How to Recruit the Right Advisor for Your Firm

by Commonwealth Financial Network

“I want to hire an advisor” is something that we hear quite frequently in the Practice Management department at Commonwealth. While it’s a common goal for many advisors, the results for those who have tried their hand at hiring have been mixed. Sound familiar? If this is something you’ve been thinking about (or maybe even tried), the good news is that there are strategies to help you recruit the right advisor for your firm. To get you started down the right path, my colleague, Angela C. Sarver, and I will share these strategies, as well as tips for how to implement them at your firm. The first step we recommend is identifying the problem.

“I want to hire an advisor” is something that we hear quite frequently in the Practice Management department at Commonwealth. While it’s a common goal for many advisors, the results for those who have tried their hand at hiring have been mixed. Sound familiar? If this is something you’ve been thinking about (or maybe even tried), the good news is that there are strategies to help you recruit the right advisor for your firm. To get you started down the right path, my colleague, Angela C. Sarver, and I will share these strategies, as well as tips for how to implement them at your firm. The first step we recommend is identifying the problem.

Some advisors will meet someone they like or get a positive referral and then pursue the hire without considering the overall firm. But you never want to create a position for a person. Instead, the needs of the firm should always be the driver of your hiring process. To help identify those needs, ask yourself what problem you are trying to solve by hiring an advisor. Here are some of the common themes we’ve heard in response to that question:

- Another advisor is needed to work with existing clients.

- The addition of a producing advisor is part of the firm’s growth strategy.

- Bringing in an advisor with a different specialty will provide an opportunity to enhance the services offered to clients.

- A next-generation advisor is wanted for continuity or succession planning.

Once you’ve identified the problem, start crafting a job description that captures the responsibilities of the position. This will help you articulate what is needed in the firm and begin your hiring process objectively.

Next, it’s time to think about recruiting. For years, traditional methods—such as posting to job sites (e.g., Monster or CareerBuilder) and cultivating professional networks—have worked. More recently, however, the recruiting climate has shifted. While professional networks remain a viable source of candidates, social media is playing a much bigger role in the recruiting process.

Sites like LinkedIn and Twitter have a wide reach, which can make identifying the right candidate a challenge. Some advisors have found success with the job site Indeed. There, you can post a job for a nominal amount and search its candidate database for free. In addition, many universities offer sites specific to alumni who are seeking jobs—another place where you may be able to post your position for free. The CFP Board has a job site as well.

Of course, these are just a few ways to recruit the right advisor for your firm. Whatever option you choose, you are likely to find candidates with varying levels of experience. For our purposes, we’ll focus on two groups:

- Experienced advisors with existing practices

- Next-generation advisors from the talent pool at colleges and universities

While the recruiting strategies for these two groups are not mutually exclusive, there are pros and cons to weigh with each.

Hiring an experienced advisor with an existing practice poses many challenges, not the least of which is a potential culture clash. If you think this might be the right path for your firm, here are the questions you should be asking:

- Will this advisor be a solo within your firm, contributing to overhead and running his or her own practice? If so, how will you handle branding and marketing?

- Will the advisor integrate into your firm as part of an existing or future ensemble? Does this strategy fit into any next-generation talent planning you have in the works?

- If this advisor has experienced success as a solo, what is his or her motivation for joining forces with you?

On the other end of the spectrum is the next-gen candidate, one who may have limited or no experience in an advisory role. Here, hiring from colleges and universities can be a worthwhile strategy.

If you’re like many advisors, focusing your search based on geography might be your first inclination. But our current thinking in Practice Management is to focus instead on undergraduate financial planning degree programs (e.g., Texas Tech, Texas A&M, Virginia Tech, Clemson). It might surprise you to learn that there are more than 100 programs in this space! Here are some actions you can take now:

- Teach a class or two per semester at a financial planning college or university.

- This will give you the opportunity to build relationships with professors and meet directly with students.

- Hire students as interns.

- This strategy will allow you to test out potential full-time hires while giving back to the community where you live and work.

- Be sure to post your internship role on the university or college website to cast the widest net.

A long-term proposition. It’s important to keep in mind that hiring a next-gen advisor is a long-term proposition. Many advisors who wish to hire or have hired an inexperienced candidate believe they can pay a salary for a year or two and then the new hire will be financially self-sufficient. But our experience in Practice Management tells us otherwise.

