

Interest rates remain a focus for many investors, as some of the major central banks around the world move toward tighter monetary policy through higher Central Bank overnight lending rates and the reduction or elimination of Quantitative Easing.

Fortunately for investors seeking stability and income, there are strategies to mitigate the risks associated with a rising-rate environment.

I’ve blogged about the potential benefits of a laddered strategy in the past (read: Why rising rates don’t have to be alarming for income investors), so now I’ll turn to the potential benefits of short-term government bonds.

Short-term government bonds are well-positioned in the Canadian fixed-income space for investors seeking to mitigate both credit risk and interest-rate risk in their portfolios. With higher credit ratings and lower interest-rate sensitivity, they tend to provide a measure of stability.

The trade-off, however, is that the yield on a portfolio comprised solely of Government of Canada bonds may be too low for investors who require income.

The inclusion of other segments of the Government bond market, like agency, provincial and municipal issued bonds, in a portfolio offers investors the potential for a higher yield than a portfolio comprised of just Government of Canada bonds of similar maturity and credit quality.

Diversification

Canadian short-term government bonds have historically demonstrated low correlation to Canadian equities and can potentially decrease overall portfolio volatility. The following table highlights the diversification benefits of short-term government bonds relative to equities as well as other government bond indices in Canada.

Source: Morningstar Direct L.P. from January 1, 1980 to December 31, 2017. Note: Canadian equities are represented by the S&P/TSX Composite Index; short government bonds are represented by the FTSE TMX Canada Short Term Government Bond Index; long government bonds are represented by the FTSE TMX Canada Long Term Government Bond Index; and all government bonds are represented by the FTSE TMX Canada All Government Bond Index. Correlations between PGB (or its underlying index) and equities may differ. You cannot invest directly in an index.

What does the low correlation to equities mean in terms of market returns during volatile periods?

The period from June 18, 2008 to March 9, 2009 was marked by one of the worst drawdowns for the S&P/TSX Composite Index. While the broad Canadian equity index declined 48.48%, short-term Canadian government bonds returned +7.99% in total.

Short government bonds also outperformed both the longer-duration government bond index and short corporate bond index that yielded higher during the same period.

Source: Bloomberg L.P., from June 18, 2008 to March 9, 2009. Data frequency: Daily. Note: Canadian equities are represented by the S&P/TSX Composite Index; short government bonds are represented by the FTSE TMX Canada Short Term Government Bond Index; long government bonds are represented by the FTSE TMX Canada Long Term Government Bond Index; short corporate bonds are represented by the FTSE TMX Canada Short Term Corporate Bond Index; and bond universe is represented by the FTSE TMX Canada Universe Bond Index. You cannot invest directly in an index.

Enhanced yield

These potential gains in times of stock market decline can provide fixed-income investors with some comfort, but in more normal market conditions, many fixed-income portfolios are expected to generate most of their return from income. While short corporate bonds may provide higher yield to maturity, they also tend to involve greater credit risk and may underperform government bonds of similar maturity during volatile periods such as the 2008/2009 financial crisis.

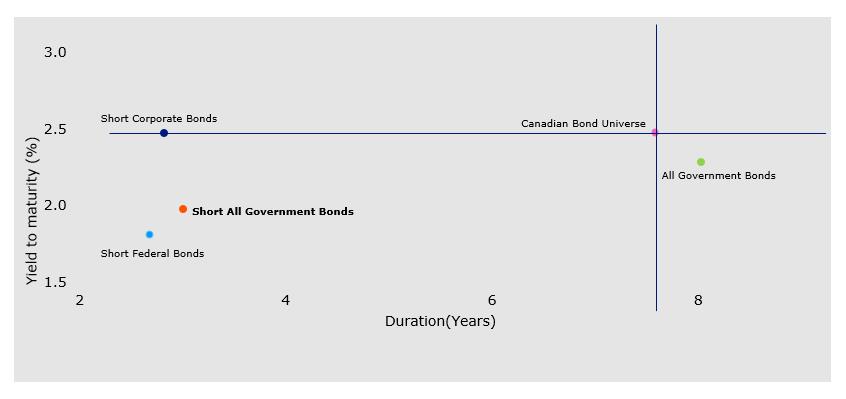

In the following chart, note that a portfolio of short-term bonds across the full spectrum of government issues provides enhanced yield versus federal bonds, with slightly higher duration. In contrast, an all government bond strategy, which includes short-, mid-, and long-maturity bonds, takes on much higher duration risk compared to short-term government bonds for an additional yield.

