by Lance Roberts, Clarity Financial

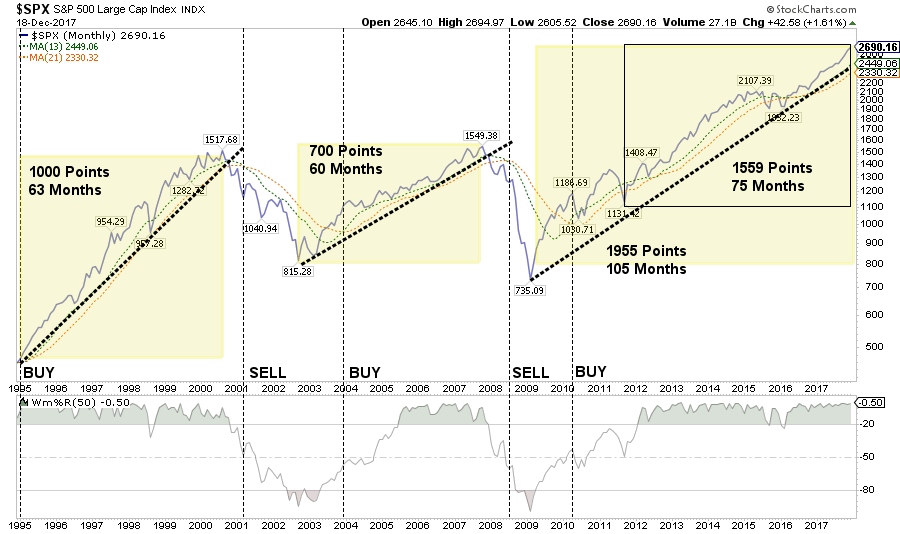

In last week’s Technical Update, I discussed the similarities between 1999, 2007 and currently. To wit:

“With the markets within striking distance of Nasdaq 7000, Dow 25000 and S&P 2700, all three levels are all but guaranteed at this juncture. More interestingly, all three will be ticking off milestone gains at some of the fastest paces in market history. In fact, the Dow has posted three all-time records just this year:

- 70 new highs,

- A 5000-point advance in a single year, and;

- 12-straight months of gains.

Just as a reminder of previous market bubbles, here is what they looked like.”

Since this is the last “Technically Speaking” post of 2017, I wanted to take a look back at the year in review of the major markets and sectors.

Sector By Sector

ENERGY

After having been out of the energy sector entirely since early 2014, we recently added some exposure back to the sector a couple of week’s ago as noted in the weekly newsletter:

“As I noted previously, the energy sector had gotten trapped between the 50 and 200-dma. The positive backdrop, however, was the 50-dma having crossed above the 200-dma. I have noted over the last couple of weeks we were looking for a tactical trading entry point. We achieved that this week with the bounce of the 50-dma. We are adding one-half of a tactical trading position to portfolios next week.”

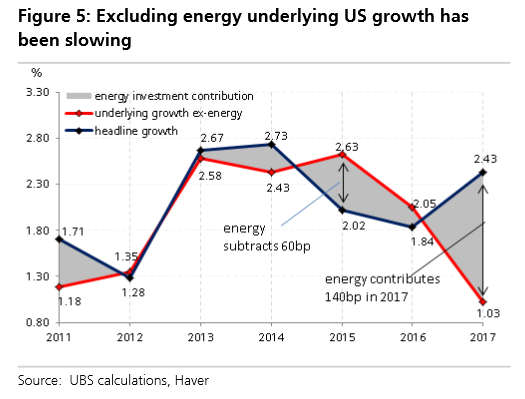

Looking back over the past year, the recovery in oil prices has led to a lift in not only the energy sector but, as noted previously, is responsible for the majority of the economic lift in 2017. To wit:

“Taken at face value, the chart suggests underlying US growth has been slowing dramatically, from about 2.6% in 2015 to only around 1% in 2017. We do not quite interpret it that way, and view it more as a story of stability and ‘adding-up constraints’. The economy can only produce so much, and when one sector is strong (energy), it absorbs labor disproportionately, while other sectors pull back. Furthermore, when investment is weak the consumer accelerates. US growth post-crisis has hovered around a 2% average and nothing in our recession probability models suggests that there is anything ominous going on. But the point of Figure 5 is to show that as energy investment runs out of steam, other sectors will need to accelerate significantly to maintain the current pace of growth.”

Furthermore, the 100% surge in energy prices from $30 back to near $60/bbl has provided a huge tailwind to earnings in the S&P 500. As noted previously:

- Energy-related earnings have helped the overall S&P 500 earnings rebound over the last few quarters.

- Inflationary pressures, which appeared with the rebound in oil prices last year, has led the Fed into a “comfort” zone thinking the inflation rise was due to economic growth.

- Economic growth also ticked up with rising commodity costs, however, that tailwind is likely reaching its conclusion.

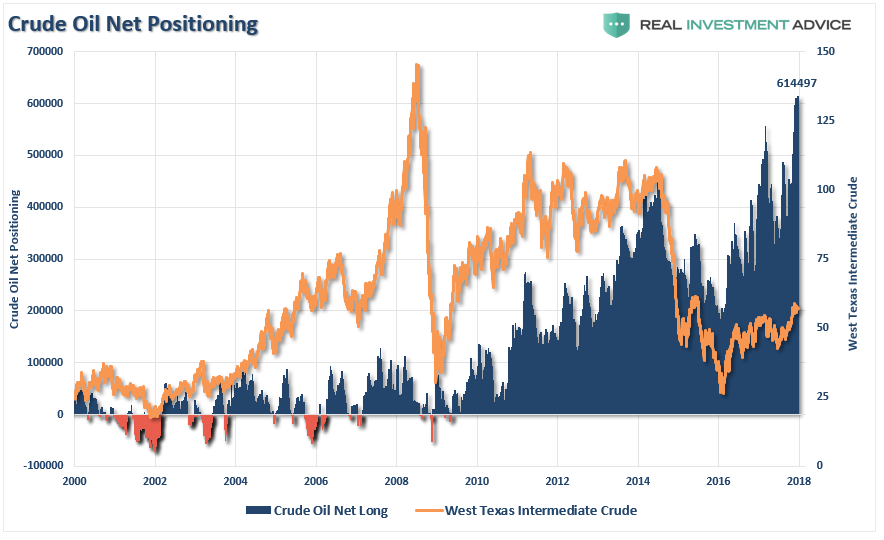

While we did add an energy “trade” recently, it is nothing more than that at the moment. Currently, the energy sector remains in a negative trend but has now reached extremely overbought levels along with oil prices. As shown below, with oil prices and energy-related indices trading at 3-standard deviations above longer-term means, a correction in the new year is quite likely. With $45/bbl now important support, it will be worth watching forward developments very closely.

Lastly, with net speculative positioning on oil now extremely long, the catalyst for a downside correction in crude prices is back at levels not seen since the previous peaks.

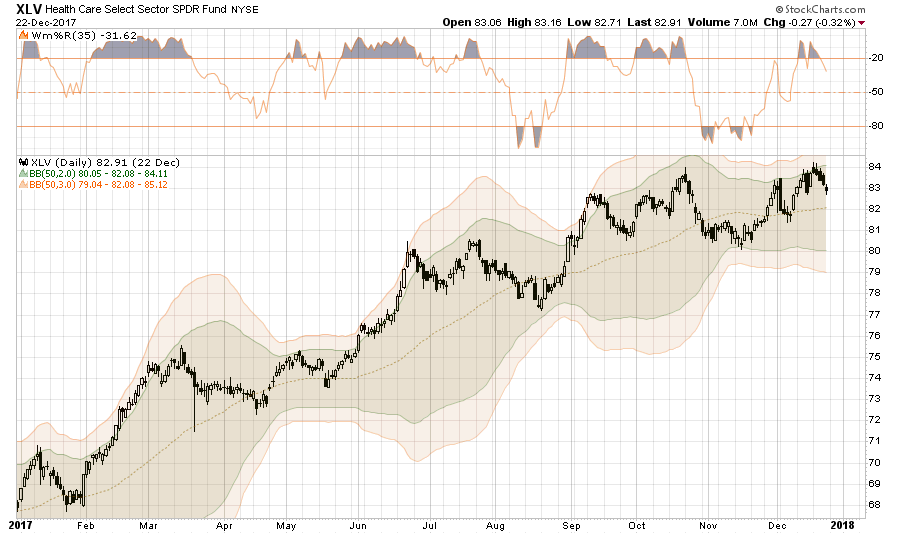

HEALTH CARE

The recent passage of the tax-reform bill included the cut of the “mandate” requiring individuals to purchase health care insurance. The belief is this repeal, which will burden health insurance providers and lead to rising insurance premiums, will prompt Congress for a quick passage of reforms to the Affordable Care Act. While this may be true, it will not be in the near term.

With the health care sector advancing sharply this past year, and now back to very overbought conditions, taking some profits in the sector and moving stop losses to $80/share makes sense from a risk management perspective. The current advance is already under some pressure so watch for further selling pressure in the New Year.

FINANCIALS

Financial stocks exploded as tax reform became a reality over the past month and the sector played “catch up” performance wise from a rather lack-luster start of the year.

With the sector once again extremely extended and overbought, taking some profits and rebalancing the sector back to portfolio weightings makes some sense. Furthermore, move stops up to support at $25.75. Like the majority of sectors in the S&P 500, look for New Year tax selling which will bring this sector under pressure.

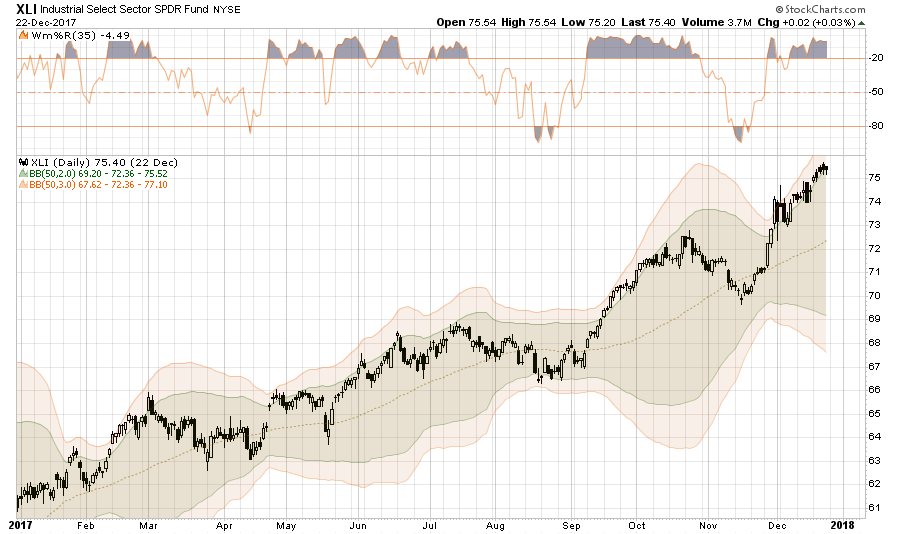

INDUSTRIALS

Industrials have had a stellar performance year on the expectations of tax cuts boosting their bottom line. With the sector extremely extended and overbought, take profits in the sector and reduce back to portfolio weight and move stop levels up to $70.

MATERIALS

The same message from Industrials applies to Materials since they are kindred spirits especially when it comes to the expected impacts of tax reform on their bottom lines. As such, the same rules apply to rebalancing positions back to portfolio weights and moving stops up to support at $57.

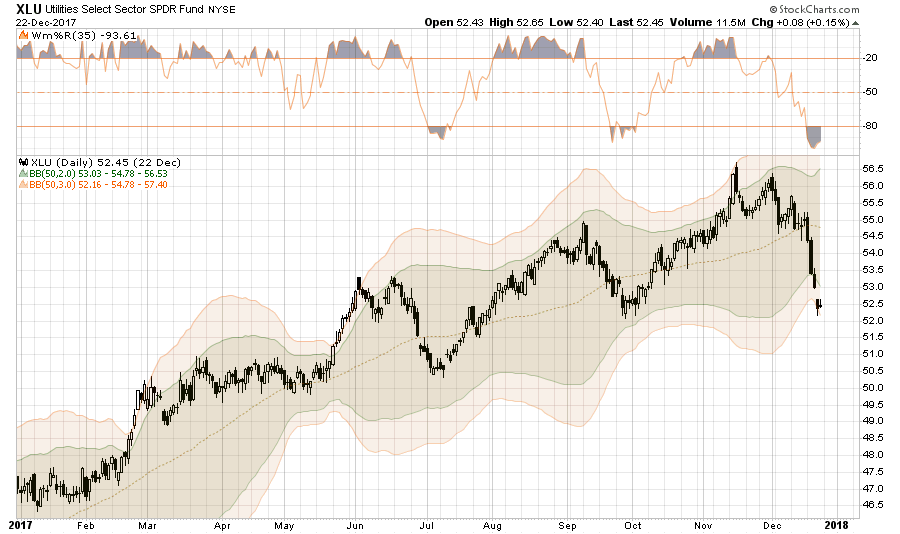

UTILITIES

Unlike every other sector of the market, Utilities have taken a solid hit over the last three weeks as money rotated from “safety” to “risk” as tax reform approached fruition. With the sector now trading 4-standard deviations below their moving average and extremely oversold, rebalance the sector back up to portfolio weight. If tax-selling comes to fruition in January, the sector will likely be a recipient of the “risk off” rotation trade.

Keep stops set at $50.50.

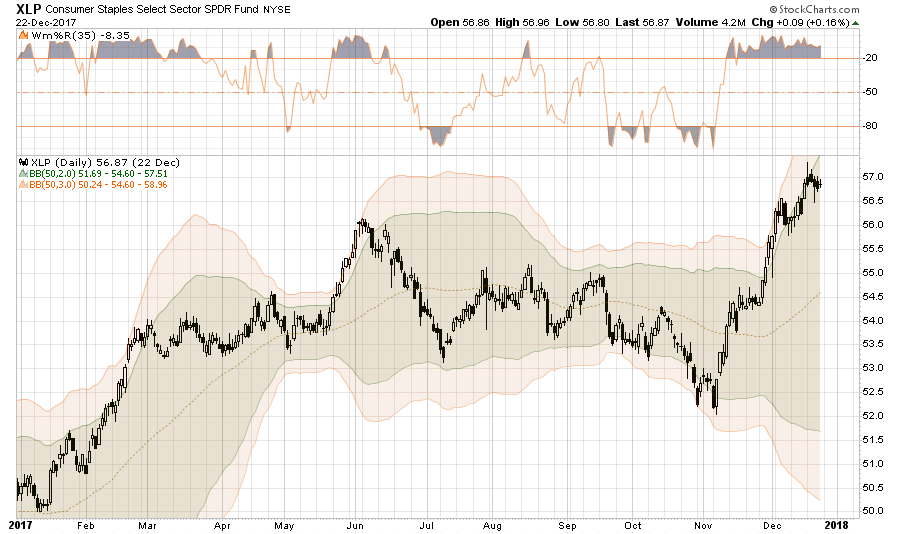

STAPLES

After a strong start to the new year, Staples stumbled into the holiday shopping season. However, since November, the sector has rocketed higher.

Once again, with the prospect of stock selling in the New Year, rebalance the sector back to portfolio weights and move stops up to $65.

DISCRETIONARY

Again, like Materials and Industrials, the siblings of Staples and Discretionary have both benefited from the year-end performance chase.

Trim portfolio weightings should back to portfolio weight with stops set at $94.

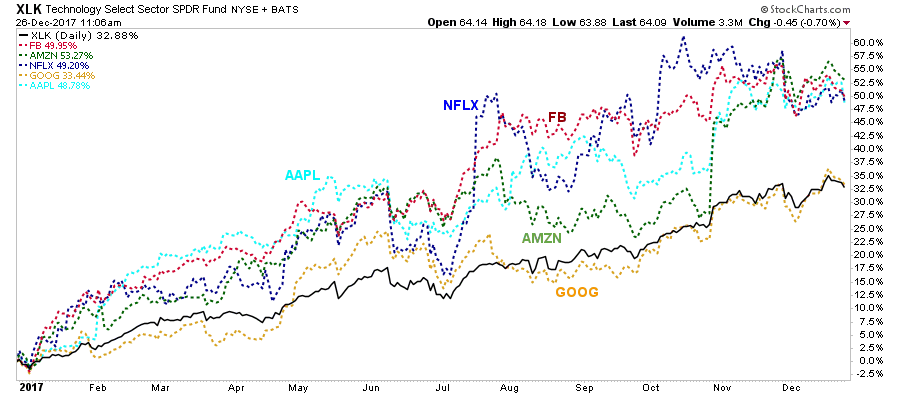

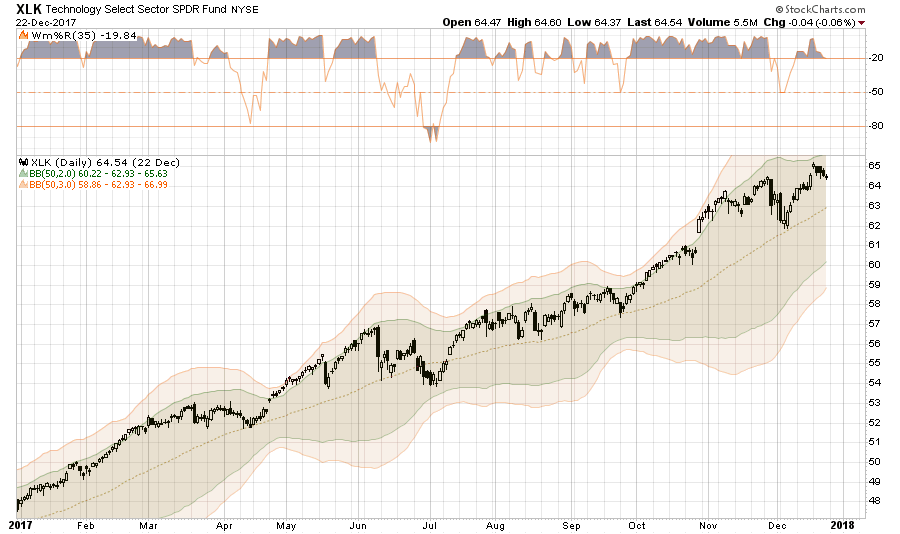

TECHNOLOGY

The Technology sector has been the “obfuscatory” sector over the year. Outside of “bitcoin,” the “FANG” trade was one of the stories of the year. Due to the large weightings of Apple, Google, Facebook, and Amazon, the sector boosted the S&P index from turning in a weaker performance prior to the election and elevated it post-election.

The sector is again extremely overbought and stops should be moved up to $62 where the recent sell-off found support at the running moving average. The bullish trendline currently intersects at $63 which could provide a reasonable entry point for additional exposure if that level holds. For now, weightings should be revised back to portfolio weight.

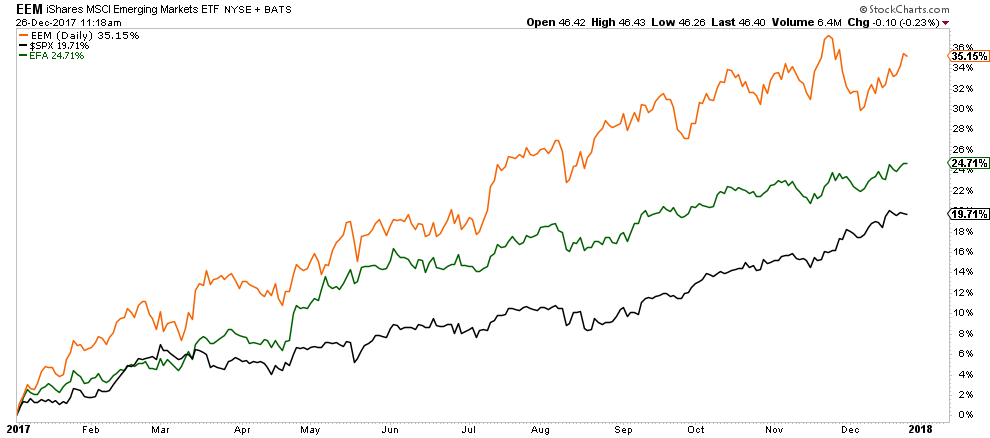

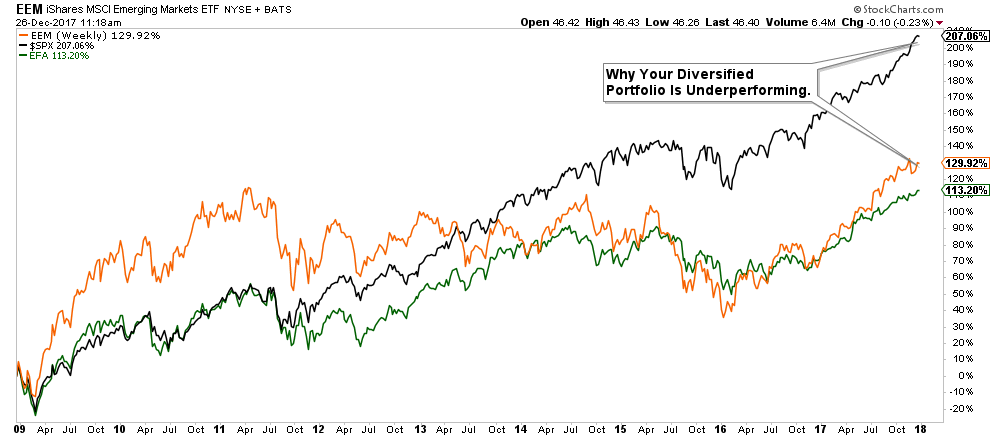

EMERGING & INTERNATIONAL MARKETS

International and Emerging markets have had very strong performances this past year. However, with those trades now extremely overbought and global growth going into next year at risk, watch China, some profit taking should be done.

Furthermore, as shown below, other than tactically trading emerging markets, holding such exposure has been the equivalent of adding a “boat anchor” to portfolio performance. The long-term underperformance of the sector relative to domestic stocks continues to keep emerging markets unfavored in allocation models for now.

Lastly, remember that “emerging markets” in particular are very dependent on the generosity of the U.S. in terms of economic demand to support countries dependent on the exportation of goods and services. The biggest risk in 2018-2019 to the emerging markets is a U.S. recession.

DOMESTIC MARKETS

As discussed last week, the S&P 500 is now more overbought than at just about any other point in history. With the chase for year-end performance chase pushing stocks this past month, the potential, as stated above, for tax selling in the new year is elevated.

There are a multitude of support levels for stocks between current levels and where we started the year at 2250. Mind you, a correction back to the beginning of this past year would entail a drop of nearly 20%. As stated previously, such a drop would feel far worse than it is given the length of time without even a minor correction.

This is why we are beginning to add a few hedges to portfolios as discussed in the latest newsletter.

“Also, as noted above, and previously, I am still looking for the right setup to hedge portfolios next week. The surge this past week is put us into the ‘ballpark.’ The strategy will be as follows:

- Rebalance to target portfolio weights all “overweight” positions

- Add exposure to bonds, utilities and REIT’s bringing allocations up to portfolio weight or slightly overweight.

- Add a tactical trade of a short S&P 500 position to hedge risk.

- Move up stops on all positions to current support levels.

We will update our positioning next week with actual changes, if any, should the opportunity present itself.

As noted, we added 1/2 of a tactical trading position in Energy two weeks ago after an improvement in performance and recent bullish change in the technical underpinnings.

We remain invested but are becoming highly concerned about the underlying risk. Our main goal remains capital preservation.”

SMALL CAP

Small cap stocks went from underperforming earlier in the year to exploding as tax reform moved toward reality. As with the rest of the market, and tax-sensitive sectors of the market, small-cap stocks are now extremely overbought and extended.

Stops should be placed at $890, a break of which would suggest a much deeper reversion is in process. Reduce exposure back to portfolio weight for now.

