Supplementing bonds with quality dividends

by Christopher Doll Vice President, PowerShares Sales & Strategy, Invesco Ltd. Invesco Canada

For income investors, the recent uptick in short-term interest rates served as a reminder that their bond portfolios remain vulnerable to risk. Rising interest rates tend to erode the value of a bond portfolio, leaving investors vulnerable to declines in portion of their portfolio which is supposed to be relatively safe.

Even after two interest rate hikes by the Bank of Canada earlier this year, rates are still historically low and don’t offer adequate yields. It may be prudent for investors to adopt a diversified approach to income investing.

Equity-derived income can provide attractive yields in this yield starved environment, along with the potential for capital growth. However, one must be cognizant of not over reaching for this yield.

Investors that may be turning to equities to satisfy their income needs must bear in mind that not all dividend strategies are created equal. A dividend strategy that focuses on quality and downside protection with a high-conviction focus on dividend growth can help investors reach their income goals while providing the potential for capital growth.

Dividend growers

Dividends can signal a number of attributes about a company, such as financial health, management’s confidence in earnings, or future growth prospects. Companies that do not pay dividends aren’t necessarily bad investments, but historically, dividend-paying companies have outperformed non-payers.

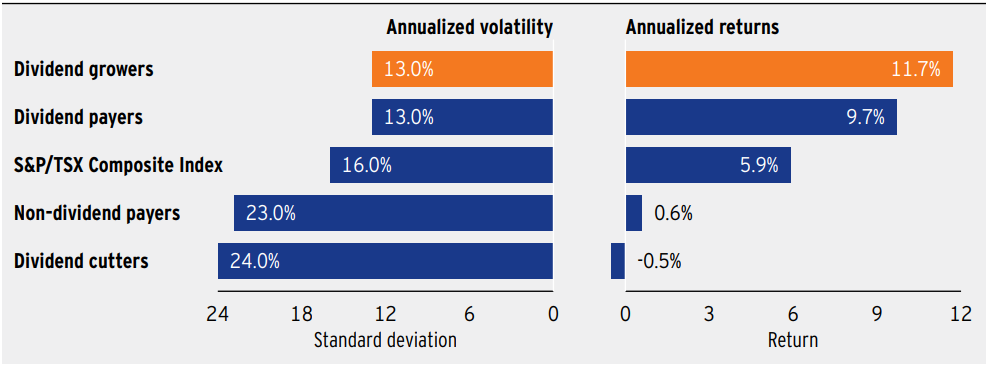

In particular, companies that have consistently grown their dividends have outperformed those that pay non-increasing dividends as well as those that don’t pay dividends at all. These companies tend to be mature enough in the business life cycle to be able to pay dividends and still retain sufficient free cash to fund continued business growth. As a result, these dividend growers have exhibited lower volatility than non-dividend payers.

Source: RBC Capital Markets Quantitative Research. Note: Data is calculated on an equal-weight basis using the S&P/TSX Composite Total Return Index between October 1986 and July 2015. Risk is measured using standard deviation. Standard deviation measures spread or variability around the average. The larger the number, the greater the historical volatility, and the higher the potential risk.

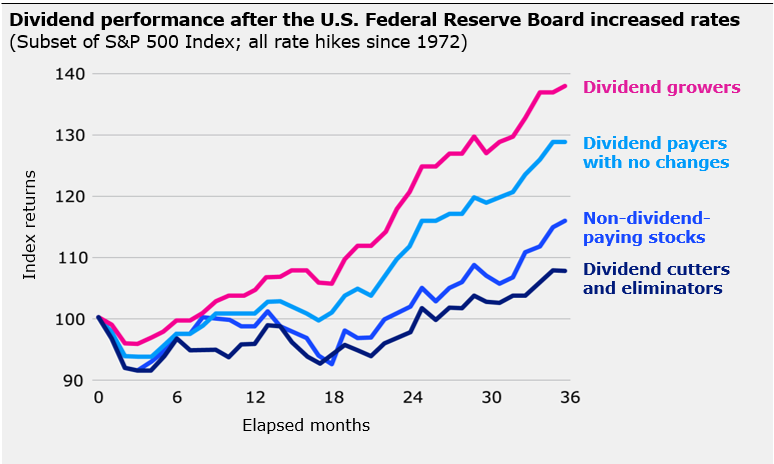

Furthermore, dividend growers have historically flourished in periods of rising rates, outperforming payers with no change, non-payers and cutters.

Source: Ned Davis Research, Inc. Further distribution prohibited without prior permission. Copyright 2015 @ Ned Davis Research, Inc. All rights reserved. Past performance is no guarantee of future results. Data shown is based on the average performance after all rate hikes since 1972, which occurred on the following dates: Jan. 15, 1973; Sept. 30, 1980; Apr. 9, 1984; Sept. 4, 1987; Feb. 4, 1994; June 30, 1999; and June 30, 2004. The returns do not reflect the deduction of any fees, expenses or taxes. Returns for stocks that paid dividends assume reinvestment of all income. Investors cannot invest in an index. All data is expressed in U.S. dollars.

A dividend strategy that screens for dividend growers may lead to a portfolio of companies that tend to be high quality, with strong fundamentals and a management team with conviction.

Chasing yields

While equities can offer attractive yields, investors should be wary of falling into a yield trap. This refers to a scenario where a company is struggling and its share value has eroded. The indicated yield appears high because it is based on past dividends, but it may only be a matter of time before the dividend is reduced or eliminated altogether. You can read more about yield traps in this blog post by my colleague Thomas Boccellari.

Dividend strategies that weight securities by yield alone may be susceptible to yield traps. To avoid this, investors should look for a strategy that focuses on consistent, growing dividends that can help avoid these yield traps and cushion against periodic downturns in the value of the underlying stocks.

Strategy in action

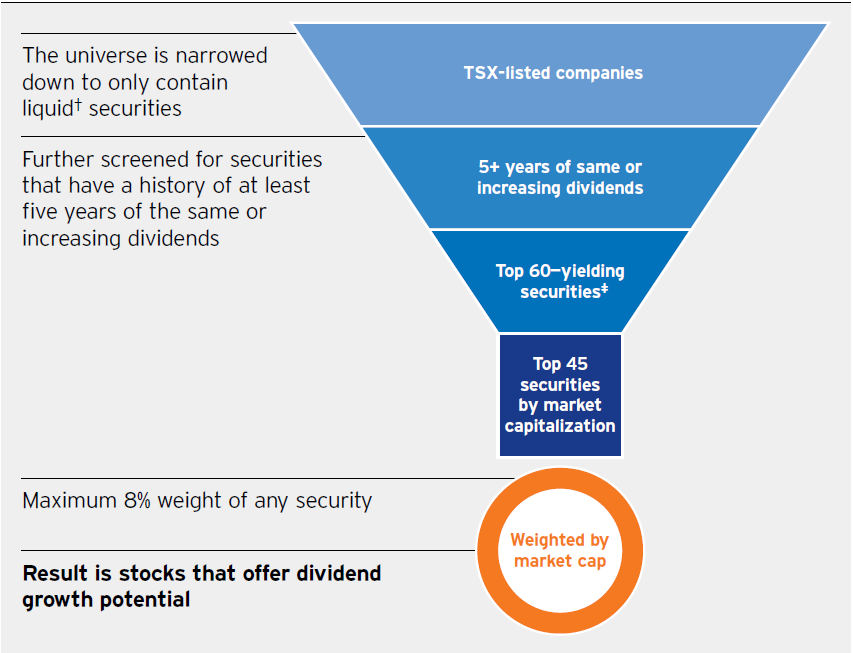

This approach is taken by the NASDAQ Select Canadian Dividend Index, which is the underlying index of PowerShares Canadian Dividend Index ETF (PDC). This index is made up of Canadian stocks that have stable or growing dividends for at least five consecutive years.

The top 60 yielding securities are reduced to the top 45 by market capitalization.‡ This helps to avoid exposure to smaller companies that may introduce unwanted volatility into an income portfolio. They are then weighted by market capitalization to a maximum of an 8% weight of any security helping to reduce single security risk.

For illustrative purposes only. Source: Invesco Canada.

†The security must have a minimum three-month average daily dollar trading volume of CAD $1 million.

‡Only one security per issuer is permitted. For more information on the index methodology, please visit powershares.ca/PDC.

For investors concerned with rising interest rates or the quality of dividend income, a strategy that focuses on stable or increasing dividends can provide better outcomes in rising-rate environments.

This methodology has contributed to PDC winning the 2017 Thomson Reuters Lipper Award for three-year performance in the Canadian Dividend & Income Equity ETF category.

This strategy is also available as a mutual fund: PowerShares Canadian Dividend Index Class1

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog