Although the swings in stock markets haven’t as large as the big moves earlier this month, equities remain choppy heading into March. The NASDAQ 100 once again faltered near the 7,000 level while the Dow and S&P 500 have topped out at lower highs.

The easy money party continues to wind down following new Fed Chair Powell’s testimony to Congress. His bullishness on the US economy particularly following tax reform and increased spending in the budget deal has been taken to indicate that continuing the course of gradual rate hikes and steadily shrinking the Fed’s balance sheet is likely the base case with the potential for acceleration if needed. The prospects of a more hawkish Fed continue to work their way through the asset classes. In addition to putting a headwind in front of stocks, hawkish expectations continue to push up bond yields and boost the US Dollar.

In this issue of Equity Leaders Weekly, we take a look at how the rebounding US Dollar Index (which is back above 90) along with political factors on the continent may impact trading in the Euro. We also look at how winter weather appears to be influencing pricing in grain futures, particularly Wheat.

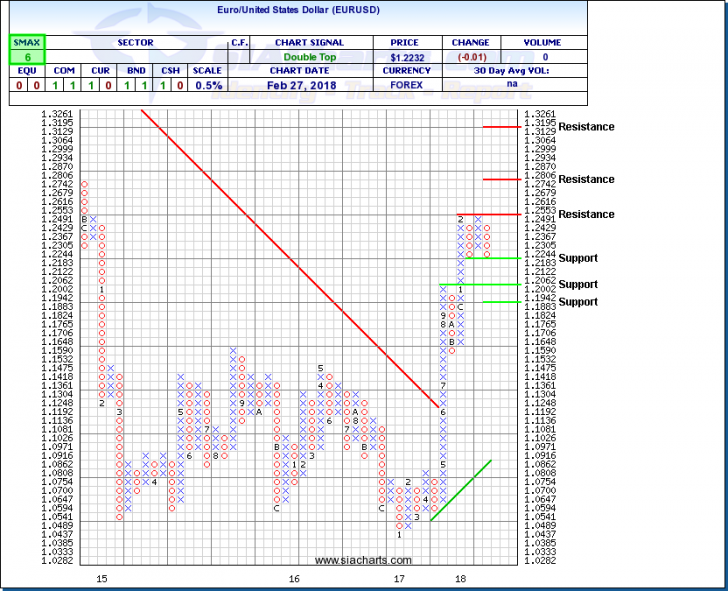

Euro/US Dollar (EURUSD)

The EURUSD forex pair is the largest component of the US Dollar Index and is recognized as the most liquid paper currency pair in the world. Trading in EURUSD can be influenced by both changes in sentiment toward the US Dollar and attitudes toward the EU economically and politically. Over late 2017 and the start of this year, EURUSD soared up from near $1.1600 toward $1.2500 but has recently levelled off in the $1.2200 to $1.2500 zone. A double top in the candlestick chart suggests that upward momentum may be slowing, and a reversal is possible.

There are a number of trends and events playing out this week that have the potential to knock EURUSD out of this current trading range. First, the US Dollar continues to show signs of life, which could weigh on the pair. With Fed Chair Powell’s testimony leaning toward more interest rate increases going forward, the greenback has been steadily recovering. Data coming out over the next week heading toward nonfarm payrolls on Friday the 9th and the first meeting of the Powell led Fed on March 20-21 could have a significant impact on trading in many USD pairs in the coming days.

Political developments may also impact trading in EURUSD from the Euro sentiment side. Brexit is moving back into the headlines with talks heading toward their next phase. The EU released a position paper on Wednesday and a speech from UK Prime Minister May on Friday could influence trading in both the Euro and the British Pound.

The event that could have the biggest potential ramifications for the Euro is this weekend’s Italian parliamentary election. Polls suggest that the Euroskeptic Five Star Movement may win the most seats but may not be able to form a government if other parties are able to cobble together a coalition. After big populist wins in the UK and US in 2016, Euroskeptic forces suffered setbacks in early 2017 in the Netherlands and France. Late 2017 saw populists make inroads in Germany and Spain (Catalonia) but not enough to rock the foundations. Italy’s election may provide a key test of the staying power of the EU as a political project and could have a significant impact on the Euro. If Five Star does better than the 28% it had been running in the polls, the Euro could weaken, but if Five Star underperforms or other parties can quickly form a government, the Euro could rally.

The chart shows current support and resistance for the Euro near $1.2183 and $1.2553 with next upside resistance possible near $1.2806 and next potential support near the $1.2000 round number or $1.1883. With an SMAX score of 6, the near term relative strength gives a slight edge to EUR at this time.

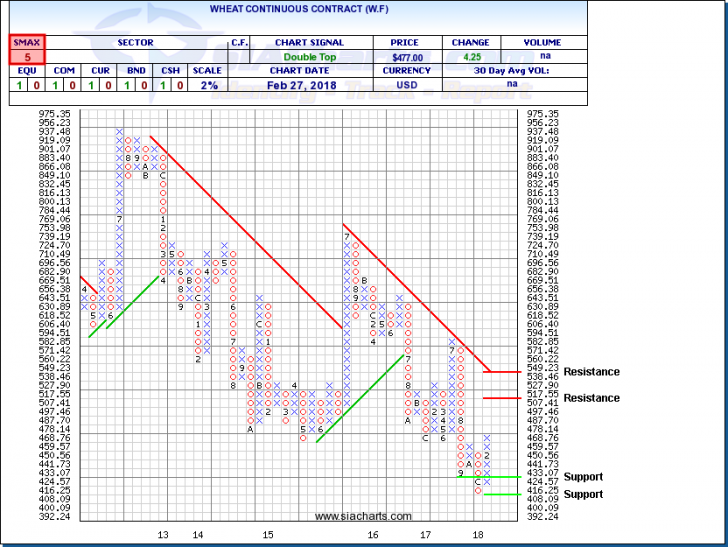

Wheat Continuous Contract (W.F)

While recent pullbacks in energy and metal markets have captured the attention of some commodity market followers, the grains group has been accelerating upward in recent days. Earlier this week, the US Department of Agriculture indicated that in Kansas only 12% of wheat was in good or excellent condition, boosting the price of wheat. A drought in Argentina, meanwhile, has sent soybean contracts soaring. Expectations that a drought in the US Plains States may continue into the spring could keep a tailwind behind grain prices in the coming weeks.

Wheat has recently shown signs of turning upward with a breakout over 468 completing a double top and potentially signalling the start of a new recovery trend. A move through 500 may be needed to confirm the upturn with initial resistance possible near 517 then 549 where a longer-term downtrend line would also be tested. Initial support may appear in the 424 to 433 area with a floor apparently in place near 408. With an SMAX of 5 out of 10, W.F is showing some, but not much near-term relative strength versus the asset classes.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

For a more in-depth analysis on the relative strength of the equity markets, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our sales and customer support at 1-877-668-1332 or at siateam@siacharts.com.