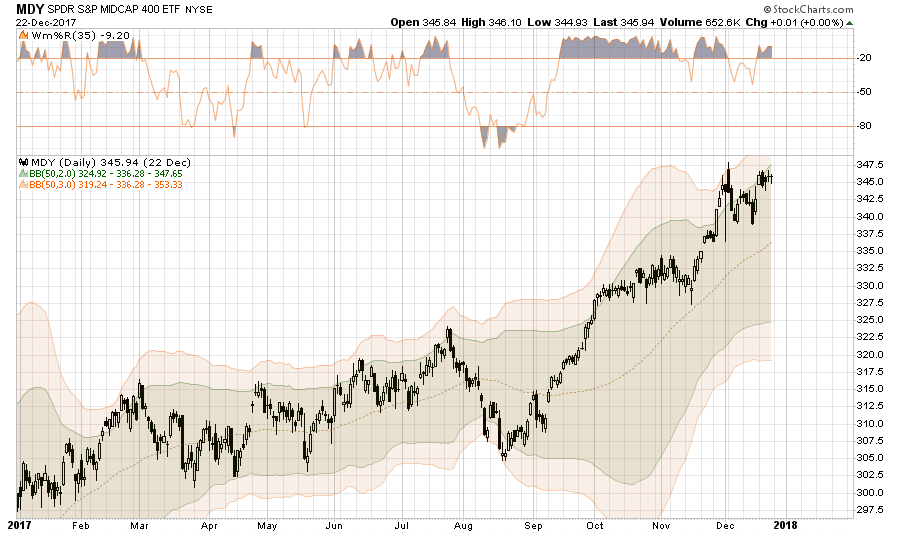

MID-CAP

As with small-cap stocks above, mid-capitalization companies had a rush of exuberance heading into the end of the year as well. However, with the risk/reward setup currently unfavorable, reduce exposure back to portfolio weight for now and carry a stop at $327.50.

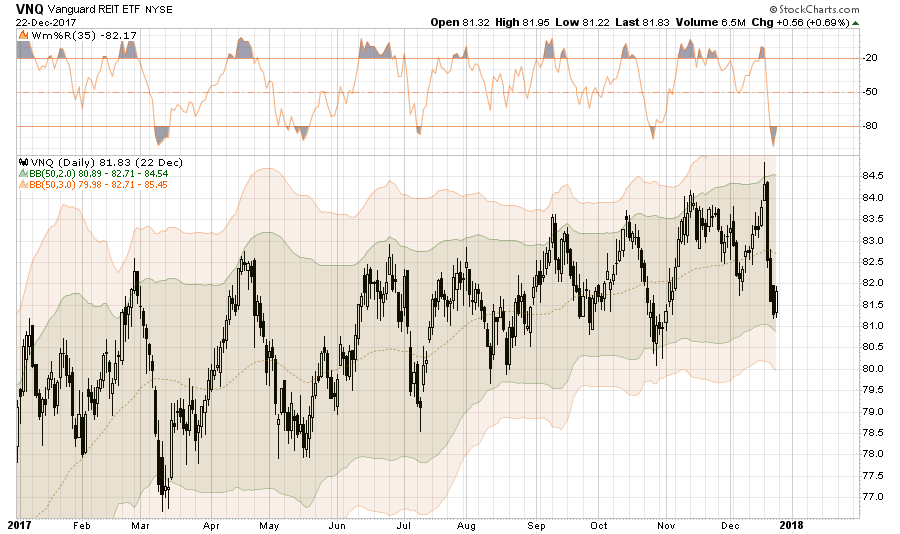

REIT’s

As with Utilities above, REIT’s have taken it on the chin as of late after hitting new all-time highs in December. However, also as stated above, look to rebalance REIT’s in portfolios for a “risk off” rotation in January. A stop should be placed at $80.