Along with a two-year, Compliance-approved training plan (which is something we require of our affiliated advisors), there needs to be a long-term development plan. A new advisor will likely start a career with you as a planning associate and/or in a client service role, with a path leading to a service advisor or producing advisor. This will not be a 1- to 2-year sprint. Rather, it will be akin to a 5- to 10-year marathon! Creating a glide path that brings this type of individual in with client service and planning associate duties is a good first step. Only then can you evaluate his or her potential to move into a service or producing advisor role down the road.

If you decide to move forward and have found a pool of suitable candidates, it’s time to assess their potential fit. One of the main ways to accomplish this part of your hiring process is by conducting a thorough interview. Advisors will often engage in a conversation that confirms a candidate’s likeability and cultural fit. But it’s important to not overlook soft skills like communication and problem solving. To get a true feel for a candidate’s skill set, consider these sample interview questions:

- Tell me about a time you came across a problem you’d never seen before. How did you handle it?

- How do you build new relationships?

- How would you define outstanding client service? Tell me about a time you delivered it.

- Tell me about a time you were responsible for a breakdown in communication. How did you handle it? What was the outcome?

If you’re interviewing a candidate with experience, there are specific questions you can ask to assess his or her skills and fit:

- Why do clients trust you with their money?

- Describe your prospecting process.

- What percentage of your sales calls (initial contacts) result in full presentation (a sale)?

- Describe the most creative (or significant, or challenging, or most enjoyable, or most difficult) approach you took to generate new leads. What was the outcome?

- How do you build new relationships? How do you enhance existing relationships?

- Tell me about a time when a client did not agree with your recommendations. How did you handle it? What was the outcome?

Other tools like the Predictive Index and Kolbe surveys can also help you assess a candidate’s fit for the position.

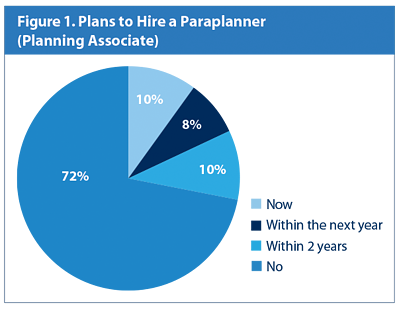

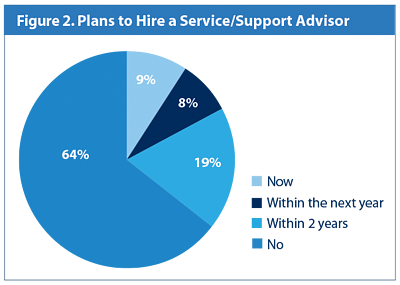

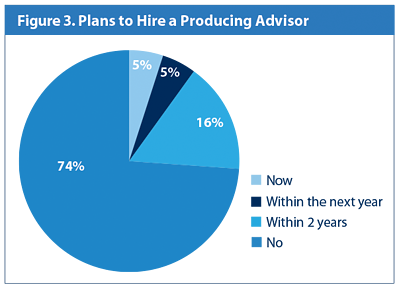

As you think about the next steps for your firm, we thought it might be helpful to give you a snapshot of what Commonwealth-affiliated advisors are thinking about in terms of hiring. Our primary research reveals that 10 percent of our advisors plan to hire a paraplanner “now” (see Figure 1), 19 percent plan to hire a service/support advisor within two years (see Figure 2), and 5 percent plan to hire a producing advisor within the next year (see Figure 3).

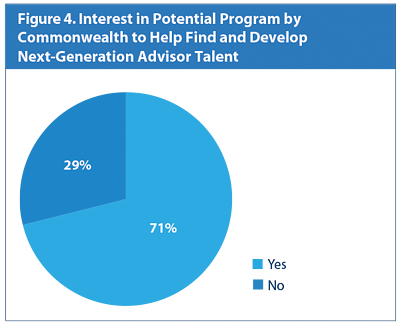

But perhaps the most interesting finding? A majority of Commonwealth advisors (71 percent) would be interested in a program to help them find and develop next-gen advisor talent (see Figure 4). We’re taking these findings seriously and exploring options for creating such a program.

As you can see, there is much to consider as you begin to recruit the right advisor for your firm, whether he or she is right out of college or an experienced professional. Referring to these considerations, strategies, and resources during your hiring process can help ensure that any future advisor relationship you begin is set up for success.

What strategies have you used to recruit the right advisor for your firm? How do you determine if a candidate is a good fit for your office? Please share your thoughts with us below!

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network