by Ryan Detrick, LPL Research

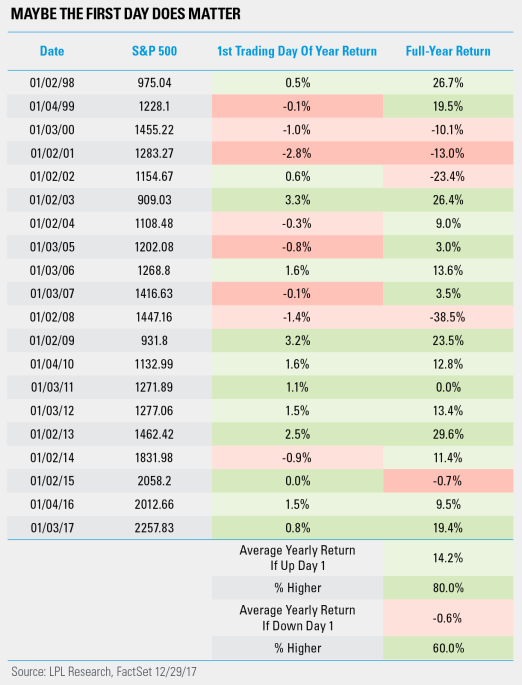

Now that 2017 is in the books, we are moving forward with the first trading day of the new year. But, does the first day really matter? Per Ryan Detrick, Senior Market Strategist, “Of course one day doesn’t make a full year, but it is quite interesting how much the first day of a new year can signal things to come. In fact, over the past 20 years, the S&P 500 Index has been up 10 times and down 10 times; when the first day is green the full-year return has been up +14.2% on average, while a lower first day has resulted in the full-year return being in the red.”

Incredibly, the past eight times the first day of the year was green, the S&P 500 was higher for the full year seven times, and that only loss was down only -0.002%.

In conclusion, this is a fun stat, but we would suggest this is more random than anything and longer-term indicators like earnings, valuations, and technicals matter more.

****