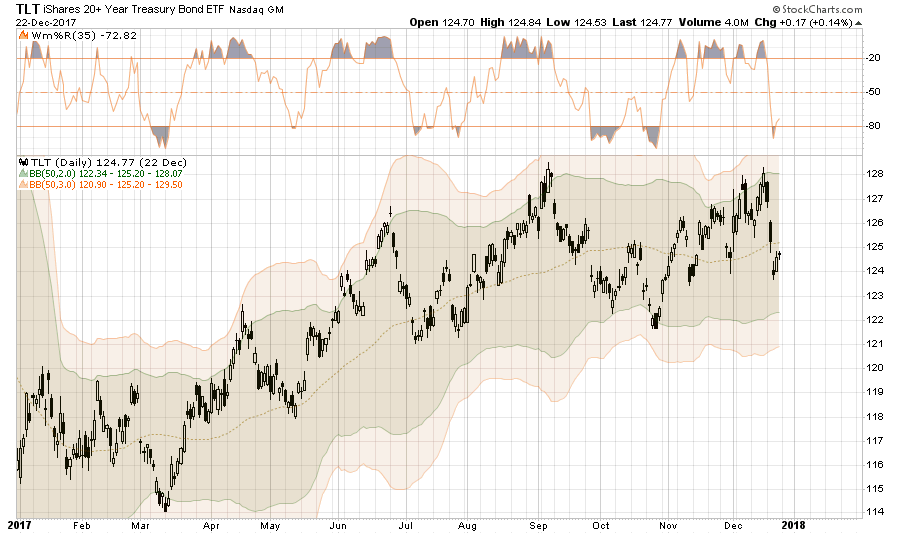

TLT – BONDS

The same goes for bonds and with REIT’s and Utilities. Rebalance bonds in portfolios for a potential “risk off” rotation trade to hedge long-equity positions against a tax-related sell-off in January. Stops for bonds remain at 122 currently.

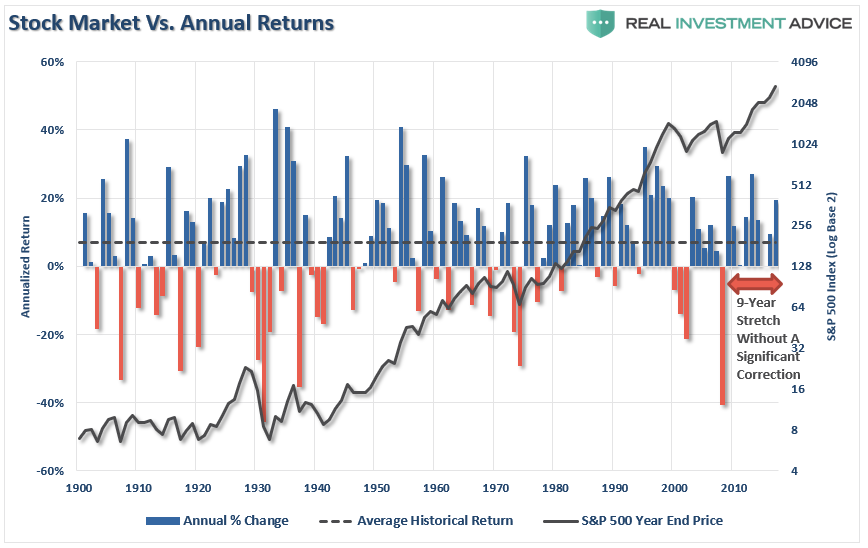

Conclusion

As we wrap up the month of the year, there are very high hopes that 2018 will be a continuation of the last several years. However, just be mindful that NOT “every year” is an “up” year. In fact, we are currently in one of the longest periods on record without a major corrective event.

With the markets very extended, over-bought, over-leveraged and overvalued it won’t take much to trip up the exuberance built into the markets currently.

If you didn’t read the “Rules Of The Road” in this past weekend’s newsletter, it might be worth a review. But here are the important points:

Our job as investors is actually quite simple. We must focus on:

- Capital preservation

- A rate of return sufficient to keep pace with the rate of inflation.

- Expectations based on realistic objectives. (The market does not compound at 8%, 6% or 4%)

- Higher rates of return require an exponential increase in the underlying risk profile. This tends to not work out well.

- You can replace lost capital – but you can’t replace lost time. Time is a precious commodity that you cannot afford to waste.

- Portfolios are time-frame specific. If you have a 5-years to retirement but build a portfolio with a 20-year time horizon (taking on more risk) the results will likely be disastrous.

With forward returns likely to be lower and more volatile than what was witnessed in the 80-90’s, the need for a more conservative approach is rising. Controlling risk, reducing emotional investment mistakes and limiting the destruction of investment capital will likely be the real formula for investment success in the decade ahead.

Happy New Year.

Copyright © Clarity Financial