Short All Government Bonds are represented by the FTSE TMX Canada 1-5 Year All Government Laddered Bond Index. Short Corporate Bonds are represented by the FTSE TMX Canada Short Term Corporate Bond Index. Short Federal Bonds are represented by the FTSE TMX Canada Short Term Federal Bond Index. Canadian Bond Universe are represented by the FTSE TMX Canada Universe Bond Index. All Government bonds are represented by the FTSE TMX Canada All Government Bond Index. Source: FTSE TMX Group , Invesco Canada and Bloomberg L.P. as at December 29, 2017. An investment cannot be made into an index.

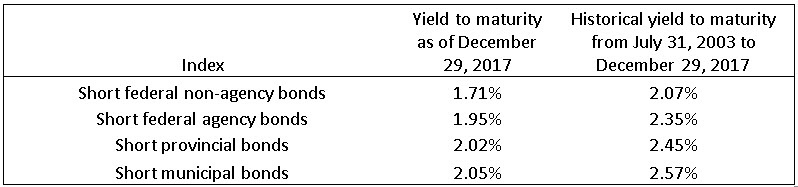

From July 31, 2003 to December 29, 2017, the yield on short municipal bonds averaged 2.57% compared to 2.45% for short provincial bonds, 2.35% for short federal agency bonds and 2.07% for short federal non-agency bonds. While the spread between the Government bond segments has narrowed the relationship still holds today.

Yield frequency: Monthly. Source: FTSE TMX Group, data from July 31, 2003 to December 29, 2017. Short Municipal Bonds are represented by the FTSE TMX Canada Short Term Municipal Bond Index. Short Provincial Bonds are represented by the FTSE TMX Canada Short Term Provincial Bond Index. Short Federal Non-Agency Bonds are represented by the FTSE TMX Canada Short Term Federal Non-Agency Bond Index. Short Federal Agency Bonds are represented by the FTSE TMX Canada Short Term Federal Agency Bond Index. Monthly data.

Less rate sensitivity, less volatility

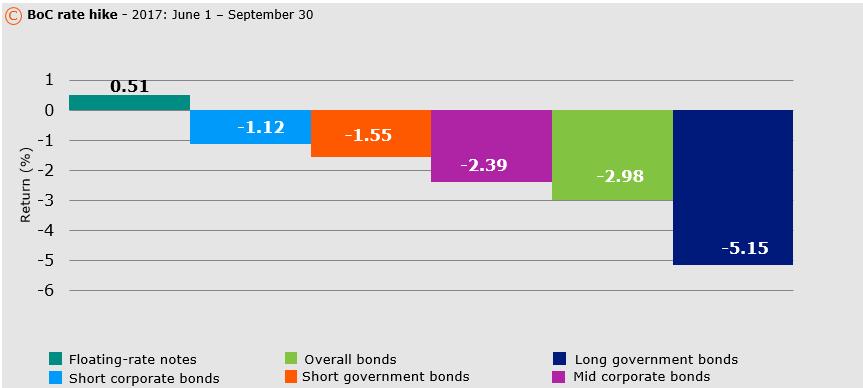

Shorter-maturity government bonds are also generally less sensitive to changes in interest rates compared to longer-maturity government bonds. The following chart illustrates performance of short-term and long-term government bond indices and the short-term corporate bond index during the 2017 rate hike cycle in Canada.

Sources: Morningstar Direct L.P. from June 1, 2017 to September 30, 2017.

Floating-rate loans are represented by the FTSE TMX Canada Floating Rate Note Index; short corporate bonds are represented by the FTSE TMX Canada Investment Grade 1–5 Year Laddered Corporate Bond Index; mid corporate bonds are represented by the FTSE TMX Canada Investment Grade 1-10 Year Laddered Corporate Bond Index; overall bonds are represented by the FTSE TMX Canada Universe Bond Index; Short government bonds are represented by the FTSE TMX Canada Short Term Government Bond Index; and long government bonds are represented by the FTSE TMX Canada Ultra Liquid Long Term Government Bond Index.

For an investor seeking the relative stability of government bonds, along with a yield edge over the standard federal government bonds, a portfolio of short-term, all-government bonds can serve both purposes. Arranging these assets in a laddered strategy can help to reduce rate sensitivity even further.

Strategy in action

PowerShares 1-5 Year Laddered All Government Bond Index ETF (PGB) selects the highest-yielding government bonds within the desired maturity that meet the index-eligibility criteria, which may enhance the overall yield of the portfolio.

PGB’s laddered bonds can help investors navigate different interest-rate environments while managing credit risk. Its consistent stream of income and potential to mitigate interest-rate risk can help investors achieve their income needs.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog