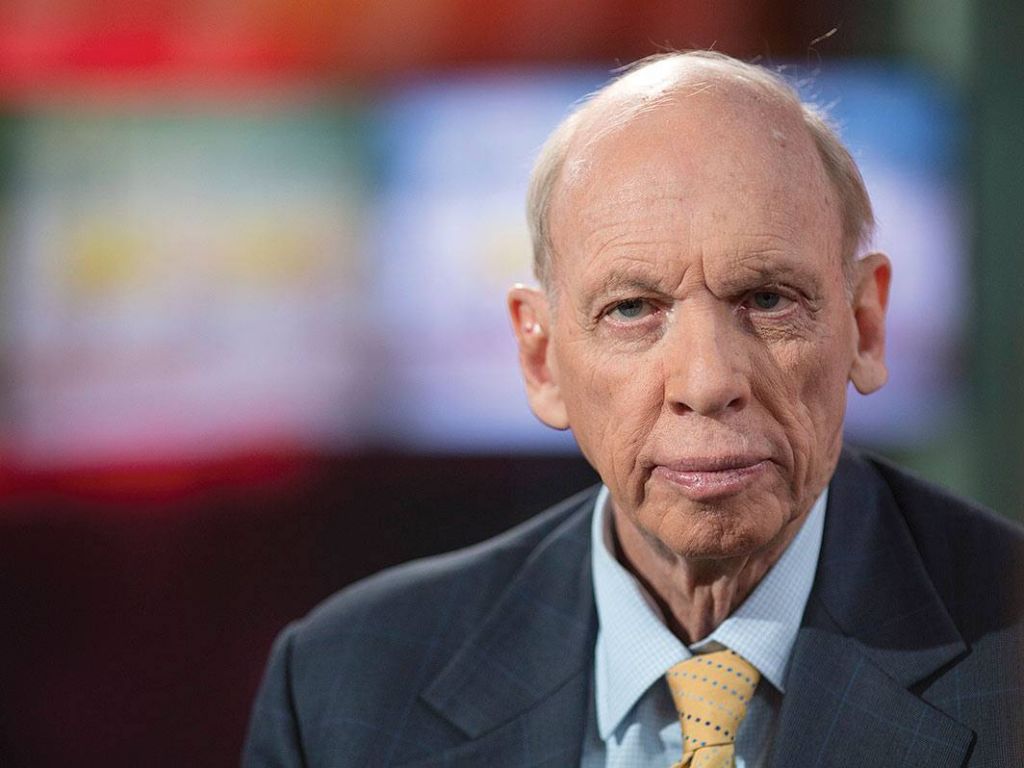

by Byron Wien, Vice Chairman, Blackstone

There is no question that there has been a rise in populism around the world during the last two years and it is continuing. The voters in selected democracies in the West have become dissatisfied with their governments and the political process, and they have become attracted to candidates who have promised them change and a better life. The election of Donald Trump based on his campaign pledge to “Make America Great Again” was a clear example of this. The decision by voters in the United Kingdom to leave the European Union was another. Sometimes populists have trouble delivering on their promises and at other times, even when they do deliver, the results are different from what the voters expected.

I think it is fair to say that Donald Trump has had difficulty implementing his pro-growth agenda. His attempt to revise the Affordable Care Act failed to get enough votes in Congress to pass. The current Tax Reform plan is running into opposition in his own party and among Democrats. Nonetheless, he has changed the mood toward business in Washington in a positive way.

Under Hillary Clinton, the atmosphere would have been anti-business, with higher taxes and more regulation. Under Trump the prospect is for lower taxes and less regulation. Donald Trump is a lucky guy, and the economy during his first year in office has been a dream cocktail of favorable results. Real growth has increased from 2% over the past few years to 3% in the second and third quarters. (The third quarter was a real surprise. Everyone expected growth at 2% or below because of hurricanes Irma and Harvey.) Inflation is tame at 2%, very low for the late stage of an expansion (unless this isn’t a late stage).

The 10-year U.S. Treasury is yielding a very unthreatening 2.4%, the unemployment rate is just over 4% and looks like it is headed into the 3% range, household net worth is at an all-time high, consumer confidence is at a 15-year high and the Standard & Poor’s 500 is at an all-time high. That’s a pretty good set of statistics for less than a year in office. Perhaps giving President Trump credit for all of it isn’t right, but it did occur on his watch.

Over in Europe the results are similarly positive. According to Joseph Sternberg, writing in The Wall Street Journal, Europeans told pollsters “they would have elected Hillary Clinton, given the chance.” But in their own countries they kept voting for unorthodox outsiders who never managed to win power. According to Sternberg, “Europe’s politicians are producing the kinds of changes American voters wanted Trump to deliver.”

In France, for example, Emmanuel Macron is overhauling a deeply unpopular entitlement program. In Germany, a plan is underway to cut one of the highest tax rates in the developed world. In the Netherlands, the new government is cutting its competitive tax rates further and plans to take over the pension system. Holland, though, unlike the U.S., intends to take in more immigrants.

The election of Donald Trump and the Brexit vote did scare Europe’s politicians. They realized that fringe challengers can win elections. The political problems that Trump is experiencing and the decline in growth in the United Kingdom have created a sense of urgency in Europe. The politicians know they have to deliver on their promises of change. There is also a new level of dialog and cooperation in Europe. Leaders are more willing to compromise on issues of mutual interest. The European Union itself is more solid than ever before. That certainly is an unintended consequence of Brexit.

Europe is on a clear growth path. Real Gross National Product should be close to 2% in 2017 and similar moderate growth should continue into next year. Unemployment is low and industrial production is strong, while inflation and interest rates are increasing slowly. Currently, European equity earnings are growing faster than earnings of the Standard & Poor’s 500, and the price-earnings ratios of the indexes are lower than comparable indexes in the U.S. Eurozone leading indicators are rising and real retail sales (without autos) are headed sharply higher.

The growth, however, is uneven, with France, Germany, Spain and Ireland doing well and Italy, Portugal and Greece struggling. Consumer confidence and consumer spending are both improving. Capital spending has been in an uptrend, but turned down recently. Monetary policy has played a big role and the European Central Bank balance sheet is now €4.29 trillion, comparable to the Federal Reserve’s balance sheet. (Debt continues to be a problem in Europe, as it is throughout the developed world, ranging from a high of 4.59% of nominal GDP in Ireland to 2.35% in Germany.)

I spent a week in Europe in October with stops in London, Geneva, Frankfurt and Paris. The United Kingdom is suffering. While the economy is still growing, most measures of economic activity are weaker than they were in the first half of 2016. Projections for real growth in the fourth quarter of 2018 are 1%, compared to 2% for the entire Eurozone. In the fourth quarter of 2016, real GDP in the U.K. was 1.9%, so following Brexit the U.K. has suffered a big drop in performance.

The mood in London was cautious, particularly among people in the financial services sector, where there was the expectation that some jobs would be moving out, costs for imported goods would increase and travel would become more difficult. Britain may have to adopt stimulative fiscal and monetary policies to maintain growth at a reasonably satisfactory level. If growth in the fourth quarter of 2018 were only 1%, it would be the slowest growth of any developed economy in the world.

On the continent, however, investors were positive. Greater conviction about the long-term survivability of the European Union was encouraging capital investment. There was clear evidence of a higher confidence in the economic momentum that is apparent in the currently reported data. This may derive from global growth which is expected to be 3.2% in the fourth quarter of 2017 and 3.4% in the fourth quarter of 2018, according to the International Monetary Fund. Part of the growth in Europe can be attributed to the ECB, which threatens to “taper” its monetary expansion but still is providing liquidity at a pretty good rate: Europe is prepared to provide some fiscal stimulus as well.

Most of us think of macroeconomic growth in GDP terms. Many economists, however, look at growth in terms of Purchasing Power Parity (PPP), which is defined as the amount of currency (usually the dollar) needed to purchase the same basket of goods and services in a given country. In my essay last month, I suggested that China would be the largest economy in the world in terms of GDP by 2035.

Graham Allison, professor at the Kennedy School at Harvard, corrected me. He said in terms of PPP, China is already the largest economy in the world. On the basis of PPP, the emerging markets now represent 58% of global GDP and the developed markets are 42%, according to Evercore ISI. Their dominance could increase to 74% in 2018.

Taking a closer look at countries on the continent, Germany continues on a 2% growth path. The one notable bright spot is the expectation that capital expenditures will increase from 3% in 2017 to 5% in 2018, as reported by Evercore ISI. In contrast to the United States, where capacity utilization is 77%, the comparable rate in Germany is 87%, which is why spending is expected to be so strong.

The country should also get a small lift from fiscal spending. The German Purchasing Manager Index is rising and real manufacturing orders are coming in well. Past structural reforms and a well-developed social safety net, the benefits of prudent economic management, have helped. German employment is at an all-time record with the unemployment rate at 3.7%. Consumer confidence is at a high; household debt as a percentage of disposable income is at a low.

The savings rate is 9.6%. German labor costs are below those in Italy, France and Spain. Its current account surplus is 7.8% of GDP and its business ranking for competitiveness, transparency/corruption, ease of doing business and economic freedom is the most favorable in Europe.

Looking at France, we see a similar positive outlook for capital expenditures, which are expected to increase from 4% in 2017 to 5% in 2018, according to Evercore ISI. The French operating rate is 84%, business confidence is high and year-over-year earnings increased 33% in the third quarter. Real GDP should increase to 2.2% in 2018, helped by fiscal stimulus of .3%. Leading indicators, the French Purchasing Manager Index, motor vehicle sales and industrial production are all positive. Real disposable income is rising and consumer confidence was at a 10-year high before a recent downtick.

Consumer spending has been somewhat disappointing recently, but it is expected to improve. Payroll employment is almost back to 2007 levels. The one weak area in France is trade, where the country is running a deficit. French government outlays are 56% of nominal GDP compared with 44.5% in Germany and 38.1% in the U.S. Its business rankings are generally favorable, except for economic freedom. The new government plans structural reforms to make the labor market more flexible, reduce corporate taxes, cut government employment and reform the pension and welfare system.

In Italy, the outlook is less favorable. Real GDP is only likely to increase 1.4% in 2018, according to Evercore ISI. Part of the reason is fiscal restraint (austerity) which is expected to have a .6% negative impact on 2018 GDP. While industrial orders are strong, retail sales are weak and the leading indicators are barely turning higher. Employment is almost back to the 2007 peak, but consumer spending is only expected to increase 1.4% in 2018.

Consumer confidence has been in a decline but ticked up recently. Capacity utilization is 77%, but Italian corporate earnings are soaring and business confidence is high, so capital expenditures are expected to increase 4% in 2018. In contrast to France, Italy has a trade surplus. The country has a variety of structural problems, including a rigid labor market and corruption, and its business ranking is unimpressive. There is an election next May. Let’s hope a reform candidate is elected. About 29% of the population is at the risk of poverty. It takes 1,120 days to enforce a contract, 227 days to obtain a construction permit, 124 days to get an electricity connection. Productivity is weak. Change is needed.

Spain is doing nicely. Evercore ISI forecasts that in the fourth quarter of 2017 real GDP should be 3.3%, and 3.0% in the fourth quarter of 2018. Consumer spending should increase 2.5% this year and next; capital spending should be up 3% in 2017 and 4% in 2018. Trade is a positive. The favorable results are in spite of a fiscal drag of .4% in 2017 and .1% in 2018. Retail sales are improving and the unemployment rate is declining, but still it is currently at 16.7%. Housing is gradually improving. The Spanish stock market has increased 7.3% this year (it was down in 2016), but has lagged other European bourses.

Non-performing loans at the banks remain elevated at 8.4%. Catalonia has caused economic uncertainty, but this is diminishing. Spain’s labor costs are higher than those in Germany and its overall business ranking is in the top quartile for competitiveness, transparency/corruption and ease of doing business. It is in the top half for economic freedom.

There are two broad macroeconomic factors that have been influencing the financial markets and the world economies positively over the past nine years. The first is the abundance of liquidity that has been provided by the major central banks: in 2008 the combined balance sheets of the Federal Reserve, the Bank of England, the European Central Bank and the Bank of Japan were $3 trillion; they are now $14 trillion.

One quarter of this monetary accommodation found its way into the real economy, stimulating growth; three-quarters went into financial assets, inflating price-earnings ratios and keeping interest rates low. The second factor has been China’s nominal growth of over 10% for the past decade. Their demand for imported goods from around the world has helped the economies of every developed country, and many undeveloped countries as well.

What could upset this applecart of favorable economic performance across the globe? I am watching eight indicators. The first is the U.S. Treasury yield curve. Right now the spread between the 2-year and the 10-year is 70 basis points positive. This is a warning area. We probably have at least a year before an inversion, if it occurs, and sometimes the market has a sharp rally when it does, but it always signals a bear market and a coming recession. We know the Federal Reserve is thinking about raising short term interest rates 25 basis points in December, so that will narrow the spread further.

The second is the Leading Economic Indicator Index. This index always loses momentum a year or two before a recession is upon us. It is strongly positive now. Related to this are corporate earnings, which are increasing sharply now. When year-over-year comparisons become less favorable, it is a warning signal. Inventories should be watched. Usually before a recession they are increasing as orders decline. Watch investor sentiment. Right now investors are optimistic, but not euphoric. Individual investors have not yet embraced the market with enthusiasm. That usually happens before the end.

While the Federal Reserve is poised to raise rates, it has not been in an aggressive tightening posture. That usually happens because inflation is increasing virulently, but inflation is tame now. Average hourly earnings are a good way to keep tabs on inflation. They are increasing at an annual rate of about 2.5% now. The danger point occurs at 4%, and we are nowhere near that now.

There could always be an exogenous event like military conflict with North Korea, strife in the Middle East that cuts off oil flow or Russian aggression in the Baltics that unsettles markets. The market is assuming none of that will happen, and if the market is right, we have at least one to two years to go before we get into serious trouble. My overall conclusion is that there are significant investment opportunities outside the United States and many portfolio managers are under-weighted globally.

The views expressed in this commentary are the personal views of Byron Wien of Blackstone Advisory Partners L.P. (together with its affiliates, “Blackstone”) and do not necessarily reflect the views of Blackstone itself. The views expressed reflect the current views of Mr. Wien as of the date hereof and neither Mr. Wien nor Blackstone undertakes to advise you of any changes in the views expressed herein.

This commentary does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. Such offer may only be made by means of an Offering Memorandum, which would contain, among other things, a description of the applicable risks.

Blackstone and others associated with it may have positions in and effect transactions in securities of companies mentioned or indirectly referenced in this commentary and may also perform or seek to perform investment banking services for those companies. Blackstone and/or its employees have or may have a long or short position or holding in the securities, options on securities, or other related investments of those companies.

Investment concepts mentioned in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position. Where a referenced investment is denominated in a currency other than the investor’s currency, changes in rates of exchange may have an adverse effect on the value, price of or income derived from the investment.

Tax considerations, margin requirements, commissions and other transaction costs may significantly affect the economic consequences of any transaction concepts referenced in this commentary and should be reviewed carefully with one’s investment and tax advisors. Certain assumptions may have been made in this commentary as a basis for any indicated returns. No representation is made that any indicated returns will be achieved. Differing facts from the assumptions may have a material impact on any indicated returns. Past performance is not necessarily indicative of future performance. The price or value of investments to which this commentary relates, directly or indirectly, may rise or fall. This commentary does not constitute an offer to sell any security or the solicitation of an offer to purchase any security.

To recipients in the United Kingdom: this commentary has been issued by Blackstone Advisory Partners L.P. and approved by The Blackstone Group International Partners LLP, which is authorized and regulated by the Financial Services Authority. The Blackstone Group International Partners LLP and/or its affiliates may be providing or may have provided significant advice or investment services, including investment banking services, for any company mentioned or indirectly referenced in this commentary. The investment concepts referenced in this commentary may be unsuitable for investors depending on their specific investment objectives and financial position.

This commentary is disseminated in Japan by The Blackstone Group Japan KK and in Hong Kong by The Blackstone Group (HK) Limited.

Copyright © Blackstone