Emerging markets as a source of corporate revenue

As you may well know by now, Trimark portfolio managers are not macro investors. We don’t spend our time formulating top-down macro views. Instead, we research individual companies to find those that we believe offer the best return potential.

The Trimark Global Equities Team’s research is strictly focused on finding high-quality companies that meet our “FORS” quality criteria (the acronym FORS refers to our focus on a company’s Free cash flow, Organic growth, Return on capital, and Sustainable competitive advantage).

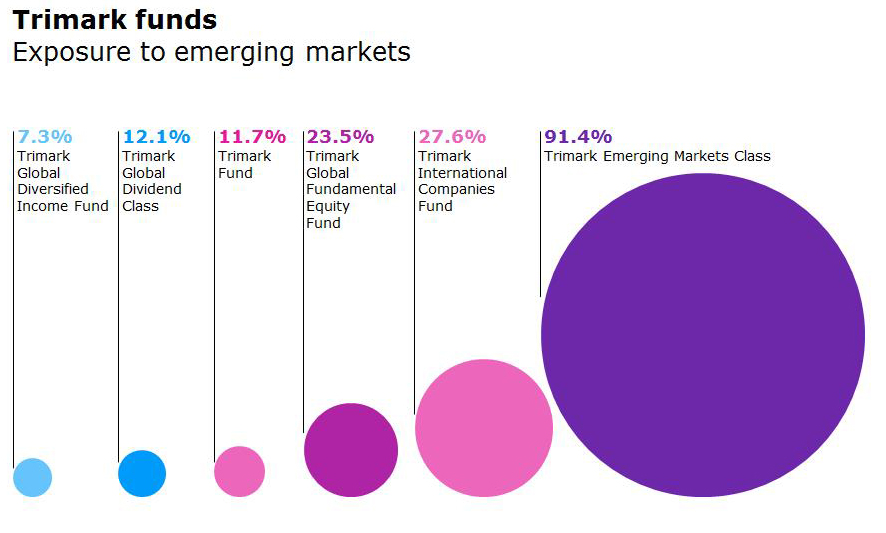

That said, our bottom-up process provides some insight as to where we are finding opportunities. For example, the majority of the FORS mandates have significant exposure to emerging markets, based on where the business is headquartered as depicted in the chart below.

Source: Invesco, as at December 31, 2017.

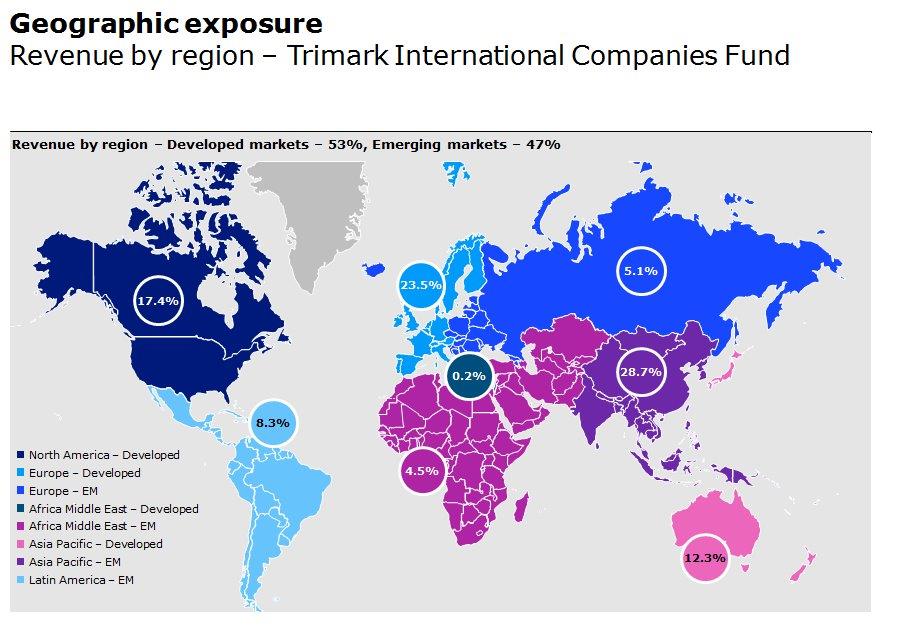

While looking at where the company is headquartered may be interesting, it does not give a complete picture of the company. More interesting to me is where the company generates its revenues. For example, 27.6% of Trimark International Companies Fund’s assets are domiciled in emerging markets – but the Fund’s revenue exposure to EM is approximately 45%.

Sources: FactSet Research Inc. and Invesco Canada Inc., as at December 31, 2017.

While it’s true that we see a lot of growth potential in emerging markets, our revenue exposure to them should not be confused with a top-down, macro-driven investment approach. Our bottom-up process aligns with many of the opportunities we see globally.

Why emerging markets?

Over the past five years, emerging markets underperformed developed markets by more than 36%, cumulatively†. Compared to developed economies, emerging markets are home to many companies with cheaper valuations, higher margins and lower debt, with potentially stronger growth.

Emerging markets can provide fertile ground for a fundamental research driven investment discipline, because companies located in these markets in some cases have little to no analyst coverage. It can take longer for material information to be disseminated and reflected in share prices. This provides the opportunity for active managers to use their experience and skill as bottom-up stock selectors to find hidden gems. In addition, many local investors often focus on short-term momentum, instead of long-term fundamentals. This gives investors like us, who are willing to endure short-term uncertainties and volatility in exchange for long-term upside, an opportunity.

Emerging market economies are growing faster than developed markets and now represent more than 50% of world GDP, but less than 15% of world market capitalization‡. Over time, I believe that market capitalization will move closer to the share of global GDP.

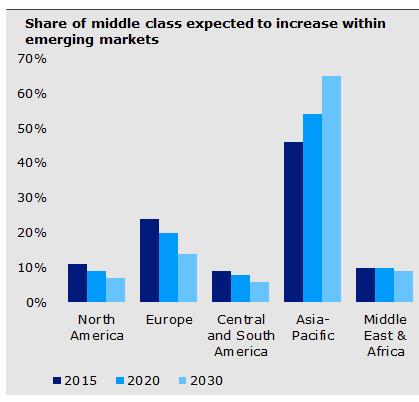

I’ve written before about the growth of the middle class within emerging markets. This shift from subsistence to prosperity is well underway, but is nowhere near being played out. As the middle class continues to grow, its members can be expected to move from consuming the things they “need” to the things they “want,” such as increased tourism, entertainment, and private education services.

Source: Kharas, H. (2017), “The Unprecedented expansion of the Global Middle Class, An Update”,Global Economy and Development at Brookings, February 2017. Source: FactSet Research Systems Inc. and Invesco Canada.

In aggregate the FORS team manages or provides emerging markets research for approximately $1.3 billion in AUM across all Trimark strategies. This is a testament to the value we feel emerging markets brings to our funds and the excess return potential the portfolio management team believes it can provide.

As emerging markets mature, I expect they will represent an ever greater share of revenues for most global companies, regardless of their location.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog