by Blaine Rollins, CFA, 361 Capital

Dallas/Fort Worth International Airport, TX, USA (Benjamin Grant/DigitalGlobe) |WIRED

Which road will Alabama take on Tuesday? Which road will the FOMC take on Wednesday? Which road will Congress go down as they have many decisions to make on the Tax Bill?

As the stock market looks to wind up for its often ‘Santa Clause’ rally in the second half of December, there are some big items that are about to be decided on. Easily the biggest decision of the week will be Tuesday’s special election for the U.S. Senate in Alabama. While the RNC may have already made a decision to thin their ranks and coffers by deciding to back Roy Moore, the state voters could surprise the U.S. by electing Doug Jones. Crazier things have happened in politics in the last 13 months. For the FOMC meeting on Wednesday, a 25bp hike would seem to be a lock in terms of where we are headed. But with a new Chairman at the center of the table, communication will be key to the markets. Let’s see if any language changes about the overall strength of the economy, and what the future plans are to deal with inflation. And in Washington D.C., the Tax Bill wrangling continues. Some very big items surrounding State and Local income tax deductions for individuals, AMT for corporations, FIFO to become mandatory for capital gains, Electric vehicle tax credits, and many others. Expect fits and starts from affected stock prices as leaks make their way to the market. There is much to be done and not a lot of time before the holidays begin.

To receive this weekly briefing directly to your inbox, subscribe now.

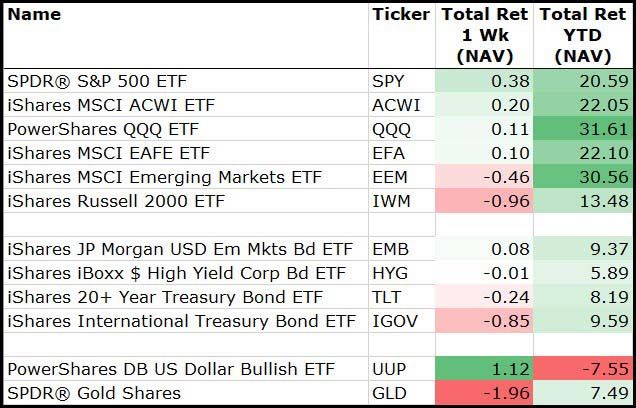

In looking at last week’s returns, it really makes you wonder if the Gold bugs are transmutating into Bitcoin bugs…

(12/8/17)

Among sectors, Financials and Industrials owned the week. Not so for Commodity stocks…

(12/8/17)

Some are worried that all the repatriated cash will be spent on buybacks. The market says no way…

Yes, some companies have no internal cash needs because their core business is very mature and has no input for additional cash. These companies should buy back stock and pay greater dividends. But any business that is growing into new industries, markets or just participating in the synchronized global GDP expansion will look to invest in Capex, R&D and acquisitions that will allow them to grow faster. This chart clearly illustrates that the market wants to reward investment in growth right now and not capital shrinkage. If a CEO and Board of Directors listens to the stock market and cares about their stock price, then they will spend time looking to deploy repatriated capital with the 2018 Tax Bill.

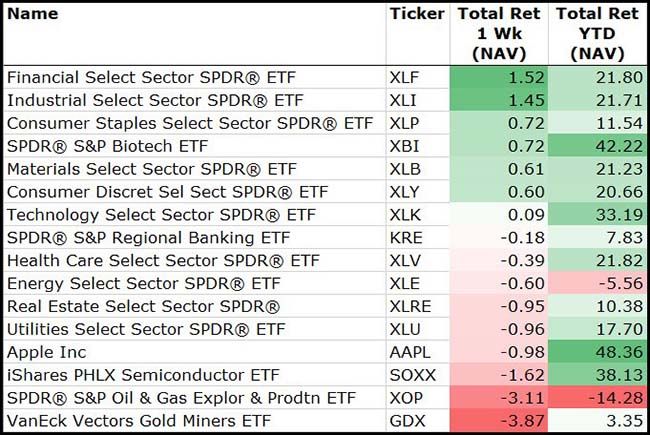

Also, just look at this ramping chart of factory manufacturing…

Companies will need to spend as production moves up and to the right.

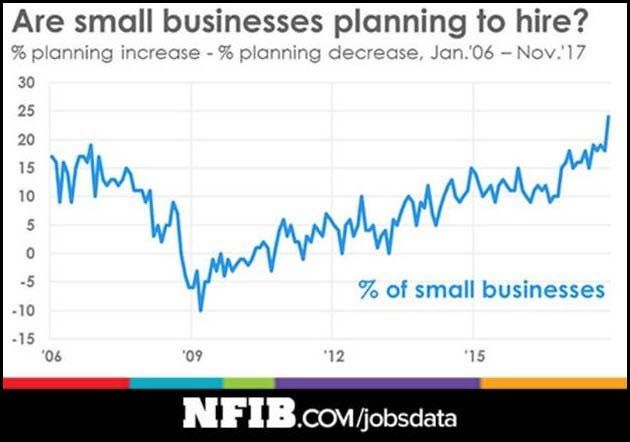

Even small businesses are looking to ramp up their hiring…

(@DriehausCapital)

Of course with a U.S. economy on fire, Goldman Sachs asks the obvious question…

…the key economic question is the impact of more stimulative fiscal policy at a time when the economy is moving beyond full employment. If most of the added growth takes the form of stronger aggregate demand without an offsetting increase in aggregate supply, as we expect, then it is only a matter of when, not if, financial conditions and monetary policy need to turn more restrictive to reverse the demand expansion. In a full employment economy, what Congress giveth, the Fed ultimately taketh away. The prospect of fiscal stimulus thus reinforces our forecast that the funds rate will rise well beyond current market pricing, with four hikes in 2018 and a terminal rate of 3¼%-3½%.

(Goldman Sachs)

Your follow up question should be, “When do we pay down the National Debt balance?”

And yes, at first glance, this does look like a price chart of Bitcoin… which begs the question even louder.

(@moved_average)

If the Fed is a go, will our Emerging Market stocks and currencies remain calm? My fingers are also crossed for the Goldilocks scenario…

The Federal Reserve is set to raise interest rates for the third time this year Wednesday, just as other central banks in the developed world have recently started to tighten monetary policy. But investors in developing countries aren’t flinching, reflecting confidence in the growing global economy and a changing investment landscape in those countries, fund managers say.

“Everybody used to think if the Fed tightens, all emerging markets die,” said Helen Qiao, managing director at Bank of America Merrill Lynch in Hong Kong. “I don’t think that is the picture anymore.”

The reversal in fortunes comes as emerging markets are enjoying what some analysts call a “Goldilocks” moment—a combination of strong global growth, stabilizing commodity prices and improving domestic fundamentals. This has fueled a rally dwarfing gains made by U.S. stocks.

(WSJ)

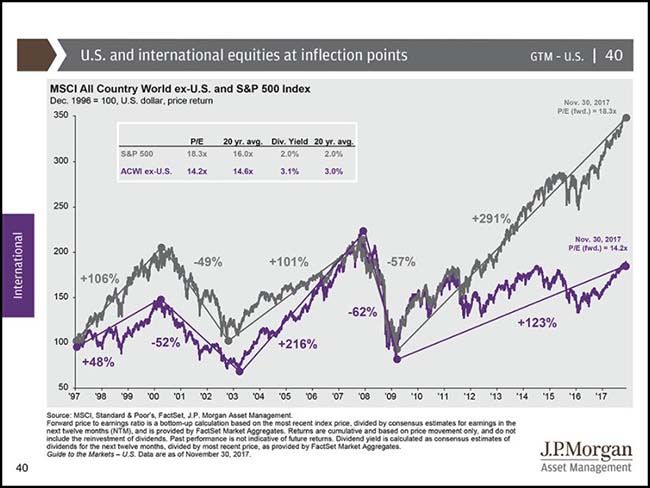

Still easier to bet on International stocks over U.S. stocks as this price and valuation chart shows…

Time for international stocks to make up some ground and close this 20% multiple gap.

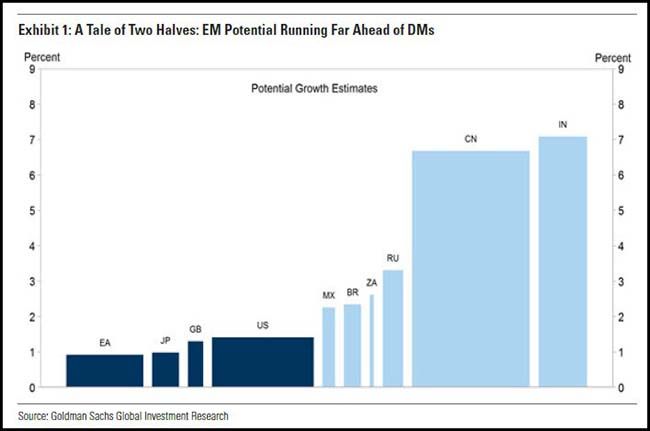

And if you look at growth potential, it is still heavily skewed towards the Emerging Markets…

Exhibit 1 compares our estimates of potential growth in 2017Q3 for several countries, with bar widths denoting the comparative economic size of each country. Notwithstanding the caveat that these are inevitably uncertain—in part because we cannot observe “potential” growth, and also due to the choice of model itself—the main conclusion is that potential growth in the largest EM economies far outstrips that of the leading DMs.

(Goldman Sachs)

Top Geek Read of the Week: A deep dive into what Jim Simons is spending his focused time on…

Simons has placed a big bet on his hunch that basic science will yield to the same approach that made him rich. He has hired ninety-one fellows in the past two years, and expects to employ more than two hundred, making the Flatiron almost as big as the Institute for Advanced Study, in Princeton, New Jersey. He is not worried about the cost. “I originally thought seventy-five million a year, but now I’m thinking it’s probably going to be about eighty,” he said. Given that Forbes estimates Simons’s net worth to be $18.5 billion, supporting the Flatiron Institute is, in financial terms, a lark. “Renaissance was a lot of fun,” he told me. “And this is fun, too.”…

Flatiron Institute researchers don’t have to teach, and they don’t have to apply for grants, which can consume much of an academic’s time. Nearly all the institute’s senior hires come from universities, and most of these universities are nearby, leading to some resentment. “People feel we have so many resources that we’re going to take over the world,” Spergel said. In an e-mail, one competitor complained to Spergel that the Flatiron was “a 1000 pound gorilla,” adding that, of the people he had recently been trying to recruit, all of them had “an offer from you.” Another researcher pointed out that, as powerful as computational science has become, it still relies on the kind of experimental science that the institute does not fund. In an e-mail, the researcher noted, “The predictions from the computation can only ever be as good as the data that has been generated. (I think!)”

What a great time to be an Aerospace Engineer…

(@carlquintanilla)

Also a great time to be a female running for political office…

If you are an incumbent male politician, start drafting your Plan B. And if you are a male thinking about running for office, just save your money. Listen to Denis Miller on this one, the ladies are going to run the table in November 2018. You might also have to give solid odds to Viagra becoming illegal on their first day in session.

Stephanie Schriock, the president of Emily’s List, the largest national organization devoted to electing female candidates, said that in the 10 months before the election in 2016, about 1,000 women contacted her organization about running for office or getting involved in other ways. Since the election, she said, the number has exploded to more than 22,000…

The largest increase by far is in the number of female House candidates — 354 — which includes 291 Democrats and 63 Republicans, according to data from the Rutgers center. The number of women challenging incumbents is almost four times the number at the same period in 2015.

In the Senate, there are almost double the number of female candidates — 25 Democrats and 13 Republicans so far — than there were at this point in 2015, and about 10 times the number in the 2012 and 2014 elections.

(NY Times)

I wonder if Lorde has tried her hand at stock picking?

Also a good time to be a leader/manager with daughters…

It makes you wonder how China will fare in the future as it rolls through its one-child, boy population bubble.

Recent research suggests one possible way of reducing perceived inequalities in the workplace: Hire CEOs with daughters.

A handful of studies that look at decision-making by chief executives, legislators, judges and venture capitalists suggest those who have daughters are more likely to make decisions that favor more equitable treatment of women.

A newly published study in the December issue of the Journal of Financial Economics shows that CEOs who have daughters scored higher in a measure of corporate social responsibility, says co-author Henrik Cronqvist, chairman of the department of finance at the University of Miami School of Business Administration. The study is an update of one that was initially released in 2015.

Merely having a daughter opens executives’ eyes to gender-related issues that they might not otherwise be aware of, says Dr. Cronqvist, who co-wrote the study with Frank Yu, associate professor of finance at China Europe International Business School in Shanghai.

The study found that when a CEO has a daughter, the company’s corporate-social-responsibility rating—a third-party measure of how companies stack up on community, diversity, employee relations and other metrics—is about 9.1% higher than that of a median firm. The study analyzed familial information of 416 CEOs from S&P 500 companies.

(WSJ)

If only the University of Louisville offered a Major in Russian Studies, they might have been able to identify and stop the corruption that just nuked their city’s finances…

Out of 125 FBS schools required to report financial data to the U.S. Department of Education, Louisville is the only one that derives more than half of its men’s sports revenue from basketball, says Jonathan Jensen, a sports marketing professor at the University of North Carolina at Chapel Hill. Much of that revenue comes from a $238 million taxpayer-funded arena, the KFC Yum Center, which opened downtown in 2010 and has become a heavy burden on taxpayers. The lease was negotiated by Jurich and the arena authority. Under the terms, taxpayer contributions make up 75 percent of the arena’s operating income while Louisville gets to keep most of the revenue — an arrangement that “blew our mind,” says state auditor Mike Harmon, whose office examined the arena’s finances. “It was like, ‘This is ridiculous.’ It’s like co-signing the loan for a friend’s home and then having to pay three-fourths of the mortgage.”

Denis Frankenberger, a local businessman who has dissected the lease in minute detail, calls it “the biggest taxpayer scandal in the history of Louisville.”

In the arena’s first year, men’s basketball revenue jumped 58 percent, from $25.9 million to $40.9 million, a trend that continued as the program became the richest in the country. Under the lease, Louisville keeps 88 percent of premium seat licensing, 97 percent of suite sales, all program revenue and half of concessions.

As Louisville was growing richer, the arena was failing — partly due to the lopsided lease, partly due to tax estimates based on “flawed data,” Harmon says. By early this year, the arena required a bailout to keep it from defaulting on more than $300 million in bond debt. Jurich’s athletic department agreed to pay an additional $2.4 million a year. The public, meanwhile, was saddled with another 25 years of arena-related taxes totaling hundreds of millions of dollars. In the end, the arena will cost more than $1 billion, with taxpayers funding most of it. Despite the bailout, some experts fear the FBI probe’s effect on the arena’s primary tenant could be catastrophic.

(ESPN)

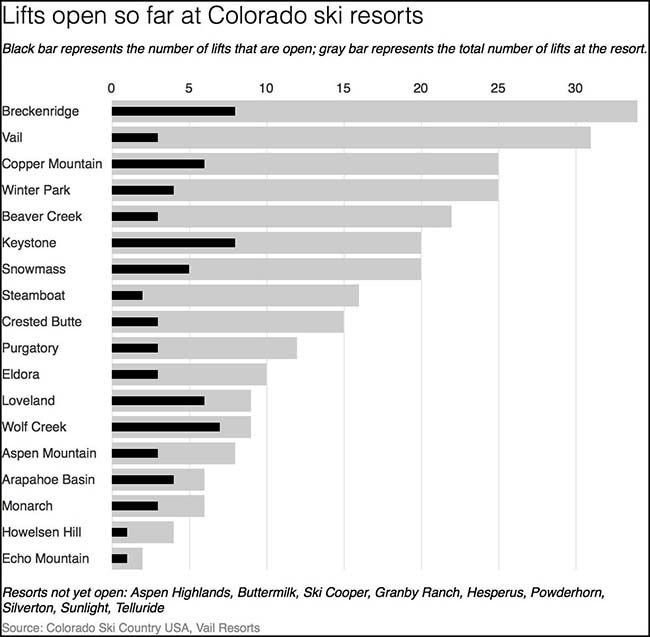

Snow in Houston? Come on mother nature, send some our way or we will miss the entire winter holiday season…

(@kevinmhamm)

And finally, for the 2nd year in a row…

Copyright © 361 Capital