The high-yield sweet spot

by Matt Brill, Senior Portfolio Manager, Invesco Fixed Income, Invesco Canada

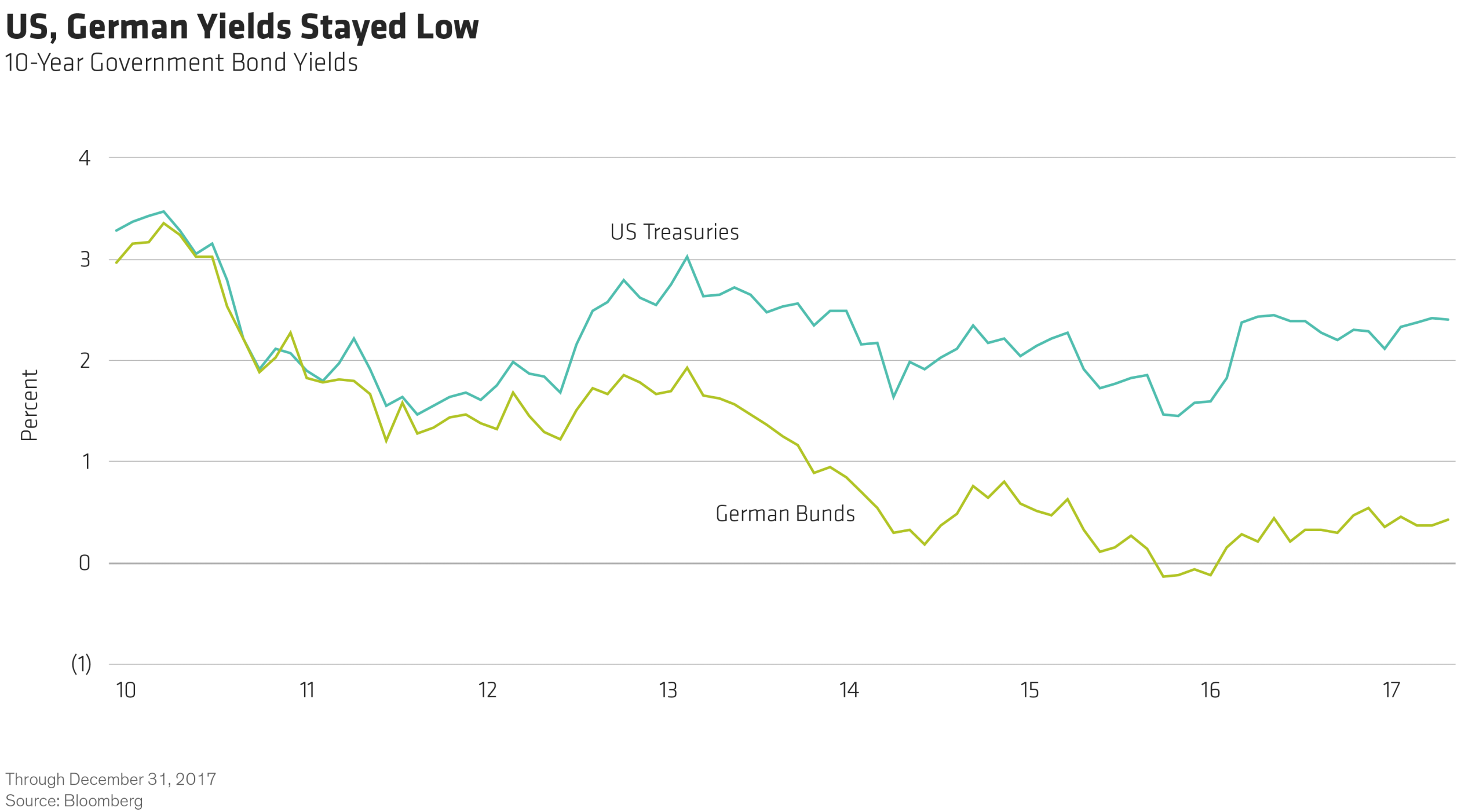

For income-focused investors, yield remains incredibly elusive in most markets, with roughly 20% of global fixed income assets delivering negative yield. In Europe, that rises to about 40%.

The one place investors can find positive yield is the United States. Foreign institutional investors have been buying up the investment grade market here, driving yields lower. As a result, many yield-hungry investors have turned to high-yield corporate credit assets.

The high-yield bond sweet spot

I believe BB-rated high-yield bonds still represent a sweet spot in the market.

Many U.S. pension plans and insurers are restricted to investment grade bonds. With these large players shut out of the high-yield market, valuations are far more reasonable, giving a strong research staff the opportunity to go hunting for potentially upgradable securities.

In the BB space, we’re still able to buy high-quality high-yield bonds with the potential for being upgraded to investment grade within the next year. In such an event, we would expect to earn a considerable return on the capital value of the bonds.

We’ve already seen this trend begin and we want to be out in front of these events.

Potential for upgrades

Some of the opportunities we see are in sectors that have rebounded with the broader economy. For example, the global financial crisis of 2008 originated in the real estate market.

During the crisis, many homebuilding companies were downgraded. Since then, U.S. demand for new homes has surged. I believe some BB-rated homebuilders could be upgraded to investment grade and we are over-weighted in the sector.

We have a strong credit analysis staff which is able to identify potential upgrade opportunities. Using our research, we strive to be six to nine months out in front of the market on these events.

Anytime you can get in front of a bond being upgraded to investment grade, it can be a material benefit to your portfolio.

The “core plus” approach

Investing in high-yield corporate credit assets requires a great deal of research and this is where the Invesco Fixed Income team can really shine.

In Invesco Global Bond Fund we combine up to a 25% allocation to higher-yielding bond sectors (what we call “Plus”) with a minimum 75% “core” allocation to high-quality investment-grade bonds. This “core plus” approach allows us to deliver the yield that is currently so elusive to investors, while still helping provide the safety that they need from their fixed income when severe market conditions hit.

To learn more about how Invesco can help address your fixed income challenges visit InvescoGlobalBond.ca

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog