February 5, 2018

Hey Equity Markets, Bond Yields toll for thee

by Craig Basinger, Chris Kerlow, Derek Benedet, Shane Obata, Connected Wealth Richardson GMP

The TSX has dropped over 4% this past week, the S&P 500 is down almost 4%, about the same for global equities. Could the long hiatus of supressed volatility be coming to an end? Suppose it had to at some point. The root cause of the recent weakness is something worth considering given everything except yields would argue for a healthy market. Earnings growth this season has been solid, based on the 50% of the S&P 500 index members having reported already.

Surprise rates for earnings and sales are running at 80%, historically high. This has sales growth tracking 10% and earnings growth 15%, hard to complain about those stellar results. The global economy is chugging along nicely with expectations on the rise. Geopolitical risk, which is always present, has been pretty low of late. Even the North Korean athletes are heading to the Olympics. So this weakness can be attributed almost solely to rising bond yields.

Surprise rates for earnings and sales are running at 80%, historically high. This has sales growth tracking 10% and earnings growth 15%, hard to complain about those stellar results. The global economy is chugging along nicely with expectations on the rise. Geopolitical risk, which is always present, has been pretty low of late. Even the North Korean athletes are heading to the Olympics. So this weakness can be attributed almost solely to rising bond yields.

Bond Yields a risen

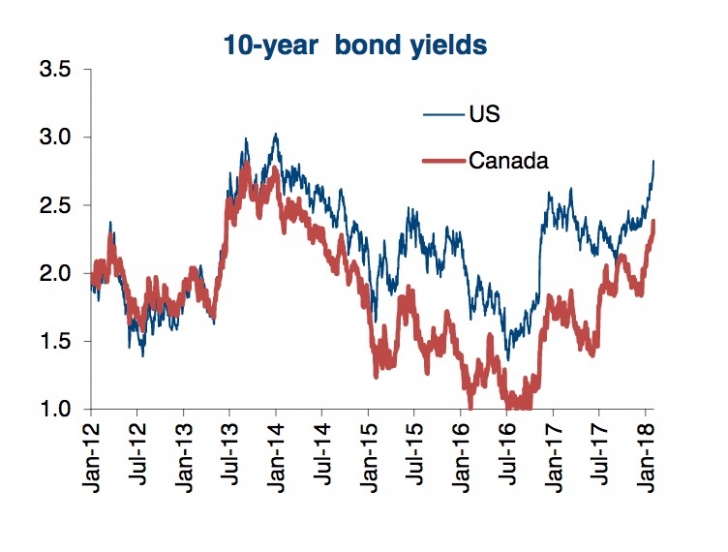

The ten-year bond yield in the U.S., Canada and just about everywhere around the globe, have turned upwards over the past few weeks. In some cases at a surprising rate. Ten-year Treasuries are now yielding 2.84%, up over 50bps in just over a month. In Canada, our ten-year Gov yielded below 1% in 2016 and is now approaching 2.4%. The German ten-year had a negative yield in 2016 and is now a juicy 0.76% (note: juicy was an attempt at sarcasm).

Bond yields are moving higher for two reasons in our view. The first, that while quantitative easing (QE: open market bond buying that puts downward pressure on yields) continues at the Bank of Japan and European Central Bank, there is rising speculation they may be reduced in the near future. The Fed pretty much ended QE in 2014. The others may stop or slow soon for the simple reason that the global economy is doing well, and so are their economies.

Japan’s economy grew 2.5% in the latest quarter and the Euro-zone is running at about 2.4% (annualized pace). Hardly paces that would warrant continued unprecedented monetary policy. Ok, maybe QE is no longer ‘unprecedented’ but if we had to guess, it looks way too long in the tooth given the data.

Where is the pain point?

For the record, we don’t think this recent weakness is the end of the bull cycle as many of our market cycle indicators remain positive (25 out of 30). However, if we had to guess how this market cycle does end, we do believe it will be at the hands of higher bond yields. Clearly 2.8% is not a high yield, nor is 0.8% for a German bond. But given the amount of QE over the past decade, the pain point for higher yields may be lower than most would normally expect.

QE did not foster a material amount of economic growth directly, but it did foster higher asset prices. Simplest example would be the central bank buys a bond from you or me, putting downward pressure on yields. We then take the proceeds, and go to buy another bond, or if a higher yield is required, equities, real estate, wine, art, etc. Asset prices go up, we feel wealthier and the economy does better thanks to higher confidence. Problem solved…for now.

