by Neil Dwane, Allianz Global Investors

Summary

An abundance of oil, thanks largely to US shale, has pushed down oil prices and sector sentiment. But since that means less investment in new production sources, the bearish market may soon rebalance from fears of oversupply to concerns over shortages – which would push prices higher.

Key takeaways

- With few exceptions, oil remains undervalued by the markets and underrepresented in portfolios

- US shale is still the star growth area of the oil industry, but it is cash-strapped and production estimates are too optimistic

- Oil’s risk premium is still too low; geopolitical risks are rising in petro-states from Venezuela to Nigeria to the Middle East

- The US natural-gas market, driven by US shale gas, is prolific and sustainable at low gas prices; the same can’t be said of US shale oil

In an article we published in May 2017, when Brent crude was around $50 per barrel, we explained why we expected the price of oil to grind slowly higher. In our view, solid global demand, renewed supply constraints and still-significant underinvestment made a clear case for investing in the energy sector.

With oil now edging toward $60 per barrel, some investors are taking a fresh look at a sector that we have been constructive on for some time. Yet the consensus view on oil is still bearish – a stance that we believe is not supported by the facts.

Multiple factors are constraining the oil supply

Global demand remains resilient at 97 million barrels a day, but oil fields are being steadily depleted. Oil producers collectively need to add about 7-8 million barrels a day in new production to keep up with demand growth and production declines, but that is difficult to do with prices so low. Increased production requires increased investment – and many firms simply lack the capital to expend after the 2014-2015 collapse in prices. Even though the price of oil has nearly doubled since January 2016, producers still have little scope to invest to grow production or are loathe to do so given price volatility. Short-term survival is winning out over long-term investments.

Oil at today’s prices leaves producers little scope to invest to grow production

There is also a geopolitical angle to the argument for higher oil prices. In May, members of the Organization of the Petroleum Exporting Countries (OPEC) agreed to extend production cuts as a way to boost prices. Yet falling tax revenues are forcing some petro-states to drain the sovereign wealth buffers they built up during the good times. This makes their institutions more vulnerable, which raises the risk of social upheaval. Turmoil in areas such as Libya, Venezuela, Algeria and the Iraqi region of Kurdistan could easily stoke fears of supply constraints – and push up prices.

US shale gas looks better than shale oil

Given that almost none of the large oil-producing nations is happy with the current price of oil, and that OPEC itself has traditionally had the power to rebalance markets, one question arises: What is throwing the traditional supply/demand relationship off kilter?

The answer is the US shale industry, which has transformed the world order for energy in just five years. By using new technologies to unlock vast reserves of shale oil and gas, US firms caused oil prices to halve, US consumer energy spending to hit multi-decade lows and OPEC to lose much of its market cartel power.

We believe the veritable bonanza in natural gas that the US shale industry created will have profound consequences for many gas projects globally, with the US cementing its status as a low-cost producer sitting atop huge reserves. In our view, the supply growth of US natural gas, driven by shale gas, is not only prolific, but sustainable.

But the boom in US shale oil, which currently represents about 60% of all oil-supply growth since 2008, looks less sustainable to us. We challenge the market consensus that this shale-oil growth will be maintained or even accelerated at lower and lower production costs. US shale oil is higher up the cost curve on a full cycle-adjusted basis than the market assumes.

We challenge the consensus view that shale-oil growth will accelerate while production costs move lower

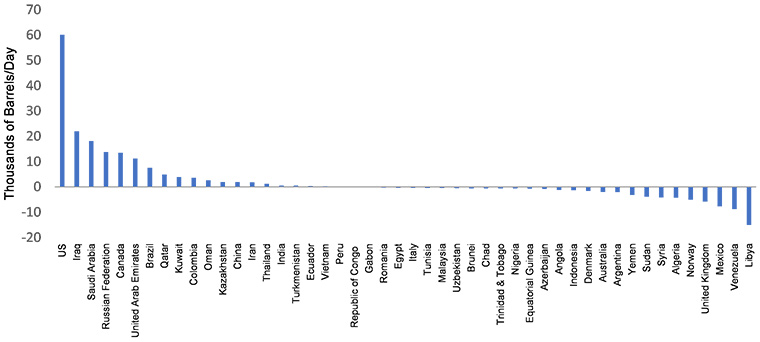

Can US Shale Continue Its Sky-High Growth?

Country-by-country share of world oil production growth, 2016 vs 2008

Source: BP Statistical Review of World Energy. Data as of June 23, 2017.

For the shale-oil industry to grow, it must overcome a steep initial decline curve by constantly drilling more wells. However, new wells are being added at an increasingly slower pace as oil-service resources tighten and profitability issues re-emerge. The cost of drilling itself is going up by 10-20% this year, according to some estimates – more evidence that US shale operators need higher prices just to stay operating.

Yet the US shale industry is by and large a cash-flow-negative one, reliant on funding from banks and investors to provide enough cash to stay in business. Indeed, US energy companies have issued approximately $100 billion in high-yield bonds in an attempt to raise the capital they need for investment. The problem is that this also raises the spectre of another boom-and-bust event for the industry, particularly in a rising-interest-rate environment.

For their part, US shale producers are seizing opportunities to hedge when prices go up, securing some of their operating cash flows and partially safeguarding future production. Without higher prices and the chance to hedge, many US shale companies will find it increasingly challenging to stay in business. For the first time, we are also beginning to see increasing evidence of US energy and production (E&P) companies becoming more disciplined with their capital, with many pledging to invest at levels at or below their cash flows. This should bolster E&P returns and reduce future growth in oil supply.

Without higher oil prices, many US shale companies could face financial challenges

Investment implications

We believe that excessive optimism over the prospects for US shale oil has contributed to unnecessarily low valuations for many global energy companies. Without this dream of US energy independence in the market, we believe energy names would be more highly valued. This, in turn, would enable the energy sector to offer stronger returns to investors – and it would enable energy companies to make much-needed investments in their businesses to address the prospect of oil-price spikes on supply shortages.

Copyright © Allianz Global Investors