by Jon Eggins, Russell Investments

Note: This is the third in a three-part series of blog posts on principles of the low-return imperative. Part 1 can be viewed here, and Part 2 can be viewed here.

At Russell Investments, we don’t like to hide from the facts. While the last several years of equity market returns have been enjoyable for many, the uncomfortable truth is that these returns leave us at the tail end of a nine-year bull market in stocks, with expensive valuations and late-cycle economic dynamics in the U.S.

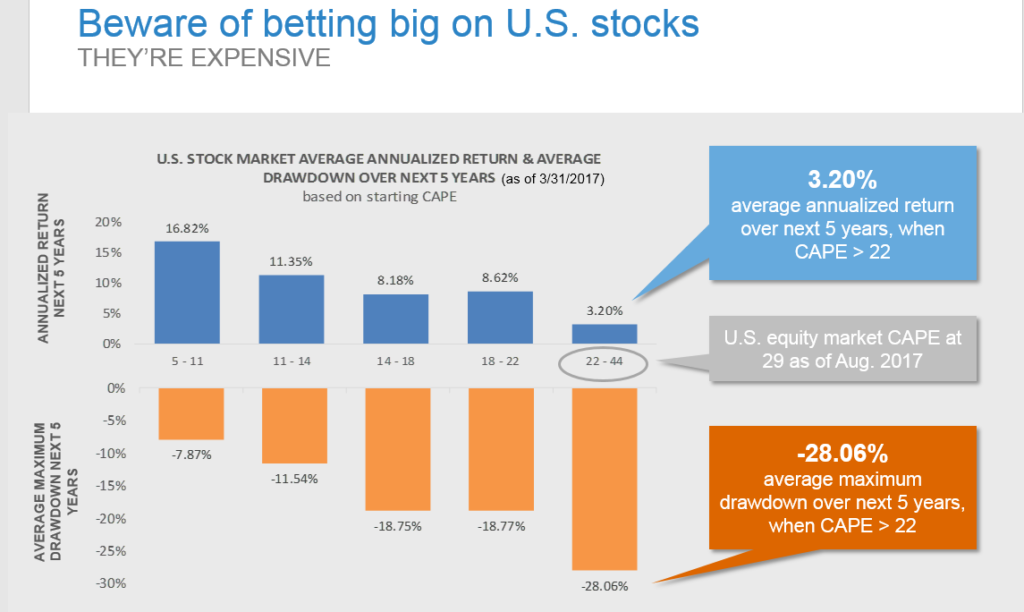

As the following chart illustrates, historically, when U.S. equities have been in the 20% most expensive range (as they are today), the average future return has only been 4.74% over the next three years. In contrast, the average maximum loss in that same time frame has been -20.75%. These aren’t good odds.

Source: http://www.econ.yale.edu/~shiller/data.htm.

Yale Professor Robert Shiller calculates a Cyclically Adjusted P/E Ratio based on stock price divided by prior 10-year earnings. U.S. stock market is represented by an index created by Professor Shiller. The stocks included are those of large publicly held companies that trade on either of the two largest American stock market exchanges: the New York Stock Exchange and the NASDAQ. Prior to 1926 his data source was Cowles and Associates Common Stocks Index, after 1926 his source has been S&P.

Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly. Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment. Average drawdown is the percentage return from period start date to the market trough within the subsequent three years.

This valuation asymmetry, when combined with continued low interest rates, is why we’ve been stressing the importance of what we call the low return imperative. What does this mean for investors? When expected future market returns are likely to be lower than investors’ required rate of return, we believe investors cannot afford to ignore any investment strategy that may offer incremental returns, should not take on risks they do not expect to get paid for, and should constantly be on the watch for ways to achieve implementation efficiency.

When investing in equities, all three of these things are crucial—for instance, active management, as well as the dynamic management of active managers, are important incremental return sources that cannot be disregarded, in our opinion. This is one of the reasons we advocate for actively managed global equity portfolios. But, active investing in equities brings with it many potential risks, and if you’re not careful, many of these may go uncompensated—i.e., become risks that you likely won’t get paid for.

At Russell Investments, we see two key risks that often rise to the surface in a global equity portfolio—risks which, in our view, are unlikely to be rewarded over the next three to five years:

- Overexposure to U.S. equities relative to non-U.S. markets

- Higher volatility exposure from active managers

Risk #1: U.S. equity overexposure

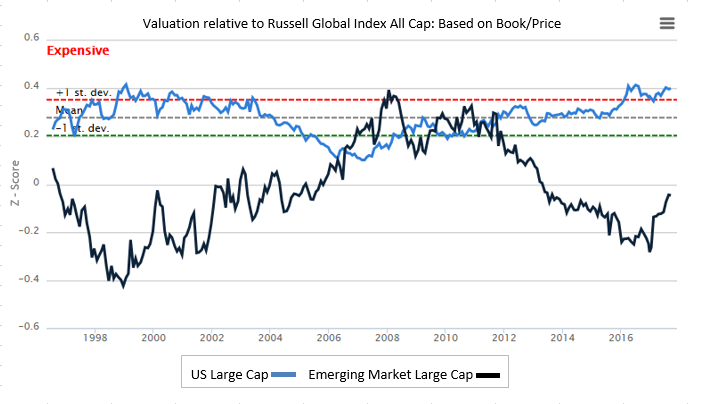

Overexposure to U.S. equities often comes from an investor’s asset allocation, where home country bias for a U.S.-based investor can result in a meaningful overweight to the U.S., relative to other markets. This has been a good thing over the last several years, as the U.S. has outpaced the rest of the world. However, because we are now nine years into a bull market in U.S. stocks, the U.S is later in both its market and economic cycle than offshore markets. It is also more expensive in valuation terms, as the chart below indicates.

The chart shows the relative valuation of U.S. large-cap equities, as compared to emerging markets large-cap equities, with the gray line representing the mean. In short, U.S. large-cap equities are priced at a premium when compared to much cheaper emerging market large-cap equities.

Chart: Valuation relative to Russell Global Index All Cap

Source: Russell.

Z-score is defined as cap-weighted mean scoring.

Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

Looking beyond the U.S.

We believe there are four main reasons to considering investing more outside the U.S:

- The potential for less volatility and higher returns from global diversification and more attractive current valuations.

- Increased active management opportunities—both in potentially less efficient asset classes, such as emerging markets where stocks are more volatile and broker coverage of individual securities is lower, but also in truly open architecture global managers investing across the global spectrum, exploiting mispricing between markets. For example, often stocks are mispriced based more on where managers live than where they make their money.

- Strong performance of developing markets. We believe that developing economies, particularly in the Asia-Pacific region, will continue to outperform developed markets this year. To wit, the MSCI Emerging Markets Index is up 28% year-to-date (as of Sept. 29, 2017), while the S&P 500® Index is up 14.3% (as of Oct. 17, 2017). That’s a difference of roughly 14%.

- Currency. This can be a major driver of returns and yet, most global managers just bring their currency exposures along for the ride with country exposures. For example, the persistent U.S. underweight often comes with a commensurate underweight to the U.S. dollar. We believe this is a shining example of taking on a risk that won’t pay. We believe it’s better to separate currency from the market, and in this case, mildly overweight the U.S. dollar while underweighting the U.S. market.

Risk #2: High volatility exposure

Many managers are overweight volatility. This is not surprising to us. Our experience has taught us that many managers like volatile stocks—for the simple reason that volatility may make portfolios go faster. What we believe this means, though, is that if you own active managers, you own volatility. This, in turn, opens the door to a myriad of risks.

At Russell Investments, we believe there are skilled active managers whose stock selection can shine through and add value over a cycle. Finding them is what we do every day. We also believe that relying on active managers for their aggregate factor exposures can be dangerous.

In aggregate, when combining managers, the resultant volatility exposure can swamp all the hard work of the underlying manager stock selection. It can then lead to a portfolio none of the managers would have owned themselves. Not only is this volatility exposure not rewarded over the long run (our strategic belief is to avoid higher volatility stocks—another risk that does not, in our view, have a commensurate return), we are also late in the cycle with elevated market valuations. In short, we believe that today is an especially risky time to be loading up on volatility exposure.

Managing volatility exposure

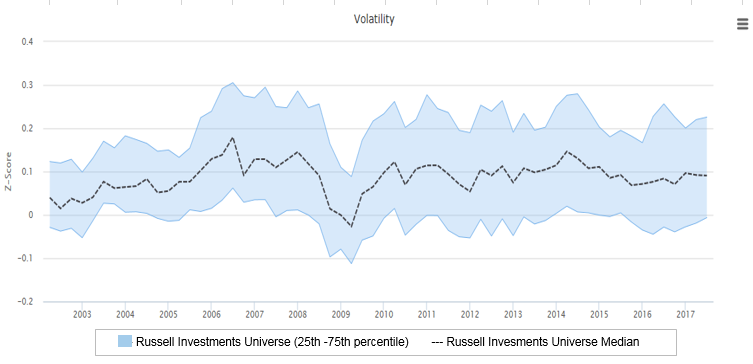

At Russell Investments, we believe that many active managers are skilled at selecting stocks, and we seek to find the absolute best. But not all have the same skillset when it comes to volatility exposure. We believe this is demonstrated by the chart below, which shows the active exposure that Russell Investments’ universe managers have to volatility. The blue collar displays the 25th through 75th percentile of volatility exposures for managers within the universe. The black line is the median.

The chart demonstrates that active managers are consistently overweight volatility. As illustrated, there has only been one time in the past 15 years when more than half of active managers had a volatility exposure even marginally below the benchmark. When? March 2009.

Does this date sound familiar? It marked the absolute bottom of the equity markets post-financial crisis—in other words, the worst possible time to be underweight volatility. The highest exposure was June 2006—not long before the market, and high volatility stocks especially, started crashing down.

Source: eVestment, Russell Investments.

Russell Investments universe consists of broad global large-cap equity portfolios, with a membership of approximately 300 products.

Z-score: Cap-weighted mean scoring. Anything greater than 0 implies higher volatility than the benchmark, and vice versa.

Right now, we acknowledge that there is somewhat of a dilemma in managing volatility exposure. Low volatility exposure is expensive, but high volatility exposure is risky. Leaning into value factors—in addition to holding some cash in the equity portfolio—may be an approach worth considering in order to manage this conundrum.

Conclusion

Risk may be an investor’s middle name, but that doesn’t mean all risks are worth taking. In today’s world, where every basis point matters, we believe that investors cannot always afford to go out on a limb—especially when the limb could very well snap. An investing approach that underweights U.S. equities and carefully manages volatility exposure may be worth considering in order to maintain a stable portfolio in today’s low-return environment.

*****

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page.

Investing involves risk and principal loss is possible.

Past performance does not guarantee future performance.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

This material is not an offer, solicitation or recommendation to purchase any security. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Please remember that all investments carry some level of risk. Although steps can be taken to help reduce risk it cannot be completely removed. They do no not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

Investments that are allocated across multiple types of securities may be exposed to a variety of risks based on the asset classes, investment styles, market sectors, and size of companies preferred by the investment managers. Investors should consider how the combined risks impact their total investment portfolio and understand that different risks can lead to varying financial consequences, including loss of principal. Please see a prospectus for further details.

Indexes are unmanaged and cannot be invested in directly.

The Russell Global Index measures the performance of the global equity market based on all investable equity securities. The index includes approximately 10,000 securities in 63 countries and covers 98% of the investable global market. All securities in the Russell Global Index are classified according to size, region, country, and sector, as a result the Index can be segmented into more than 300 distinct benchmarks.

The S&P 500®, or the Standard & Poor’s 500, is a stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

MSCI Emerging Markets Index: A float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Source for MSCI data: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Russell Investments’ ownership is composed of a majority stake held by funds managed by TA Associates with minority stakes held by funds managed by Reverence Capital Partners and Russell Investments’ management.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

Copyright © Russell Investments Group LLC 2017. All rights reserved.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI-11156

Copyright © Russell Investments