by Rob Waldner, Chief Strategist and Head of Multi-Sector, Invesco Fixed Income, Invesco Canada

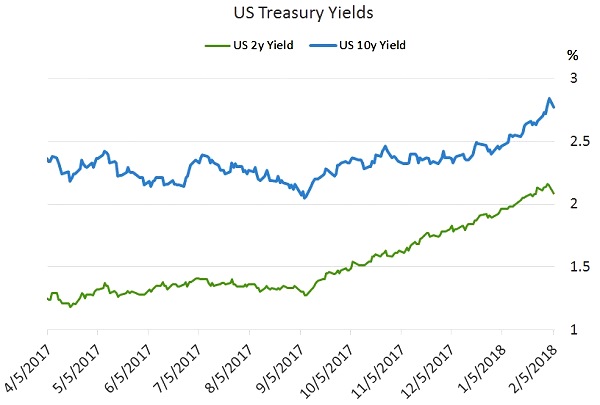

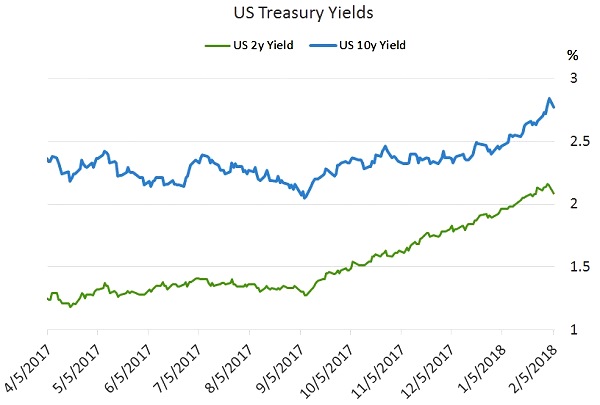

Market expectations of inflation have risen in recent days, after signs of wage growth – often seen as a harbinger of inflation – appeared in the January jobs report. We at Invesco Fixed Income believe investor concerns that inflation is finally showing signs of life have helped drive interest rates higher and impacted credit markets, where worries over higher interest rates (and their potential impact on companies) have caused declines in stock markets and other risky assets.1

We have noted for a while that investors may have been underpricing inflation and that signs of potential price pressures could disrupt markets. Inflation is a risk we are monitoring closely. This is because concerns over inflation could incentivize the U.S. Federal Reserve (Fed) to hike interest rates faster and higher than previously expected. Tighter monetary policy could tighten overall financial conditions, which could be negative for financial markets.2 There has been little realized inflation, but recent volatility suggests that bond investors are beginning to worry that inflation will rise sharply on the back of strong growth boosted by tax cuts in a late-cycle economy.3 We believe that few investors have anticipated a sharp rise in inflation, so this would be a surprise to the market.

We have noted for a while that investors may have been underpricing inflation and that signs of potential price pressures could disrupt markets. Inflation is a risk we are monitoring closely. This is because concerns over inflation could incentivize the U.S. Federal Reserve (Fed) to hike interest rates faster and higher than previously expected. Tighter monetary policy could tighten overall financial conditions, which could be negative for financial markets.2 There has been little realized inflation, but recent volatility suggests that bond investors are beginning to worry that inflation will rise sharply on the back of strong growth boosted by tax cuts in a late-cycle economy.3 We believe that few investors have anticipated a sharp rise in inflation, so this would be a surprise to the market.

However, our inflation forecast for 2018 (1.8%) suggests that inflation is unlikely to rise quickly to a level that will concern the Fed. We do not believe that inflation is dead, but we do not think it is likely to become a driving factor of monetary policy soon. While inflation concerns may drive interest rates higher in the future, it is premature for the market to factor in a sharp Fed reaction, in our view.

We believe that recent market moves have been driven more by investor repositioning than major changes in economic fundamentals or financial conditions. These moves may have been reinforced by certain financial products that are sensitive to changes in volatility.

In terms of economic fundamentals, Invesco Fixed Income believes that growth should continue to be strong, fueled by easy monetary and fiscal policy, and that inflation is unlikely to accelerate in the next couple of months.4 We do not believe that economic fundamentals justify the high level of market volatility we are currently seeing. That said, we expect risky assets to perform well as volatility subsides, supported by solid growth (we expect 2.75% growth this year) along with continued low inflation and interest rates.

Invesco Fixed Income’s view of key asset classes:

Investment grade

Investment grade credit spreads are tighter compared to the start of year.5 We believe the sharp drop in the supply of corporate bonds has been supportive, as companies have used repatriated cash rather than issue new bonds in the investment grade market. Over the past few days, as market volatility has increased, investment grade spreads have held in well.6 Liquidity appears lower than usual, but markets are operating normally.7

We are focused on analyzing the impacts of tax reform on inflation – especially on wage pressures. While inflation itself is typically not bad for credit spreads, potential Fed rate hikes to combat this could be negative. We believe markets need to reassess inflation expectations and monetary policy before we see stability.

Taking a longer-term view, we believe greater volatility could generate attractive opportunities for certain high quality, high yield and investment grade bonds. Such opportunities have been difficult to find in the past. We believe the positive trajectory of the economy continues to support credit, but we are aware of increased volatility risks and the need to be agile.

High yield

The high yield market has been pressured downward by the recent sell-off in risky assets but has outperformed the S&P 500 Index month-to-date.8 In general, the spillover effect of the recent market volatility on high yield has been limited. As we view the high yield market today, we see strong fundamentals and benign overall financial conditions. We do not believe these market underpinnings have changed in the last few weeks. While we acknowledge that overall high yield spreads are tight, we still see value in selected individual names.9 In terms of performance, we believe strong underlying fundamentals will likely allow us to return to a healthy market in which spreads continue to narrow. History has shown that high yield has performed well in rising interest rate environments, having benefited from growing earnings and potentially lower default risk in a stronger economy.10

Emerging markets

In general, volatility has been muted in emerging markets relative to what we would expect based on history, given the significant sell-off in developed market equities. We believe this is due to still-easy overall financial conditions, even if they are tightening somewhat. In the past, the U.S. dollar has often appreciated when U.S. Treasury yields were rising, but this has not been the case recently – and as a result, financial conditions have remained easy.

The primary risk we see to emerging markets debt is a strengthening in the dollar that markedly tightens financial conditions; this could lead to a widening in emerging markets credit spreads and depreciation in emerging markets currencies versus the dollar. Absent such a move, we expect the emerging market asset class to hold up relatively well.

We do not view the recent financial market sell-off as indicative of a slowdown in global growth, but rather a short-term, market-volatility event. Unless the sell-off deepens and materially impacts financial conditions, we do not expect to adjust our expectations for emerging markets growth, fundamentals or return expectations for emerging markets debt for this year.

European fixed income

The yield on the benchmark 10-year German government bond has risen from 40 basis points at the start of the year to 75 basis points in the past week.11 This is a response to an upbeat European Central Bank (ECB) President, Mario Draghi, and the realization that quantitative easing (QE) in the euro area is coming to an end. Our analysis suggests that the ECB could cease its bond-buying program in September, after which other investors would be expected to take up the slack.

While it is possible the market could overshoot, we do not think the European bond sell-off will gather pace unless we begin to see signs that inflation is gathering pace. Our analysis indicates that global inflation pressures could remain subdued for the next six months or so, enabling the ECB to remain accommodative. A slow and gradual approach, coupled with a continued buoyant global economic environment, should be good for risk assets, in our view. The risk, however, is that, with labour markets tight in some regions, such as Germany, we may begin to see material wage increases and subsequently higher inflation. The probability of this scenario has increased in recent months.

As global central banks, including the ECB, bring their QE programs to an end in 2018 and begin to raise interest rates, the safety net is being removed and markets will have to survive without the ECB’s constant (and reassuring) demand for bonds. This should undoubtedly create a more volatile environment. However, that may be a positive dynamic for active investors. As central bank policies diverge, we could see more dispersion of returns across markets and asset classes, meaning there may be more relative value opportunities and greater opportunities within currency and rates markets.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog