by Blaine Rollins, CFA, 361 Capital

Many are asking how far can the market go? The better question might be what is going to stop its ascent? After finishing 2017 with strong gains, the first week of January did not disappoint. Earnings are starting this week and they are coming in hot, thanks to the roaring global economy plus the U.S. corporate income tax cuts. The reported Q4 numbers will be a mess at the bottom line as companies write down past tax assets and take charges for repatriated overseas cash.

Global economic data continues to be very strong as seen in last week’s PMI and ISM figures; also construction spending, factory orders and each U.S. housing data point. Equally bad news for the three bears as Goldilocks has been putting miles on her Peloton and she is hungry. Even as the Global economic data continues to run strong, inflation is still very weak as we see in European consumer prices and in Friday’s U.S. wage data. This is a really good time to be an equity investor. Worry about the giraffe instead.

If you have a question about beginning-of-year strength, Kora Reddy has the answers for you…

Just as you thought, a strong start in January will tend to lead to further gains. Of course if you bump into another 1987, all bets are off.

(@paststat)

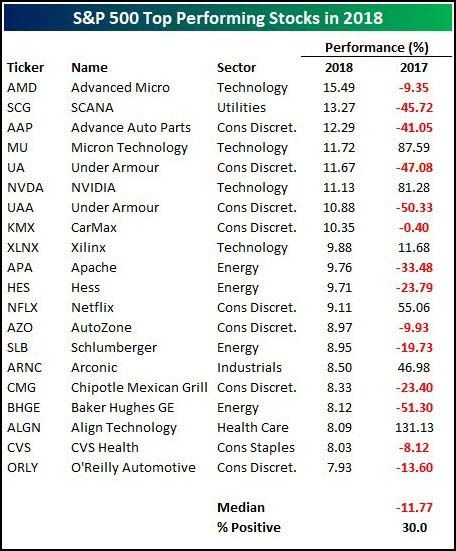

Bespoke also notes the broad strength in the market by highlighting the bounces in so many of the 2017 dead cats…

@bespokeinvest: Only 6 of the 20 best performing S&P 500 stocks so far in 2018 were up in 2017.

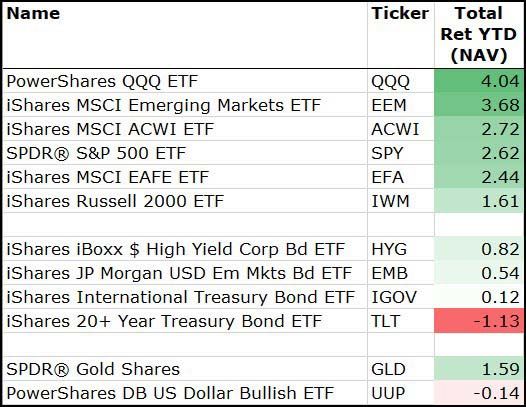

For the week, it was Risk that shot out of the gate…

(1/5/18)

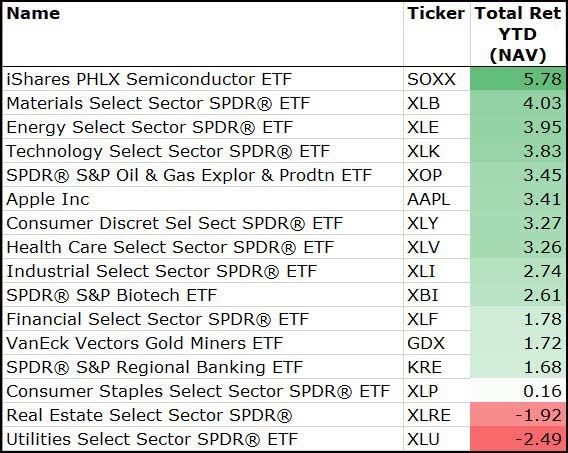

Among sectors, again the performance was risk oriented with Semis, Tech, Commodity groups leading while Utilities and REITs lagged…

(1/5/18)

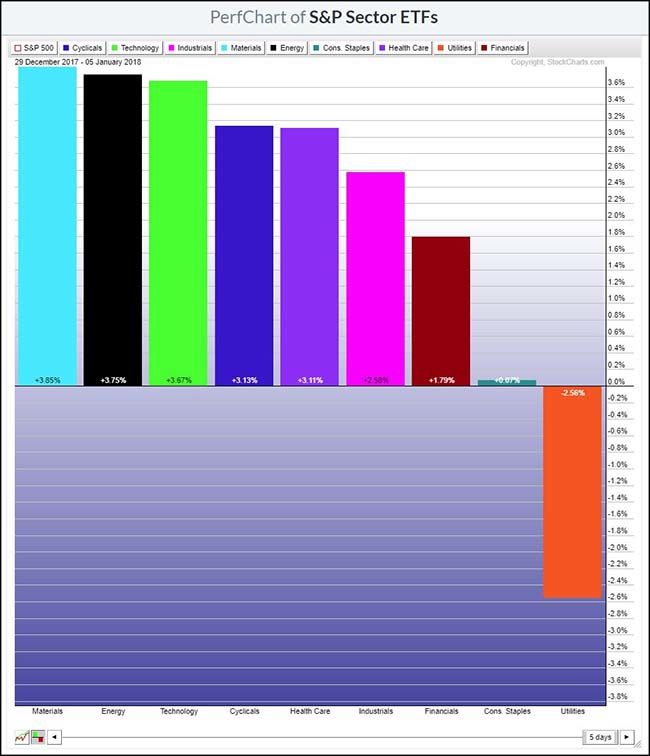

A visual of the sector ETFs show how pronounced the underperformance of Utilities was last week…

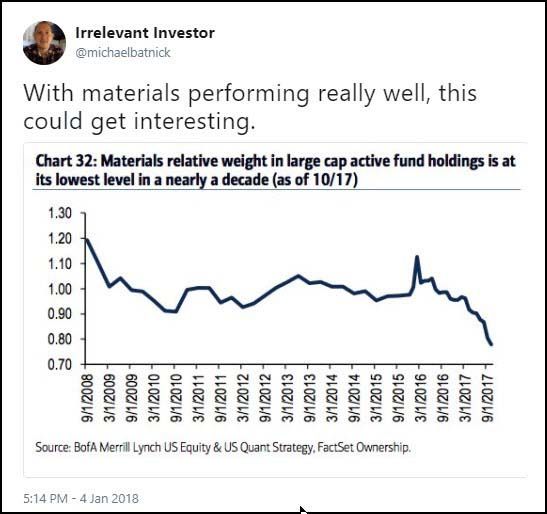

Agree strongly Michael…

The top performing sector for 2018 ended 2017 with its lowest relative weight in the S&P 500 in 10 years? Where do I sign up?

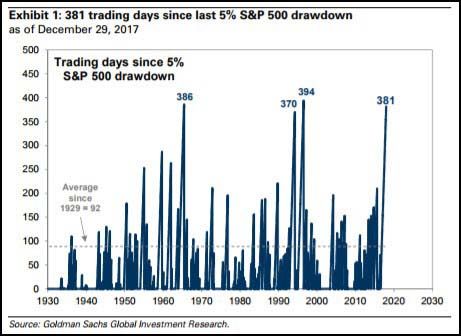

Guess which record is going down this month?

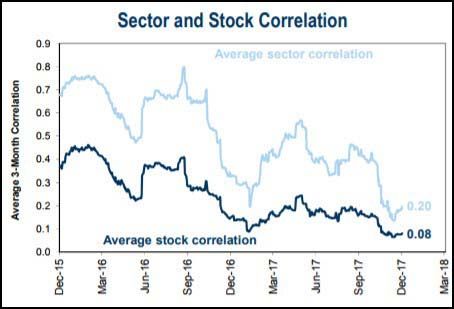

Just your monthly reminder of what a great environment this is for picking stocks (and sectors)…

(Goldman Sachs)

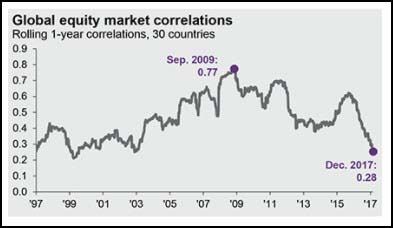

Global equity investors are also finding this to be a great environment to pick geographies…

(JPMorgan)

Speaking of overseas, look at this improving relative performance of the Frontier Markets (think even more risky than Emerging)…

@G_krupins: Updated Frontier Markets ($FM) vs $SPY. Still think international set to outperform US markets over the next few years

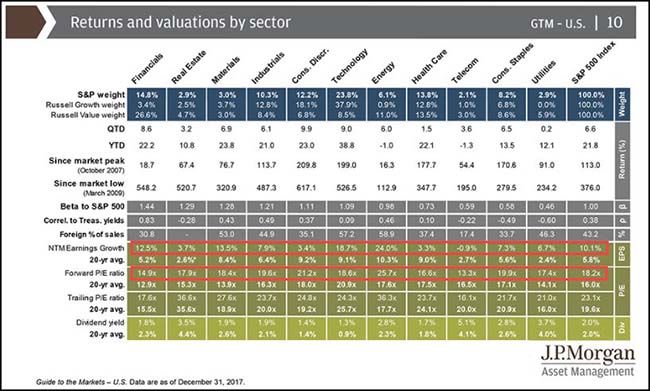

One area of little dispersion seems to be among the sector P/E multiples?

Can we blame this on the flood to passive investing in indexes and ETFs? Click on the sheet below to see the fine data but excluding Telecom and Energy, there is only a six-multiple difference between 2018 P/E multiples but a 15.4 percentage point difference between their earnings growth. Tech trading at a 1.0x PEG ratio versus Staples at 6.2x. Two words: Amazon toothpaste.

(JPMorgan)

Q4 earnings hit the tape starting this week. Here is your hit list…

(@eWhispers)

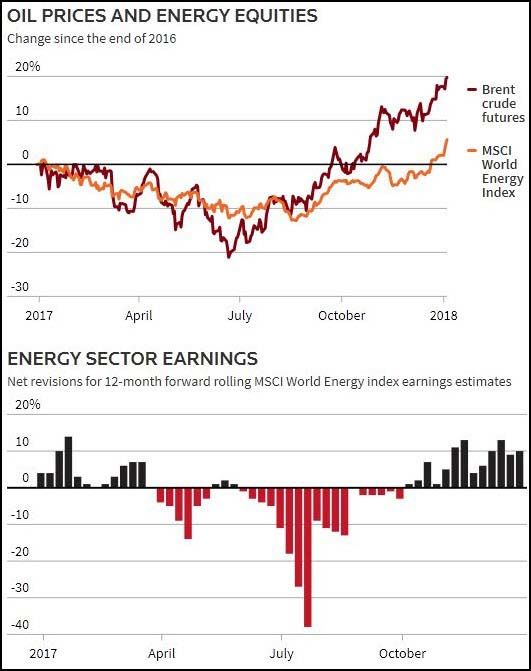

Expectations for Energy earnings have risen along with crude prices. But Energy stock prices have definitely lagged. Could they breakout this month?

@TN: while Brent #crude oil rose almost 20%, MSCI World Energy Index has yet to reflect that (+5.6%) or sector’s improved earnings $XLE #OOTT

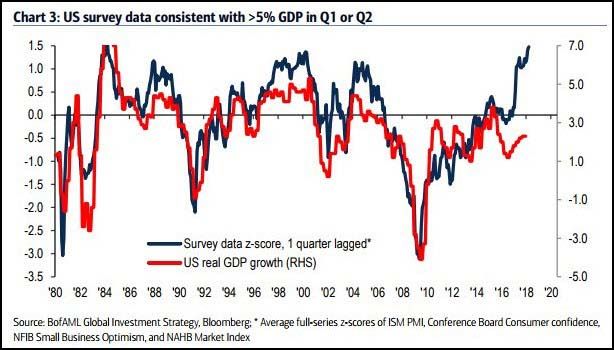

The BofA Merrill Lynch GDP forecasting chart seems to be imitating a SpaceX rocket right now…

How many economists or Presidents would completely lose it if GDP prints a 5-handle this year?

(@Driehaus Capital)

Looking through Friday’s jobs data shows a job market that is near full…

(WSJ/DailyShot)

Speaking of full employment, you might have seen the snowplow driver problem in Maine two weeks ago…

Here’s a chilling sign that low unemployment has its downsides: Maine can’t find enough snowplow drivers.

The state Department of Transportation has about 50 openings among about 700 positions and expects 30 snow storms in the season that stretches from mid-November to mid-April. Exacerbating the problem: some cities like Portland hire their own drivers and pay more, and private sector demand for experienced drivers is also high.

“It’s really the shortage of workers,” said Dale Doughty, the Maine transportation department’s director of maintenance and operations.

Like other states, Maine is contending with low unemployment that has made it hard to find enough workers everywhere from fire houses to technology startups. Maine’s unemployment rate of 3.5% ranked among the lowest in the country in October, and is below the national rate for the month of 4.1%, according to federal data. Jobless rates in its southern counties are even lower.

(WSJ)

Another good slice shows no slowdown in temporary jobs…

@HumbleStudent: More thoughts for the weekend: Temp jobs lead NFP & there are no signs of a peak in temp employment

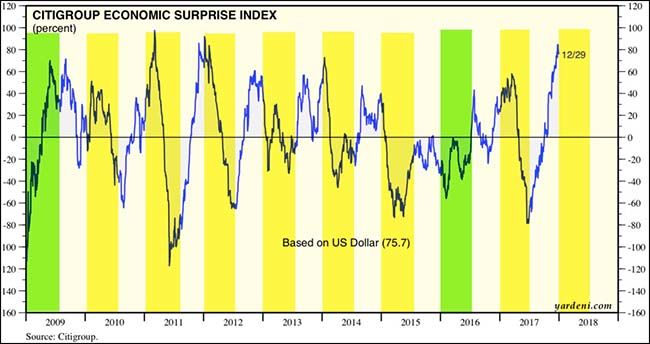

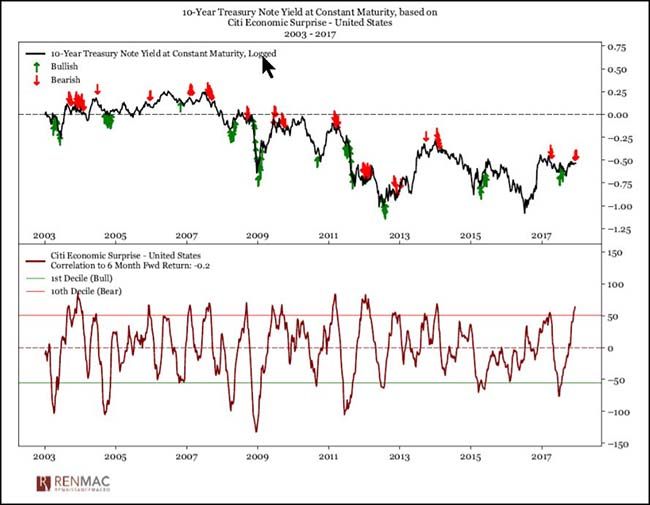

U.S. Economic Surprise index hits its 4th highest level since 2003. Will it slow in the 1st half of 2018 as it usually does?

Macro data will likely underperform expectations in 1H18. Why? Macro data ended 2017 well ahead of expectations. During the current expansion, that has led to underperformance of macro data relative to expectations into the following mid-year (yellow shading). 2009 and 2016 had the opposite pattern: macro data underperformed expectations into the prior year-end and then outperformed in the first half of the year (green shading).

If U.S. economic surprises do slow, then bond yields should turn lower…

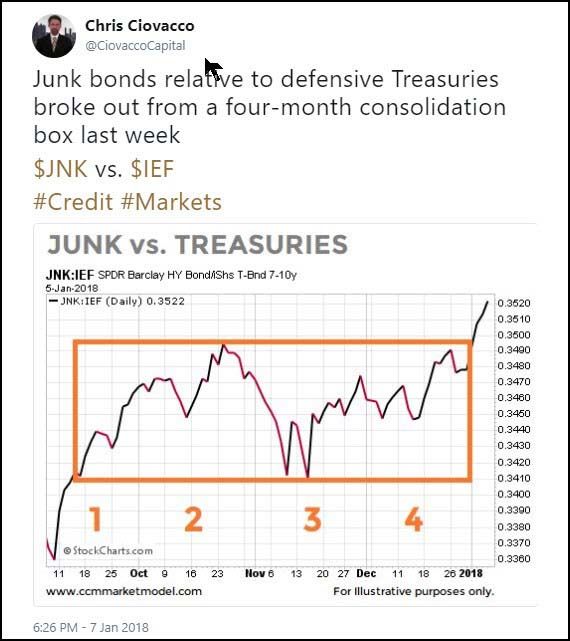

One less thing for stocks to worry about is the breakout in Junk Bond Credit last week…

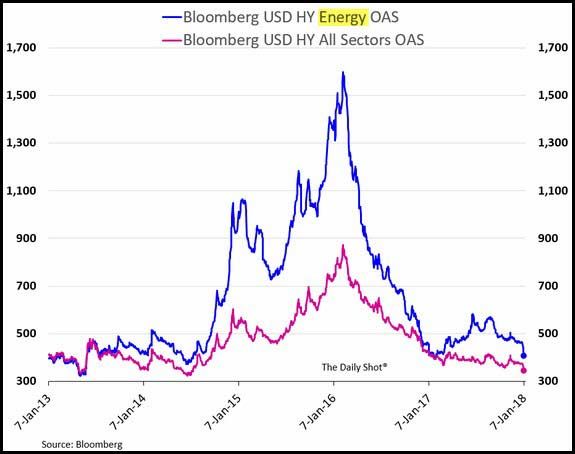

A big help to the High Yield Credit markets has been higher oil prices which have eased the stress among energy credits…

(WSJ/DailyShot)

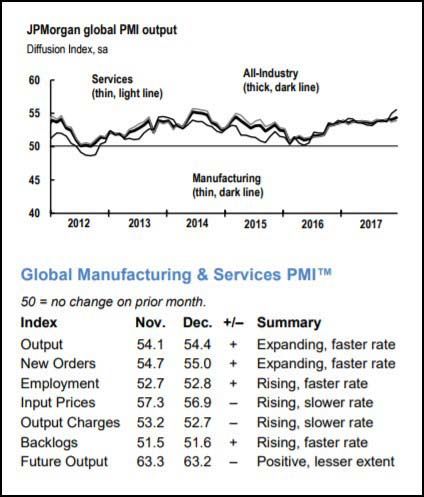

Looking more globally, the Purchasing Manager data last week was exceptional…

The global economy ended 2017 on a firm footing. Output rose at the fastest pace since March 2015, underpinned by the steepest increase in new business in three-and-ahalf years. The expansion remained broad-based, with economic activity rising across the six sectors covered by the survey (consumer, intermediate and investment goods and business, consumer and financial services).

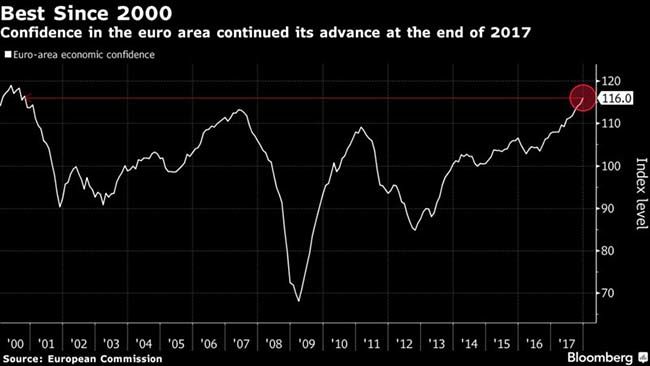

And as a result, Business Confidence in Europe hit a 17-year high…

Confidence in the euro area continued its advance at the end of 2017, capping what was probably the strongest year for the economy in a decade.

The European Commission’s measure of sentiment touched its highest since late 2000 in December. The reading of 116 was above the median forecast of 114.8 in a Bloomberg survey and was based on an improvement in the outlook for industry and services.

And European economic happiness spreads to the football pitch…

Byron Wien’s list of surprises hits and like a few others, he thinks that animal spirits might add some volatility in 2018…

The U.S. economy has a better year than 2017, but speculation reaches an extreme and ultimately the S&P 500 has a 10% correction. The index drops toward 2300, partly because of higher interest rates, but ends the year above 3000 since earnings continue to expand and economic growth heads toward 4%.