QE did not foster a material amount of economic growth directly, but it did foster higher asset prices. Simplest example would be the central bank buys a bond from you or me, putting downward pressure on yields. We then take the proceeds, and go to buy another bond, or if a higher yield is required, equities, real estate, wine, art, etc. Asset prices go up, we feel wealthier and the economy does better thanks to higher confidence. Problem solved…for now.

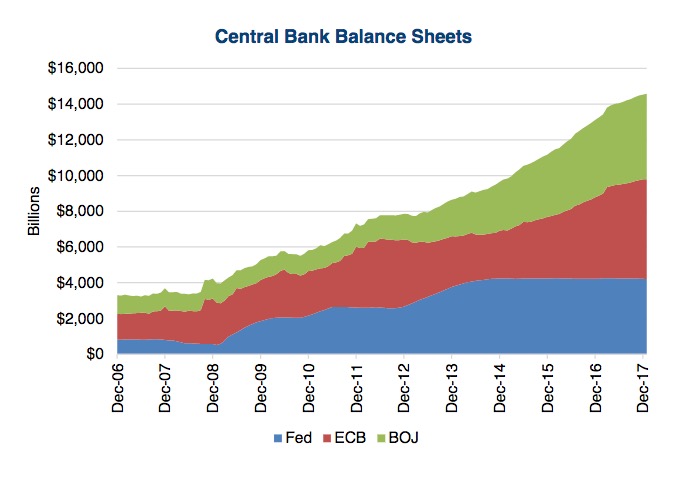

Except now bond yields are ticking higher, albeit still low from historical standards. But if QE in combo with lower yields inflated asset prices, will the removal or slowing of global QE plus higher yields do the opposite? Likely, with the big question being by how much. Central bank balance sheets went from $4 trillion in 2007 to over $14 trillion today (Top chart: Fed, European Central Bank and Bank of Japan). Given that $10 trillion helped inflate asset prices the sensitivity to higher yields may be much lower than many expect. Perhaps we are seeing a hint of this today.

Cycle End Game

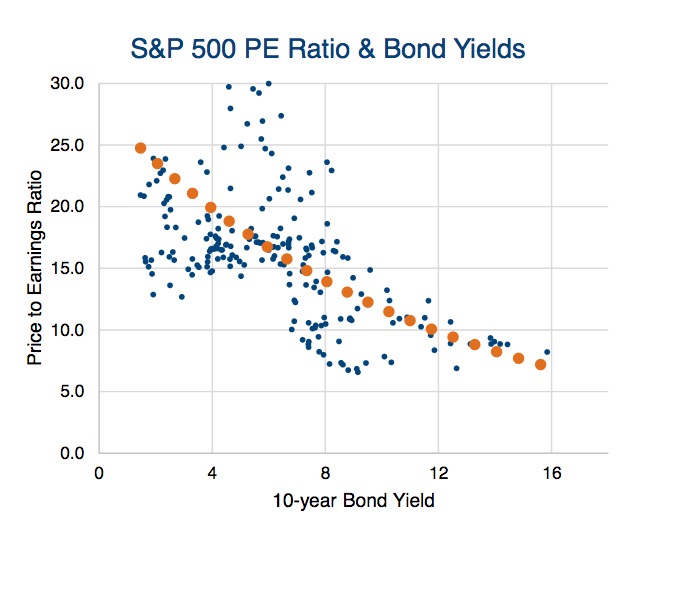

Higher bond yields will weigh on asset prices, including not just bonds but also equities and other assets such as real estate. There is a relationship between bond yields and the market price-to-earnings. Higher bond yields usually equal a lower market multiple. If bond yields continue to rise on the back of better economic data, we could see broader asset prices fall. This could cause the wealth effect and confidence to decline, circulating back to lower economic activity. In our view this scenario is a front runner for what will end the current bull market. With the most important question being at what point will higher yields potentially trigger this scenario. We don’t think this week’s market action is the start but may be a hint of things to come in the quarters or years ahead. Bond yields, inflation and other economic data will be key.

*****

Charts are sourced to Bloomberg unless otherwise noted. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of securities mentioned herein. Past performance may not be repeated. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. However, neither the author nor Richardson GMP Limited makes any representation or warranty, expressed or implied, in respect thereof, or takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use or reliance on this report or its contents. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

Copyright © Connected Wealth Richardson GMP