Despite the concerns surrounding financial markets, 2017 produced healthy returns. What will 2018 hold in store? In our 2018 Outlook, our investment professionals offer their perspectives.

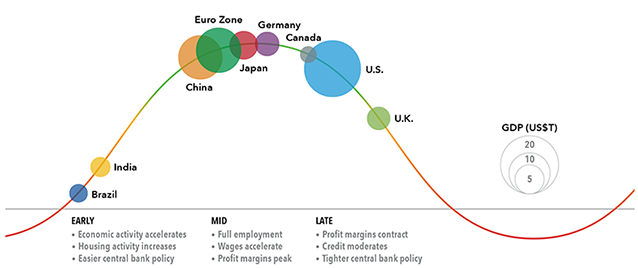

Global Economies Continue to Gain Ground

Investors can see blue skies just about anywhere they look heading into 2018, as the synchronized global economic recovery gathers a head of steam.

Most major economies are experiencing early- to mid-cycle characteristics

Sources: Capital Group, FactSet. GDP data as of 6/30/17. Country position within the business cycle are estimates by Capital Group economists.Market Levels Suggest Better Opportunities Abroad

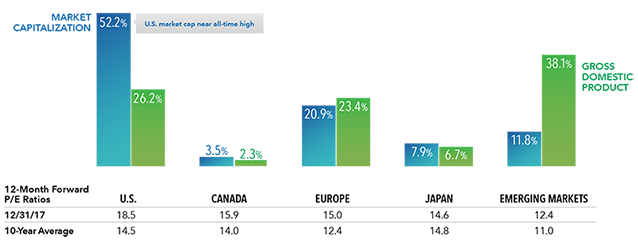

Most of the world's equity market indices achieved or neared multiyear highs in 2017, as investors set aside concerns about politics and focused on the broadening expansion. Market levels suggest that better investment opportunities may continue in non-U.S. markets.

Percentages of total world market capitalization and global GDP

Sources: Capital Group, FactSet, MSCI, RIMES, Thomson Reuters. As of 9/30/17. Market capitalization is each country or region's weight within MSCI All Country World Index (ACWI). GDP is each country or region's percentage of total world nominal GDP. Price-to-earnings ratios as of 9/30/17.U.S. Economic Engine Reaches Higher Gear

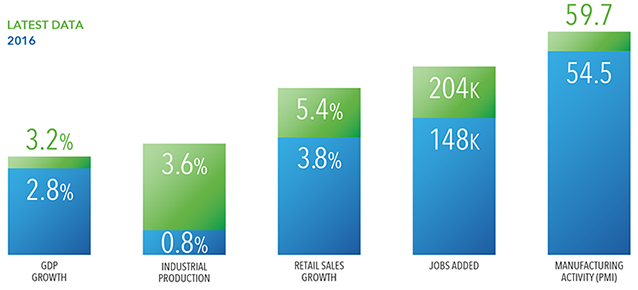

After more than 100 months of expansion, the U.S. economy appears to be in a period of self-sustaining equilibrium. The jobs market is solid, consumer confidence is soaring and retail sales growth is picking up.

The American economy is drawing from numerous sources of strength

Sources: U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics, Thomson Reuters. GDP growth is the year-over-year growth in 3Q16 and 3Q17. Inflation and retail sales growth are year-over-year changes on 9/30/17, and 9/30/16. Inflation uses the change in the consumer price index. Jobs added is the monthly change in the payroll survey as of 10/31/17, and 10/31/16. Manufacturing activity is the manufacturing component of the 9/30/17, and 9/30/16, Institute of Supply Management (ISM) Purchasing Managers' Index (PMI) reports.Emerging Markets Have Only Just Begun Making Up Ground

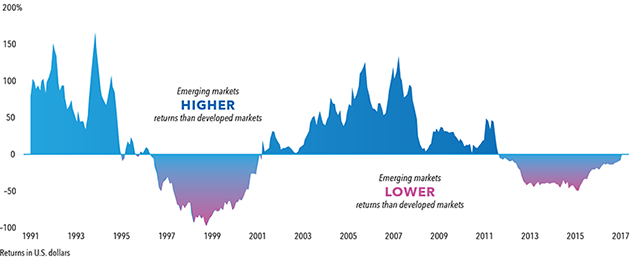

The rally in emerging markets equities is more than 20 months old, with stocks up 70% since a trough in early 2016. Is the rebound getting long in the tooth? An expanding global economy, strengthening currencies and robust demand for technology-related components all bode well for emerging markets.

Until recently, emerging markets equities had trailed developed markets for several years

Sources: Capital Group, MSCI, RIMES. Data represents cumulative rolling three-year total returns of MSCI Emerging Markets Index versus the MSCI World Index through 9/30/17.

Read/Download the complete report below:

2018 Outlook by dpbasic on Scribd

Copyright © Capital Group