by Equities, AllianceBernstein

There’s a curious anomaly in the US stock market. Shares of highly profitable companies have risen more slowly than their earnings growth has in recent years. This is an important signpost for investors in today’s complex market conditions.

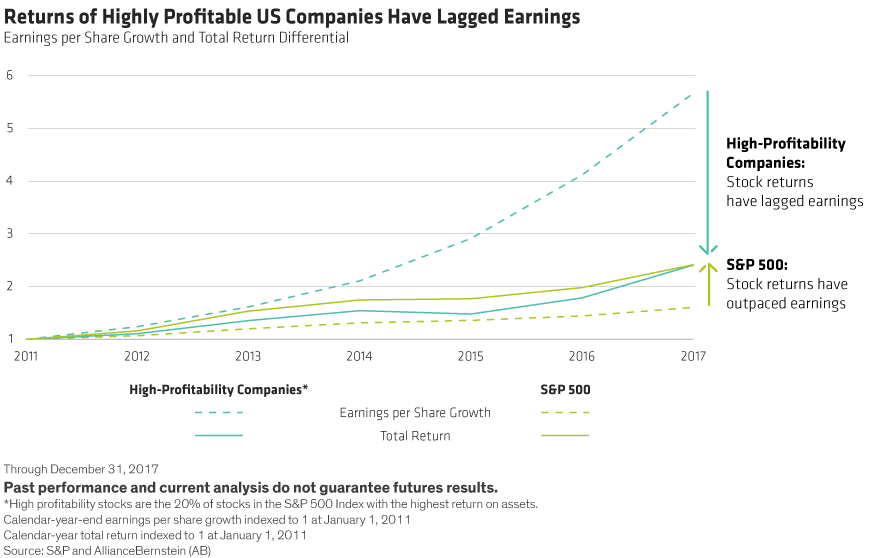

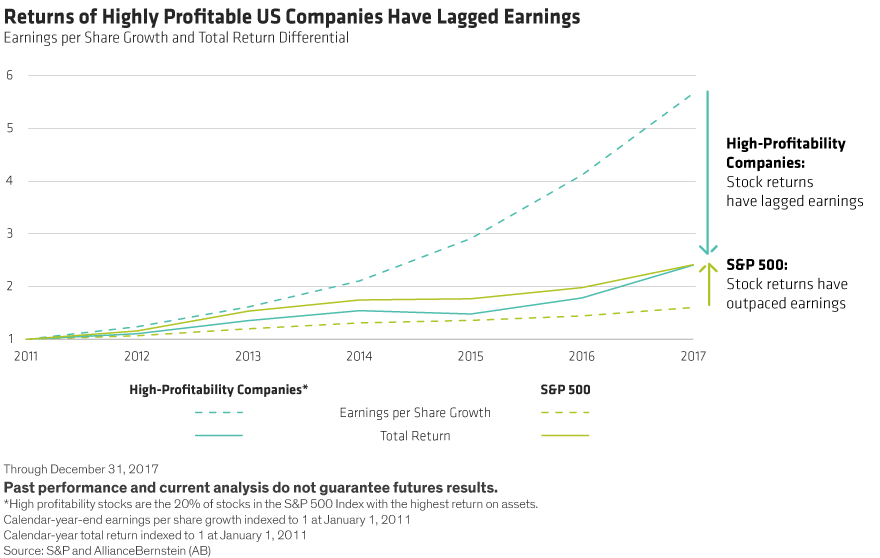

Even after the recent correction and modest bump to earnings from tax reform, US stocks still appear somewhat expensive. Beneath the surface, there are unseen imbalances that have been created by the multiyear bull run. For example, over the past six years, the total return of the S&P 500 Index has outpaced earnings growth of the S&P by a wide margin (Display, green lines). Yet for stocks of companies with high profitability, as measured by returns on assets (ROA), the reverse is true (Display, blue lines). While shares of high-ROA companies have advanced along with the broad market, the pace of their gains has lagged far behind their earnings growth.

Post-Correction Valuations Remain Elevated

How can we explain these trends? In our view, the broad market includes many companies that have modestly increased earnings growth, with stock valuations that have risen much more than earnings have.

Companies like these are especially common in sectors seen as bond proxies, such as consumer staples, utilities and real estate. Investors have flocked to these sectors in recent years in search of dividend yield. Yet even after the recent market correction in early February, the valuations of these companies remain elevated. US utilities stocks ended February trading at 16 times 2018 earnings estimates, while consumer staples stocks traded at 17.8 times. The chart above suggests that S&P 500 companies—in aggregate—would need to generate a lot of earnings growth to catch up with share-price returns. These days, when US operating margins are quite high at 16.7%, that’s a tall order.

High margins also challenge companies that are sensitive to economic cycles. These include industrials and materials groups whose stock valuations have increased on expectations that the global profit cycle will be robust. The profitability of companies like these is often very volatile and tends to revert to the mean—especially given today’s environment of high operating margins.

High-ROA Stocks: Pent-Up Potential

That’s why it’s so important to find companies that can sustain profitability into the future. We believe that ROA is a strong indicator, especially when combined with other predictive factors such as the volatility of profitability and valuation. Indeed, our research shows that stocks of high-ROA companies outperformed the Russell 1000 Growth Index by 3.7% annualized from 1992 to 2017.

Yet as the display above shows, shares of high-ROA companies have lagged their own profit growth in recent years. Since earnings of these companies far exceed returns, their stocks would need to generate big gains to catch up with their profit growth. In other words, we think there’s strong pent-up potential in these stocks that has not yet been recognized by the market.

Positioning for Volatility

So where do you want to be positioned if turbulence strikes again? We would argue that broad market exposure leaves investors more vulnerable to a potential market shakeout, in which stocks that have run too far ahead of their earnings growth could be punished more harshly.

Focusing on high profitability is a great way to prepare for potential market unrest. That means looking for companies with healthy balance sheets, durable business models and prudent management. Companies like these are likely to deliver strong returns through a three- to five-year period, in our view. And if they get hit in a downturn, investors can have conviction in their long-term prospects to increase positions at more attractive prices.

The correction in early February was a wake-up call. It’s time for investors to take a close look at equity portfolios and make sure that their holdings’ earnings history—and potential—is not out of synch with their returns.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein