by Michael Antonelli, Managing Director, Robert Baird and Co.

Equities start the day flat after the biggest skirmish since the Battle of Bull Run. And while that battle started a larger war I don’t think we are facing the same escalation. So what on God’s green earth happened yesterday? What one event caused the biggest selloff we’ve seen in YEARS. Well my friends you just witnessed the death of a very popular trade made popular by Target managers. For years people shorting volatility have made stupidly easy money.

[Tweet "Bull Markets end primarily because of recessions, not from popular trades imploding. @bullandbaird"]The market goes up and to right, no one cares about anything in the World so the trade has minted countless millionaires. That trade started to crack late last week (due to fears about rising yields) and it truly imploded on Monday/Tuesday. You see everyone short volatility needed to cover that position and in order to cover they effectively needed to buy VIX. As the VIX soared it caused every PhD programmed computer to sell stocks indiscriminately.

Why were they selling stocks? Because the VIX was going up. Why was the VIX going up? Because the Target manager guy was trapped short. That endless circle played out and knocked the DJIA down 1500 pts. Look, it’s been so long since anything happened that yesterday’s price action feels very ominous. But you know what? On average the market falls 5% three times a year, on average it falls 10% once a year, and on average it falls 20% once every 3 to 5 years.

The question we have to ask is are we witnessing the end of the Bull Market? IMHO we are NOT. Bull Markets end primarily because of recessions, not from popular trades imploding. Does anyone think the economy is currently in or near a recession? All I know is that the “short volatility” trade just got buried in our history books alongside the Confederacy and you were there to witness its fall. God I love markets when things finally happen…let’s go baby!

After the open it was chaos mixed with anarchy and a dash of madness. Most of the VIX ETFs were halted (probably for redemption) and futures diverged from cash because they sold off after the close on Monday. At one point S&P futures were up 2% while the index was negative. If you wanna learn about spot futures parity go here but honestly I’d rather bang my head against an icicle than re learn that. Anyway, $SPX rallied slightly off the bell but spent the bulk of the morning going sideways because no one wanted to make a move while the VIX churned.

Here’s a random sample of VIX prices in the first 3 hrs of trading: 23, 32, 40, 46, 35, 32, 30. Efficient market theory? What a bunch of garbage. When something this complex unwinds it’s going to disjoint markets and that’s exactly what happened. Random people losing $4 million overnight tends to make the market indecisive. Winners TRIP, SWKS, MU, NWL, TPR, GM.

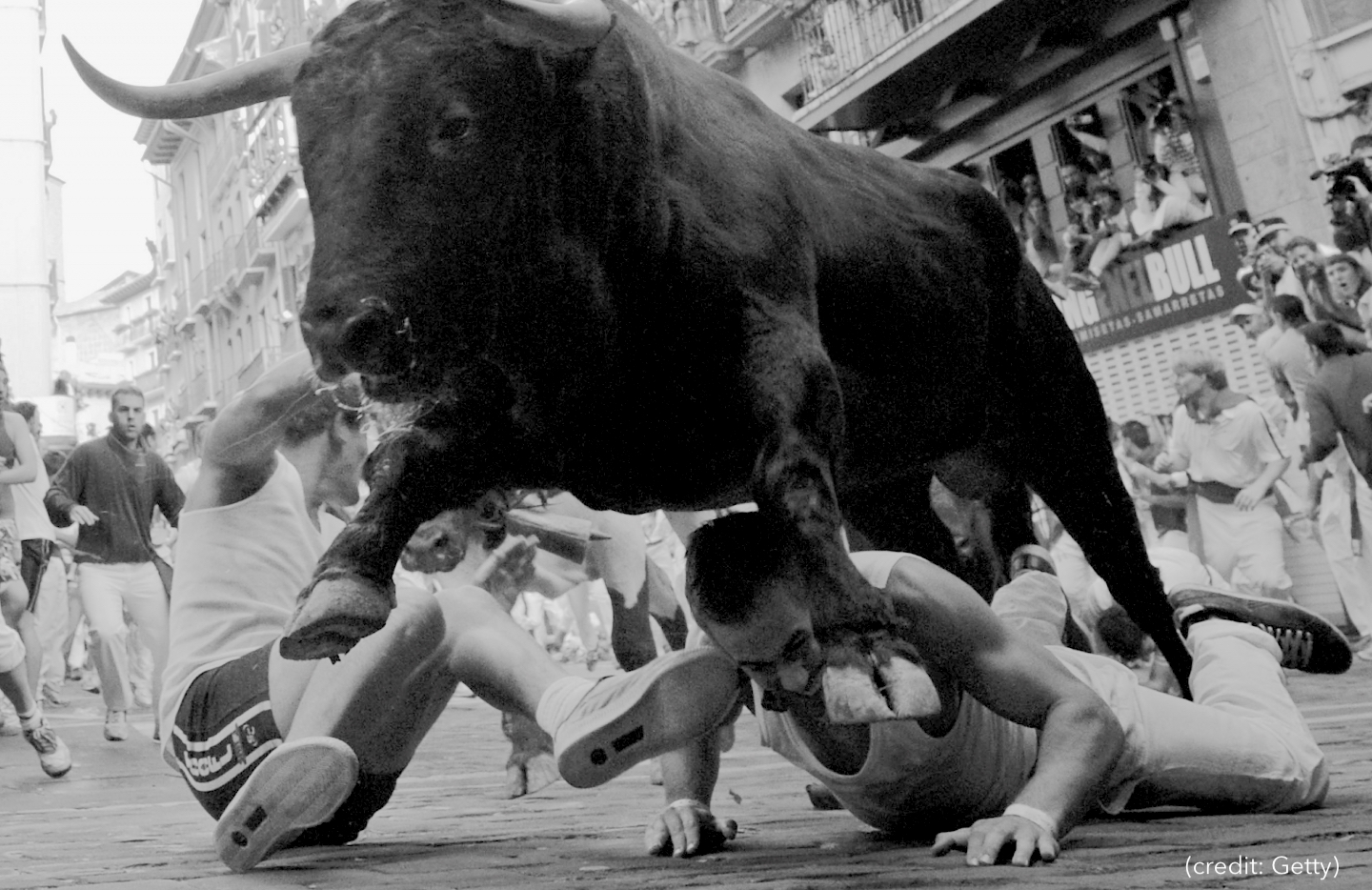

Losers CBOE (I assume from all the lost vol biz), ARNC, IT, CMI, PEG, and FIS. Things were nutty at the individual stock level but indices really didn’t go anywhere in the morning. By lunch the S&P was down 37bps, the DJIA was down 12 bps, and the Nasdaq was up 17bps. If you skipped all that looking for a video to sum up what it’s like selling vol you can just click here. Eventually you miss the ledge…

The afternoon saw a wallop of a rally as the market, for now at least, brushed off fears about a larger meltdown. We closed at 2,695 up 1.75%. Hey…we all wanted things to move again right? Violent price action creates opportunity, it always has. Don’t bemoan markets finally waking up from their slumber, embrace it and try to find ways to profit.

Active management needs these kind of events to show their investors that their process works and that they don’t take 4% losses in a day the S&P 500 ETF did. I’m off tomorrow but we’ll be back on Thursday to see how the week ends! Oh and while we sat here fretting over a made up volatility index Space X did this. Perspective people…

Final Score: Dow +234bps, S&P500 +175bps, Nasdaq +213bps, Rus2k +108bps

News Highlights:

- Succinct Summation of the Day’s Events: Sorting thru the carnage after a popular trade melted down. Fingernail biting everywhere

Ok so I have to end on this video because it perfectly encapsulates what the market felt like yesterday.

Have a good night.

Copyright © Robert Baird and Co.

About Michael Antonelli

Michael Antonelli is a Managing Director and equity sales trader at Baird, where he covers International clients. Prior to joining Baird in 2007, he worked in derivative sales at Fimat, a division of Societe Generale.

In 2013, Michael launched “Bull and Baird,” a market blog that explores catalysts moving the day’s financial markets, shares links to relevant news stories and editorials, provides market perspective and offers comic relief on the day’s developments.

Michael received an MBA in analytic finance from the University of Chicago Booth School of Business and is a graduate of Purdue University.