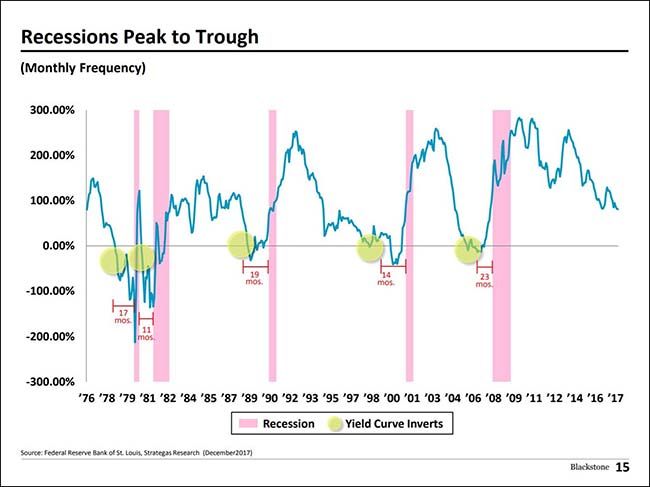

But as his chart suggests, we are still some distance away from our next recession…

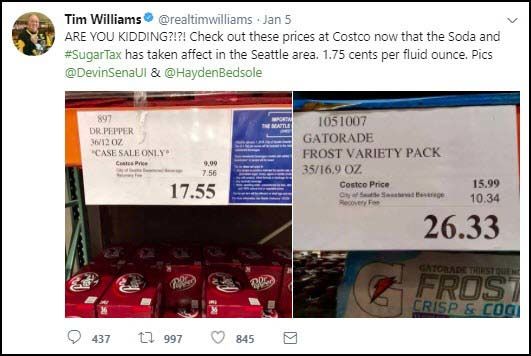

If you are looking for the next recession, start with the soft drink distribution business in Seattle…

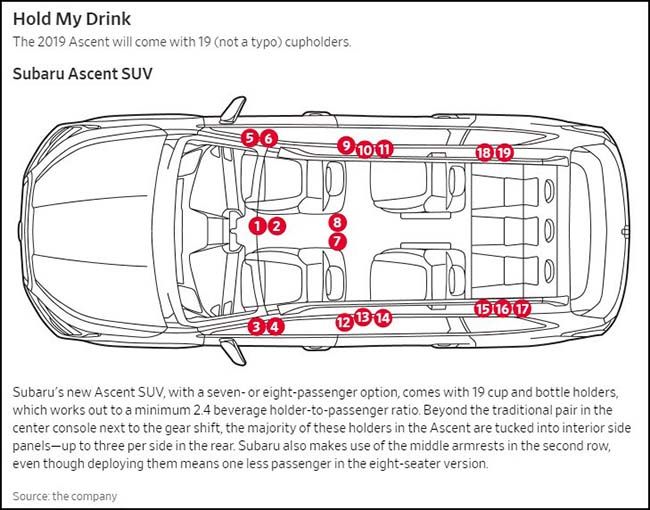

And so in the city of Seattle, it will now cost you more to fill up your cup holders with Big Gulps than it will to fill up your gas tank…

(WSJ)

Speaking of excesses, North America is still over stored…

Creative tax avoidance idea of the week…

Hot statistic of the week…

How do all male candidates not start at least five points behind in the average political race this year?

Whitmer might not bring it up, but she represents what probably will be one of the 2018 elections’ most significant trends: More women than ever are in the mix to potentially lead their states as governor — traditionally one of the hardest reaches for female candidates and a position now held by just half a dozen women.

This year, at least 79 women — 49 Democrats and 30 Republicans — are running for governor or seriously considering it as filing deadlines approach, according to a tally by the Center for American Women in Politics at Rutgers University.

The numbers are more than double what they were four years ago and on track to surpass the record 34 women who ran for governor in 1994. In Ohio, there are three women running for governor in the Democratic primary and one in the Republican. In Georgia, both Democratic candidates are named Stacey.

Copyright © 361 Capital