ETF trading: Keep an eye on volatility

by Hussein Rashid, ETF Capital Markets Specialist, Invesco Canada

Our goal on the PowerShares ETF Capital Markets trading desk is to help our clients experience smooth and efficient ETF trades. In this blog series, I’m highlighting some of the most common guidance we provide. Today, I’m going to look at volatility – how it can distort the bid-ask spread, what to look for and how to get help.

Market volatility and spreads

We answer questions every day from advisors trading ETFs, and volatility is a concern for many. Increased market volatility means that the price of an ETF’s underlying securities may be fluctuating more widely than usual. Market makers, who provide liquidity for our ETFs, can see increased risk when market volatility increases. This can cause the ETF bid/ask spread to widen (see “Volume does NOT equal liquidity. Here’s why” for more info on market makers and their role in ETF trading.)

Track major market events

Market news affects volatility. Keeping an eye on big economic announcements like interest-rate changes, legislative updates or geopolitical news allows you to be aware when volatility is likely to increase. Individual company earnings reports can cause spikes in volatility as well, particularly with those that are well known and tracked by analysts and the media.

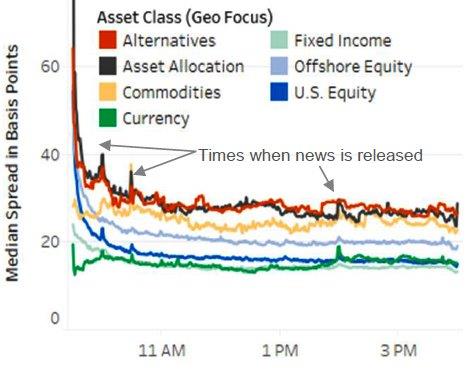

Research has shown that ETFs can see spreads spike at 10 a.m., 10:30 a.m. and 2 p.m., which are popular times for the release of economic news. Underlying markets typically move on the news, spiking volatility (see Exhibit 1).

Exhibit 1:

Note: Median spread is calculated by taking the median bid/ask spread in all U.S.-listed ETFs within an asset class in one trading day. One percentage point equals 100 basis points.

Source: Virtu Financial, as at September 11, 2017

Use limit orders

I covered limit orders vs. market orders in a previous post (read: Get the right price), but using limit orders becomes particularly important during periods of market volatility. While there is a place for market orders in ETF trading – if your highest priority is completing the trade as quickly as possible – during volatile times, it is generally advisable to place a limit order so you can control the price you pay should markets swing while your trade is executed.

When in doubt, help is available. Our ETF Capital Markets team is immersed in the world of ETF trading in Canada and focused on helping you achieve the best trading results possible. We work directly with different market makers and these relationships allow us to support you and your specific trading needs.

We are available to advisors for trading and liquidity guidance, pre-trade questions and execution assistance. To get in touch with our ETF Capital Markets team, please contact your PowerShares Sales rep at 1.800.261.8689 or e-mail us at capitalmarkets@powershares.ca.

This is the third and final blog post looking at ETF trading best practices. In case you missed them, read Get the best price and Watch the clock. If you have any questions, please feel free to leave them in comments below.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog