by Carl Tannenbaum, Ryan James Boyle, Northern Trust

This month’s forecast follows a wave of generally positive economic data that appeared to shake off the weather-related disruptions seen throughout the summer and early fall.

The next set of clouds on the horizon relates to tax reform. The outline currently being considered by Congress would have a wide range of effects across a variety of taxpayer profiles. Such a broad proposal should not be executed in a hurry, and we do not expect a major overhaul to be passed this year. Although a less ambitious set of changes may follow, legislators may be shy to pass reforms in a midterm election year. For now, we have not factored any fiscal stimulus into our projections.

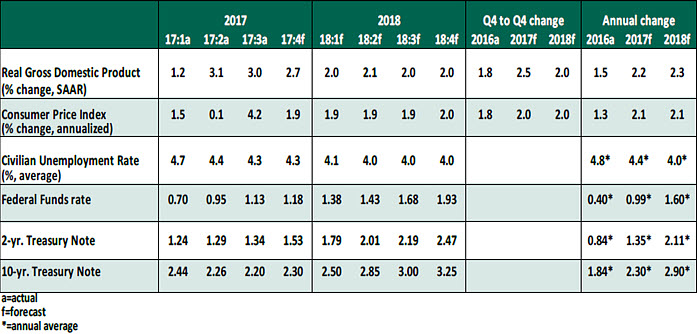

Key Economic Indicators

Influences on the Forecast

-

- Third-quarter gross domestic product (GDP) growth beat expectations, and the last two quarters have seen annualized growth of better than 3%. This is encouraging news; we were expecting more modest results for the third quarter, reflecting localized slowdowns caused by major storms in Texas and Florida. We are now starting to see the effects of rebuilding in those areas, which we expect to boost construction spending over the next several quarters. The auto sector is also showing a rebound in sales, driven by consumers replacing vehicles damaged in the hurricanes.

-

- Business spending has been a key driver of economic growth this year. Nonresidential fixed investment has posted two consecutive quarters of growth. Equipment spending increased by 8.6% and software spending grew 6.6% in the third quarter. Aside from a broadly positive economic environment, businesses impacted by the hurricanes are rebuilding their inventories.

-

- The labor market also presented an upside surprise, with unemployment reaching 4.1%, a level not seen since 2000. The latest report showed the U.S. economy added 261,000 jobs in October, shy of economists’ expectations but continuing a trend of strong job growth stretching back seven years. The labor force participation rate of 62.7% is in line with readings for the past three years. Participation has stopped falling but has yet to show a meaningful recovery.

-

- For several months, the number of job openings has hovered at a record high of over six million. Despite the rising demand for labor, wage growth remains persistently sluggish. Hourly earnings grew only 2.4% year-over-year in October. Though jobs are plentiful, many of the new positions have been in lower-wage sectors. As long as wage growth is slow, inflation will be tempered, and this may slow the timing of future interest rate increases.

-

- As expected, the Federal Open Market Committee took no rate action at its most recent meeting. We are expecting an increase of 25 basis points in overnight rates at the next meeting on December 13, with staggered rate increases to follow in the years ahead. Meanwhile, the Fed has begun reducing the volume of bonds held on its balance sheet, starting at a rate of $10 billion monthly, with a plan to advance the pay down rate to $50 billion per month by the end of 2018. The impact of unwinding has been benign thus far.

-

- Inflation remains low, with core inflation measuring only 1.33% year-over-year through September. Inflation has been tepid in the context of steady employment and GDP growth. Some transitory measurement factors have been at play here in the U.S., but the absence of meaningful price level acceleration is a global phenomenon.

-

- We expect inflation to resume its approach to the 2% target held by the Federal Reserve. The absorption of available supply in many markets should lead to this outcome. But risks to inflation are on the downside, given global and technological forces.

-

- President Trump nominated Jerome Powell to be the next Chair of the Board of Governors of the Federal Reserve, and we do not expect his confirmation by the Senate to encounter any controversy. When Janet Yellen steps down at the end of January, Powell is expected to continue the policy precedents she established.

Strong employment, modest interest rates and stable inflation are bolstering consumer confidence and business investment. With the holiday season in sight, we expect to celebrate a well-functioning economy.

northerntrust.com

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2017 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.